Summary:

- For dividend champs like MO, dividends provide the most reliable insights into its true economic earnings.

- Given the stock’s recent dividend raise of 4%, I see a sizable margin of safety judging by the FWD yield.

- I anticipate the margin to further widen given the market’s updated outlook for interest rate cuts.

- Despite some issues, the dominant picture I see is a highly resilient business with 10%-plus total shareholder yield trading at an attractive valuation.

3D_generator/iStock via Getty Images

MO stock just raised dividends by another 4.1%

My last article on Altria Group stock (NYSE:MO) was published in early September and it focused on the company’s total shareholder yield [TSY]. That article, entitled “Altria: 7%+ Dividend Yield Is Good, 10%+ Total Shareholder Yield Is Irresistible,” examined its recent share repurchase program and debt management. Quote:

The company uses other mechanisms to return capital to its shareholders too. The company just completed its $2.4 billion accelerated program in the past quarter and is also paying down its debt at a good pace. Once all these mechanisms are considered, I expect a TSY easily exceeding 10%.

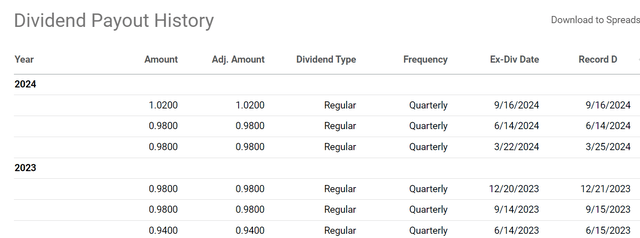

Since that writing, there have been a few key developments surrounding the company. I think they represent key catalysts for investors to take a new look at the stock. First and foremost, the stock has announced another dividend raise payable on Oct 10. To wit, the quarterly dividend reached $1.02 per share in the most recent quarter, translating into a year-over-year growth rate of 4.1% compared to the previous level of $0.98 per share. As a poster boy of a dividend growth stock, this raise continues its remarkably long track record of consistent dividend increases. Thus, I think it’s worthwhile to examine the implications of this raise more closely.

Seeking Alpha

The second catalyst involves the changes in the market’s interest rate outlook due to the new job data and CPI data released since my last writing. I firmly believe that any dividend yield should be benchmarked against risk-free interest rates. As such, later in the article, I will detail my thoughts on how the market’s new expectation of rate cuts can impact MO’s return potential.

Overall, my conclusion is that both these developments support a favorable return/risk profile for the stock. Hence, these developments also led me to upgrade my rating from the earlier Buy to Strong Buy, and I will detail my thought process for this upgrade immediately below.

MO stock: Dividends don’t lie

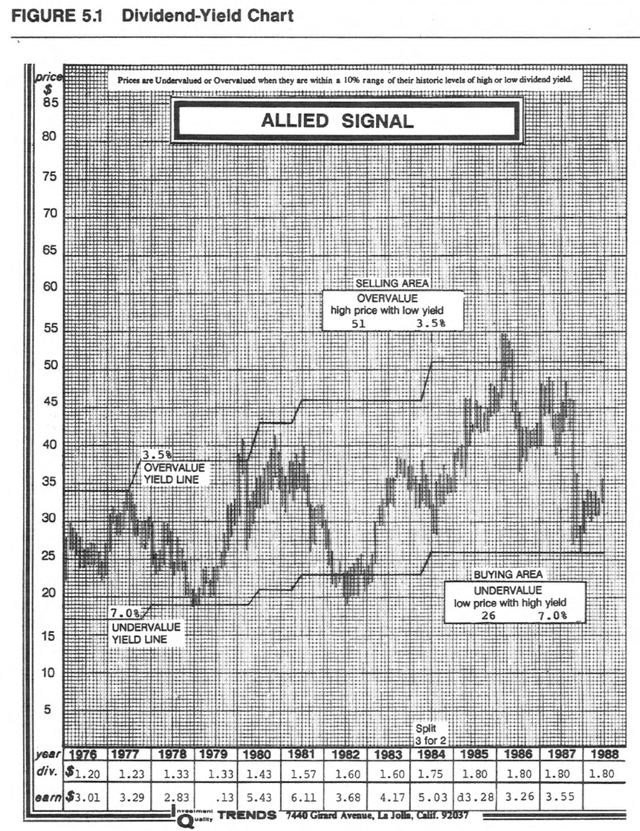

Since we are analyzing one of the most quintessential dividend champions, I thought the title I picked was very fitting. But I have to confess that the title was stolen from one of the first investment books I read. The book was Geraldine Weiss’ classic entitled Dividends Don’t Lie, which was followed by another book titled Dividends Still Don’t Lie. I highly recommend both books for dividend investors in case you have not read them. To the best of my knowledge, a key concept dividend investors use all the time today originated from the book. The concept is the so-called dividend bands with another example for Allied Signal, a blue-chip dividend stock at the time of the book (by the way, that was more than 30 years ago).

Dividends Don’t Lie by Geraldine Weiss

We still rely on this chart today because there are several powerful and timeless ideas behind the concept. The most important two on my list are the role of dividends as an indicator of owners’ earnings and the margin of safety. Dividends are the most reliable value metric (hence the title of the book) for stocks that have an established record of paying/raising dividends. They represent owners’ earnings in the long term better than accounting earnings. However, as indicative as they are, we should always allow some margin of safety. As you can from the dividend bands of Allied Signal above, the band was quite wide even for blue-chip stocks.

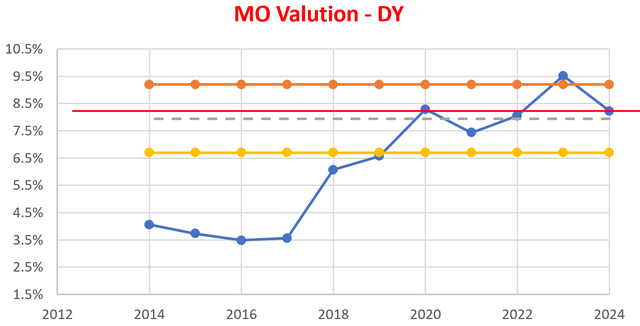

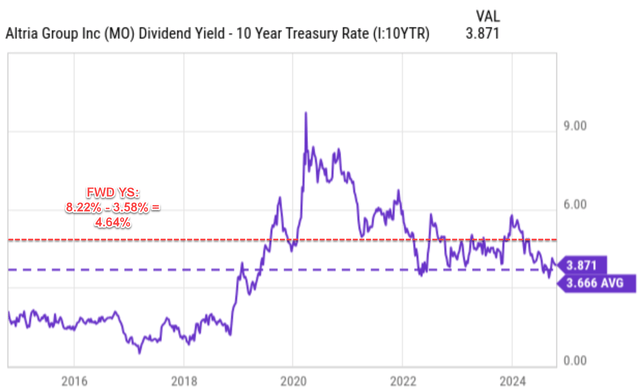

Against this background, let’s examine MO’s recent dividends more closely. First and foremost, the fact that MO continued raising its dividend at a consistent pace indicates the company’s healthy economic earnings, regardless of the fluctuations in its accounting EPS. Second, after the dividend raise, the stock now features a sizable margin of safety judging by its FWD yield as you can see from the chart below. In this chart, I’m simply plotting the dividend band promoted by Weiss in a different way thanks to the advancements in computing technologies and software. As seen, MO’s FWD yield hovers noticeably above its normal range historically. To wit, with its latest raise, the stock is yielding about 8.22% on an FWD basis as of the price at this writing. This level (illustrated by the solid red line) is noticeably above the historical average which was indicated by the gray dotted line in the chart, suggesting a good margin of safety.

Next, I will explain that when benchmarked against risk-free rates, I’m also seeing a good margin of safety too given the market’s updated outlook on interest rates.

Author

MO stock’s yield benchmarked against risk-free rates

As aforementioned, in my mind, any discussion on dividend yield should be benchmarked against risk-free interest rates as they serve as the gravity for all asset valuation. Here, I will use the dividend yield spread [YS] between MO and 10-year Treasury bond rates for such benchmarking purposes. Details of this method were provided in our earlier article. So I will just quote the end results below:

The dividend yield spread [YS] is based on a timeless intuition. No matter how times change, the risk-free rate serves as the gravity on all asset valuations, and consequently, the spread always provides a measurement of the risk premium investors are paying relative to risk-free rates. The next chart shows the yield spread between MO and the 10-year Treasury in the past 10 years. As of this writing, the yield spread is about 3.87%, noticeably above the historical average of 3.66% as seen, suggesting a good margin of safety again.

Seeking Alpha

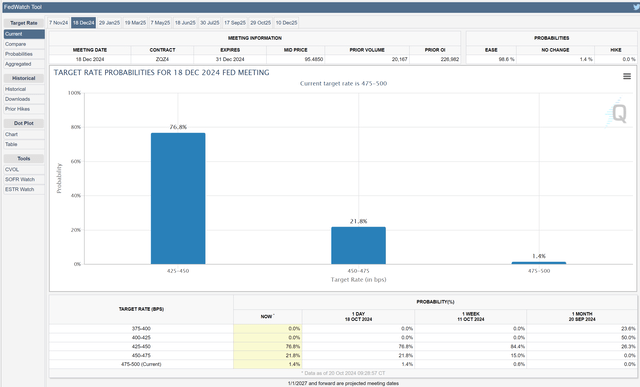

More importantly, looking ahead, I expect the margin of safety to further widen given the market’s outlook for interest rates. More specifically, the following CME Group FedWatch Tool compares the current probability of rate cuts between now and Dec. 18, 2024, vs. a month ago. As you can see, currently, the market expects dominant odds for the Fed rates to be further lowered to the 4.25% to 4.5% range by Dec. 18. This new outlook, admittedly, is less aggressive than the outlook a month ago. At that time, the market expected 50% odds for even deeper cuts.

However, even the new and less aggressive outlook points to a wider margin of safety for MO when combined with its recent dividend hike. Assuming the Fed rates are lowered by 50 basis points from the current (i.e., to 4.25%) by 2024 and 10-year Treasury rates decline by the same degree, then the 10-year rates would be around 3.58% by the end of the year (vs. 4.08% as of this writing). Thus, the FWD YS between MO stock and 10-year rates would be 4.64%, far above the historical average as seen in the above chart.

CME Group

Other risks and final thoughts

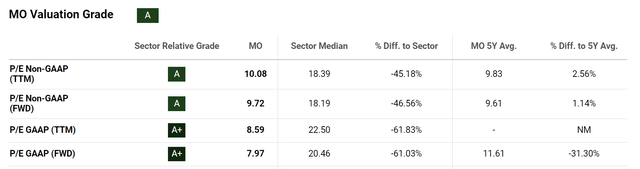

In terms of downside risks, unlike its dividend yield, the stock’s P/E ratios don’t suggest obvious discounts. For instance, the P/E Non-GAAP (TTM) of 10.08 is slightly above its historical average of 9.83x. The picture remains about the same in FWD terms too, as seen. However, as explained above, I place more weight on the use of its dividend yield.

Seeking Alpha

Besides the above-average P/E, that business was also facing some unevenness across its various segments. As an example, in the past quarter, MO was hurt by a 13% drop in domestic cigarette volumes. In its e-vapor segment, the growth of illicit products lately is an ongoing concern. On the positive side, these issues/declines were partially offset by sales increases from other divisions, such as the Oral Tobacco Products division. I’m also seeing some margin pressures due to the lower sales, higher total promotional investments, and elevated manufacturing costs in recent quarters.

All told, I consider these issues to be only temporary and relatively minor when compared to the positives. To recap, the dominant picture I see is a highly resilient business with 10%-plus total shareholder yield (the focus of my last article) trading at a sizable margin of safety judging by its FWD dividend yield. I further anticipate the margin of safety to become even wider in the next few months given the market’s updated outlook for interest rate cuts.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.