Alibaba: Time To Bail Out

Summary:

- I sold my Alibaba Group Holdings stock after a 50% rise, driven by Beijing’s stimulus measures, which I believe won’t have long-term benefits for consumers.

- The stimulus program focuses on the financial sector and property market, risking speculation rather than boosting consumer spending, which Alibaba relies on.

- Alibaba’s stock surged past key moving averages but has since shown bearish signals; I closed my position due to the overbought condition and high valuation.

- Despite my long-term bullish view, I see limited immediate benefits for Alibaba from the stimulus and will consider reentering at a lower price range.

maybefalse/iStock Unreleased via Getty Images

Alibaba Group Holding (NYSE:BABA) has enjoyed a parabolic rise in its stock price in September and October, after Beijing announced stimulus measures that are meant to promote economic growth and help both companies and consumers deal with a slow-growing economy. The stimulus proposal primarily focuses on the financial sector; however, that is poised to lower refinancing rates.

I am critical of this spending plan as lowering financing costs could primarily fuel speculation in financial and real estate markets and such plans don’t tend to have long-term impacts on the economy and might not help consumers much at all.

Taking into account that Alibaba Group Holding’s stock substantially rose last month, I have decided to take profits. I think the risk of a deflation is high here, given an emerging stock consolidation pattern in Alibaba Group Holdings’ stock chart.

My Rating History

I argued in my last piece on Alibaba Group Holding that the eCommerce company was a compelling growth story long-term, and thus assigned a stock classification of Buy.

With that said, Alibaba Group Holdings’ stock price ballooned in the last six weeks, reflecting growing optimism about China’ stimulus proposal. I think this proposal is not guaranteed to help consumers and Alibaba much at all, and therefore have sold into the strength to realize profits.

Stimulus Proposal And Potential Impact On Alibaba Group Holdings

China’s economy has seen a very slow, sluggish and choppy recovery after the COVID pandemic. China’s GDP rose 4.6% in the third quarter, which was weak in China’s historical context, but it beat the estimate of 4.5% growth regardless. It was also the lowest annualized growth figure since 1Q23, which suggests that China’s economy is not doing all that well. The Communist Party of China is targeting 5% per annum growth in its gross domestic product this year, a figure that some observers consider hard to achieve.

China’s Gross Domestic Product (National Bureau Of Statistics Of China)

With a choppy recovery after COVID and China’s economy possibly falling short of the CCP’s stated growth target of 5% in 2024, Beijing is resorting to stimulative measures in order to kick its economy into gear.

The People’s Bank of China slashed interest rates on mortgages by 0.5 percentage points last month and is easing reserve requirements in order to promote lending. More than anything, in my view, these measures are directed at propping up the debt-laden property sector, which has seen speculative excesses in the past. China is also considering putting 1 trillion Yuan (US$141 billion) into its state banks in order to support lending activity.

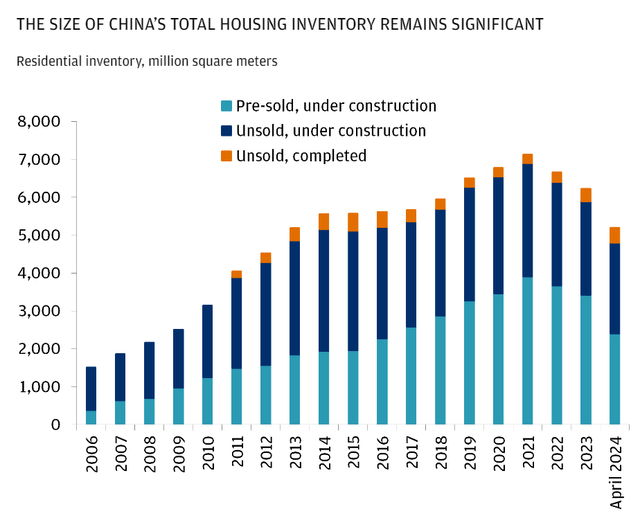

Easing financial requirements for mortgage holders, however, risk exacerbating speculation in financial and real estate assets. Property speculation is one of the brewing problems in China’s economy, as indicated by a big amount of unsold housing inventory. With developers having more problems to sell their apartments and condos, fiscal stimulus bills that are focused primarily on borrowers, not consumers, risk creating new speculative bubbles.

China’s Total Housing Inventory (J.P. Morgan Private Bank)

Moreover, retail spending in China has been soft in the last year as well, thanks to growing strains emanating from the leveraged property sector.

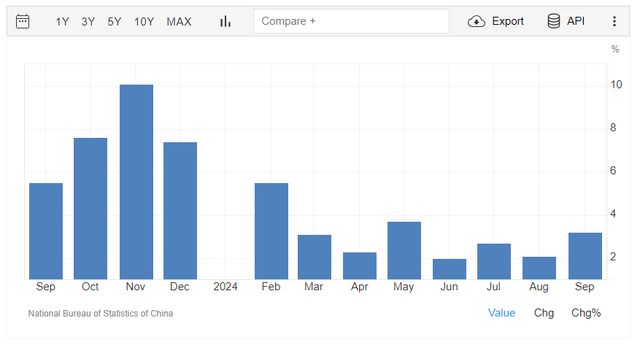

China’s retail sales have disappointed much of this year: In September, sales in China’s retail sector rose 3.2% YoY, but sales growth has substantially moderated over the last twelve months, highlighting risks to companies like Alibaba Group Holdings which are dependent on consumers opening up their wallets freely and willingly.

China’s Retail Sales (National Bureau Of Statistics Of China)

Though my long-term view on Alibaba Group Holdings is bullish, I am not sure that the eCommerce company is poised to benefit from a financial sector-focused stimulus program. The eCommerce company could profit from higher retail sales spending if Chinese consumers are actually spending money on eCommerce or food delivery products that Alibaba Group Holdings provides.

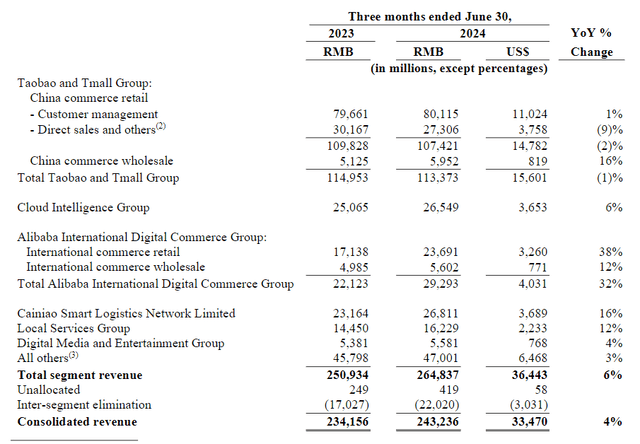

In the quarter ending June 30, 2024, Alibaba Group Holdings’ produced 4% sales growth and could need a shot in the arm. Sales in the eCommerce group (Taobao and Tmall) actually decreased 1% YoY, partially because China’s economy is slowing down. The eCommerce business accounted for roughly 47% of sales in the last quarter, so Alibaba Group Holdings does have considerable exposure to other segments.

So even if some of China’s stimulus money ends up at Alibaba Group Holdings’ eCommerce business, the bottom-line impact is probably going to be quite small.

Consolidated Revenue Growth (Alibaba Group Holding)

Technical Chart Profile

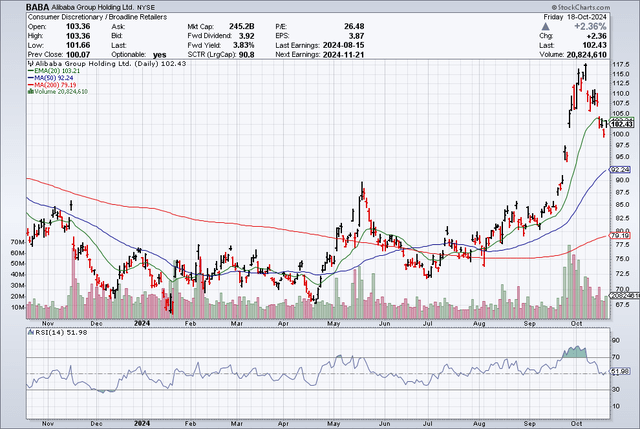

Alibaba Group Holding’s stock started to surge in September and appears to have peaked in early October. This surge was catalyzed by speculation that Beijing’s stimulus packages would reinvigorate economic growth and, by extension, help companies heavily engaged in consumer-centric businesses, such as Alibaba Group Holdings’s eCommerce segment.

As a consequence, Alibaba Group Holdings’ stock broke through the 200-day, 50-day as well as 20-day moving average trend lines on escalating volumes, creating successive daily opening gaps at the end of September. This buyers’ rush has run out of steam in October, however, and Alibaba Group Holdings already fell through the 20-day moving average trend line, which is a bearish short-term signal. Alibaba Group Holdings’ stock was also heavily overbought in September and October, a sentiment that is now at risk of reversing.

In my view, taking into account the severe upsurge in Alibaba Group Holdings’ price, I have decided to take profits last week and close my position for the time being. While I am not a trader, the 50% increase in stock price is a good justification to realize profits here.

Moving Averages (Stockcharts.com)

Alibaba Group Holdings Is No Longer A Steal

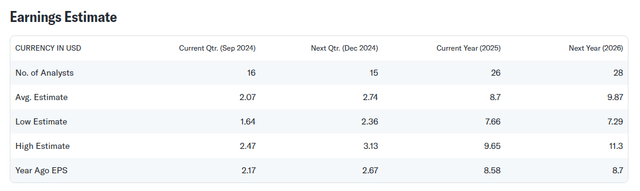

Profit estimates have not moved much since my last review of the eCommerce company (they are up $0.01 per share for next year). The market presently models $9.87 per share in profits for next year, which reflects back to us an anticipated profit jump of 13% YoY.

At a present stock price of $102.43, Alibaba Group Holdings’ stock is selling for 10.4x next year’s profits, as opposed to 8.3x at the start of September. A substantial re-rating has occurred here, and the stock came very close to touching my intrinsic value estimate (I derived an intrinsic value estimate of between $118 and $128 last time I reviewed Alibaba Group Holdings).

I ended up selling my position between prices of $108-110 and might considering reestablishing a long position in the $80-90 price range.

Earnings Estimate (Yahoo Finance)

What Might Go Wrong

I might be wrong and too pessimistic about the impact of China’s proposed stimulus program. If it turns out that the People’s Bank of China’s efforts to stimulate lending actually have a durable impact on consumer spending, then Alibaba Group Holding might indeed be a beneficiary of this stimulus package.

Furthermore, if evidence were to emerge that China’s retail spending is growing, I could make a strong case for owning Alibaba Group Holdings’ stock due to its eCommerce exposure.

However, taking into account the parabolic increase in Alibaba Group Holdings’ market valuation, however, I still think this might not be the worst time to take profits.

My Conclusion

I sold my holdings in Alibaba Group Holdings last week and presently own no position.

Alibaba Group Holdings’ stock went parabolic in September as investors cheered Beijing’s stimulus proposals, which pointed to relaxing conditions for the financial sector. This in turn created a surge in interest in eCommerce companies, some of which are anticipated to profit from an incremental increase in retail spending related to such stimulus proposals. However, I think that the stimulus program may first and foremost aid financial speculators and property owners, not so many consumers and Alibaba Group Holdings.

In addition, stimulus bills don’t tend to have long-lasting effects on consumer spending or economic activity, which suggests to me that this stimulus proposal will be nothing more than a short-lived straw fire.

In my view, Alibaba Group Holdings now longer has a promising risk/reward relationship, and I most definitely wouldn’t want to be a buyer after such a substantial rise in price. Thus, I am taking profits and moving to the sidelines for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.