Summary:

- Verizon Communications Inc. reported a somewhat mixed quarter, but the initial share price reaction suggests that the market was expecting more.

- Despite strong net additions in mobility, weak wireless retail postpaid performance and stagnant ARPA growth raise concerns.

- The quarter also shed some light on the company’s recent decision to acquire Frontier Communications and why skepticism around the deal could be justified.

Roman Tiraspolsky/iStock Editorial via Getty Images

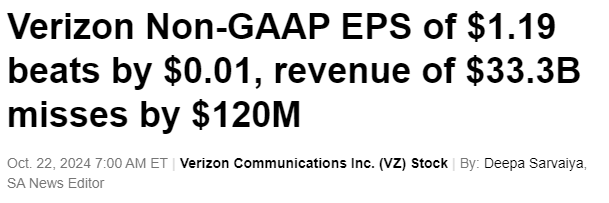

After reporting a slight beat on the bottom line and a slight miss on the topline, Verizon Communications Inc. (NYSE:VZ) stock is already down more than 6% in the early trading hours.

There wasn’t anything too surprising during the quarter, and the share price reaction shows that there has been a major mismatch between investors’ expectations and what is being delivered by the management on a 3-month basis.

Seeking Alpha

Personally, as a long-term investor, I wouldn’t make much of a daily share price reaction to a quarterly report, but it is important to properly evaluate the 3-month report in light of Verizon’s long-term strategy.

Expectations And Shareholder Returns

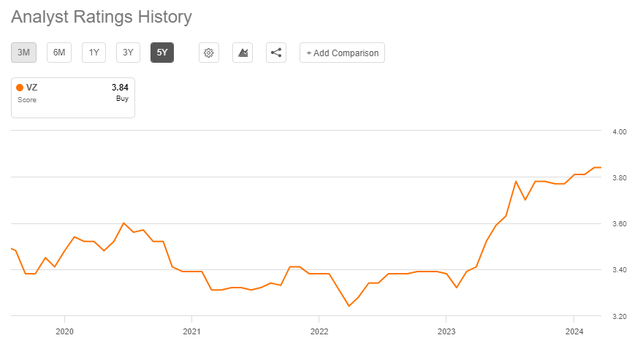

On the surface, the somehow mixed EPS and total revenue figures in combination with management remarks regarding fewer device upgrades done during the quarter were enough to scare-off some short-term investors. Moreover, we have seen a wave of analyst rating upgrades over the past year, which is just another factor contributing to the aforementioned mismatch between near-term expectations and actual results.

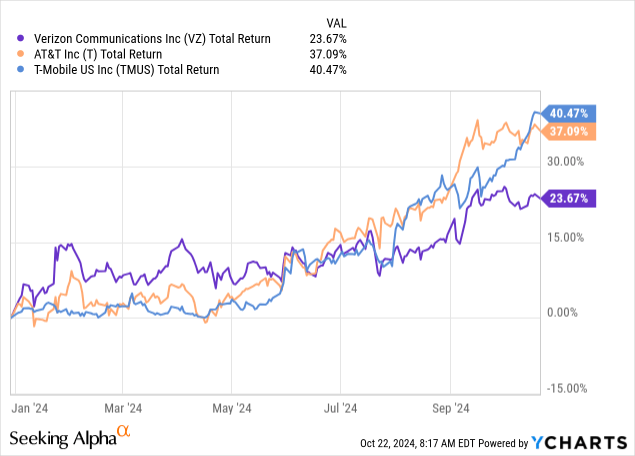

Even if we disregard the daily decline following the Q3 results release, however, Verizon is still the worst performer year-to-date from the three large telecom carriers in the United States.

The stock was performing roughly in-line with its peers until early September, when the announcement of the Frontier Communications (FYBR) acquisition was made.

Seeking Alpha

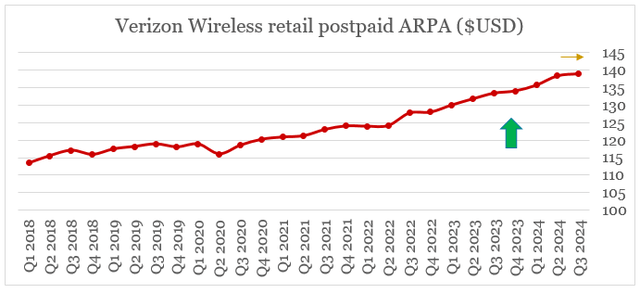

Clearly, the market has been skeptical of the upcoming takeover. The mixed quarterly results today seem to confirm some fears that Verizon’s recent investments might not be enough to reinvigorate growth and sustain the recent up-trend in average revenue per account (ARPA).

The Troubling News

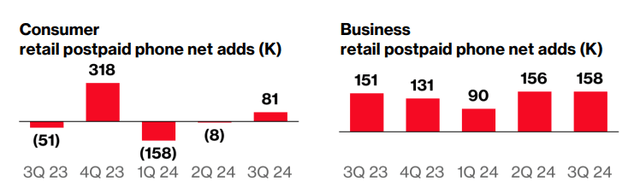

From an operational perspective, Verizon’s management reported a strong quarterly growth in net additions. According to the CEO, net adds in the mobility segment more than doubled from a year ago, which sounds very encouraging.

In mobility, we more than doubled postpaid phone net adds over last year with 239 thousand.

Hans Vestberg Verizon Communications Inc – Chairman and CEO. Source: VZ Q3 2024 Transcript.

It appears that it was mostly due to the strong performance within the business sub-segment that helped deliver these results, while in consumer we also saw relatively good performance with growth in connections returning.

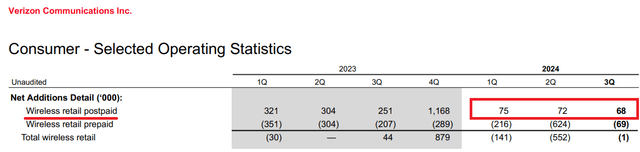

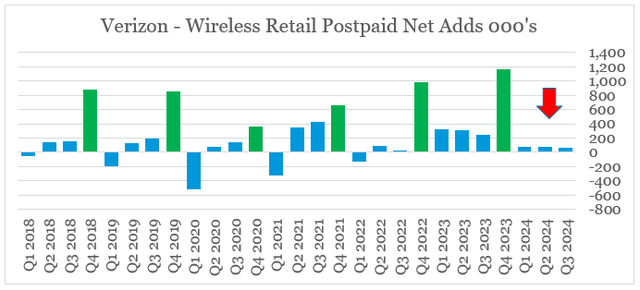

Within the large wireless retail postpaid sub-segment, however, Verizon’s Q3 results did not deliver. Net additions remained low and fell even further when compared to the prior 3-month period.

Verizon Quarterly Operational Data

From a seasonal perspective, the fourth quarter is usually the strongest quarter in terms of new additions in the wireless retain postpaid segment. The first three quarters of a given year are typically a good indication of what investors could expect in Q4. In that regard, it appears that the next 3-month period is unlikely to be something to brag about.

prepared by the author, using data from earnings releases

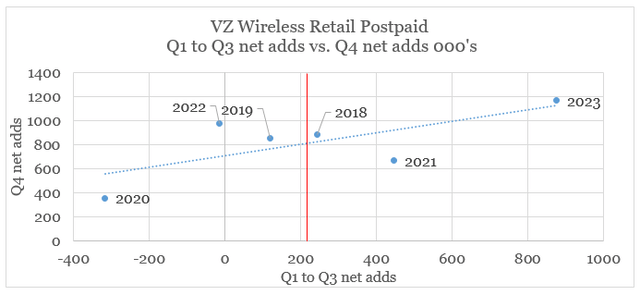

If we plot the net adds figures for the first 3 quarters of each year on the x-axis and the corresponding Q4 net adds for the same year on the y-axis, we could see the relationship that I described above (see the graph below).

Although it is not a guarantee, it appears that the net adds for the first 9 months of this year (market with the red line) would likely result in net additions of around 800,000 for the fourth quarter of 2024. Such a scenario would see Verizon’s net additions decline by nearly 30%, from almost 1.2m in Q4 of 2023.

prepared by the author, using data from earnings releases

Another negative development during the quarter was the growth in average revenue per account (ARPA). While the low net additions number above might not have been a surprise for Wall Street analysts, the Q3 results saw a sudden halt of the upward trend in quarterly ARPA figures. Although Verizon’s management stressed the fact that ARPA continues to grow on a year-on-year basis by 4.2%, the sequential growth has stalled.

prepared by the author, using data from earnings releases

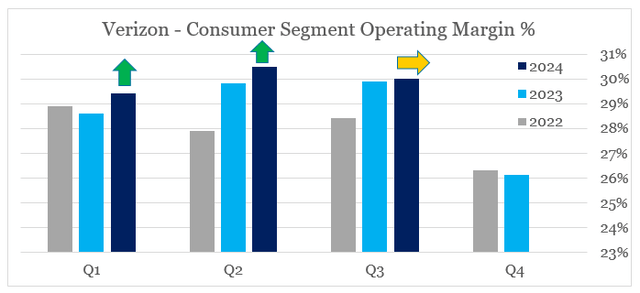

It will be worth waiting for AT&T (T) and T-Mobile (TMUS) quarterly results to put all these metrics within context. However, for now, it now appears highly likely that the much anticipated margin improvement in the seasonally strong fourth quarter might not happen. In my view, this will put some pressure on VZ share price, especially if its peers show better quarterly performance.

prepared by the author, using data from earnings releases

Conclusion

Quarterly results usually contain a lot of noise, and they rarely set a trend. That is why, I am not rushing to make any decisions on Verizon’s stock price based on the Q3 2024 results. We have acknowledged, however, that the lackluster quarter does bring some important points for consideration by long-term investors. Moreover, in the light of the recently announced deal for Frontier Communications and its fiber assets, it appears that Verizon’s management might be anticipating more difficulties within the wireless segment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.