Summary:

- Snapchat’s user growth is primarily outside profitable markets, with no notable DAU growth in North America or Europe over the past two years.

- The company faces long-term solvency risks, with significant debt maturing by 2027, necessitating positive operating income and active user growth.

- Despite efforts to boost revenue through targeted ads and subscriptions, Snapchat’s margins and operating income remain poor, risking further equity dilution.

- Snapchat’s survival hinges on carving a niche in a competitive market, with potential user attrition and debt challenges threatening its recovery.

- I expect the company may have decent revenue and income results for Q3, but potentially poor user activity trends as new advertising methods hamper user experience.

Richard Drury

Snapchat (NYSE:SNAP) has long defied the old social media rules, failing to grow while avoiding significant deterioration. Usually, social media is a “grow or die” business, as the value of a platform rises and declines proportionally to its number of active users. Should users leave the platform, others will likely follow suit as its ecosystem fades.

According to its data, Snapchat has had ample active user growth over the past five years; however, almost all of that growth is seen outside of North America and Europe, which are by far the most profitable markets. Snapchat’s initial descent began when Instagram (META) launched a similar “stories” tool in 2019, making Snapchat’s similar tool largely redundant. That was followed by the rise in TikTok, which further expanded into Snapchat’s dwindling territory.

SNAP lost all of its 2020 gains and is now trading at around $10.5, less than half of its IPO price and nearly 90% below its peak price. To slow the bleeding, Snapchat is doubling down on its advertising platform, adding new “sponsored snaps,” sent directly to user’s inboxes with a push notification. In my opinion, adding more ads to a platform already oversaturated with ads will likely push away its remaining active users. This approach may temporarily boost SNAP’s advertising income, at the cost of likely upsetting its fickle user base.

SNAP also faces some risk from a lawsuit accusing it and other social media platforms of profiting from youth social media addiction. There is a similar lawsuit filed in Canada. The company is also in a lawsuit regarding more problematic issues relating to minors, which extend broader social media safety concerns.

Overall, I think we may be seeing signs of Snapchat’s “end of the end.” Although the company has maintained sales and positive operating cash flow for some time, I doubt its ability to overcome the numerous challenges mounting against it. For investors, I believe this situation will likely result in losses through potentially higher equity dilution rates if its operating cash flow falters.

Snapchat Needs Active Users, Not More Ads

In my view, given the rise of Instagram stories and TikTok, Snapchat lacks a necessary niche. There are very few things users can do only on Snapchat that they cannot do on either those two or YouTube (shorts). The company has tried to find alternative revenue sources other than advertising, such as “Snapchat+” subscriptions, offering minor user benefits, but has only managed 11M subscribers in North America, with a small 12% YoY growth rate.

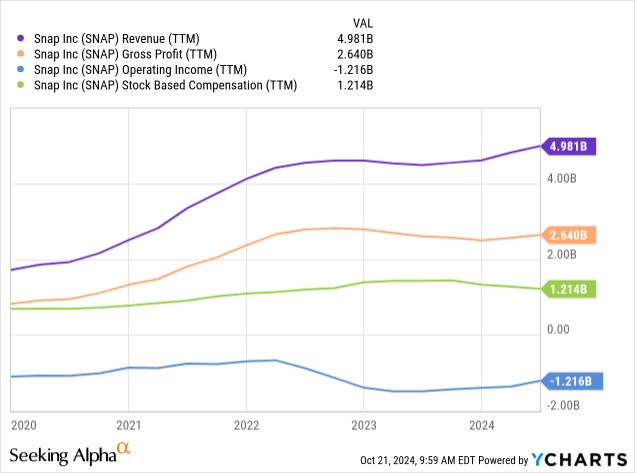

Although its North American and European user base is not growing, the company has had minor revenue growth since its 2022 spike as it continued to roll out more target ads. Likely, some of this growth stems from technological development, such as AI-targeted advertising, which has aided the growth of most social media companies. The firm has not seen the same increase in its gross profits as its margins have slipped. Further, its operating income remains poor at -$1.2B per year, offset by equally sized stock-based compensation. See below:

Snapchat has avoided liquidity and balance sheet issues by utilizing significant stock-based compensation to offset negative operating income. Although many analysts and investors will look toward adjusted figures that do not account for this, I see stock-based compensation as being a little different than general operating expenses because it’s dilutive to equity investors. Usually, the lower a company’s market capitalization is, the more dilutive stock-based compensation is. At 1.21B TTM, that accounts for ~7% of its $17.4B market capitalization.

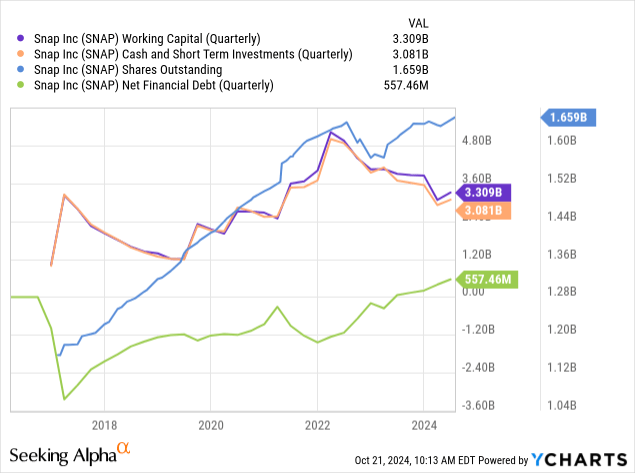

To be fair, the company has not had significant dilution activity since 2022. Between solid growth from 2020 to 2022 and its debt position, Snapchat’s share outstanding temporarily declined in 2022 as it sought to buy its shares as they fell. However, since then, we’ve only seen balance sheet deterioration, with its net financial debt recently becoming positive as its liquidity dwindles. See below:

Snapchat’s liquidity is not necessarily a short-term issue but likely a long-term one. In 2025, it has only $36M in due debt, which will rise to ~$250M in 2026, $1.15B in 2027, and $1.5B in 2028. Today, the company has almost enough cash to meet these obligations, but given its negative operating income, it likely cannot use it unless it dramatically cuts overhead spending. Most of its commitments are convertible debt, with its current stock price below all of its conversion prices, though a few may be tenable (if SNAP rises) with conversion prices in the low $20s.

Thus, I estimate Snapchat has until early 2027 to turn itself around, ideally with consistently positive operating income while maintaining and growing an active user base. The company seems to be aware of this timeline, working hard to expand its advertising sales to reach a higher revenue per user. Its quarterly average revenue per user was $2.86 in Q2, down from $3.2 in Q2 2022 but slightly up from $2.69 in Q2 2023, showing no clear trend. However, its ARPU in North America is $7.67 but just $2.36 in Europe, indicating growth potential. Facebook’s Europe gap is similar, suggesting it would be difficult to achieve, though Facebook’s ARPU is twice as high (converting from annual data) in the US and Canada than Snapchat.

I do not expect Snapchat to have a similar ARPU to Facebook, naturally. Facebook has multiple large platforms with far more user connectivity and, more importantly, user data that allows for highly targeted advertising. In fact, there is some evidence that large Snapchat publishers are leaving the platform due to the poor results of its advertising system.

The company is trying to improve user engagement by marketing itself as anti-social media. Although this approach may be interesting, I do not agree, and studies on teen user’s mental health seem to corroborate, though Snapchat offers research suggesting the opposite. At any rate, in my own experience, it seems to be one of the most advertisement-oversaturated platforms. For me, having ads recently sent to me via notification was the last straw. Though there is little concrete survey data from users regarding this issue, as most surveys suggest users are generally annoyed with social media ad inundation, I expect these changes will negatively impact user activity.

The Bottom Line

Snapchat will report its Q3 results on the 29th. Although I can only speculate on the issue based on my experience and inferences, I expect disappointing user activity changes. Potentially, that will be offset by higher ARPU, resulting from increased advertising efforts. In line with its seasonal trend, analysts expect $0.05 in EPS and $1.36B in revenue, with a YoY growth rate of 14.3%.

I believe these targets are reasonable, resulting from increased monetization efforts. However, if Snapchat financially performs at the cost of a lower North American active user base, its stock may decline. Ultimately, Snapchat must prove it has a solid niche in the competitive social media landscape. Between TikTok and Facebook (Instagram), I think most of its profitable users lack more attention that can flow toward Snapchat. As relevant survey data is scarce, I can only speak from my own experience, but Snapchat’s advertising experience is the worst among the major social media firms.

The analyst consensus still expects Snapchat to have constantly positive EPS by next year, rising to ~$1.4 by 2029 and doubling or tripling its annual sales by then. This is possible if Snapchat can achieve a moat, but I doubt it. In my view, it is more likely that its existing user base will continue to deteriorate, leaving it with a poor cash position and negative cash flows by its considerable debt maturity in 2027. I think its performance over the next two quarters, specifically on DAUs, will be the most telling signal regarding its long-term survival potential.

Since SNAP is quite volatile and could bounce if it outperforms its Q3 data, I would not short SNAP today. Further, if we assume it has a path to the profitability of an EPS of $1+, it may be fairly valued or even undervalued today, so I am not particularly bearish on it. That said, my base case view is that it may lose its existing value by 2027 and struggle to repay and refinance its debt as it faces accelerated user attrition. For me, SNAP’s best hope is a TikTok ban; however, fewer Americans support a TikTok ban today, and Trump has seemingly backed away from that issue, joining the platform. I may become bullish on SNAP if TikTok is banned, but that seems very unlikely for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.