Summary:

- Bank of America’s preferred shares offer attractive fixed dividend yields, especially BAC.PB and BAC.PK, despite loan performance challenges and Warren Buffett selling common shares.

- The bank’s net interest income remains strong, with loans generating more interest income, although higher interest expenses persist.

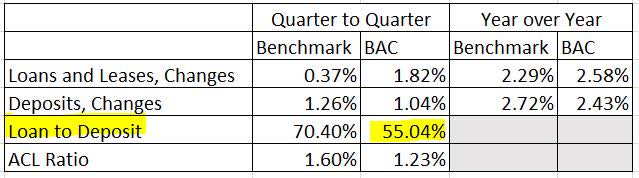

- Bank of America’s loan growth outpaces the commercial banking sector, and they have maintained a low loan to deposit ratio since the pandemic.

ProArtWork

Introduction

Bank of America (NYSE:BAC) (NEOE:BOFA:CA) is one of the world’s largest banks. Back in July, I warned investors against investing in the bank’s floating preferred shares as interest rates were expected to decline. Warren Buffett has been a notable shareholder in the bank, and his recent selling of shares has set alarm bells off for investors. While all the focus has been on the bank’s common shares, investors shouldn’t ignore the opportunities being presented by the fixed dividend preferred shares.

Microsoft Excel API

Bank of America Earnings

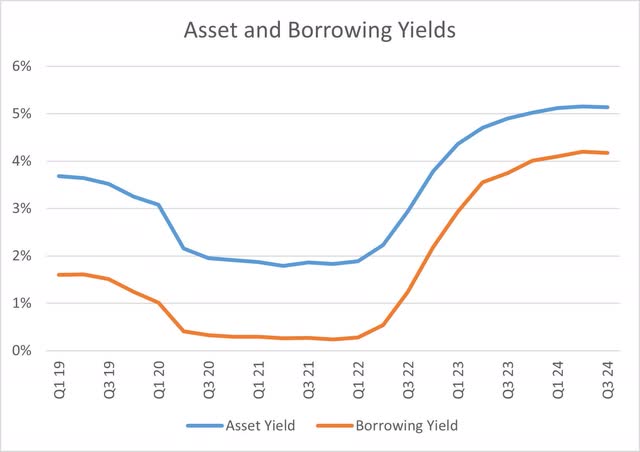

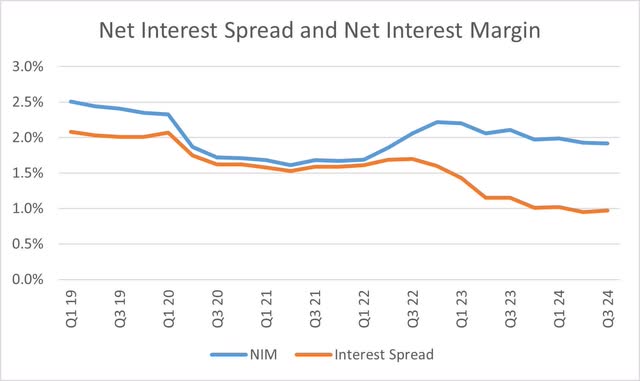

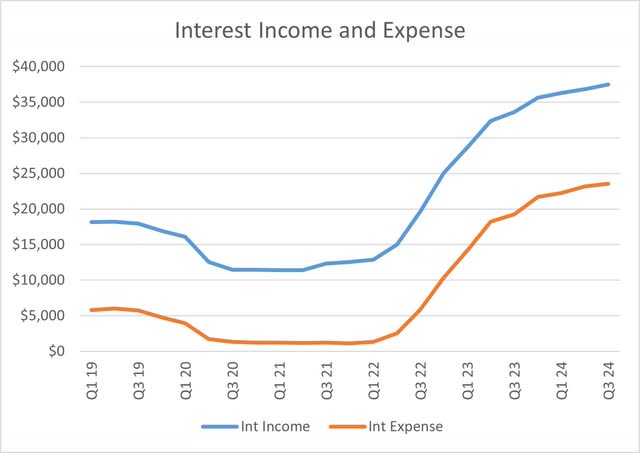

Like all banks, Bank of America has had to deal with interest rate volatility, with historically lower interest rates during the pandemic followed by higher rates lasting longer than expected in the fight against inflation. Asset yields have gone from under 2% during the pandemic to over 5% this year, and borrowing yields have jumped by more, going from 0.3% during the pandemic to over 4%. The drop in net interest spread has been troublesome but has been partially offset by the fact that the bank’s net interest margin, which reflects the weight of its leverage, has remained above pandemic levels.

Company Financials Company Financials

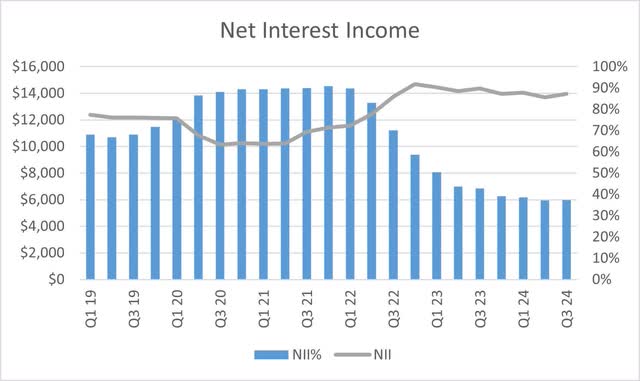

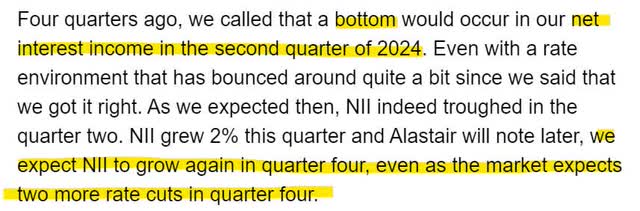

As rates have risen, Bank of America’s loans have been generating more interest income and consequently, the bank has faced higher interest expense. The bank’s net interest income (interest income less interest expense) grew to over $14 billion on a quarterly basis in late 2022 and continues to hover around $14 billion in the seven quarters since. Management has projected that net interest income will continue to grow in the fourth quarter.

Company Financials Company Financials Earnings Call Transcript

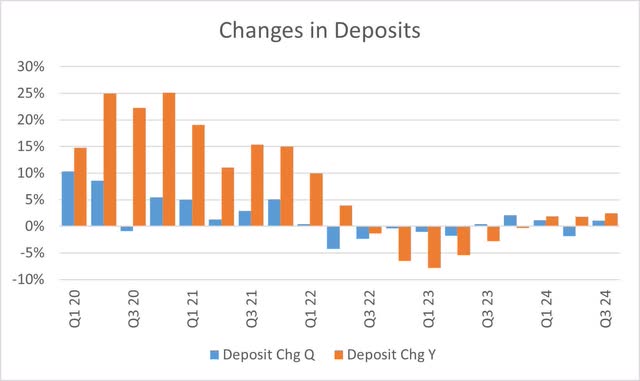

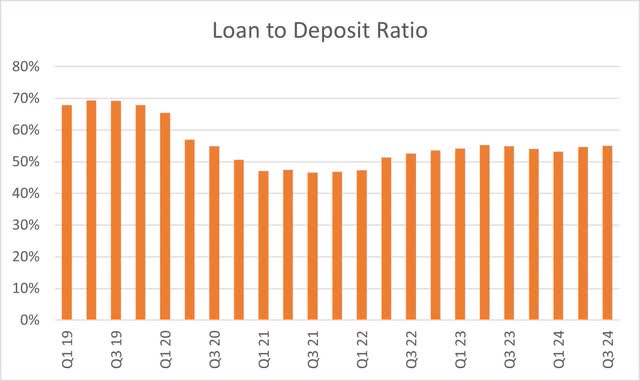

Loans and Deposit Growth

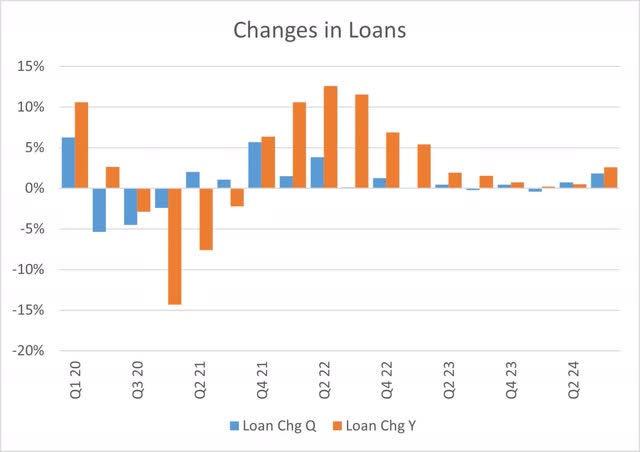

Bank of America’s loan growth continues to outperform the commercial banking sector. Loan growth for the bank rose by 1.8% in the quarter and 2.6% on a year-over-year basis. Deposits have grown by 1% on a quarterly basis and 2.4% on a year-over-year basis. When loans outgrow deposits, it increases the bank’s loan to deposit ratio, which increases the bank’s reliance on external financing.

Company Financials Company Financials

Fortunately, Bank of America has had a very low loan to deposit ratio since the pandemic. While the bank had a ratio of around 70% in the pre-pandemic era, the loan to deposit ratio currently sits at 55%, well below the norm for commercial banks, and it has been under 60% since the second quarter of 2020.

Company Financials Company Financials & Federal Reserve Data

Risks to Bank of America

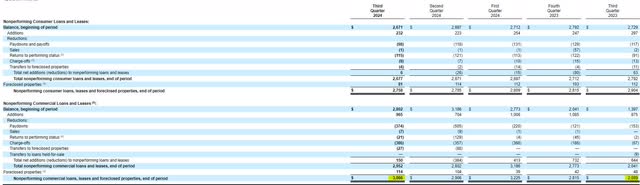

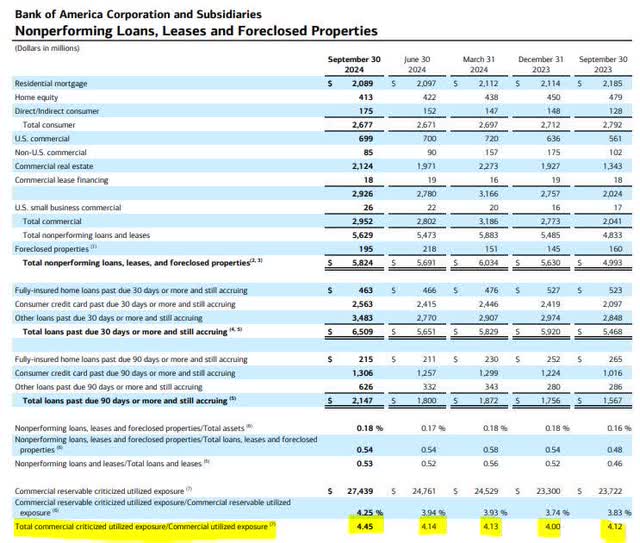

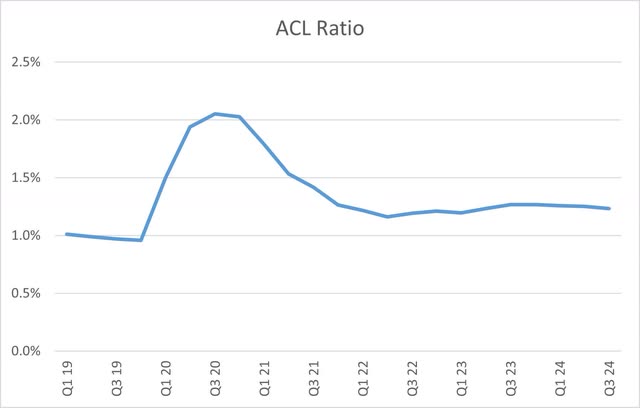

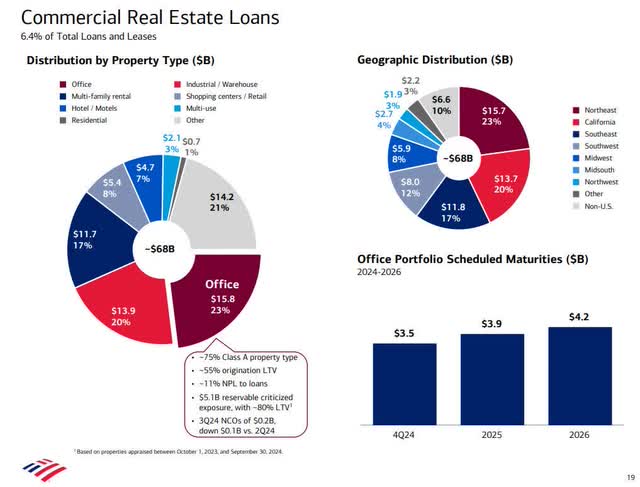

Bank of America’s loan performance and its exposure to commercial real estate is of concern for investors. Nonperforming loans have jumped by $1 billion from $2 billion to $3 billion. Meanwhile, the amount of loans under criticism by the bank has risen from 4.12% to 4.45% of gross loans. The lower-than-average allowance for credit losses could become a source of pain for earnings in the event of increased loan defaults. Bank of America is also facing a wall of office related debt maturities in the fourth quarter, which could hurt earnings. These are reasons for avoiding the bank’s common shares.

Earnings Release Earnings Release Company Financials Earnings Presentation

Not all Preferred Shares Are Created Equal

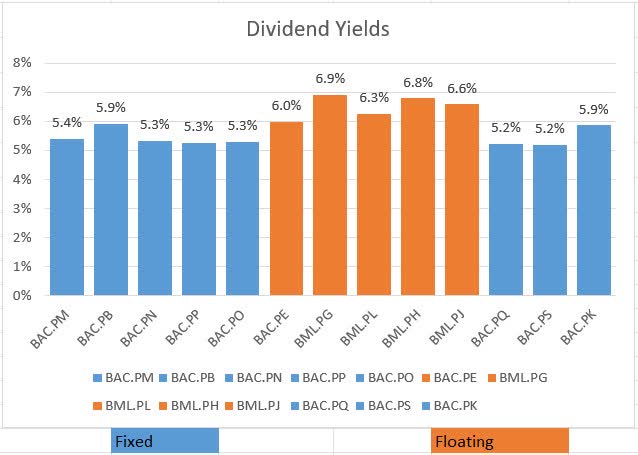

While Bank of America is facing loan performance challenges, the earnings headwinds should affect common shares and preferred share dividends cannot be touched unless the bank’s common shares dividends are eliminated, which is highly unlikely. Bank of America has three types of preferred shares, floating dividends, fixed dividends that are callable, and fixed dividends that are callable in the future.

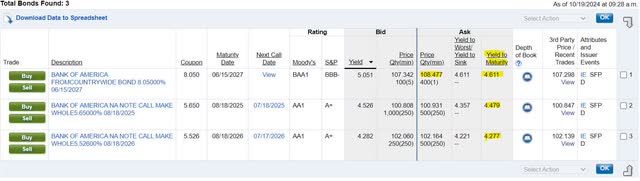

While the floating preferred dividends are trading at higher yields, lower interest rates in the near term are set to drive those dividends down. While investors who think rate cuts will stall in the face of higher inflation could invest in floating preferreds, I’m not in the mindset of trying to fight the Federal Reserve. I do like the two callable fixed preferreds (BAC.PB) (BAC.PK) due to their close to 6% dividend yields and the unlikeness of them being called inside the next quarter (where one quarter covers their small call risk premiums). One drawback of the fixed dividends that are callable is that they will not appreciate in price if interest rates drop because of their call risk.

Investors who are looking for interest rates to plunge due to recession fears may be interested in the lowest dividend preferred share (BAC.PP). These shares are trading at below $20 per share and would rise, providing capital appreciation to shareholders, if the interest rate drops. Unfortunately, I don’t believe that Bank of America’s bonds are attractive as they are trading well under preferred share yields and have moved past the height of interest rates where some bonds offered 6.55% coupons at par.

Conclusion

Troubles in the loan portfolio and Warren Buffett selling may turn people away from Bank of America shares, but investors should be mindful of the opportunities in the bank’s preferred shares. Both of Bank of America’s callable fixed preferred shares are trading slightly above call price, but they are providing the best fixed income return. I believe Bank of America will wait until rates have bottomed out until they call in these shares, so income investors should get a couple of years of 6% income returns with BAC.PB and BAC.PK.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.