Summary:

- 3M Company’s impressive recovery, marked by strong earnings growth and improved margins, positions it as a potential long-term dividend grower despite past setbacks.

- The company’s focus on innovation, particularly in high-growth sectors like automotive and electronics, accelerates product development and operational efficiency.

- Robust free cash flow enables 3M to reward shareholders through dividends and buybacks, even after the dividend cut, signaling high-quality earnings.

- Despite its cyclical exposure and the lingering impact of the dividend cut, MMM stock remains undervalued with significant upside potential, making it a strong buy.

undefined undefined

Introduction

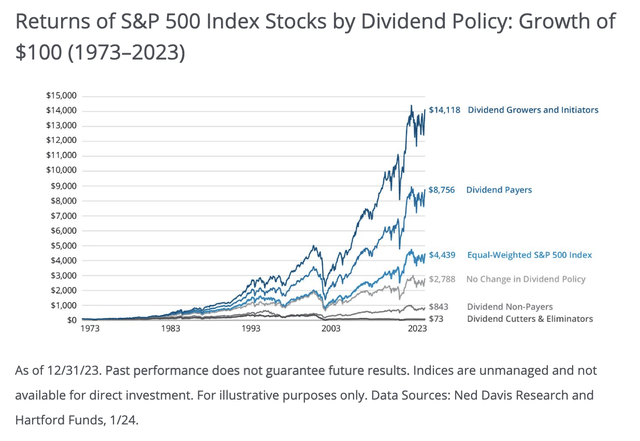

Historically speaking, the worst-performing stocks on the market are dividend cutters, including companies eliminating their dividend. This group of stocks turned a $100 investment in 1973 into $73. During this period, dividend growers turned this $100 bill into more than $14,000!

However, while the odds are against dividend cutters, they are not all bad!

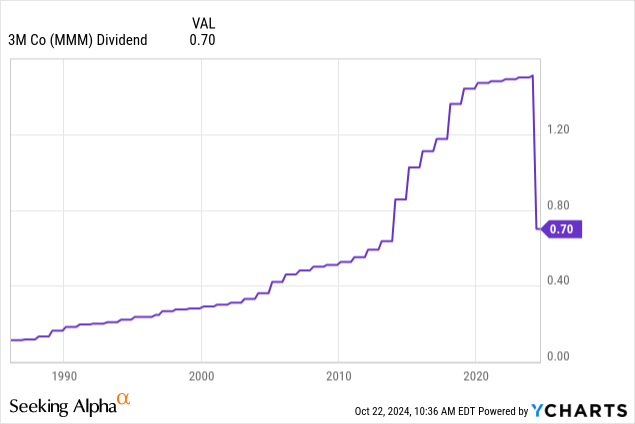

One of them is the 3M Company (NYSE:MMM), which cut its quarterly dividend from $1.51 to $0.70 on May 14, turning the former Dividend King into a dividend cutter.

The good news is that 3M is one of the “good guys.”

I started covering the company on September 29, 2023, again. Back then, I called it “A 30% Undervalued Dumpster Fire.” Since then, shares have returned 75%, more than twice the return of the S&P 500 (SP500).

My most recent article on the stock was written on July 2, titled “3M: A Dividend Cutter With A Strong Buy Rating.” The company has returned 32% since then.

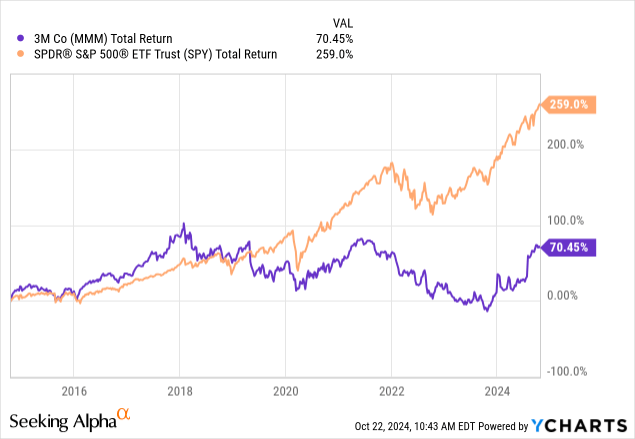

With that said, I cannot blame investors who have sold the stock recently, as it took the company roughly six years before it bottomed and regained upside momentum. This has resulted in a ten-year total return of 71%, a mile below the market’s 259% return.

Hence, the point of this article is to update my bullish thesis on 3M, as the company continues to prove it’s one of the few cutters capable of returning to long-term dividend growth.

To make my case, I’m using its just-released earnings and other major developments that hint at more elevated capital gains.

So, as we have a lot to discuss, let’s get right to it!

The Recovery Continues

3M is not an easy company to assess. This has at least three reasons:

- It is a company recovering from contracting earnings and lawsuits.

- This year, it spun off its healthcare segment.

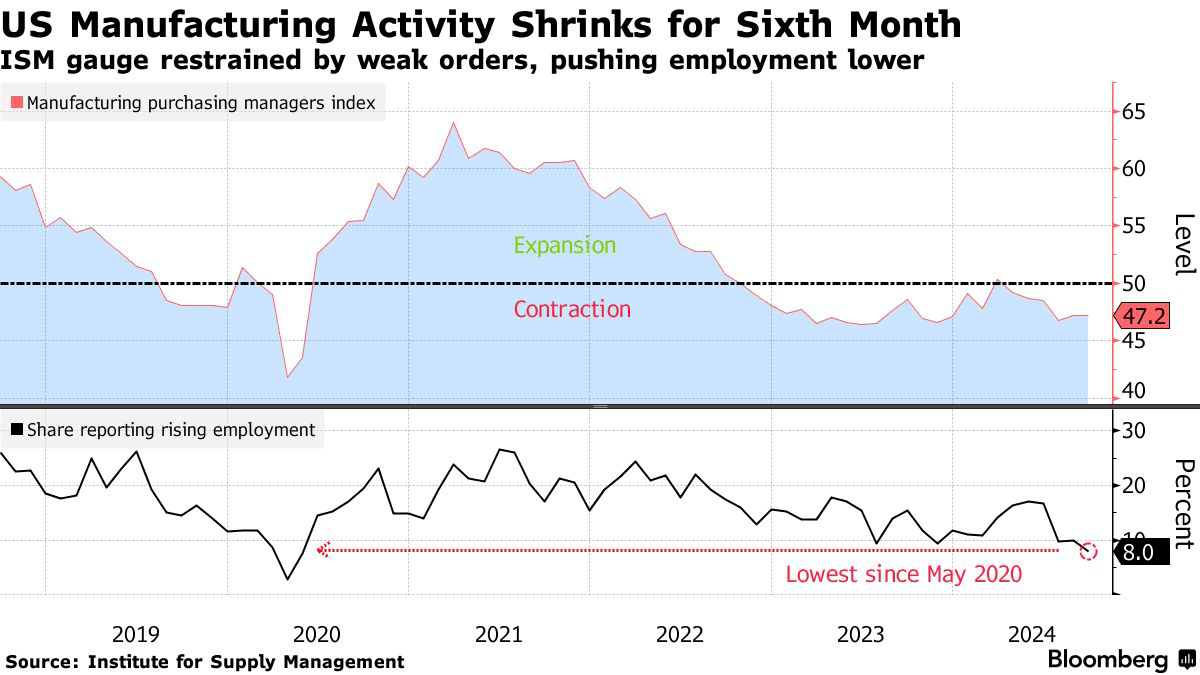

- It is still a cyclical company operating in an environment of contracting manufacturing expectations (see below).

Bloomberg

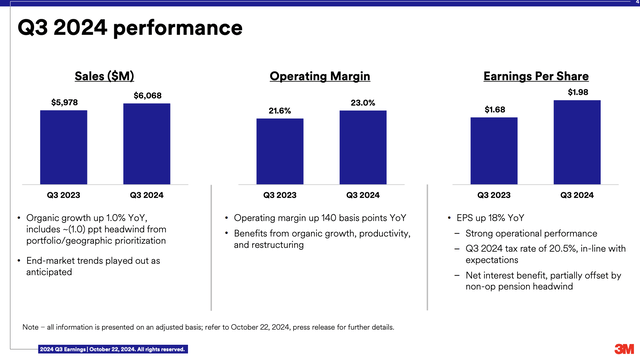

The company also has a new CFO, Anurag Maheshwari, who used to be the CFO of Otis Worldwide Corporation (OTIS). Mr. Maheshwari’s first earnings call was off to a good start, as he reported 18% year-over-year non-GAAP earnings-per-share growth, supported by 1% organic revenue growth. When adjusted for geographic prioritization and product portfolio initiatives, organic growth rose by 2%.

Moreover, operating margins improved by 140 basis points to 23.0%, allowing the company to generate $1.5 billion in free cash flow, 141% of its net income.

However, in light of my cyclical headwind comments, the company saw mixed results, as it encountered volatile industrial demand, strength in electronics, lower automotive build rates, and softness in consumer retail.

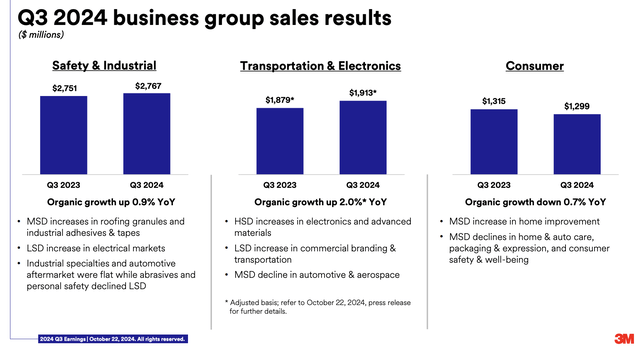

- Safety and Industrial organic growth: 0.9%. This segment saw growth in areas like roofing and electronics.

- Transportation and Electronics organic growth: 2.0%. Here, electronic sales offset a global decline in car production.

- Consumer business organic growth: -0.7%. Rising home improvement sales were unable to offset the general pressure on consumer sentiment in other areas.

Most of my more regular readers will know that all of this is in line with the macroeconomic discussions we had in prior comments.

Despite a challenging market for cyclical companies, 3M’s ability to achieve positive organic growth by focusing on secular trends and improving margins through productivity gains and restructuring is a great sign.

The only thing better than strong earnings is updated guidance.

A Path To Sustained Elevated Growth

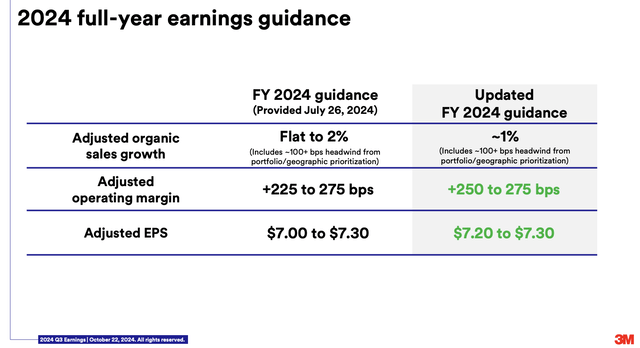

As we can see below, the company raised the lower end of its full-year earnings guidance by $0.20, now targeting an EPS range of $7.20 to $7.30.

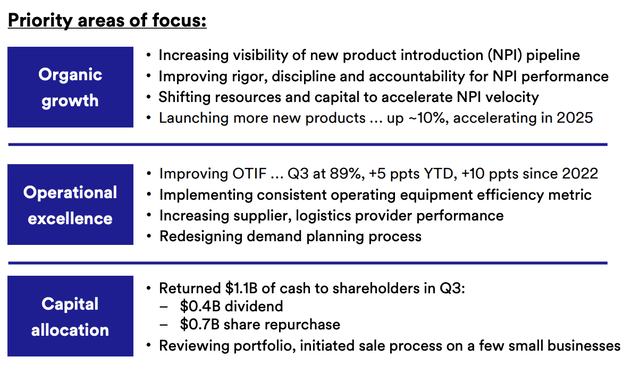

On top of good 3Q24 results, the company is confident in its strategic goals for 2024. These goals are based on three pillars:

- Driving sustained organic growth: This includes investing in innovation and improving commercial execution.

- Improving its operational performance: The company is focused on efficiency improvements across the board. This is key to accelerating margin improvements.

- Capital Deployment: Disciplined capital management is crucial to improve shareholder value. This includes winning back the trust of investors who jumped ship recently. Given how stubborn most investors are (and rightfully so!), this could take a long time.

As these strategic priorities sound extremely vague and generic (every company focuses on sustained organic growth, improving, margins, and deploying capital effectively, etc.), let me add some color.

For example, to accelerate growth, the company is focusing on R&D, including the introduction of more new products. This includes reducing administrative burdens on engineers and speeding up SKU setup time from 100 days to 60. In other words, products are getting to market faster and engineers can be more creative.

It is also shifting its focus, as it moved 100 people within R&D (and added 50 more researchers) to new product developments, especially in automotive, aerospace, electronics, and semiconductors.

According to the company, this realignment aims to reverse a decade-long decline in new product introductions, with a 10% increase in new launches expected this year.

Additionally, it is improving the way it reaches customers and deals with suppliers. After all, having better products is only helpful if customers are aware and able to get their products on time.

In addition to training new staff and improving its sales force and distribution network, it has done an impressive job in solving critical supply issues that have led to business losses in the past. I added emphasis to the quote below.

[…] we’ve seen continued progress in delivering on-time in full or OTIF to our customers. I know we’ve lost business and have paid fines due to poor delivery performance, and I’m encouraged by the steady improvement we’re making, ending Q3 at 89% OTIF, up 5 points since the beginning of the year and 10 points above Q4 of 2022. – MMM 3Q24 Earnings Call.

The company also increased its supplier performance. For many years, the company has dealt with subdued on-time supplier delivery rates in the low 60% range. Thanks to measures like better demand prediction, reliability is now in the low 70% range.

While investors wait for 3M to further improve their business, they enjoy well-covered dividends and buybacks. Year-to-date, the company has generated $3.5 billion in free cash flow. That’s after $1.7 billion in capital expenditures and R&D and 2% above its net income. This is a sign of high-quality earnings, as more than all of it is turned into distributable cash.

It also allowed the company to return $2.7 billion to shareholders. $1.1 billion of this was indirectly returned in the form of buybacks. The good news is that after the cut, MMM still yields 2.1% with a payout ratio of just 39%. That’s based on the midpoint of its new 2024 guidance.

Going forward, I expect dividend growth to return.

MMM Stock Valuation

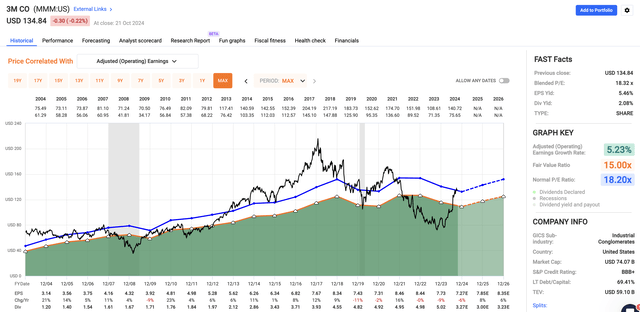

Using the FactSet data in the chart below, 3M is expected to grow its EPS by 8% and 6% in 2025 and 2026, respectively. These growth rates are favorable in light of macroeconomic challenges. If we were to see a cyclical growth bottom, I expect the actual numbers to be substantially higher.

That said, working with current numbers and its long-term average P/E ratio of 18.2x, we get a fair stock price target of $152, 13% above the current price.

This is slightly above the $149 target I gave in my prior article.

As a result, I remain bullish on 3M.

While the company is not turning into a fast-growing industrial juggernaut anytime soon, I believe it has what it takes to turn into a sustainable dividend grower again. This time, it will have a streamlined business model, better innovation, improved supply chains, and a valuable life lesson from the 2018-2023 downturn.

Personally, however, I am not buying 3M because of my elevated industrial exposure through railroads, machinery companies, and aerospace players. Currently, there isn’t room for more (overlapping) exposure.

Takeaway

3M’s journey from a struggling dividend cutter to a potential dividend grower is a lesson in resilience.

Despite significant setbacks, including legal challenges and a dividend cut, the company has made impressive improvements to its operations and capital efficiency.

Moreover, its better focus on innovation, supply chain improvements, and disciplined capital management is driving a slow but steady recovery.

While 3M isn’t out of the woods yet, I believe its earnings growth potential and improved fundamentals make it a strong contender for long-term investors.

Hence, I am very confident that 3M will regain its place as a reliable dividend grower in the years ahead.

Pros & Cons

Pros:

- Strong (And Important!) Recovery: 3M is bouncing back with impressive earnings growth and improving margins.

- Innovation Focus: The company is accelerating product development, especially in high-growth sectors like automotive and electronics.

- Free Cash Flow & Dividends: With strong free cash flow, 3M continues to reward shareholders through dividends and buybacks, even after the cut. However, it could take time until it wins back the trust of dividend investors again (see my cons).

- Valuation Upside: At current levels, 3M remains undervalued, with a cyclical growth bottom being an additional wild card.

Cons:

- Dividend Cutter Reputation: The dividend cut still hurts many, making it tough to regain investor trust.

- Cyclical Exposure: 3M is exposed to economic cycles, which may slow its growth in tough markets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.