Summary:

- We take a look at the themes to watch for in the third-quarter earnings for Mastercard.

- Shares have rallied over the past year amid solid growth indicators that are expected to continue.

- Key performance indicators, including transaction volumes, will set the tone for Mastercard stock into 2025.

The Good Brigade

Mastercard Inc. (NYSE:MA) has delivered a banner year for investors with shares up 21% thus far in 2024 and currently trading at a record high. The payments giant is benefiting from a resilient global economic backdrop, powering steady earnings growth expected to continue.

That trend will be tested in the company’s upcoming third-quarter earnings set to be released on October 31st, offering management an opportunity to update the market on the current conditions and set the tone for the stock into 2025. Let’s discuss the high-level themes to watch in the report and whether the rally can keep going.

MA Q3 Earnings Preview

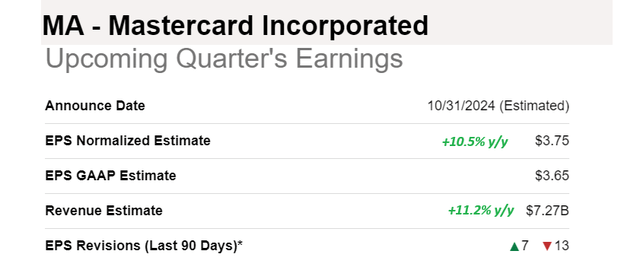

According to consensus estimates, Mastercard is forecast to report Q3 EPS of $3.75 (for the period ended September 30), representing an 11% increase from the $3.39 result in the period last year. The revenue forecast at $7.27 billion, if confirmed, would be 11.2% higher from Q3 2023.

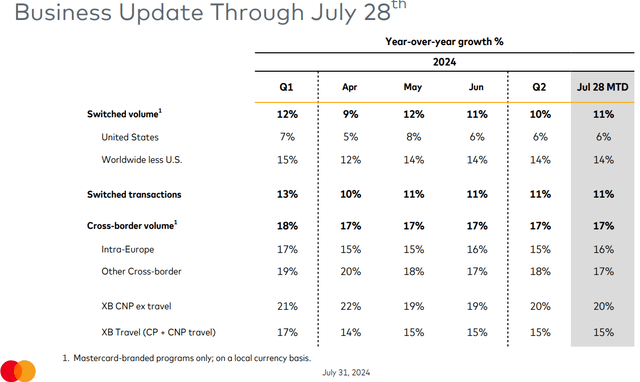

The context comes on the heels of what was described by management as a strong second quarter, reflecting “healthy consumer spending”, and “robust cross-border volume growth”. A major theme for Mastercard is that despite a gradual slowdown in the top line compared to peak pandemic-era growth rates, the company has managed to capture more value-added services and solutions as a new growth driver.

The company’s momentum internationally has balanced softer results in the United States where switched volumes (referring to the dollar value of transactions processed through the Mastercard network), climbed just 6% in the last Q2, down from levels above 10% as recently as 2022.

For Q3, signs that the recent Fed rate cut is beginning to be reflected in higher levels of card usage activity should be well-received by the market. Mastercard has also been making an effort to control costs and expenses. The adjusted operating margin will be a key monitoring point this quarter.

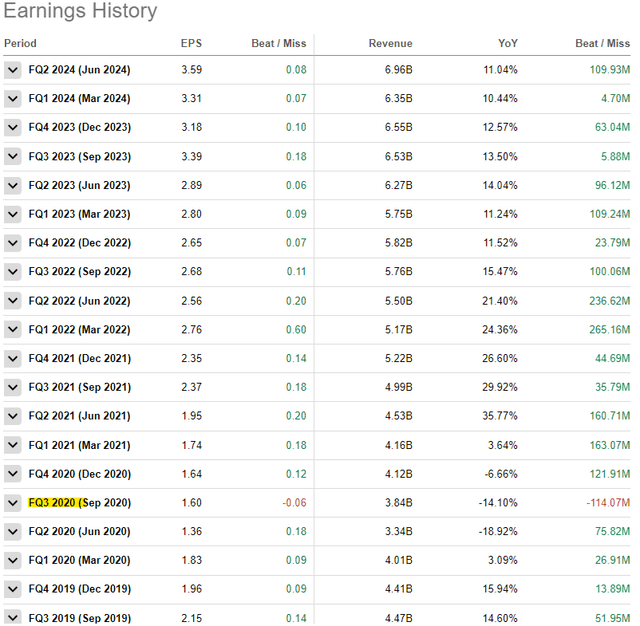

It’s worth noting that Mastercard has a record of consistently beating earnings expectations, missing quarterly EPS and revenue estimates only once in the past five years. One explanation is that given the breadth of the regularly updated operating indicators, there shouldn’t be too many surprises.

By this measure, we don’t expect a major move in the stock in either direction when it reports the Q3 results, with comments by management being more important than the headline numbers. It would take something exceptional for the stock to surge higher, while data suggesting underlying weakness could open the door for a volatile trading action.

Is MA a Good Stock to Buy Now?

During a recent investor conference, Mastercard CEO Michael Miebach described his company’s long-term growth “algorithm” as an otherwise simple formula centered around five pillars driving the core payments industry, including:

- The natural flow of economies – capturing exposure to more transactions.

- Efforts to accelerate the secular shift from cash into digital payments.

- Reaching previously underpenetrated markets or new verticals.

- Winning market share – outperforming the competition.

- Optimizing the portfolio to better serve the 3.4 billion card network.

Recognizing Mastercard has been wildly successful in executing this strategy across its storied history, the one factor outside of its control is the constantly changing macroeconomic environment (what it calls the natural flow of the economy). We bring this up because it highlights a key consideration when thinking about the stock today as an investment, and where shares will go next.

On the upside, a scenario where the global economy remains resilient or even sees a resurgence of growth should be positive for Mastercard’s core operating performance metrics between network transactions and cross-border volumes as a tailwind for the company’s earnings outlook.

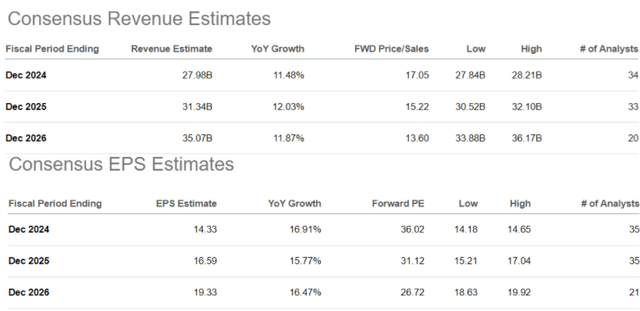

According to consensus estimates, the company is forecasted to maintain its double-digit pace of annual revenue growth for the next few years, while the market also sees EPS growth emerging a bit stronger, averaging around 16.5% per year through 2026. The ability to keep moving in this direction is a positive tailwind for the stock.

On the other hand, the main risk facing Mastercard is simply the possibility that economic growth falters, representing a headwind compared to the current baseline of expectations. Beyond uncertainties related to Fed policy or U.S. interest rates, ongoing geopolitical conflicts in Europe and the Middle East are separate areas of concern that could impact the company’s performance.

Is Mastercard Overvalued?

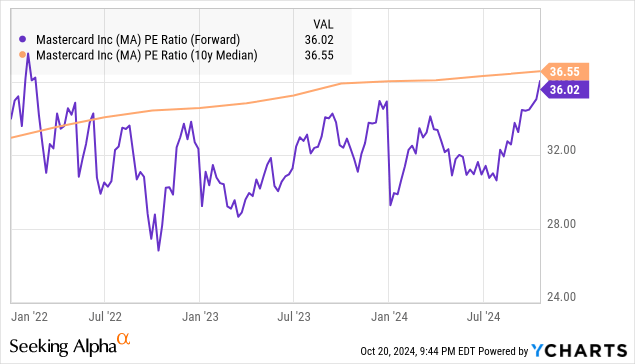

In terms of valuation, Mastercard stock is currently trading at 36 times its full-year consensus EPS as a forward P/E ratio, which is nearly at the ten-year average for the multiple just under 37x.

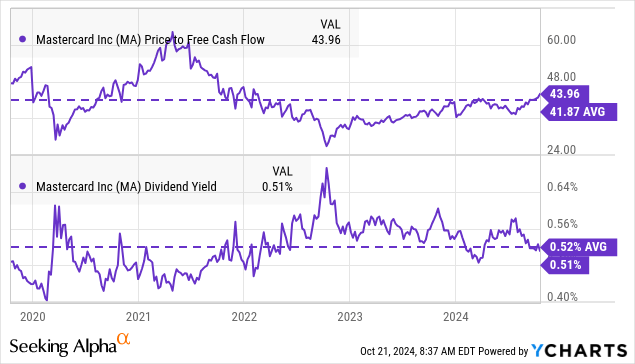

One interpretation is that the stock is near fair value, commanding a premium valuation based on its high-quality cash flows and industry leadership position. That line of thinking is also reflected in other multiples like the price to free cash flow at 44x, slightly above its five-year average, or the dividend yield holding steady at around 0.5%. Nothing with MA necessarily stands out as materially over or undervalued.

Still, the other side of that discussion is a recognition that even with the solid earnings growth outlook, MA’s growth rate has decelerated relative to trends five or ten years ago. Compared to fiscal year 2021 when revenue was climbing by nearly 30%, it has now become harder to justify a significant expansion of those same valuation multiples.

Decision Time on MA Ahead of its Q3 Earnings

We rate Mastercard stock as a hold, implying a neutral view of its near-term direction. Expectations for the Q3 earnings report are high, but the company is well-positioned to keep delivering on its financial targets. For current shareholders, the prudent move is to stay the course, while investors on the sideline may find more attractive opportunities in terms of upside potential elsewhere in the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.