Summary:

- Amazon is expected to meet or exceed Q3 earnings estimates, driven by strong performance in AWS and advertising.

- Looking ahead, Retail margin improvements may slow due to labor cost pressures and increased regulatory scrutiny, impacting overall profitability.

- AWS faces intensified competition and a shift towards multi-cloud strategies, which renders monopoly-like margins in 2-3 years from now unlikely.

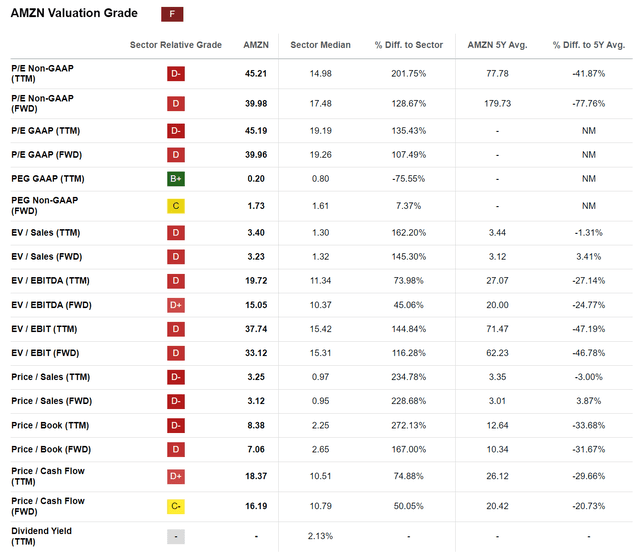

- Amazon’s stock currently trades at roughly 33x EV/EBIT based on 2025 estimates. This appears relatively high compared to valuation multiples of other Mag 7 stocks.

- I’m downgrading Amazon shares to a “Hold” ahead of this earnings announcement.

HJBC

Amazon (NASDAQ:AMZN) is set to release its earnings for the September quarter on October 31st, after the market closes. According to data compiled by Refinitiv, analysts (at midpoint consensus) project around $157.2 billion in revenue and $15.3 billion in operating profits, reflecting an 11% and 42% YoY increase, respectively. Considering the broader macro backdrop, which remains favorable for e-commerce and cloud computing growth, these estimates appear reasonable, and I expect Amazon to meet or even exceed projections. Looking for Q4 and early 2025 guidance, however, I see downside risk, as cost and competitive pressure drive margin risk in the retail and cloud segment, respectively. On valuation, Amazon’s stock is trading at approximately 33x EV/EBIT for 2025 estimates, suggesting a stretched entry point compared to the valuation multiples seen in other Mag 7 stocks, notably Google (GOOG)(GOOGL) and Meta (META). As such, I downgrade Amazon shares to “Hold” heading into this earnings report.

For context, Amazon stock has performed about in line with the broader market this year. Year-to-date, AMZN shares have risen by about 24%, while the S&P 500 (SP500) has increased by roughly 23%.

Margin Improvement In Retail Business Could Slow Meaningfully

Amazon’s retail segment has shown notable efficiency improvements, particularly through the regionalization strategy implemented under CEO Andy Jassy. Indeed, during the period spanning from Q1 2022 to Q2 2024, Amazon managed to increase the operating margin in the North America segment from -2.3% to 5.6%, mostly as a consequence of reduced fulfillment and shipping costs.

I don’t think Amazon’s Retail business can maintain a similar margin trajectory over the next few quarters, as the comparable basis is more difficult to improve upon and persistent labor cost pressures cannot be ignored, particularly within the core retail and logistics operations: For context, the company employs over 1.5 million people globally, and rising wages are a significant contributor to increasing operational expenses. Moreover, Amazon faces continued labor-related headwinds due to external pressures such as increased union activities and regulatory scrutiny. The FTC has been advocating for stricter labor regulations, and there’s an ongoing push to classify third-party delivery drivers as full employees rather than contractors. For example, in September 2024, Amazon raised wages for approximately 800,000 U.S. workers by $1.50 per hour, bringing the average hourly wage to around $22. Assuming that Amazon workers bill about 2,200 hours a year, the incremental costs for Amazon could add up to about $2.6 billion.

At the same time, I am not very bullish on Amazon’s ability to offset its higher cost base with higher prices. Indeed, I point out that Amazon’s reliance on low-priced essentials, alongside Prime Day and promotional events like Big Deal Days, has led to a rise in low-ASP products. While essential goods provide strong volume growth, the overall profitability is lower, which makes me doubt that Amazon can sustain high retail margins amid a discretionary spending slowdown.

AWS: Revenue Upside Clouded By Weaker Margins

AWS is expected to see another acceleration in its revenue growth throughout the second half of 2024, supported by new workloads, increased AI monetization, and easing optimization trends. For Q3 2024, AWS revenue is projected to grow around 20% YoY, according to data collected by Refinitiv, marking the fifth consecutive quarter of acceleration.

Despite the optimistic revenue figures, AWS’s market dominance is increasingly under threat: In the last few quarters, it has become clear that AWS facing intensified competition from Microsoft Azure, Google Cloud Platform, and Oracle. Notably, Microsoft’s integration of OpenAI’s large language models with Azure and its exclusive access to GPT models are giving it a competitive edge, which is particularly attractive to enterprise clients focused on AI applications. Google, in turn, is leveraging its Gemini models and data tools like BigQuery, resonating well with customers that require extensive AI and machine learning capabilities. At the same time, I am worried that Oracle’s recent progress with its cloud infrastructure is becoming a direct threat for AWS, as Oracle has seen success in retaining and expanding its cloud customer base by leveraging on the AI and database needs of its existing clientele.

On a longer dated perspective, I am not only concerned about AWS market share, but also about the structural change toward multi-cloud strategies. Enterprises are increasingly wary of single-cloud dependencies, and a substantial portion of them are choosing to diversify their cloud investments. In this context, AWS still remains the primary provider in many multi-cloud arrangements, but the market share dynamics are shifting, and I doubt that AWS can extract monopoly-like profitability in 2-3 years from now.

Advertising: A Bright Spot

The only clear bright spot I can see in Amazon’s upcoming Q3 report is advertising. On the advertising macro backdrop, UBS research noted (emphasis mine):

Budget growth accelerates throughout 3Q24: Despite a slower start, ad budgets accelerated in Aug into Sep citing uplift from political, brand advertising recovery, and improved consumer sentiment; and while most verticals ramped through 3Q24, we note particular strength in auto and CPG. Meta/Instagram and Google/YouTube both benefited from political spend and optimization/efficiencies unlock from automation and a greater share of budgets moving through Performance Max and Advantage+. (Source: UBS research note dated 7th October: 3Q24 Online Advertising Preview – Rising Tide Lifts All Boats on the 2024 Outlook)

Amazon’s advertising business is running at a growth rate of around 20% YoY, and I expect a 20% YoY growth also for Q3. That said, I also argue that the integration of generative AI into Amazon’s advertising tools and the incremental contribution from Prime Video ads could drive upside risk to the 20% benchmark. As a potential downside risk, the integration of costly content rights like the NBA into its advertising portfolio could drive up costs, potentially impacting margins.

Valuation: Only ~5% Upside

Amazon stock is currently trading at 33x EV/EBIT for 2025 estimates. This is somewhat expensive, in my view: Investors should consider that the EV/EBIT range for the Mag 7 stocks trends closer to 25x to ~30x (Meta 23x, MSFT 25x, AAPL 28x, GOOG 17x, NVDA 40x, TSLA 93x).

To be more precise on valuation, I highlight that I have previously estimated Amazon’s fair implied value at approximately $201 per share. And heading into Q3, I continue to view this estimate as reasonable, based on the enclosed assumptions:

For FY 2024, 2025, and 2026, I now anticipate EPS to be approximately $4.8, $6.2, and $7.8, respectively. These EPS estimates are about 10%-15% higher than consensus, primarily due to underestimations of Amazon’s advertising and cloud momentum. Additionally, I maintain a 3.5% terminal growth rate post-2026 and have adjusted my cost of equity assumption down by 50 basis points to 8.5%, aligning it with the broader Magnificent Seven group. With these updated EPS projections, I calculate a fair implied share price for Amazon at $201.

Looking at my target valuation of $201, and comparing it to Amazon’s current trading price of $190, I would argue that there is currently little valuation upside in AMZN shares (only ~5% according to my calculation).

Investor Takeaway

Amazon is scheduled to report its earnings for the September quarter on October 31st, after market close. Analysts, based on Refinitiv data, anticipate revenue around $157.2 billion and operating profits near $15.3 billion, reflecting 11% and 42% year-over-year growth, respectively. Given the favorable macro environment for e-commerce and cloud services, these estimates seem attainable, and I believe Amazon could match or exceed them. However, looking ahead to Q4 and early 2025, I see potential downside risks due to increasing cost and competitive pressures impacting margins in both retail and cloud segments. In terms of valuation, Amazon’s stock currently trades at roughly 33x EV/EBIT based on 2025 estimates. This appears relatively high compared to valuation multiples of other Mag 7 stocks, like Google and Meta. Therefore, I’m downgrading Amazon shares to a “Hold” ahead of this earnings announcement.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.