Summary:

- Centene, a leading health insurer, shows strong fundamentals and growth despite sector challenges, making it a “Buy” at a target price of $70/share.

- The company’s 2Q24 results indicate robust earnings growth and increasing membership, contrasting with peers like Humana, which face significant declines.

- Centene’s valuation at $61/share with a P/E of 9x is attractive, projecting a potential 27.17% annualized upside until 2026.

- Despite lacking a dividend, Centene’s stability and growth prospects in government programs and managed healthcare segments justify a conservative investment approach.

AmnajKhetsamtip/iStock via Getty Images

Dear readers/followers,

Centene (NYSE:CNC) is an interesting stock and play in health insurance, with both age, tradition, and the sort of fundamentals that you’d really want to be focusing on if you were looking to invest in healthcare companies. It has revenues in the hundred-billions, it has exposure to Medicaid and Medicare. The fact that it lacks a dividend is only a slight discouragement. My last article was back in late December of 2022. That was, at this point, almost 2 years ago. Unfortunately, during this article, I went “Buy” on the company. This was indisputably the wrong choice, given that this stance has underperformed by over 75%, with a negative 25.48% RoR, while the S&P500 is up 52%.

At the same time, my thesis before this was a “Hold” – as were the articles preceding it. It was a miscalculation on my part, going “In” at that time. I’m only thankful that my position in this case was fairly small, and above all that it was options-based, and I was able to leave it behind. Centene is, in fact, in a sector that i, in fact, have mostly left behind entirely.

Why have I left the sector behind?

Because the trends in healthcare and health insurance, especially in the USA, are not necessarily things I want to get into. The visibility here too is poor – and I don’t see a clear pathway to profit that would entail me taking the risk that I see this being (in terms of a risk/reward ratio).

At the same time, one consideration that I will be looking at here is that Centene is being unfairly dragged down with other insurers, despite being better than those insurers.

Is that the case we have here? Should we, in fact, Buy, more of the company?

That’s the question that I aim to answer here.

Centene – Updating for 2024-2026E

Centene is in the business of offering insurance plans. Despite the drop in valuation, we’re talking about a market capitalization of a $32.2B. Centene has 28.5M members as of the last full annual and manages to generate earnings in excess of $2.6B every single year, out of premiums of over $140B for 2021.

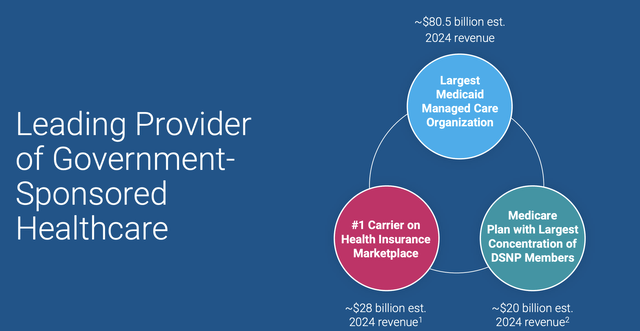

Centene is the #1 health insurance carrier in the United States (marketplace).

Centene IR (Centene IR)

Like other companies in this field, the company claims that its conviction and goal is to deliver better healthcare outcomes at lower costs. It’s these healthcare savings that both politicians and individuals are looking for. 1 in 15 people in the USA have coverage with Centene using Medicaid and Medicare, including things like prescription drug plans as well as the TRICARE program.

Centene also partners with other commercial organizations and healthcare players to provide specialty services.

The latest set of results we have to look at for Centene is 2Q24, but we’re a short time away from the 3Q24 period. That means that this article will serve as a preview of what Centene could deliver as a business – and based on this, whether the case for the company is stronger or weaker here.

2Q24 would certainly suggest that the positive stance is the one to take.

Why?

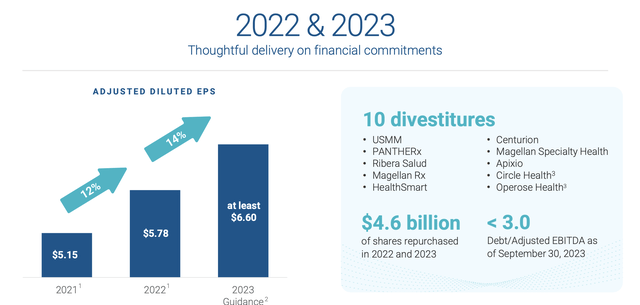

Centene IR (Centene IR)

Because earnings continue to grow despite the trends seen in valuation. Adjusted EPS on a diluted basis is up 15%, premiums and service memberships are growing, and the trends in health insurance actually mean that more members are seeking to join Centene as a service, not less. The company’s SG&A expense ratio is below 8.5%, and its health benefit ratio for 2Q24 is at 87.6%. These numbers alone are of course not enough to suggest or to see what upside or what trends we might see here.

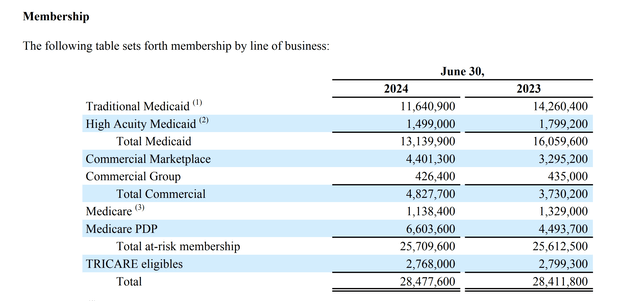

Also, membership in the company’s various programs has been increasing, suggesting that there is further growth here to be had – despite the company selling off segments.

Centene IR (Centene IR)

I want to trace a connection between Centene and other insurers here – namely Humana (HUM). Humana is a company that I personally never invested in, even though at times it was interesting to do so if the right valuation appeared. However, Humana is on track for a decline in 2024E earnings, and a fairly significant one. We’re talking well over 35% (Source: F.A.S.T Graphs Paywalled Link). The question is if Centene will mirror this decline in earnings and results.

The current forecast tells us that this is not the case – or at least, not the current assumption. Centene has been improving its structure, including selling off the Collaborative Health Systems – but above all, it has not been declining.

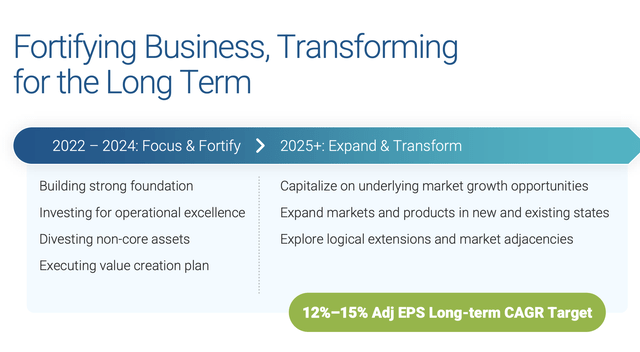

The company, since last year, has maintained its 12-15% average adjusted EPS long-term growth target. I believe we can assume that this target, at this point based on estimates, is about halved. So that needs to be taken into consideration when considering an investment into Centene.

The company is continuing to see growth in the fastest-growing segment of the market, including government programs. Centene – and others – are expecting the government programs to continue to drive healthcare spending and enrollment. The risk here in opposition to this expectation is that the government/s will be looking at every avenue to cut costs – and when it comes to something like healthcare, governments can sometimes “decide” on something even knowing that it will hurt the margins of the companies that are involved. Just look at what happened with Humana. The thing about these insurers is that their profit margins are incredibly slim. Every single adjustment or restriction has impacts – a company with a 2-3 % profit margin doesn’t have a whole lot of wiggle room.

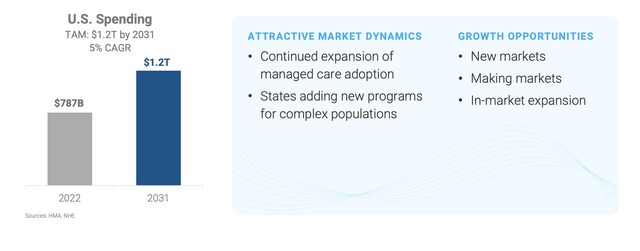

So while Medicaid is attractive, and while US spending for Medicaid programs, in my estimate, is expected to grow in accordance with the expectations we see below…

Centene IR (Centene IR)

…the question becomes also what the company can expect in terms of margins. When looking at things like margins, inflation, wage growth, and other factors (including some of the arguments like a growing population of “gig” workers, which the company views as a positive for its marketplace), the question becomes again, pricing for the individual and margin for the company, and the government’s role in all of this.

A lot hinges on these companies managing this rope-balancing act in a good way. Take a look at one of the things that caused Humana to drop. The government was set to cut its rating on one of the insurer’s large Medicare Advantage plans, due to missed performance measures – with analysts clarifying that any such drop would significantly impact rebates and quality payments from the government (Source).

This caused a 21.3% drop in a single day as the day was starting by Humana. And this also dragged down Centene as well – as well as other insurers with similar exposure. In fact, I believe Humana’s response made it worse, actually, given that the cut was due to “narrowly missing” higher cut points in the industry on a small number of measures.

Because if the margins for error are so small, what does that say for the company’s fundamental appeal?

So, is Centene an attractive company? Yes – and it also had a decent 2024 Q2, though it does have some work to do with some of its plans. But the risks I see here are significant, not as they are right now, but as I would see them over the next 5-10 years. And that’s where I am looking for a company like this one, without a dividend and with no real rating advantage.

Centene IR (Centene IR)

Centene is not Humana. It has a different mix. 2Q24 is only the latest proof of that. I do not currently expect Centene to decline in earnings this year, nor next year or the year after that, 2026. But I do expect the growth, for all of these aforementioned trends, to be significantly less than the company was originally forecasted at. Perhaps even as low as 7-9% annualized EPS growth.

Why is this low for Centene, and what drives this valuation?

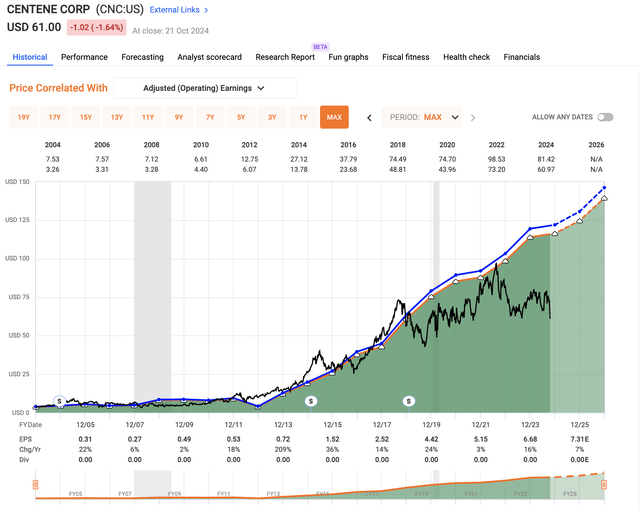

Centene – The valuation shows appeal, but we have to consider the worst scenario

First off and repeating, Centene is not Humana. This is not a company that has declined massively in earnings. At this time, it’s trading at $61/share, which represents a normalized P/E of just south of 9x based on its current estimated earnings. This is attractive, even with BBB- and no dividend, given the company’s growth rate even if that growth rate is halved, to 7.5% per year. The current estimated EPS growth rate is on average about 9% per year.

The fact that it does not pay a dividend makes it tricky. But using even the shortest-term and lowest average forecast multiple of 12x P/E, we find a 27.17% annualized upside or a total RoR of 70% until 2026 as well as an estimated share price of $103/share. And that is what I would consider the more conservative estimate.

Using 20-year averages, we find an annualized upside of nearly 50% or a total RoR of 140%. But because we are unlikely to see historical growth rates for healthcare here, I don’t think that this is valid.

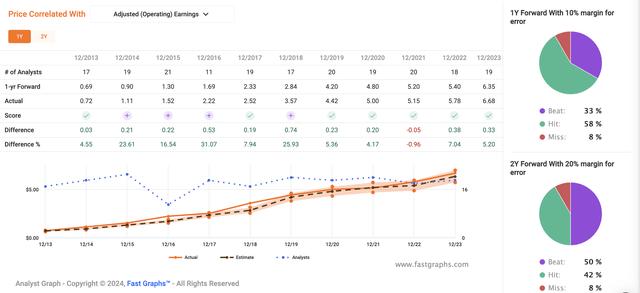

Still, it wouldn’t be fair to not consider the fact that Centene 50% of the time beats estimates.

F.A.S.T Graphs Forecast Accuracy (F.A.S.T Graphs Forecast Accuracy)

It is, therefore, in my estimate, a false equivalency to consider Centene impaired just because Humana and the sector is impaired. We do need to discount it for a lower growth rate, but that’s all we’ll do here. I’ll apply a fairly steep discount for the company to account for the risk I see here, but I view it as crucial that we do not engage in overreaction as to this company’s overall potential, its upside or downside, and what might happen.

For 3Q24, my expectation is for the company to perform in line with a full-year EPS growth estimate of 1-2%. Unlike other peers, which are set to drop over 30%, I do not forecast Centene will drop in earnings. Beyond that, the state of the industry is in flux and therefore hard to forecast. But generally speaking, and also because the company does not have the burden of a dividend (a burden in this context), I believe Centene will have an easier time outperforming and continuing to grow even in this environment – and this should, consequently, result in some upside and some positive trends.

I do not believe that Centene’s valuation reflects its earnings growth or stability trajectory. Centene is not Humana, and its path of earnings is better illustrated than talked about.

Centene Earnings Growth Forecast (F.A.S.T Graphs Growth Forecast)

As you can see above, the company is being traded down, despite the estimate of continued growth and stability. It, in fact, reminds me quite a bit of the Teleperformance situation, which I have covered in other articles.

While I remain careful about these companies due to the aforementioned political challenges that I see in them, I do clearly see and state that Centene is undervalued here. The lowest valuation I can see myself moving to in PT is $70/share – any lower would be unfairly valuing the company’s equity, even with every risk in consideration.

Consequently, Centene receives a “Buy” recommendation with the following thesis for the 3Q24 period.

Thesis on Centene’s Common Shares

- Centene is a class-leading managed healthcare company in several key segments that aren’t going anywhere. It has proven, historically, that it can effectively allocate capital and outperform over time no matter the market. It is, however, BBB-rated and has no dividend – and losses or underperformance is a very real possibility if you don’t pay attention to valuation.

- For that reason, my conservative view on Centene is that it should not be bought above $83/share, and that’s where I put my PT.

- I played the company and the situation using options last time around and was able to sell those at an attractive profit. At this time, I do think it still warrants a “Buy” recommendation, but I am not interested in going in deeper at this time but may do so going forward

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills 3 out of 3 quality indicators, and 1 out of 2 valuation indicators. Based on this, and a valuation target of $70/share where I see a risk/reward-adjusted upside that’s attractive enough for me, I give the company a “Buy” rating as of October 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TLPFY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.