Summary:

- On October 15, UnitedHealth Group published financial results for the third quarter of 2024, which surprised me primarily due to the sharp increase in Optum Rx revenue.

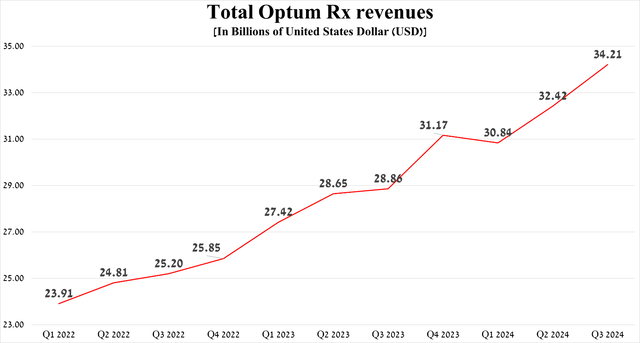

- Optum Rx’s revenue reached about $34.2 billion in the third quarter of 2024, up 18.5% year-on-year.

- Overall, due to year-over-year revenue growth in UnitedHealth Group’s two main divisions, Optum and UnitedHealthcare, it repurchased shares worth $1.7 billion in Q3 2024.

- Additionally, due to its strengthening balance sheet in recent quarters and high dividend growth in recent years, I am initiating coverage of UnitedHealth Group with a “buy” rating.

dragana991/iStock via Getty Images

Headquartered in Minnesota, UnitedHealth Group (NYSE:UNH) is one of the largest companies in the global healthcare services market.

Investment thesis

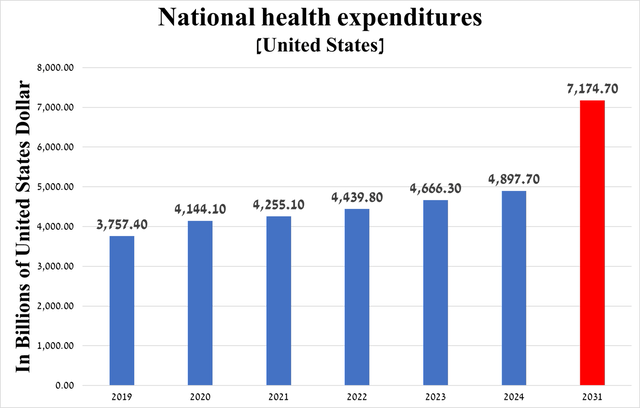

According to CMS analysis, national health expenditures will continue to grow relentlessly by single-digit percentages in the coming years, reaching $7.17 trillion by 2031, in part due to the aging of the US population, the observed increase in the number of people suffering from cardiovascular disease and various chronic illnesses in the post-COVID-19 era, which in turn will lead to a rise in the number of diagnostic and surgical procedures, as well as prescriptions for drugs that directly affect Optum Rx’s revenue.

Source: table was made by Author based on the Centers for Medicare and Medicaid Services

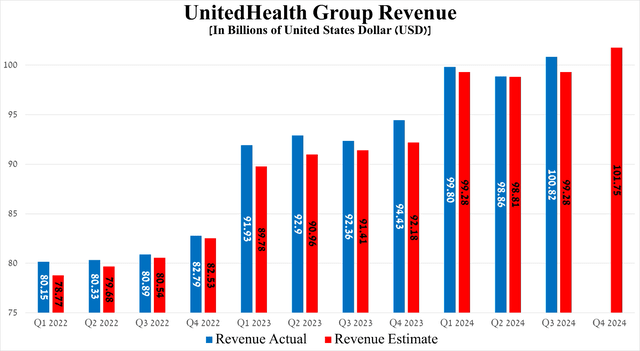

Yet, due to the company’s strong position in the fast-growing health insurance market, not only has it continued to consistently beat Wall Street analysts’ expectations in recent quarters, many of whom remain conservative about UnitedHealth Group’s business prospects, but more importantly, its revenue and operating income have grown steadily year over year.

As a result, I’m initiating coverage of UnitedHealth Group with a “buy” rating.

UnitedHealth Group’s financial results for the third quarter and outlook beyond 2024

On October 15, UnitedHealth Group released its results for the third quarter of 2024, which beat not only my expectations but also Wall Street analysts’ forecasts, despite a February 2024 cyberattack on its Change Healthcare unit that caused temporary chaos in the U.S. healthcare system as data transmission between health facility organizations and insurance companies was disrupted.

The company’s revenue was $100.82 billion for the three months ended September 30, 2024, up 9.2% year-on-year and, importantly, beating the consensus forecast of $992.8 million.

Source: Seeking Alpha

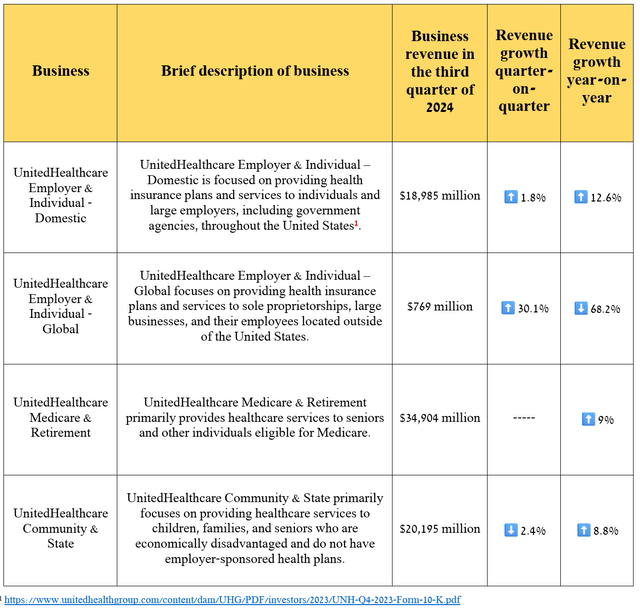

In my opinion, the key contributor to the growth of this financial metric was its segment called UnitedHealthcare, which provides a wide range of health benefit plans and services to individuals and employers not only in the United States but also abroad through four businesses.

Source: table was made by Author based on UnitedHealth Group’s 10-K/10-Qs

As I always say in my analytical articles about pharmaceutical companies, the numbers reflecting the changes in a company’s revenue and net income are undoubtedly important, but I believe the primary focus should be on identifying key factors and assessing the impact of each on the development of the UnitedHealthcare segment in recent months and over the long term.

Like most of you, the first logical question that comes to mind is this.

What factors contributed to the increase in the UnitedHealthcare segment’s revenue year-on-year?

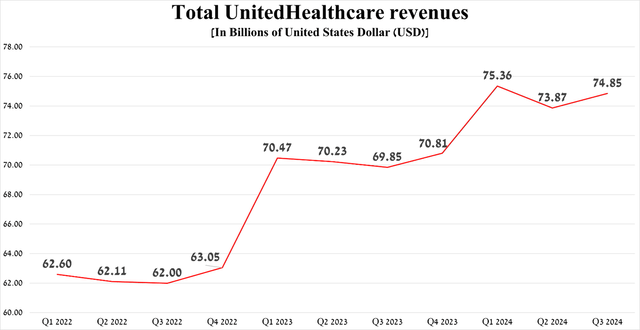

First, its total revenue was $74.85 billion for the three months ended September 30, 2024, up 7.2% year-on-year.

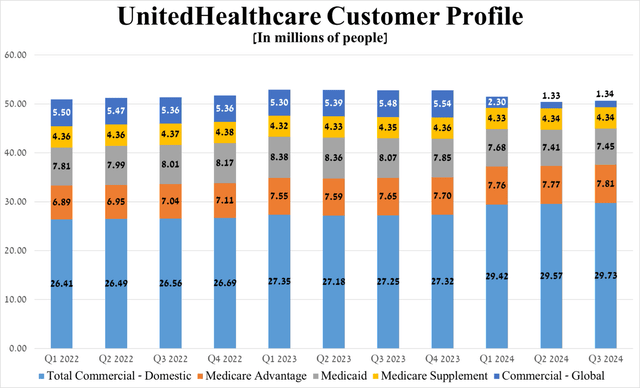

Source: graph was made by Author based on 10-Qs and 10-Ks

The growth of this financial metric was driven by UnitedHealthcare’s expansion of its service offerings and improvements in their quality, which ultimately led to an increase in the number of customers served through Medicare Advantage (from 7.65 million people in Q3 2023 to 7.81 million in Q3 2024) and those with commercial health plan products within the U.S. (from 27.25 million to 29.73 million people).

On the other hand, due to the sale of UnitedHealthcare’s Brazilian health insurance business to José Seripieri Filho in 2023, the total number of people served globally dropped from 5.48 million to 1.34 million at the end of September 2024, thereby becoming the main reason for the slowdown in the segment’s revenue growth rate quarter-on-quarter.

Source: table was made by Author based on UnitedHealth Group’s 10-Ks/10-Qs

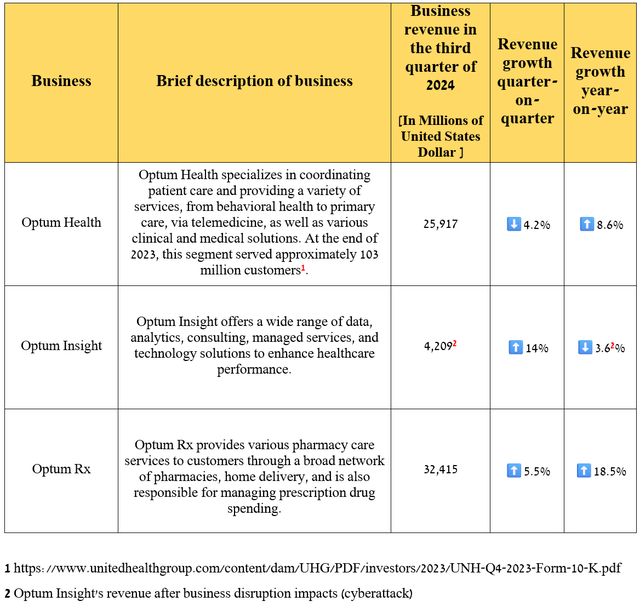

Readers should not forget about the company’s second segment, called Optum, which demonstrated higher year-over-year revenue growth.

Source: table was made by Author based on UnitedHealth Group’s 10-K/10-Qs

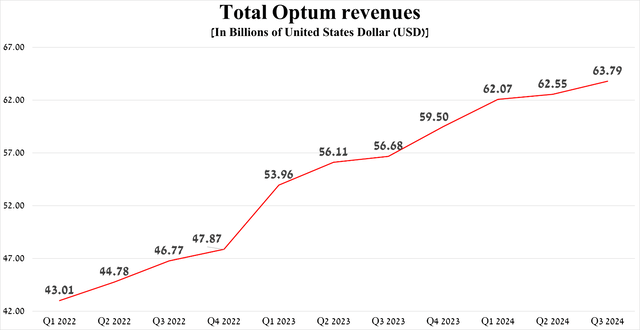

Total revenue for this segment, including Optum eliminations, reached about $63.79 billion in the third quarter of 2024, an increase of 12.5% year over year and 2% quarter over quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

However, what is more important to me is that Optum’s revenue shows more stable positive growth dynamics relative to UnitedHealthcare despite the cyberattack on Change Healthcare at the end of February 2024.

What are the reasons behind Optum’s successful business development?

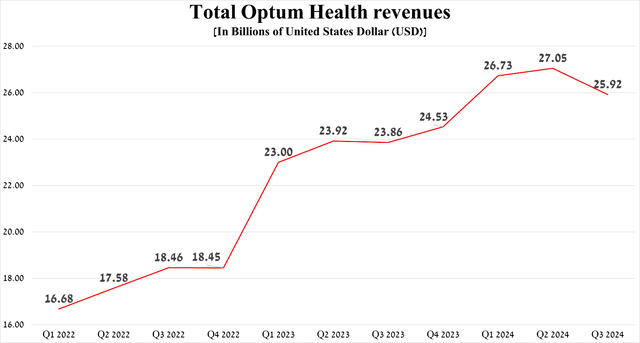

Firstly, I would like to note that the successful development of this segment in recent years is directly related to two of its units, namely Optum Health and Optum Insight.

Optum Health’s revenue reached $25.92 billion in the third quarter of 2024, up 8.6% year-on-year, driven primarily by the expansion of the types of health-related products it provides, which ultimately translates into an increase in the number of customers served under value-based care arrangements. At the same time, this unit served 104 million people at the end of September 2024, up one million from the previous year.

Source: graph was made by Author based on 10-Qs and 10-Ks

Meanwhile, Optum Rx’s revenue reached $34.21 billion for the three months ended September 30, 2024, up 18.5% year-on-year and 5.5% quarter-on-quarter, mainly due to the expansion of the range of pharmacy services, as well as higher script volumes from new customers. Overall, this unit of Optum fulfilled 410 million adjusted scripts in the third quarter of 2024, which is 30 million more than in the third quarter of 2023.

Source: graph was made by Author based on 10-Qs and 10-Ks

The Seeking Alpha platform offers financial data on Wall Street analysts’ anticipations for the coming quarters.

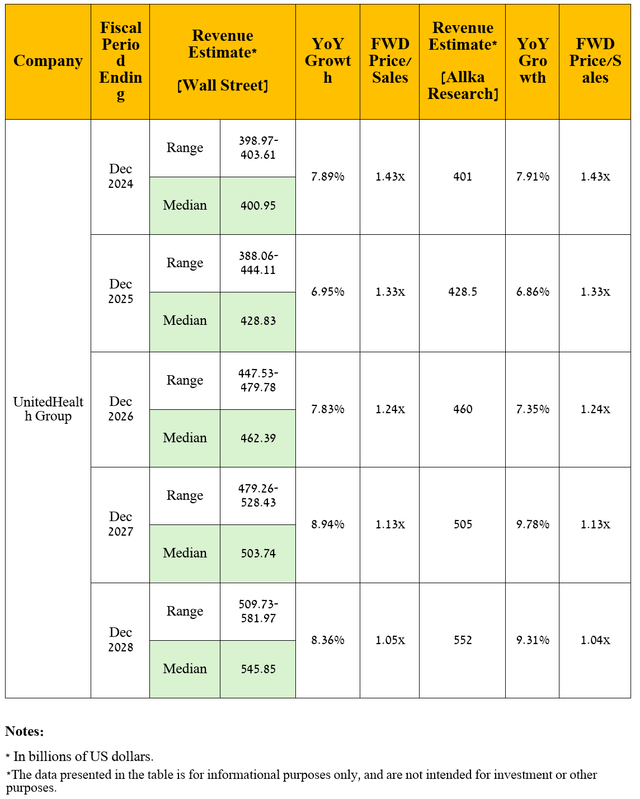

So, Wall Street analysts expect UnitedHealth Group’s revenue for the fourth quarter of 2024 to be between $100.48 billion and $104.14 billion, which implies its growth of 7.8% year over year.

Meanwhile, its price/sales ratio [FWD] is 1.41x, which is not only 3.1% higher than the 5-year average but also higher than many of its competitors in the U.S. health insurance market, including Humana [P/S ratio is 0.29x] (HUM) and Elevance Health [P/S ratio is 0.57x] (ELV), thus being the first of the factors that, in my opinion, indicate that the company is trading at a slight premium at the moment.

On a more global level, UnitedHealth Group’s revenue is expected to continue to grow in the coming years, thanks in part to factors such as the increased likelihood of exacerbations of chronic diseases caused by the COVID-19 pandemic, the continued positive growth trend of people covered by its health insurance plans, as well as the aging population, which is driving up healthcare costs in the United States.

So, I anticipate its total revenue to be $552 billion in 2028, which firstly implies its average annual growth over the next five years by single-digit percentages, and secondly, it is in line with the forecasts of two analysts. Accordingly, its P/S ratio will decrease from 1.53x over the past 12 months to 1.04x by 2028.

Source: graph was made by the Author

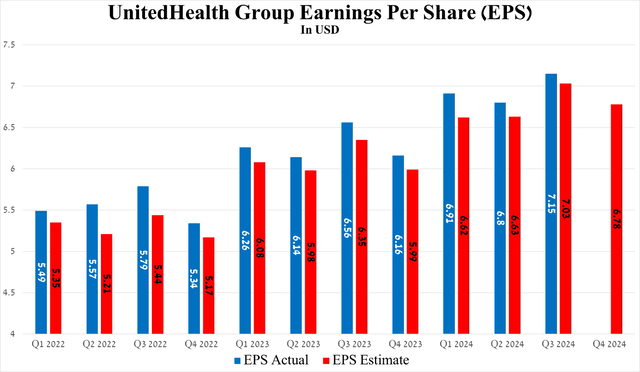

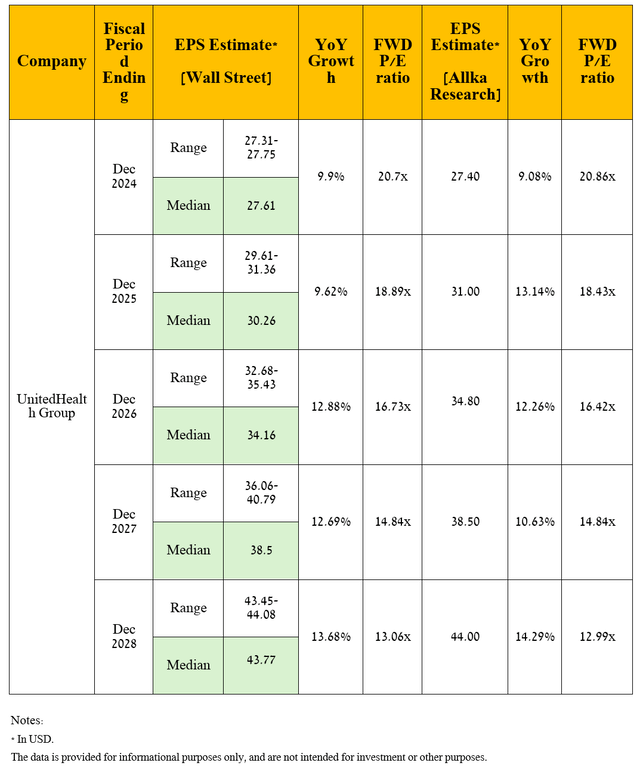

Moving on to a discussion of an equally important financial indicator, namely non-GAAP earnings per share [non-GAAP EPS], which, in my opinion, more accurately and comprehensively determines how effective the business strategies implemented under the leadership of CEO Andrew Witty are.

So, its non-GAAP EPS for the three months ended September 30, 2024, was $7.15, beating analysts’ consensus estimates by 12 cents. In comparison, it is expected to be in the range of $6.45 to $7.03 in the fourth quarter of 2024, implying growth of 10.06% year over year.

Source: Seeking Alpha

Moving to a longer time frame, I expect UnitedHealth Group’s trend of increasing operating income to continue despite the temporary reduction in Medicare Advantage funding, including through optimization of general expenses, as well as growth in the number of consumers served through its commercial offerings.

Ultimately, due to the expected commitment to the share buyback program in the coming years, as well as the increase in its revenue under my forecast, which was noted earlier, I expect the company’s EPS to be $44 in 2028, which is near the upper limit of the analysts’ range [$43.45-$44.08] and also implies a decrease in the P/E ratio from 22.75x to 12.99x.

Source: graph was made by the Author

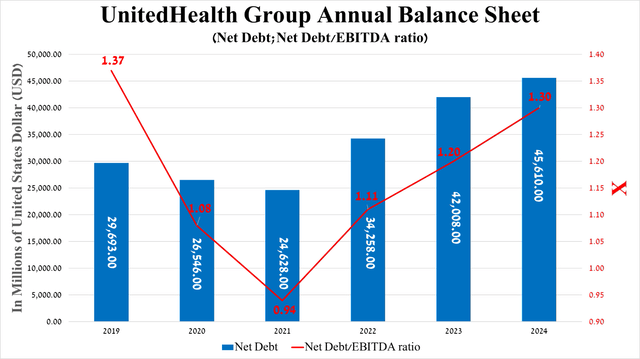

It is equally important to discuss debt, which, in my opinion, is not a risk to UnitedHealth Group’s financial position even given its gradual growth since 2021, since the company’s EBITDA continues to grow year-on-year, including due to the factors I indicated in the article earlier, as well as the steps taken by its management aimed at optimizing administrative expenses.

The growth rate of its net debt/EBITDA ratio is not that high and, more importantly, remains below 1.5x at the end of September 2024. As a result, I believe this suggests no considerable financial risks to UnitedHealth Group’s financial position.

Source: Seeking Alpha

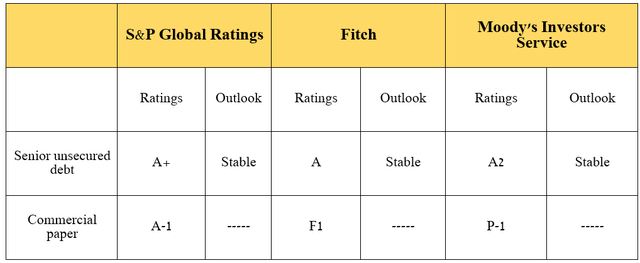

I would also like to point out that UnitedHealth Group’s credit ratings from S&P Global Ratings (SPGI), Fitch, and Moody’s (MCO) remain at investment grade.

Source: graph was made by Author based on UnitedHealth Group’s Form 10-Q

Risks

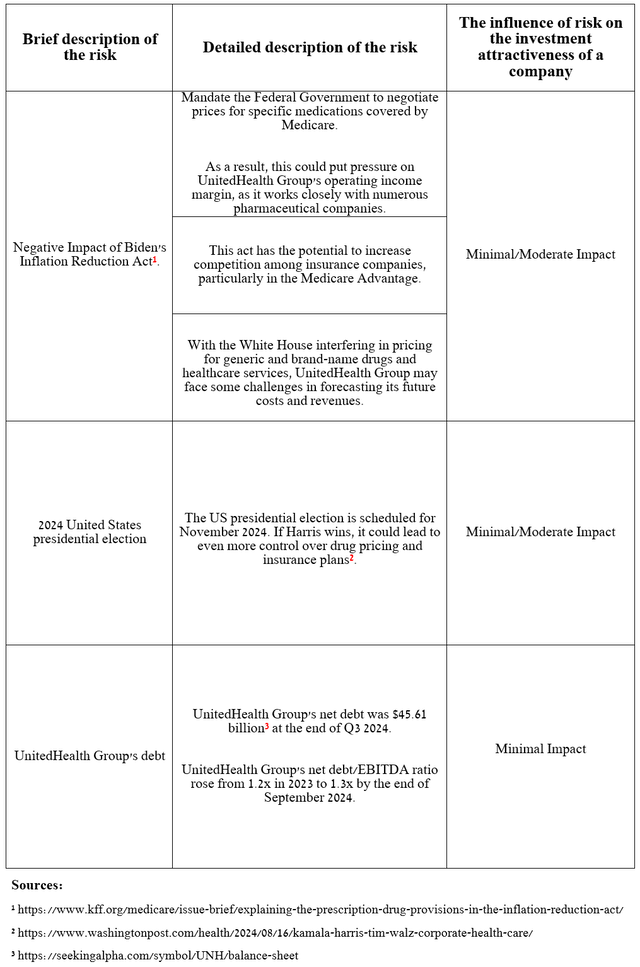

I would like to note the following risks that may negatively affect UnitedHealth Group’s investment attractiveness.

Source: table was made by Author

Takeaway

The company strives to improve access and efficiency of the healthcare system through its two main divisions, Optum and UnitedHealthcare, with the primary goal of improving the quality of life for millions of employees of large corporations and individuals.

The company’s revenue growth and EBIT margin, its high return on equity relative to its key competitors, including CVS Health (CVS) and Humana, double-digit growth in its dividend payments year-on-year, and the predictability of its business model make UnitedHealth Group an extremely attractive stock for long-term investors, especially after the sharp drop in its share price caused by a slight decrease in its 2024 adjusted EPS guidance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.