Summary:

- Despite a decade of declining revenues, McDonald’s improved free cash flow through effective cost control.

- Management is focusing on value products and digital engagement to counteract consumer distress and declining market share, with Q3 earnings to shed more light.

- Technological advancements and menu flexibility, including a focus on chicken, are expected to drive future growth, but long-term returns are unlikely to impress at the current valuation.

Brandon Bell/Getty Images News

McDonald’s (NYSE:MCD) is a legacy company, the biggest fast food chain in the world, and favorite of many investors.

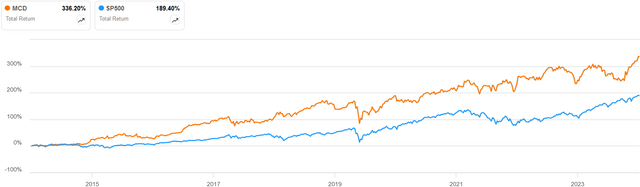

MCD vs. S&P 500 10Y Total Returns (Seeking Alpha)

Given MCD’s superior returns when compared to the broader market since 2014, such esteem is unsurprising.

For today’s long-term investor, however, we have to weigh the attractiveness of MCD’s $227B market cap, which gives a price of about $315 per share. I believe McDonald’s has the right tailwinds and strategy for growth, but I also feel that most of this is already priced in, warranting a Hold for now.

Financial History

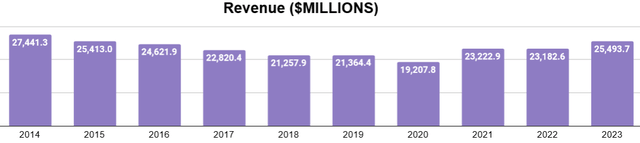

It’s fun to observe McDonald’s financial record, as revenues declined over the past decade, not something you’d expect of a growth candidate.

Author’s display of 10K data

They were already on a decline before COVID, where they bottomed. The recovery since the pandemic put 2023 revenues at some of the highest they had seen in years, suggesting not only a complete recovery but improvements in the aftermath.

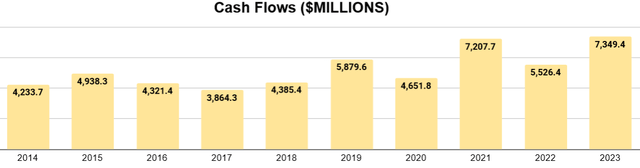

Author’s display of 10K data

Despite the fickle revenues, McDonald’s grew its free cash flow over time. Average, annual FCF for the first half of the decade was $4.3B, while the second half saw $6.1B.

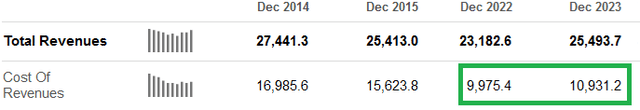

Aggregated 10K Data (Seeking Alpha)

The most obvious explanation here is the long-term reduction in cost revenues, providing substantial improvements in gross margins. These cost reductions have remained intact even as revenues return to higher milestones.

Author’s display of 10K data

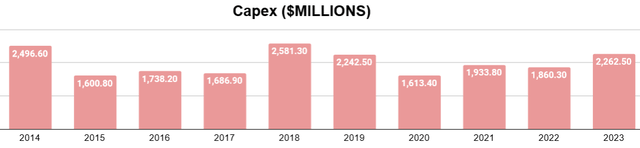

At the same time, McDonald’s has managed to keep its capex around a ceiling of $2.5B over this period. Overall, the company has a competent history of cost control in an industry where margin really matters.

Author’s display of 10K data

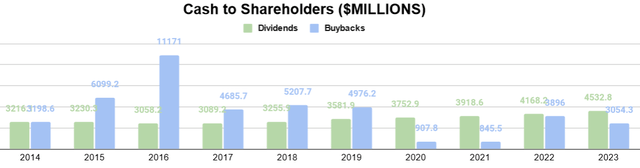

Being consistently cash-flow positive, nearly all of FCF has been returned to shareholders via a growing dividend and share repurchases with remaining cash flow.

Author’s display of 10K data

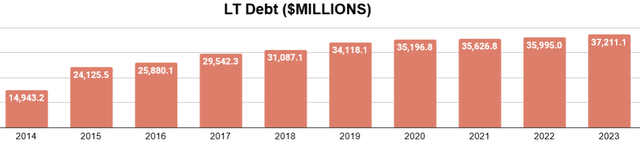

If there is one spot for cautionary pause, it’s MCD’s debt. Long-term debt at the end of 2023 was 2.5 times the amount in 2014, reaching $39B.

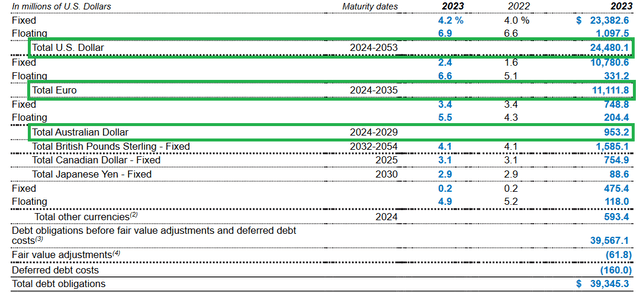

Debt Breakdown (2023 Form 10K)

The latest breakdown of their debt maturities comes from their 2023 Form 10K, and we can glean that about half of this debt is due within the next decade. While not the leanest balance sheet, the staggered maturities and relatively low interest rates indicate that the debt is manageable for now.

Overall, my view of the company is that it’s been an effective operator, even amid the distress caused by trying moments such as the COVID pandemic and the associated lockdowns. Where we might be skeptical is in their capital allocation, given the increased leverage on the balance sheet against significant cash outflows for dividends and buybacks.

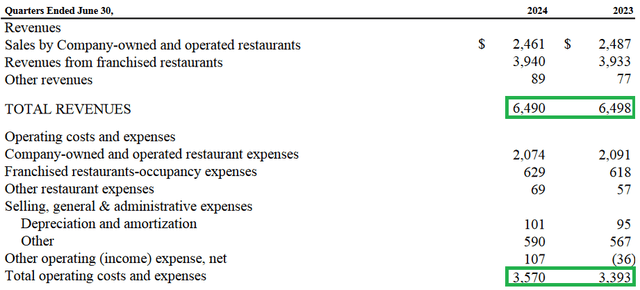

Q2 Results, Current Day, and Q3

During the release of its second quarter’s results in the summer, management warned of the distressed consumer, not only the U.S. but around the world, in the backdrop of increased interest rates since early 2022. CEO Chris Kempczinski noted during the earnings call:

Beginning last year, we warned of a more discriminating consumer, particularly among lower-income households. And as this year progressed, those pressures have deepened and broadened. The QSR sector has meaningfully slowed in the majority of our markets and industry traffic has declined in major markets like the U.S., Australia Canada and Germany.

Q2 Earnings Release

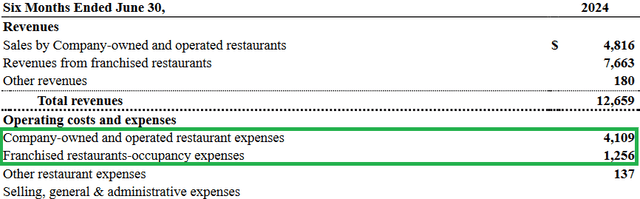

While there was a post-COVID trend of growth, that did not continue into 2024. Corroborating Kempczinski’s remarks, year-over-year revenues were flat and operating expenses up slightly.

Q2 2024 Form 10Q

Cash flows meanwhile, remained positive, not observably different from the prior year.

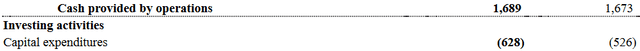

Company Website

During the earnings call, management spoke to their priorities to return growth: recapture shrinking market share with value products for these price-sensitive customers, while also building on their digital experience to encourage customer loyalty and retain their share over time.

These efforts are already having some impact. Seeking Alpha reported that traffic increased in response to the $5 Meal Deal campaign and adjacent efforts.

When the final results of Q3 come out next week, we will want to see how much this increased revenue and if any trade-off in margin was worth it. We will also want to get a pulse on how much new products, such as the Chicken Big Mac, are doing well with customers.

Long-Term Outlook

Yet, what matters for investors is not what happens in the course of a single quarter. Rather, it’s how developments in these quarters shape our understanding of investments like MCD. Whether or not investments provide satisfactory returns over time is a function of the growth potential of the business and the price we pay for it.

Valuation

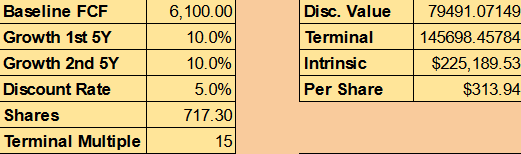

Author’s calculation

Above, I’ve done a rough calculation that gets us something approximate to the current market price. I used the $6.1B figured I referenced earlier as a baseline for free cash flow. With that figure, today’s market cap gives as a multiple of 37. I’ve decided a multiple of 15 therefore represents the lower end of MCD’s valuation and post-decade cash flows.

Meanwhile, if someone wanted to price in a 5% annual return, then McDonald’s FCF would only need to grow at a rate of 10% per year for today’s price to be a fair one. What things could drive FCF growth?

Growth Tastes Like Chicken

The release of the Chicken Big Mac is one hint. Kempczinski spoke to this as well during the last earnings call:

We continue to have a significant opportunity for growth in chicken, a category that’s twice the size of beef globally and growing at a faster rate.

Chicken is generally a cheaper and leaner protein than beef. As margin matters, prioritizing chicken for the long term is an important move for these reasons.

If I could generalize this further, however, I think MCD’s real magic trick isn’t moving into chicken but its flexible menu. I remember reading Peter Lynch, and he remarked how McDonald’s boosted its earnings by introducing the breakfast menu: Mostly the same overhead, now with the added volume of breakfast.

Their ability to shift from their core burger product and implement chicken, fish, and vegetarian options has allowed them to shift from being a burger joint to a fast food restaurant of choice for whatever one is craving.

By now, they’ve proved that they can do this, and so investors can likely count on McDonald’s menu adapting with consumer habits, whether it concerns chicken or other foods.

Tech Effects

The second factor is how improvements in the tech sector pave the way for operational improvements. One of the simpler aspects was mentioned during the earnings call by Kempczinski:

Loyalty membership has now reached 166 million members, pacing ahead of expectations as we work towards our ambition of 250 million members and identified users now represent 25% of system-wide sales. We know that engaged loyalty customers spend more and visit more often. And as a result, we’re driving digital market share gains and continuing to build on our understanding of customer preference, personalization and behaviors.

It’s easy enough to see how an app to drive customer engagement with rewards helps growth. That this allows for mobile orders and even deliveries for better customer experiences is another factor. As they accumulate more members, this should feed into revenue growth.

I think the other side of this is how advancements in tech will allow large-scale operators like McDonald’s to create new savings in ways that may not be true for smaller players. Some might recall last December, when McDonald’s announced a partnership with Google (GOOG) to use its generative AI capabilities. The meat of this partnership was summarized as:

With Google Cloud edge computing capabilities, McDonald’s will be able to draw new insights into how equipment is performing, enact solutions that reduce business disruptions, and diminish complexity for crew so restaurant teams can focus on delivering amazing hospitality to customers.

With autonomous kiosks already implemented and more innovations to roll out over time, I expect that McDonald’s will manage its payroll costs well. That is, it can do more with the same personnel and perhaps even reduce this figure.

Q2 2024 Form 10Q

Restaurant expenses are the biggest expense. Payroll (which is consolidated under those two items) accounts for at least a couple billion in potential savings. Plus, there’s the general reduction in wasted inventory that likely will follow as well.

These forces, in addition to its ongoing trend of store expansion, make 10% growth expectations seem feasible, even if they might be optimistic.

Conclusion

McDonald’s is an excellent company, and the market seems to recognize it. I believe 10% annual growth of free cash flow is in the realm of possibility over the next decade, and McDonald’s has the benefits of scale to realize it.

Where I might quibble is the extensive leverage coupled with their buybacks. Additionally, the current price suggests that long-term returns may well be positive but not particularly attractive, around 5%. I don’t think McDonald’s is facing disaster, but as its price is a fair one, I find it more suitable as a Hold for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.