Summary:

- Affirm is likely to remain a long-term BNPL winner, thanks to its double-digit growth rates in GMV, Active Customer base, and Revenues.

- Despite market volatility and elevated interest rate environment, the fintech has been able to grow its positive adj operating margins while guiding FY2025 GAAP profitability.

- AFRM’s growing merchant/ card fees arising from the higher transaction volumes may also balance the temporal rate normalization over the next two years.

- Given the consecutive double beats over the past six quarters and the relatively prudent FQ1’25 guidance, the management may record another beat and raise performance in November 2024.

- While AFRM remains a Buy, we offer a few caveats for interested investors attributed to the overly greedy market sentiments.

Klaus Vedfelt

AFRM Remains A Prime BNPL Player After A Moderate Pullback

We previously covered Affirm (NASDAQ:AFRM) in June 2024, discussing why we had reiterated our Buy rating, attributed to its renewed growth tailwinds as Apple (AAPL) exited the Buy Now Pay Later [BNPL] market while providing opportunities for other fintech lenders, such as AFRM and other credit/ debit card providers.

With AFRM still reporting robust double-digit growths and the consensus quietly upgrading their forward estimates, we believe that the stock remained a compelling Buy then.

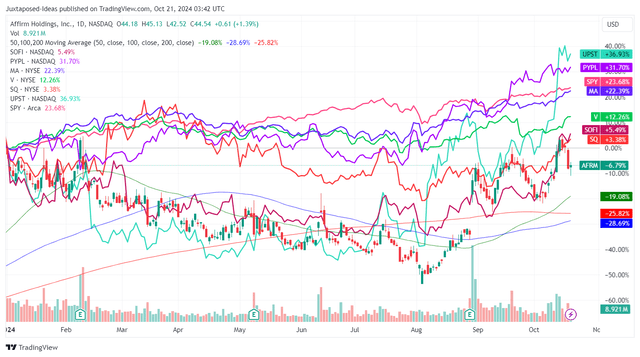

AFRM YTD Stock Price

Since then, AFRM continued to trade sideways before the painful market rotation in July/ August 2024, with the Fed’s outsized pivot by 50 basis point in the September 2024 FOMC meeting triggering the much-needed reversal in market sentiments and its stock price trajectory.

The same recovery has also been observed in numerous fintech stocks, thanks to the lower borrowing costs at between 4.75% to 5.00% by the time of writing, with the market already pricing in another 25 basis point rate cut in the upcoming November 2024 FOMC meeting.

This is a critical development for fintechs such as AFRM indeed, since the “lower interest rate environment (may potentially) lead to increased consumer demand and a corresponding boost in” its revenues, on top of the lower cost of funding.

If anything, the BNPL leader has been able to sustain double-digit growth rates in Gross Merchandise Value [GMV], Active Customer base, and Revenues, despite the supposedly elevated interest rate environment over the past few quarters.

This is on top of the positive adj operating margins of 16.4% over the LTM (+18.4 points sequentially), implying its ability to operate at scale despite the challenging macroeconomic environment.

Combined with the strategic partnership with numerous commerce/ Big-Tech companies, including Shopify (SHOP), Amazon (AMZN), Walmart (WMT), Lowe’s (LOW), and Apple, AFRM’s position as one of the market leaders in the BNPL space is undeniable indeed.

These developments may also be why the management felt confident to commit to its GAAP profitability guidance by the end of the FY2025 (August 2025), with it further underscoring why the stock has outperformed on a YTD basis.

While the lower interest rates may potentially trigger the moderation of its interest incomes and subsequently, top-lines, we believe that AFRM’s prospects remain extremely bright.

This is attributed to the fintech’s higher merchant/ card fees arising from higher transaction volumes potentially balancing the temporal rate normalization, as observed in the segment’s robust growth by +31.7% YoY in FY2024 – with it already signaling the platform’s growing adoption and sticky consumer/ merchant base.

The same has been observed in AFRM’s growing funding capacity of $16.1B (+3.2% QoQ/ +37.6% YoY), compared to the overall loan portfolio at $11B (+5.7% QoQ/ +26.4% YoY) – underscoring the lending partners’ growing optimism about the BNPL space along with the management’s execution thus far.

Perhaps part of the tailwinds may be attributed to AFRM being able to report a healthy loan portfolio performance, based on the relatively low delinquency rates at 2.4% for 30 days past due, 1.5% for 60 days past due, and 0.6% for 90 days past due.

This is compared to its credit card lending peers at 3% as of August 2024 and 2.67% in August 2019, with it implying AFRM’s decent execution, perhaps attributed to its waterfall partnership with Katapult (KPLT), a fintech focusing on the non-prime consumer base and a lease-to-own business model.

With this strategy allowing AFRM to generate rich fees from KPLT (through subprime and near-prime borrowers) while maintaining an internally prime/ healthy loan portfolio, we can understand why the market is increasingly optimistic about its relatively robust prospects, significantly aided by the $50B in BNPL TAM.

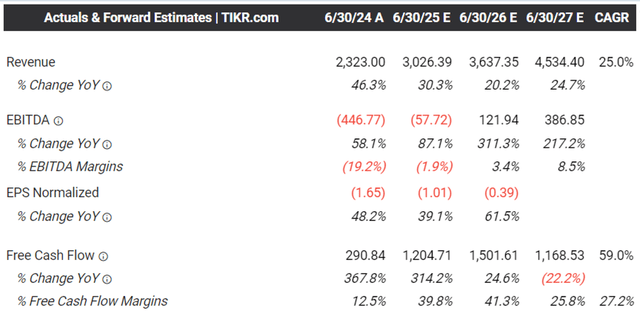

The Consensus Forward Estimates

For now, with AFRM expected to report FQ1’25 earnings call on November 07, 2024, readers may want to compare the management’s execution to the previously offered GMV guidance of $7.25B at the midpoint (in line QoQ/ +29.4% YoY), revenues of $655M (in line QoQ/ +31.7% YoY), and adj operating margin of 15% (-7.7 points QoQ/ +3 YoY).

Given the consecutive double beats over the past six quarters and the relatively prudent FQ1’25 guidance, we expect the management to exceed expectations while potentially offering a relatively robust FQ2’25 guidance, if the fintech executes as per historical trends.

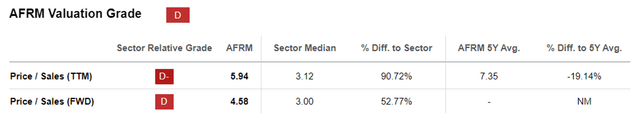

AFRM Valuations

This is also why we believe that AFRM remains compelling at FWD Price/ Sales valuations of 4.58x, compared to its 3Y mean of 5.88x.

Even when comparing to its high-growth fintech peers, including Upstart (UPST) at 8.38x, SoFi (SOFI) at 4.39x, and Block (SQ) at 1.86x, we believe that AFRM remains attractive after a moderate pullback.

So, Is AFRM Stock A Buy, Sell, or Hold?

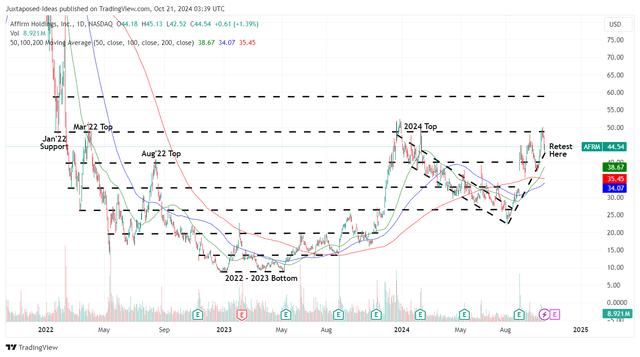

AFRM 3Y Stock Price

For now, AFRM has already charted an impressive near vertical recovery after the worst of the August 2024 bottom, with the stock currently sustaining a robust uptrend support while running away from its 50/ 100/ 200 day moving averages.

With the stock now retesting the $44s support levels, interested investors may want to pay attention to its near-term movement, since the raised consensus forward estimates well exceed the management’s relatively prudent revenue guidance by $9.44M – with a miss potentially triggering a near-term correction.

This caution is not overly done as well, since the stock market appears to be increasingly greedy, with elevated McClellan Volume Summation Index at 1,724.59x compared to neutral levels of 1,000x, and the CBOE Volatility Index increasingly elevated at 18.79x compared to the start of the year at 13.20x.

While we remain optimistic about AFRM’s long-term prospects, we believe that the recent rally has been overly fast and furious, warranting a cautious approach.

While AFRM remains a Buy, we urge interested readers to observe for lower entry points, preferably at its previous support levels of $37s for an improved margin of safety – with those levels also triggering a more attractive FWD Price/ Sales valuations of ~3.5x.

Patience may be more prudent for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.