Summary:

- PepsiCo needs margin expansion to justify its high valuation; current financials show slower growth and deteriorating margins.

- Long-term challenges include margin deterioration and competition, despite efforts to optimize supply chains and expand into growth areas.

- Emerging markets and efficiency improvements are potential growth drivers, but current valuation is too high; I’d consider buying below $160.

- I rate PepsiCo a hold, with interest in buying unless the stock price drops or if there are significant improvements in margins and growth initiatives.

Jonathan Knowles

Investment Thesis

PepsiCo (NASDAQ:PEP) needs to expand its margins to deliver adequate total shareholder returns. I fear that adequate growth drivers no longer exist for the company to meet the relatively high valuation it is being warranted by the market. On the surface, a 25x earning multiple doesn’t appear too high, but the financials of PEP show a slower-growing company with deteriorating margins.

With Q3 2024 earnings out, I decided to look at PEP to see if there is any hidden value in the company and to determine at what price it might become buyable for a long-term investor seeking total returns over income. With a roughly 3.1% dividend yield, significant growth in dividend per share, and the company reducing its share count significantly over the past ten years, I’d like to own PEP at the right price; I just don’t think the price is currently right for me.

I plan to revisit the company over the next few months to learn more, so this is not one my usual in-depth articles, it is more a primer of the company now that we have some results.

Long Term Challenges

Pepsi is experiencing long-term challenges that prevent me from getting excited about the stock. The business is still strong and reliably grows revenue, but looking deeper I see some signs that warrant caution.

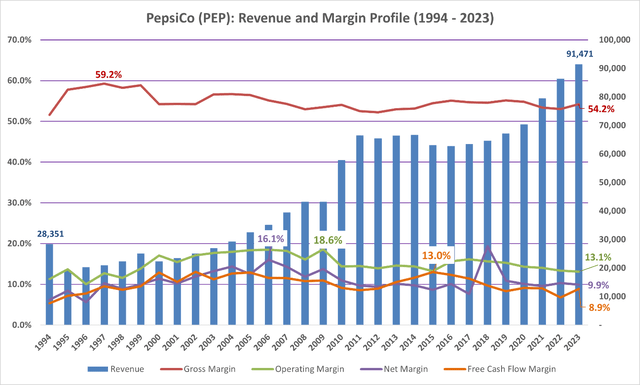

The long-term trend I see is margin deterioration. I don’t like investing in companies experiencing this unless I see a fundamental reason for a turnaround and I’m paying a good price. I just don’t see this in PEP right now. Gross margin has steadily declined since the 1990s. It still remains in the mid-50s, but shows the company must compete on price with its main competitors, Coca-Cola (KO), Keurig Dr Pepper (KDP), Monster Beverage (MNST), and smaller competitors. Trends further down the income statement don’t look any better. Operating margin peaked at 18.6% in 2009, it was 13.1% in 2023. Net margin was 16.1% at its peak in 2006, and stood at 9.9% in 2023. Free cash flow margin was 8.9% in 2023, 410 basis points below its peak in 2015.

PepsiCo Long Term Margin Profile (Author-generated chart (data from SEC filings and stockanalysis.com))

When Ramon Laguarta came in as CEO, he clearly intended to change these trends by optimizing the supply chain through automation and digitalization and by expanding into growth areas, such as healthier snack options and fast-growing small brands. This plan was discussed five years ago at the CAGNY conference, so it remains to be seen how well these investments will pay off and how much margin improvement PEP can make from them. I don’t see meaningful changes yet, but it likely takes more than five years to make significant supply chain optimization changes for a company the size of PEP.

These are significant measures PEP is undertaking, and even if I assume that they pay off, I am uncertain how much it will drive growth or how much it will just prevent deterioration. In other words, is PEP a company in the capital return phase of the business cycle or a company in the very early stages of decline?

To be clear, I don’t see PEP as a company that will see declining revenues soon, but it’s important to ask ourselves if its growth levers are starting to disappear.

With a normalization in volume and slowing growth rates, I wonder when the bottom will be in for PEP. I hope to identify a price where the stock becomes buyable for a total return-focused investor with a long investing timeframe ahead of me. PEP is a stalwart company, so I might demand less of a total return than most other stocks, understanding that the risk is significantly lower than tech or early-stage companies.

Margin expansion into the mid-teens is the company’s target over the next few years, and PEP expects to drive EPS growth higher, roughly in the high single-digits range.

Earnings Review

Revenue came in at $23.3 billion, declining 0.57% YoY and missing expectations by $459 million. The company had an EPS of $2.31 per share, beating analysts’ expectations by $0.02. PEP lowered its organic revenue outlook to low single digit growth from a prior expectation of 4%. A recall of Quaker Oats products and weak demand for Frito-Lays affecting overall performance.

Segment Results

Frito-Lays

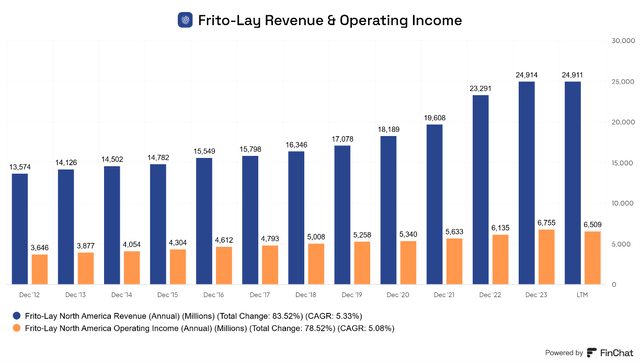

Frito-Lays saw slower volume and contracting margins due to normalized demand. PEP cited several years of annualized double-digit growth during the pandemic, as seen in the annual results chart below. Apparently, consumer preferences have shifted.

PEP Frito-Lays Revenue (FinChat)

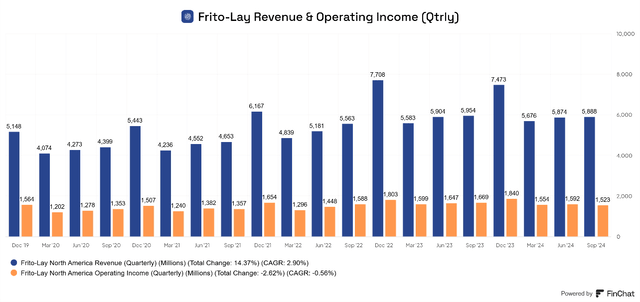

The quarterly chart doesn’t look any better.

PEP Quarterly Frito-Lays Revenue (FinChat)

PEP cited out-of-home activities and financial pressures as key challenges in this segment. Going forward, PEP is attempting to grow its multicultural snack options, like Sabritas and Santitas and is hoping to capitalize on shifting consumer trends that will be discussed below.

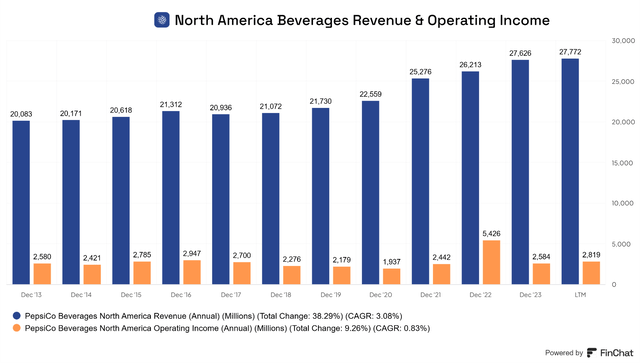

North America Beverages

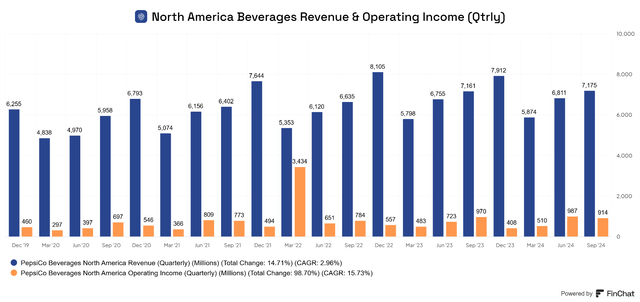

Beverages had relatively strong results, led by Gatorade and Propel, and gained 3% of household penetration. PEP stated that demand has remained resilient post-pandemic and that consumers have continued shifting preferences toward hydration, energy, and sports drinks.

PEP Quarterly North America Beverages Revenue and Operating Income (FinChat)

Annual growth in this segment has been steady, unlike the accelerated Frito-Lay growth during the pandemic and normalization post-pandemic.

PEP Annual North America Beverages Revenue and Operating Income (FinChat)

PEP is aiming for mid-teens margins in this category, by optimizing its supply chain, and adjusting its portfolio to match consumer preferences. PEP remains confident in its partnership with Celsius (CELH) and is focusing on expanding product distribution. Focusing on health-focused beverages is also a key component of its growth plans.

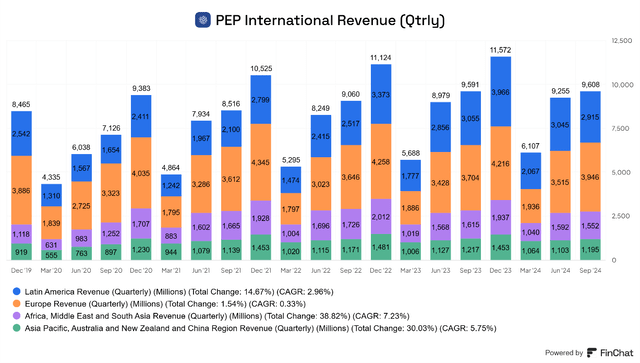

International

Growth in the middle class of emerging markets could be a key driver of growth for the company going forward, which is also reflected in Q3 results for some nations where PEP does business. It saw strength in Southeast Asia, India, parts of Eastern Europe, and Brazil.

However, PEP reported weakness in the Middle East, China, and Mexico. According to management, geopolitical issues are weighing on sales in the Middle East; economic issues are impacting China’s sales, and Mexico appears to be impacted by reduced social program spending and political uncertainty.

PEP International Revenue (FinChat)

How Pepsi Can Beat The Market

The only way I see PEP as a market-beating stock is through efficiency. However, as we will see in my valuation section, I don’t know if this will be enough. PEP is prioritizing measures to improve margins by automating and optimizing its supply chains. From automating procurement to distribution, PEP sees reason to believe in margin expansion by lowering operational costs.

Consumer preferences may be shifting towards healthier and more convenient snacks and beverages. This shift is forcing PEP to innovate or acquire new products and brands. Management mentioned smaller, more frequent meals as an example of Gen Z snacking preferences. I see this as a potential area where PEP can incrementally improve margins. Smaller snack packs and drink sizes tend to cost more money per ounce. If consumers shift to smaller snack sizes without decreasing frequency, or better yet, increasing frequency, this could be a benefit to PEP.

Why I Don’t Believe Pepsi is a Market Beater From Here

The company also mentioned marketing campaigns to help make up for lost volume. As hopeful as I am that this drives a near-term benefit for PEP, I don’t think meaningful increases in promotions or marketing are a long-term sustainable growth driver. I expect a powerful brand to be able to sell most of its products without increasing selling costs substantially. However, marketing emerging brands, like healthier options, or to emerging markets may be something that can create long-term value.

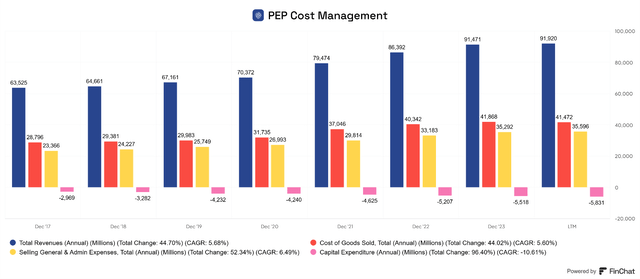

Additionally, capital expenditures have increased significantly, from just under $3 billion in 2017 to $5.8 billion over the TTM period. This increased Capex must deliver substantial returns to justify purchasing the stock, as margin improvement must be made, not just maintenance of current margins.

PEP Expense Management (FinChat)

The above chart shows a company fighting off competition and the fact that it is very large and running out of growth opportunities in its established markets by spending money to market itself and get more efficient. Because these investments take time to show, I would not be surprised to see the stock suffer from any market or economic downturn that spooks investors or an abnormally poor earnings report.

Emerging markets are a significant growth opportunity for PEP. I’m not sure how much juice can be squeezed out of the North American market, but International growth is an area where a mature company like PEP can find long-term growth.

As stated previously, I wonder when the bottom will be in for PepsiCo and I am looking for the right price point to consider opening a position in PEP. Due to the company being a reliable stalwart company, I might require less of a total return than higher growth dependent stocks.

Valuation

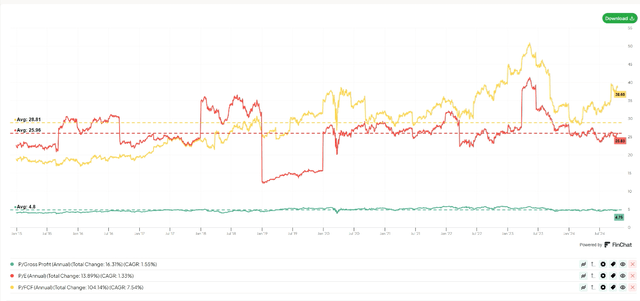

PEP roughly trades at its average ten-year historical trailing P/E and Price-to-Gross Profit multiples but at a significant premium to its 10-year average P/FCF multiple. I’m not interest in buying PEP unless it gets cheap.

PEP Historical Valuation (FinChat)

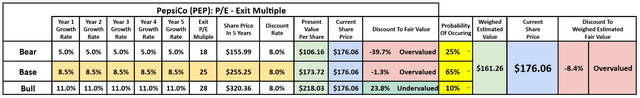

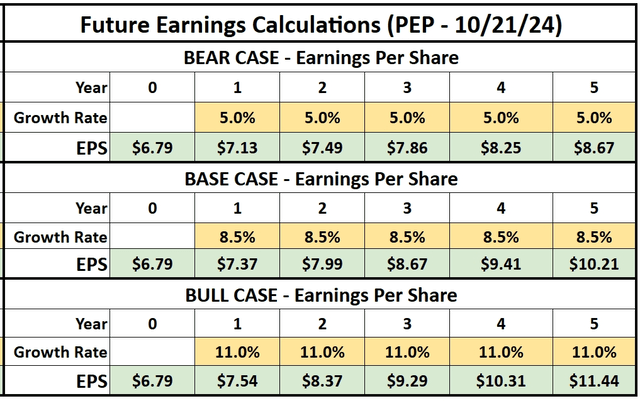

The company is targeting annualized EPS growth in the high single digits. I will use this as my base case for a DCF exit multiple model.

My base case is weighted as 65% probable and assumes that PEP grows EPS at 8.5% for ten years, with an exit P/E multiple of 25. 25x earnings is roughly in line with its historical average and current P/E.

My bear case is weighted as 25% probable and assumes PEP delivers a 5.0% EPS growth CAGR, in line with the last ten years of performance. The exit multiple is 18x earnings, reasonable for a company showing signs of low growth.

My bull case is weighted as 10% probable and calls for an 11.0% EPS CAGR, which I find less likely but challenges my bearish take on the company. The exit multiple is 28x earnings, a historical premium for PEP, which would be warranted by the higher growth profile.

Author-Generated DCF (exit multiple)

Under these assumptions, PEP would still be overvalued today and would require a continuation of healthy growth beyond ten years to justify the stock price.

Author-Generated EPS Calculations for model

I would be interested in considering PEP as an investment if the stock fell below a price of $160. At that point, I would reconsider my investment thesis and look for signs that the company is delivering on its growth initiatives.

Conclusion

PepsiCo is as solid a company as one can find. Its brand makes for a powerful moat, and its growing dividend makes for an interesting income play. I think my analysis might not hold up for income investors, which is something I should point out. But for total return investors with a long time horizon, I just see no reason to buy PEP stock today. I will look to add the company to my portfolio if the stock price is falls below $160, potentially even lower, or if I see meaningful shifts in PEP’s margin profile resulting from emerging market growth or efficiency improvements. If I held the stock, I would be unlikely to sell it right now. I rate PEP a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CELH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.