Summary:

- Three years ago, Box was an enterprise software company focused on document collaboration.

- As it looked forward, BOX hoped to build on those capabilities with a new workflow automation tool and expand its fledgling artificial intelligence capabilities.

- As the world’s workforces started working hybridly/remotely, the boundaries of offerings were run into more often and BOX’s extended capabilities in comparison have become more obvious.

- Many investors still don’t understand the boundaries of their competitors’ offerings and continue to regard Box, despite their growth, as a commodity offering.

greenbutterfly

The following segment was excerpted from this fund letter.

Box Inc (NYSE:BOX)

Given the Fund’s three-year mark, I thought it appropriate to revisit our largest position over that period, Box, Inc.

Three years ago, Box was an enterprise software company focused on document collaboration. The company’s competitive advantage was born from its security and governance capabilities that allowed it to succeed in regulated industries and the superior number of integrations with other services that made it easy to use a single file across functions. As it looked forward, it hoped to build on those capabilities with a new workflow automation tool and expand its fledgling artificial intelligence capabilities.

There was significant opportunity in its sales and marketing expenditures which were relatively inefficient. The Company was overly dependent on partners to penetrate larger enterprises and generally struggled to sell to the mass enterprise market despite its superior product. From a financial perspective, the company had line of sight to operating profit breakeven and robust free cash flow generation when excluding the cost of stock-based compensation but had a history of missing Street expectations.

Its co-founder and CEO, Aaron Levie, was well thought of within the industry and was considered a visionary, but the company had a difficult time delineating to investors what differentiated the company from Microsoft’s (MSFT) OneDrive and SharePoint, Google (GOOG, GOOGL) Drive, Dropbox (DBX), and a host of less sophisticated sync and share offerings.

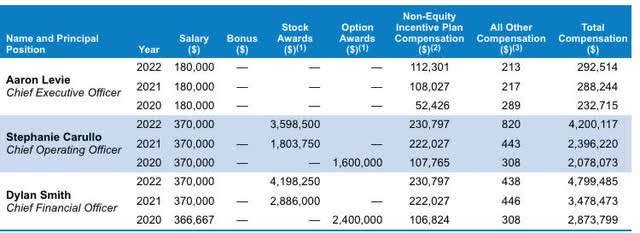

On almost all fronts, the Company is stronger today than it was then. From a leadership standpoint, founding and running Box is likely to be a starting point for Levie. He continues to be a top mind and has proven an inspirational leader within Box. Even while reigning in stock-based compensation continues to be an opportunity, Levie does not, and has not for several years partaken. It’s both admirable and a source of some consternation, as the pay of the top executives appears to be in reverse to the value provided.

The Company’s growth has accelerated on the back of pricing changes by its competitors (now charging for storage for large enterprises) and the greater demands put on information workers and therefore the requirements of their document storage. Their competitors’ offerings, particularly the free ones, were always great for ~85% of use cases, but as the world’s workforces started working hybridly/remotely, the boundaries of those offerings were run into more often and Box’s extended capabilities in comparison have become more obvious.

Additionally, Box’s offerings have matured. 3 years ago, they were building the foundations of the house, and allowing others to make more money than they were building on top of their solution. Now, they are starting to expand, offering superior or fast follower versions of the applications they know their customers are willing to pay for, sometimes for free.

For instance, Box now offers e-signature capability for paying users of its basic offering, allowing a purchaser to make the argument that it can replace DocuSign (DOCU) or Adobe (ADBE) Sign – tangible use cases – while also upgrading their additional file capabilities for free as a throw-in. They also offer, for additional expense, a best-in-class security solution to track employee file usage and prevent cybercriminal activity, at scale.

Moving forward, as investors, we can expect the Company to continue this motion, offering higher margin services on top of the infrastructure they’ve already built while increasing the compellingness of the platform.

At the behest of an active investor, they’ve become more mindful about their expenses, resulting in a more efficient go to market approach, and more efficient research and development spending. Their capital allocation has also improved, now buying back stock and using M&A to add features to their platform. They still struggle with their investor communications – many investors still don’t understand the boundaries of their competitors’ offerings and continue to regard Box, despite their growth, as a commodity offering. There is opportunity there.

Over the near term, despite their flawless execution over the past year or so, I believe they’re likely to miss headline earnings because of their outsized exposure to the Japanese Yen and the extent of that foreign exchange rate adjustment. I continue to like the stock over the medium term however and we continue to hold.

| All investments involve risk, including loss of principal. This document provides information not intended to meet objectives or suitability requirements of any specific individual. This information is provided for educational or discussion purposes only and should not be considered investment advice or a solicitation to buy or sell securities. The information contained herein has been drawn from sources which we believe to be reliable; however, its accuracy or completeness is not guaranteed. This report is not to be construed as an offer, solicitation or recommendation to buy or sell any of the securities herein named. We may or may not continue to hold any of the securities mentioned. White Brook Capital LLC and/or their respective officers, directors, partners or employees may from time to time acquire, hold or sell securities named in this report. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Additional disclosure: ©2022 by White Brook Capital