Summary:

- Meta’s upcoming earnings report is expected to show solid results, but slowing revenue growth and rising expenses in the quarters ahead may limit further stock upside.

- The challenge of lapping high sales growth and low expense growth, combined with significant AI investments: Margins and profitability will be pressured in 2025.

- Meta must find new revenue sources, such as increasing ad inventory in Reels or monetizing WhatsApp, to offset rising costs and maintain growth.

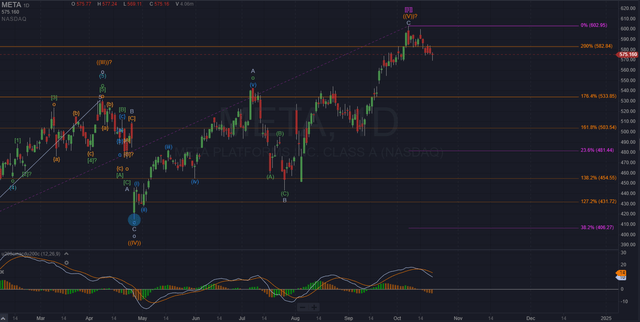

- Despite bullish AI prospects, the chart has reached a significant Fibonacci level and suggests a potential decline post-earnings, leading to further lows in a corrective scenario.

NanoStockk/iStock via Getty Images

In a little over a week, Meta Platforms, Inc. (NASDAQ:META) will report earnings. And by and large, the results should be pretty solid and provide ample reason to continue the strength the stock has shown – at least on its face. But factors beyond reason and logic drive stock prices and the market. While Meta will likely continue to provide decent relative growth, with the stock at all-time highs as it enters not only a slowing period of revenue growth, but an increase in expenses is a reason I’m hesitant to expect more upside.

The Shift In Fundamentals From A High Base

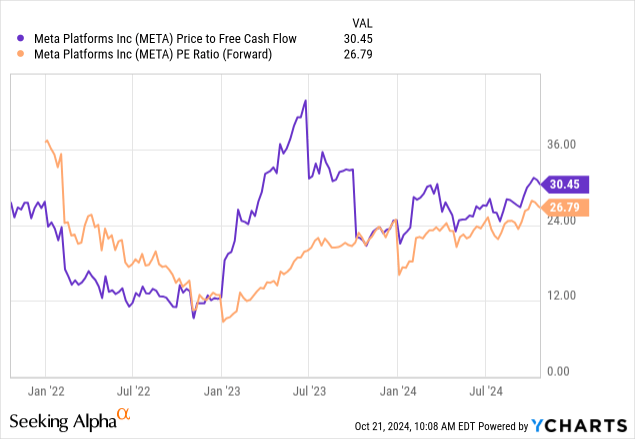

Lapping high sales growth by itself is difficult, but lapping both high sales growth and low expense growth at the same time is an interesting recipe for the market to handle. In August, I outlined this coming challenge and how Q4 will be the first quarter to highlight this. Thus, guidance will be interesting. But since then, the market has rewarded Meta with an expanding margins valuation as the valuation returns to more historically average levels.

Once the 2025 picture comes into focus, it won’t be an easy game to play when the massive AI investments start parking themselves on the P&L while revenue growth naturally slows down as it laps high growth from last year and this year. Meta’s only out is to open up a new revenue source. Some of its options include increasing ad inventory in Reels or pushing further into the monetization of WhatsApp. Even if it were to decrease AI investments tomorrow – which I don’t advocate for (more on that in a bit) – the already built infrastructure of AI accelerators brings more costs and a wave of depreciation.

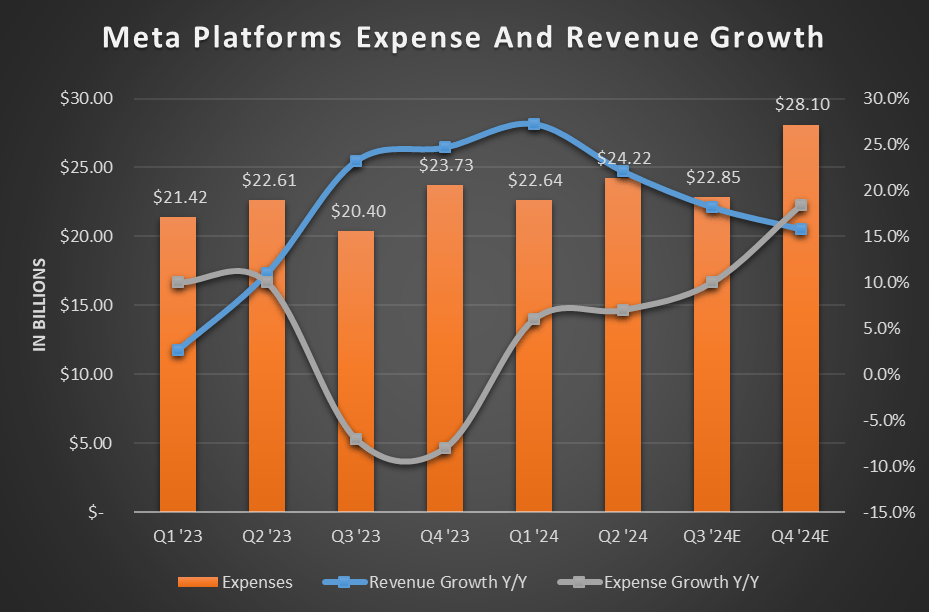

Because the nature of the business world requires growth to accelerate or, at the very least, be maintained at higher levels to continue to be rewarded, the 2025 revenue outlook and opportunity to find new ample growth opportunities become the primary concern. The chart below, which I used in August’s analysis, shows the past two years of high growth and high spending are about to settle in. The obvious piece is the crossover in revenue growth and expense growth, which should begin in earnest in Q4.

Chart is author’s, data from SEC filings and author’s estimates

Once expense growth exceeds revenue growth, margins decline. While I don’t expect a return to 2022 or early 2023 margin levels, they may have peaked for the foreseeable future, setting the stage for challenging bottom line growth in 2025.

Overcoming The Natural Slowdown

Expense growth will remain elevated as depreciation begins to set in from the capex in AI infrastructure over the last two years, along with the operating costs of said infrastructure. While the investments are necessary to keep Meta in the lead amongst its competitors in the advertising space, they come with a natural cost. But if it can become the most efficient player with those purchases, there’s no reason it shouldn’t continue to make the investments – which it has already planned for 2025. This, of course, is why new forms of revenue or wringing out more growth from current revenue centers are required. Without it, the investments pile on and don’t accelerate growth like they did this past year, and margins shrink, choking out profits.

I’m still very much bullish on Meta’s AI prospects as it has made the right decisions by open-sourcing its LLM and investing its capabilities in the front and back end of its products – the front end being the user feed and the back end being the ad targeting. The general capabilities of AI at this point lend themselves naturally to Meta’s primary business model, much like GPUs lend themselves naturally to training and inferencing generative AI. Other companies like Alphabet Inc. (GOOG)(GOOGL) and Microsoft Corporation (MSFT) are more shoehorning generative AI into their products as enhancements or new products altogether. Meta is primarily augmenting its products by having AI do the same things but better due to the nature of the algorithms and pattern recognition strengths this type of AI is designed for.

The catch-22 for Meta to remain competitive is it must continue investing in AI and executing as it has, even though the investments increase costs and decrease margins (in the short term) until the investments provide greater operating efficiency (long term).

Sizing Expectations In The Context Of The Stock

Now, much of this isn’t terribly new information to you. After all, I covered the financials two months ago. But what has changed is what I alluded to at the beginning of this piece: The stock price.

Lower expectations as the company enters a slowing growth and higher expense period are one thing, but it’s another to send the stock to all-time highs. These all-time highs also correlate with an important Fibonacci level, signaling the potential end to a two-year-long rally. This combination is why Meta is more likely to fall after earnings than to continue higher in the wake of the report.

Generally, a five-wave move in Elliot Wave Theory will culminate at or near the 200% extension of waves 1 and 2. With Meta’s rally from 2022 now just above the 200% extension and bouncing back below it, the risk of further decline has increased. A setup is in place to see a bounce going into earnings and a drop afterward.

Now, there’s an upside risk. Since the correction I ultimately expect will be in the larger hot pink/purple degree, no matter the situation, I’m expecting three waves down. Three waves down could also signal further upside since the rally higher would provide five waves up. So the risk is this is just a smaller-degree three-wave decline before the stock makes another high. The next target for that high is $662 at the next higher Fib level. A post-earnings rally would likely target that.

However, if we see the stock bounce toward $590-$600 by the time earnings arrive, there’s a better than 50% chance the C wave down of this initial move off the high is getting prepared to happen on earnings. This targets $562 and below. From there, a three-wave bounce confirms the correction has already started.

Higher Expenses Meets Higher Share Risk

Considering the fundamentals, financials, and the chart, I have to be very cautious going into earnings. Nothing prominent in the earnings report may cause the selloff in a conventional wisdom manner, but it may happen nonetheless. Considering Meta’s stock has rallied quite well over the last two years, there isn’t anything unusual in a healthy consolidation and correction before the next even bigger leg gets set up for the coming years. It just so happens the timing aligns with an earnings catalyst as it reached the target of the two-year rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, if you want more of this two-fold fundamental and technical chart analysis, step up to being a paid subscriber to my Investor Group Tech Cache with a two-week free trial and read more of this type of analysis on other tech stocks and assets. Currently, I have a 20% discount for the SA Election Summit!