Summary:

- Despite concerns about Disney’s “woke” culture, my deeper analysis of its content pipeline suggests management is on the right track creatively.

- However, the company faces growing competition from Netflix, Amazon Prime Video, and YouTube, as traditional Hollywood comes under increasing pressure from tech giants.

- To benefit shareholders, Disney could increase its dividend. A yield of 3.5% or higher would make the stock a portfolio staple.

- While investors shouldn’t expect long-term alpha, I estimate the stock will rise from $97.30 to $120 or more within a year.

Evgeniya Shihaleeva/iStock via Getty Images

I last covered The Walt Disney Company (NYSE:DIS) in July, outlining a 12-month price target of $120 and a five-year price target of $170. Since that analysis, the stock has gained 7.25% in price. Now, I’ve looked more into Disney’s current creative direction-this is one of the areas that I’ve criticized the company for recently.

This analysis focuses entirely on Disney’s creative intellectual property in the form of movie releases, as I consider this the foundation of any Disney investment thesis. Moreover, it requires a significant amount of attention to this aspect of the company’s business alone to fully understand management’s creative strategy.

From my research surrounding this analysis, I’ve changed my mind quite significantly about Disney operationally-this has led me to increase my earnings estimates for the company. However, on further analysis, Disney’s value opportunity is a little more vulnerable than I initially anticipated. At this time, my 12-month price target remains approximately $120.

Disney’s Current Movie Pipeline: A Future Steeped in Legacy

Disney has quite a robust pipeline at the moment from a movie release standpoint. All of its biggest titles set to be released soon are sequels or additions to already-established movie brands. Of course, this is in keeping with management’s emphasis on reviving legacy titles. In this article, I ‘steelman’ the argument that focusing on legacy remakes is the right strategy, while being open to changing my mind (those who have read my previous coverage of Disney will know I criticized it for this).

Management has invested in titles like Frozen, The Lion King, and Avengers for releases in the medium term. While we might like to see more creative innovation, it has to be understood that these beloved intellectual properties have a much higher chance of success. Due to the recent criticism, the company has received-and based on the interests of shareholders-I imagine management wants to generate as high of returns as possible. Investors will want the same, and arguably, if these titles have a higher chance of success, they also satisfy the company’s global customer base.

| Upcoming Title | Release Date |

| Moana 2 | November 2024 |

| Mufasa: The Lion King | December 2024 |

| Captain America: Brave New World | February 2025 |

| Snow White | March 2025 |

| The Fantastic Four | July 2025 |

| Toy Story 5 | June 2026 |

| Incredibles 3 | June 2027 |

| Frozen III | November 2027 |

| Avengers: Secret Wars | May 2027 |

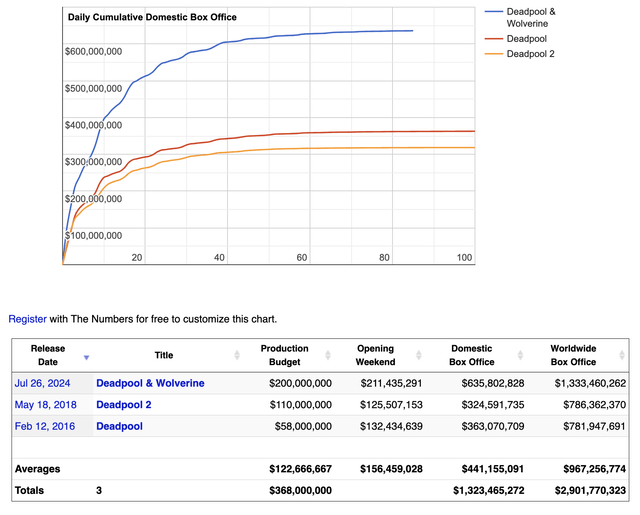

I was a kid when many of these titles were initially released, and I have to say that there is a strong sense of nostalgia and attraction from these strong brands. I’m sure many other members of the public feel the same. That being said, it’s a big deal to be releasing so many of these iconic titles in such a short space of time. One thing is for certain: the public will know if they’ve been sold short. If the upcoming releases appear to simply be churned out for the sole purpose of wanting to make money off previous hits (and the quality is much less noticeable than the previous iterations), then this could be a big reputational loss for Disney. On the other hand, management has already proven successful with the recent release of Deadpool and Wolverine, which grossed approximately $1.33 billion worldwide, with $635 million from domestic sales and $699 million internationally-it’s the highest-grossing R-rated film of all time.

There’s a lot of negative sentiment in the media for a lot of companies right now. Each has a different way of operating. Many dislike Musk’s visionary attitude at Tesla, Inc. (TSLA) for his lack of a grasp on realistic timeframes-others dislike Disney for its lack of original innovation and “woke” ideology. In my opinion, Tesla is much more than its timeframes, and Disney is much more than any temporary ideology. Disney has some of the most iconic intellectual property of all time, and I expect this to continue to be substantially accretive to shareholders over the long term if management has more successes like Deadpool and Wolverine.

This is an iteration of my previous Disney thesis-as I mentioned, I was previously quite critical of management’s creative direction. However, as the company is walking further toward its legacy-based future with confidence, I can see the merit in its strategy. It is still too early to tell how successful the 2025, 2026, and 2027 releases will be (both in terms of gross revenue and ratings)-maybe Deadpool and Wolverine were particularly helped by Ryan Reynolds’ input, not to mention Hugh Jackman. Thankfully, we can expect more of this star power to drive growth in upcoming releases, as Moana 2 will have The Rock, Toy Story 5 will have Tom Hanks, and Avengers: Secret Wars will have Chris Hemsworth, Tom Holland, and Benedict Cumberbatch. My bet? Disney’s Hollywood star isn’t dying yet, but it’s certainly no longer king.

Valuation Update: The Stock Is Still Undervalued

As a Disney investor, one shouldn’t expect high growth anymore. Instead, investors are largely likely to get returns of around 10% per annum over the long term from this investment. I hope that management will return more value to shareholders in due course because, as it stands, the forward dividend yield is only 0.93%. I think Disney could become a portfolio staple with a yield of 3.5% or more.

Currently, its TTM P/E non-GAAP ratio is 20.1, which is a 30.55% contraction from its five-year average. One reason why some investors may consider this a fair valuation contraction is that on a GAAP basis, the company’s long-term consensus EPS growth forecast is down 33% from its five-year average. While that’s concerning, I anticipate it will achieve a full-year 2025 normalized EPS of $5.50 (its pipeline should support this), and I also estimate it will achieve a $4.96 normalized EPS in full-year 2024. This indicates 10.9% year-over-year growth. That’s 16% lower than its five-year average in forward diluted EPS growth of 13%. Therefore, a 30.55% contraction in its TTM P/E non-GAAP ratio from its five-year average seems unreasonable to me. In simple language, Disney is moderately undervalued on an earnings basis.

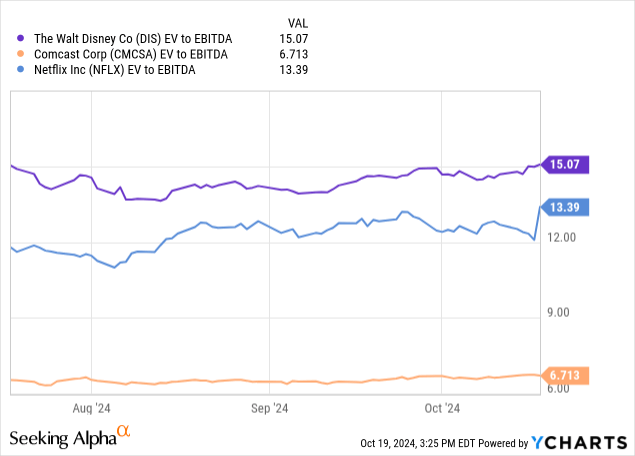

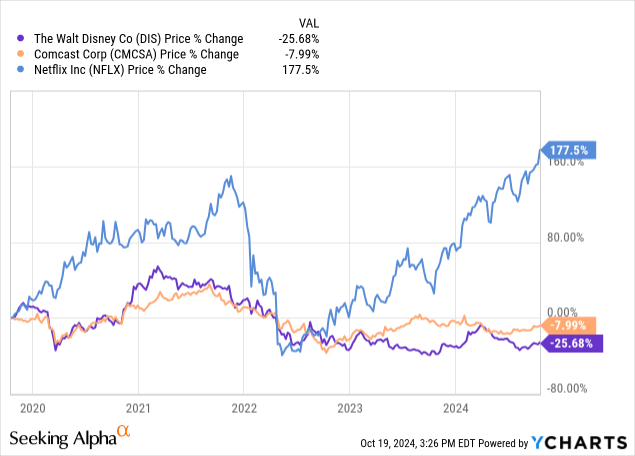

That said, looking at the charts below, I think Disney’s management really needs to consider becoming more dividend-oriented. Whether Disney and old Hollywood like it or not, Big Tech players like Alphabet Inc. (GOOGL) (GOOG) with YouTube, Amazon.com, Inc. (AMZN) with Prime Video, and the more concentrated Netflix, Inc. (NFLX) pose a significant threat to the throne. Just look at the following chart, where Walt Disney is valued more highly than Netflix on EV-to-EBITDA but is failing to deliver anywhere near Netflix’s level of EBITDA growth.

Arguably, the company’s perceived political approach hasn’t provided genuine resolve related to the ethical concerns of the entertainment industry. Recently, Disney has faced allegations of prioritizing its political agenda over profitability, leading to a decline in its market cap in my opinion. In contrast, YouTube, Amazon, and Netflix have not been as severely criticized by their shareholders related to politicization. Disney will likely still have a leading position in the future of entertainment over the long term, but it is unlikely to be a strong growth company because it is already well-established and is being out-competed by Big Tech.

With this in mind, I estimate the company will have a stock price of $121 in 12 months, based on my earnings estimates and valuation analysis (I consider a P/E non-GAAP ratio of 22 fair for the company). Primarily, I think Disney is likely to perform well in the near future because management is cleverly capitalizing on the tailwinds of its established intellectual properties. By not taking on excessive risk in new themes and creations, the company can ensure more stable returns. I have argued previously that the company might not have the creative talent to support a predominant focus on new stories, and I think this argument still holds despite my recognition of the merit of management’s legacy-focused strategy in this analysis. I expect these iconic remakes and sequels to provide substantial tailwinds to Disney’s broader entertainment ecosystem, including theme parks, theater productions, and merchandise.

However, given my peer analysis, investors still need to realize that they are paying a premium for Disney’s brand. Similar to Ferrari N.V. (RACE), Disney trades at a one-of-a-kind valuation. The difference is Disney is having a harder time staying in the right lane.

When I assess its long-term prospects, the company’s alpha potential is a little less bright. As the stock nears a P/E non-GAAP ratio of 22 or higher, I expect little capital gains based on valuation expansion alone. Instead, it will be purely up to the company to sustain its moderate growth rates and maintain customers’ and shareholders’ positive sentiment related to the careful stewardship of its historical legacy. Disney has a risky stock for the simple reasons that its brand is under scrutiny, its valuation is high, and management may not execute the majority of the company’s future content productions effectively.

Conclusion

I think Disney is doing better than many of its detractors give it credit for. Management has a vast, iconic portfolio of intellectual property to work with, and I expect that the company is doing the right thing by focusing predominantly on legacy content. After all, there is such a rich history to work from that it could be counterproductive to negate this. That being said, management is still faced with slower future growth rates than I would like at the stock’s current valuation. Therefore, I think investors should be careful about holding Disney at a high weight in portfolios. Its brand is under scrutiny, its position in the entertainment business is under attack from novel tech companies, and its stock is valued like a one-of-a-kind luxury enterprise. My rating is a cautious Buy for its near-term alpha, but it will most likely be a Hold in a year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.