Summary:

- Healthcare stocks are both defensive and present a mean reversion opportunity, making them attractive for risk-averse investors.

- Revenue exposure analysis shows consistent growth trends over 10 years, indicating stability and resilience but downward over 5.

- Valuation metrics show AbbVie to be only slightly undervalued based on FY 2025 projections.

- With Humira revenue degrading, it would be wise to wait for evidence of a revenue replacement before jumping in.

MoMo Productions

Healthcare is both defensive and a mean reversion case

After writing a recent article on Johnson & Johnson (JNJ), I had some requests in the comment section to cover AbbVie (NYSE:ABBV). This is a stock I have owned for a while that was purchased a few years ago as part of a “Magic Formula” 30 stock buy and hold strategy that I implement for a part of my portfolio.

The company remains on the Magic Formula screener as a good value, starting at stocks with a market cap of $80 billion or larger. However, the screener is not flawless and there are some anomalies that make free cash flow larger than the valuation metric I used, “owner earnings”. The main difference is the line item “write down and restructuring costs” which was recorded on the cash flow statement at nearly $5 billion on a trailing twelve-month basis is not a sustainable add-back to cash from operations. Owner earnings only utilize Depreciation and Amortization as an add-back.

AbbVie is a decent deal based on the dividend, but new CEO Robert Michael who took over for Richard Gonzalez, an internal promotion from Michael’s COO role prior to Gonzalez’s retirement, made it seem like single-digit growth is about the best the company has in store for the next few years. More in a bit, but the Humira patent expiration in 2023 also presents a bigger problem than I think the new CEO’s first earnings call opined. I own the stock and will continue to, but the stock is currently a hold in my opinion until either the stock grows into its valuation or the price comes down.

Current story and trends

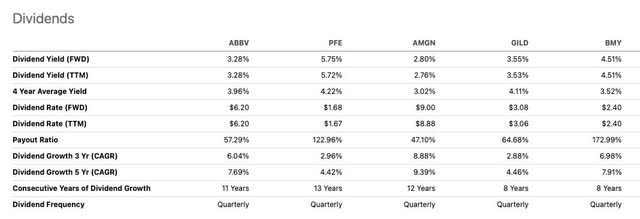

AbbVie is one of the pure pharma plays in healthcare that is solely reliant on its drug sales and in-organic acquisitions of other drug companies to grow top and bottom lines. They are dissimilar to a company like Johnson & Johnson, which also has a med tech division and is more in line with competitors like Amgen (AMGN) or Pfizer (PFE).

The main area where AbbVie differs from other pharmaceutical companies is that they have one of the highest exposures to “immunology” versus oncology drugs, at more than 50% revenue exposure. Think of things like psoriasis, Crohn’s disease and other drugs related to autoimmune disorders.

Humira exclusivity has ended

An excellent 2023 piece from Healio describes just how big of a deal Humira is:

In 2021, Humira — the blockbuster biologic that has for years been the highest grossing drug in the world — accomplished something that no drug had previously achieved when its global revenues topped $20 billion.

Through both biosimilar competition and an ending of exclusivity in 2023, the Humira boom is over. Revenues have started to deteriorate, and the ending of this blockbuster drug’s exclusivity was probably a factor in the previous CEO stepping down at the top of the mountain. It didn’t get much better for the company than the 10-year run up to 2023 which saw revenues absolutely boom.

Both revenue and gross profit more than doubled during these 10 years, and the new CEO has big shoes to fill to keep investors happy for the next 10.

Revenue exposure

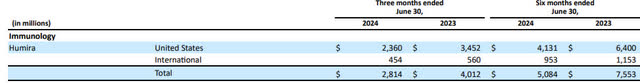

All numbers in millions courtesy of ABBVIE most recent 10-Q:

| SEGMENT | REVENUE | PERCENT |

| Immunology | 6971 | 56.5% |

| Oncology | 1506 | 12.2% |

| Aesthetics | 1390 | 11.27% |

| Neuroscience | 1931 | 15.65% |

| Eye care | 533 | 4.32% |

| Total from major segments | 12331 |

This is the most recent revenue exposure for AbbVie from their most recent quarter’s 10-Q covering not all of their revenue, but the revenue that covers their wholly owned drugs. We can see that AbbVie is a heavy play on immunology. I personally think this is going to be a growing industry as someone who suffers from food allergies. The amount of specialized foods that now exist to help allergy sufferers with autoimmune disorders is a great indication that this trajectory is only going one way.

With Rheumatoid Arthritis being one of the main presenting issues from autoimmune disorders along with intestinal and dermatological, Humira was definitely a “catch-all” for this segment.

| IMMUNOLOGY SEGMENT | Revenue | Percent of segment |

| Humira | 2814 | 41.20% |

| Skyrizi | 2727 | 40.90% |

| Rinvoq | 1430 | 17.70% |

| total | 6971 |

With the self-proclaimed “degradation” of Humira earnings on the most recent quarter’s earnings call, Skyrizi is coming up the back end in the immunology segment and will soon become AbbVie’s leading drug. This drug goes beyond mere Rheumatoid Arthritis and gets into being a cytokine disruptor aimed at alleviating a whole host of autoimmune issues including plaque psoriasis, psoriatic arthritis, Crohn’s Disease, and Ulcerative Colitis.

With the primary patent for Skyrizi not expiring until 2033, this will be the primary cash cow for the company until further notice, in my opinion.

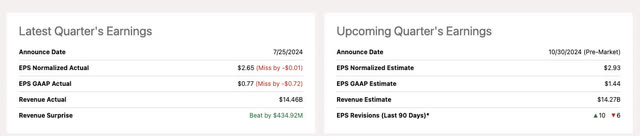

Upcoming Earnings

With earnings set to report October 30th, there have been 10 upward revisions since the last earnings report, where the new CEO guided higher on the call. I did find it odd that he expressed such confidence in how well everything was going after a miss on the bottom line.

Keep in mind, in comparison to last year, Humira revenue has declined 31.6% on a 3-month basis and 35.4% on a 6-month basis. If this keeps up and other drugs don’t pick up the slack, it will be difficult to keep growing at high single digits as guided.

The company has already started to look at earnings growth “ex Humira”, which means they are putting that top revenue generator on a perpetual negative growth train to hades.

Measuring reflexive trends

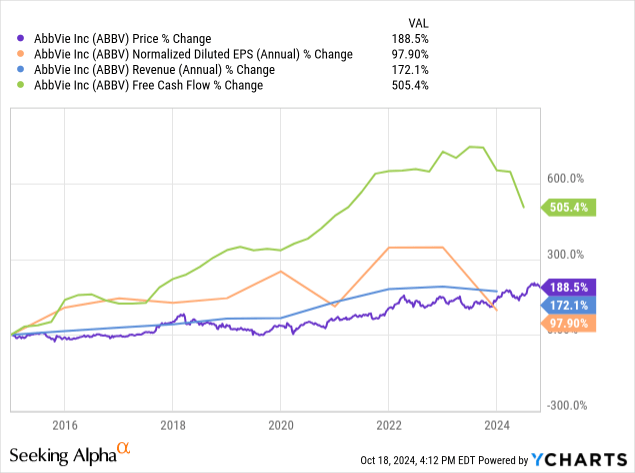

10-year trend

On a ten-year basis, the reflexive trends for long-term holders have not been horrible, with free cash flow growing well ahead of price growth. However, we see obvious trends in chart lines dipping downward starting in 2023 for revenue, normalized EPS, and free cash flow. Let’s zoom in closer at the 5-year level.

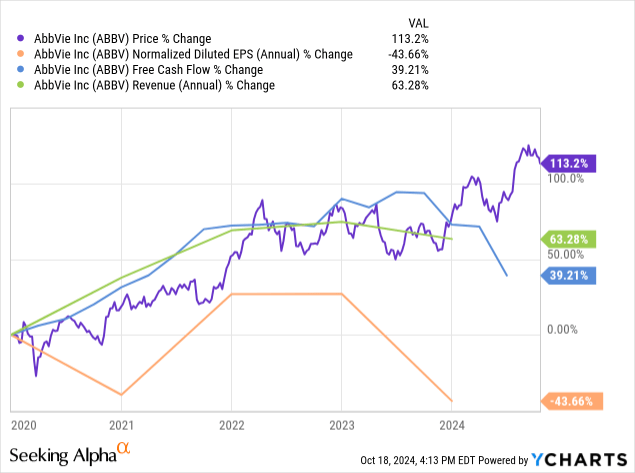

5-year trend

On a 5-year comparison, we now see all major profitability metrics [revenue, free cash flow and normalized EPS] dipping well below price growth during this period. For new buyers, the current trend might not be your friend.

Valuation

AbbVie is a slow grower. Thus, this company needs to be weighed against its current “cheapness” using the risk-free rate.

In this model, I use the classic Warren Buffett “Owner Earnings” model. Similar to discounted cash flow, except this takes into account taxes, interest and stock-based compensation. This model uses GAAP net income as it’s base profitability metric and then adds back depreciation and amortization. Finally, TTM CAPEX is deducted.

This is all discounted by the risk-free rate using the 10-year Treasury. Buffett argued that if a company could predictably grow earnings from the point of entry into the future, then an investment in the evaluated stock would be better than an investment in a risk-free alternative like the 10-year Treasury since that is a fixed return versus a growing one for said company. Currently, the risk-free rate sits around 4.2%, and I will use this as my discount rate.

In the case of AbbVie on a trailing twelve-month basis, we have the following:

All numbers in millions courtesy of Seeking Alpha:

- Net Income: $5,339

- Depreciation and Amortization: $8,516

- TTM CAPEX:$858

- Equation: [$5,339 + $8,516]-$858= $12,997 “Owner Earnings”

- $12,997/4.2%= $309,452 fair market cap.

- Divided by shares outstanding [1,766.3] = $175.19 fair price.

With consensus estimated earnings guidance slated at 11% growth in EPS from FY 2024 to FY 2025, that would put the fair price at $194.46 if all other items in this model remained constant [CAPEX requirements and depreciation and amortization]. That would make AbbVie slightly undervalued based on next year’s earnings, but I’d rather see the profitability trend lines tick positive before I take the chance to buy more shares with such a thin margin of safety.

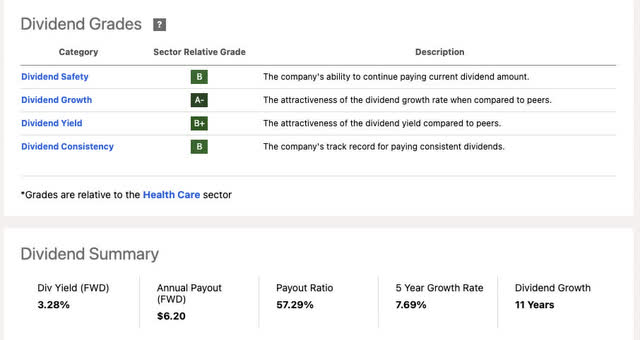

The dividend

As a percentage of free cash flow per share:

- TTM FCF/share= $10.05

- FCF payout ratio= 61%

This is one of the main items that makes this stock popular, it pays a really nice dividend with growth for 11 years and a moderate payout ratio.

The dividend is actually second best on this list of peers in my opinion as AbbVie provides a 3.28% yield which is still covered on a GAAP earnings basis. Gilead Sciences (GILD) would be the top yield at 3.55% and still covered.

Even though the dividend looks safe for now, they are going through a write-down phase with Humira that is freeing up some free cash flow with the write-offs but creating more moving parts, making it more difficult to predict future free cash flow.

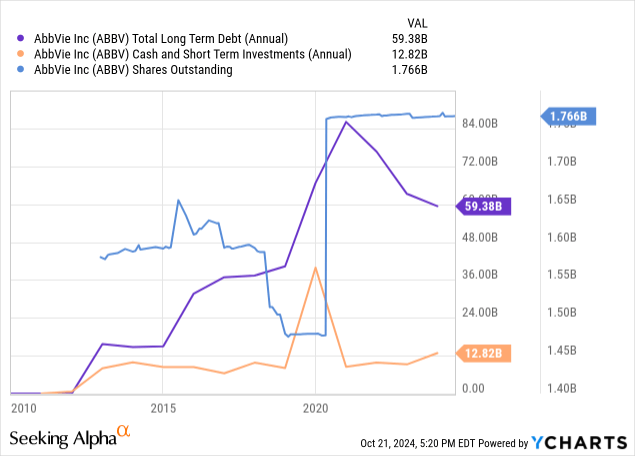

Balance sheet

This balance sheet is a bit of a mixed bag observing my 3 favorite metrics, shares outstanding, long-term debt and cash and short-term investments.

Share count may tend to fluctuate in big pharma names as acquisitions come into the pipeline, which may be purchased with shares if advantageous due to share price appreciation.

Long-term debt has dipped a bit and cash has leveled out since those share issuances. We can clearly see the correlation between cash and shares during that early 2020s period.

Nothing to write home about here, not a particularly strong or weak balance sheet, with LT debt about 5 X cash and only about 2 turns greater than the company’s $26.12 Billion TTM EBITDA.

Share buybacks would be welcome here to start getting the float back on a downward trajectory, or else AbbVie might start creating its own headwinds to beating analyst expectations for EPS.

Catalysts

Cerevel was the most recent big acquisition closing in August, here are some details for the bolt on outlook:

AbbVie’s acquisition of Cerevel strengthens our foundation in neuroscience and positions us to deliver sustainable long-term performance into the next decade and beyond,” said Robert A. Michael, chief executive officer, AbbVie. “Our new Cerevel colleagues share our commitment to deliver meaningful change for patients living with neurological and psychiatric conditions. We are excited to welcome the talented Cerevel team to AbbVie.”

There are multiple programs in Cerevel’s pipeline across several neurological and psychiatric conditions such as schizophrenia, Parkinson’s disease and mood disorders, where there continues to be significant unmet need for patients. Cerevel’s pipeline is highly complementary to AbbVie’s existing neuroscience portfolio and the completion of the acquisition is an important step forward to delivering new and better tolerated therapies.

Keep in mind, Cerevel is a pre-revenue mid-stage drug developer that AbbVie can now take to market, but the end market is in no way a proven top or bottom line grower.

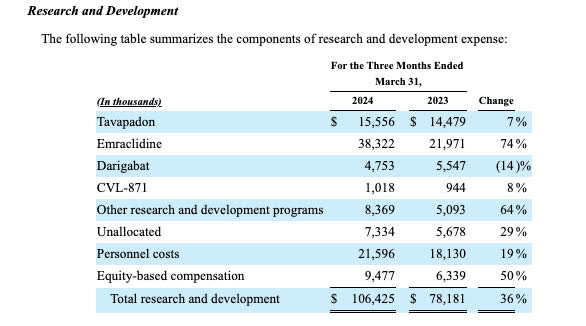

Cerevel MR10Q

In Cerevel’s most recent 10Q, they lay out the R&D costs for their drug lineup, listed in thousands. This is the final 10Q before going private and becoming part of AbbVie.

The total R&D cash burn before absorption stood at over $100 million.

The other growth areas, as focused on by CEO Robert Michael, were the cross-selling of the different immunology drugs. From my understanding, many of these immunology drugs can be prescribed for different autoimmune disorders. Having the drugs prescribed for new autoimmune disorders that they were not previously prescribed for are new organic growth areas.

Risks and summary

We have a new CEO after an amazing run with Humira, and a doubling in top-line revenue over the last decade.

Now the company seems to be relying on a bump in other immunology drugs entering new autoimmune prescriptions combined with a growth bump in oncology and growth in neuroscience. The company has goals and a clear trajectory of what they want to do, but it could be a long road and the current growth rate lines in all profitability metrics are pointing in the wrong direction.

The stock also seems overvalued on an owner-earnings model up against this year’s earnings and moderately undervalued up against next year’s earnings if they hit analysts’ predicted growth rates. This is a hold for the nice covered dividend, but not cheap enough for a buy rating based on profitability trends.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, AMGN, JNJ, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.