Summary:

- I expect Amazon to outperform the indices in the coming year(s) due to strong revenue and earnings growth, driven by AWS and Advertising, with a projected 25% upside.

- AWS shows robust growth momentum, benefiting from AI advancements and increased cloud infrastructure spending, positioning it for continued revenue acceleration.

- I also believe that its Advertising revenue, fueled by Prime Video, is set to skyrocket, leveraging Amazon’s closed ecosystem and high-intent audience for superior ad spend returns.

- Despite macroeconomic headwinds affecting the Stores Business, Amazon’s leadership in e-commerce and efficiency improvements support a “buy” rating with a $237 price target.

HJBC

Introduction & Investment Thesis

Amazon (NASDAQ:AMZN) is set to report its Q3 FY24 earnings on October 31 where the company is expected to grow its revenue by 11% to $157.16B while growing its earnings per share by 32% to $1.14.

So far, for the whole year, Amazon has performed at par with the S&P 500 and Nasdaq 100. However, I believe that the stock is set for outperformance in the coming year given its revenue and earnings growth estimates and relative valuation compared to some of its peers in the Magnificent 7 complex.

I started my initial position in Amazon after the stock dipped post its Q2 FY24 earnings on August 1 and have steadily increased the size of my position, with my latest round of purchase at its current level, as I believe that the stock has at least a 25% upside from its current levels with its growth vectors of AWS and Advertising business.

With the earnings around the corner, these are the following business segments and metrics that I will be paying attention to.

The growth momentum in AWS will likely continue ahead.

In the previous quarter, AWS continued to rebound for a third quarter after seven consecutive quarters of decline, where customers were forced to cut costs in a tougher environment.

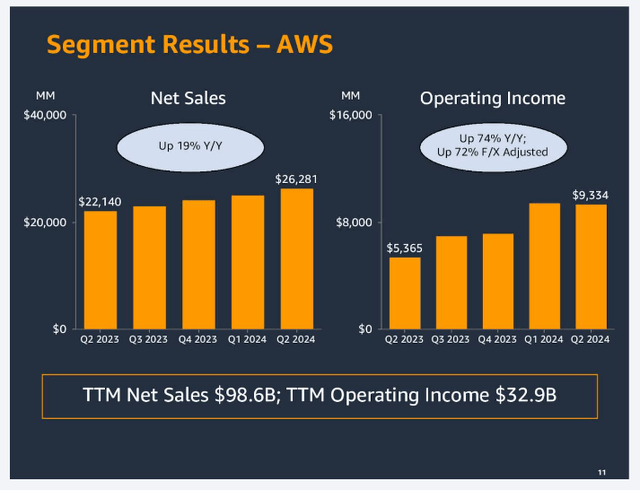

The growth momentum reflected a 200 basis point sequential acceleration to 19%, which was better than Google Cloud (GOOGL) (GOOG), which improved by 100 basis points to 29%, while Microsoft Azure (MSFT) decelerated 100 basis points to 29%. It is also important to note that the base for AWS is higher compared to its competitors at $26.3B, which represents around 18% of Total Revenue, along with an elevated operating margin of 36%.

Q2 FY24 Earnings Slides: Revenue and Operating Income trend of AWS

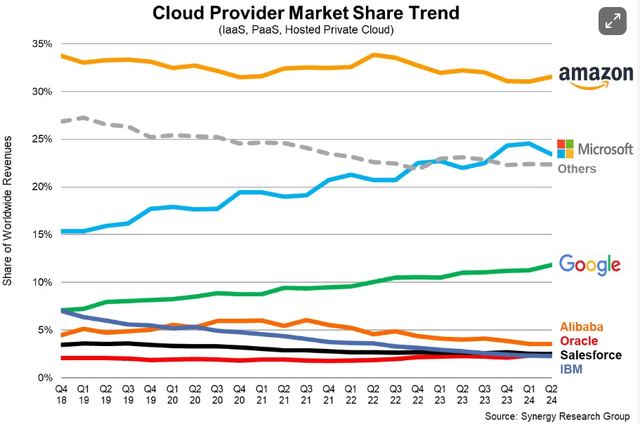

Furthermore, with Synergy Research Group estimating that cloud infrastructure spending grew 22% YoY to $79B in Q2, Amazon had a market share of 32%, compared to 23% for Microsoft Azure and 12% for Google Cloud.

Synergy Group Research: Market share of hyperscalers

During the earnings call, Andy Jassy, CEO of Amazon, pointed to three growth tailwinds for AWS in the following commentary:

“First, companies have completed the significant majority of their cost optimization efforts and are focused again on new efforts. Second, companies are spending their energy again on modernizing their infrastructure and moving from on-premise infrastructure to the cloud. And third, builders and companies of all sizes are excited about leveraging AI.”

Looking forward, I believe that Amazon should continue to see a sequential acceleration in its AWS revenue segment given the growth tailwinds that Andy Jassy outlined in the previous earnings call, which should boost investor sentiment.

Meanwhile, the product innovation in the AI stack is robust as Amazon is developing its customized machine learning chips like Trainium for training and Inferentia for inference for the Infrastructure Layer to provide customers with choice and option, while offering “LLM as a Service” in its Models Layer, also known as Bedrock, enabling companies to build GenAI apps by leveraging existing LLM’s such as Anthropic’s Claude 3.5, Meta’s Llama 3.1, and more. Finally, on its application layer, Amazon released its own AI-powered assistant, Amazon Q, which Jassy called a “gamechanger” given it has the highest known score and acceptance for code suggestions, while boosting efficiency for developer teams. With Amazon having the advantage of having the largest market share among all hyperscalers, I believe it gives it a potential adoption edge, especially given its broad functionality, superior security and operational performance, and deep partner ecosystem.

On the note of capital expenditures, the management also established that they expect capital investments to be higher in the second half of the year to support the growing need for AWS infrastructure in the face of a strong demand environment for both GenAI and non-GenAI workloads. Although its AI businesses continue to grow with a multi-billion dollar run rate, according to the management, it is important to keep in mind that we may not see ROI (return on investment) for a multi-year period.

Prime Video will help advertising revenue skyrocket.

Shifting our focus to Amazon’s next growth engine, Ads, it grew at 20% YoY to $12.8B, close to 9% of Total revenue. While the segment saw a sequential slowdown from a 24% YoY growth rate in Q, it is the fastest-growing segment, driven by sponsored ads and Prime Video.

During the earnings call, the management reiterated that they are at the “beginning of what’s possible in video advertising” and believes there to be tremendous opportunity as Amazon can deliver a superior return on ad spend given its closed ecosystem, purchase data, and high-intent audience, thus directing higher advertiser spend down the line. What is also important to note is that Prime Video ads started only in Q1 FY24, and with a reach of 180M users in the US, this move will likely turn Amazon into a giant ad-supported streaming platform.

The way that I see it, as Amazon continues to invest in its content catalog and expand into live sports, Prime Video may start to gain a higher share of total US TV share, where it currently has a 3.1% share as per Nielsen. As more and more Prime members turn to Prime Video as their go-to streaming platform for ad-supported content, this could evolve into a significant revenue driver for Amazon, with Advertising Revenue growing as a larger share of Total Revenue.

Stores Business will likely remain under pressure from a mixed consumer amid macroeconomic uncertainty.

Finally turning to the largest revenue segment, its Stores Business saw a 9% YoY growth rate in North America and a 10% YoY growth rate in its International markets. However, what was partly concerning was that the company was seeing lower ASP’s (Average Selling Prices) with the management presenting a bleak picture of the economy as prices continue to batter American wallets.

This also led to the company missing its Q2 revenue estimates, along with the management warning for softening consumer demand in Q3 as shoppers have turned increasingly cautious. However, the company emphasized its commitment to innovate on selection, low prices, and faster delivery by expanding their use of automation and robotics, building their same-day facility network, and more. For instance, its speed of delivery for Prime customers has been faster than ever before, with more than 5B units arriving the same day or next day, resulting in improved customer experience, higher shopping frequency, and higher order values as they look to Amazon to fulfill their shopping needs.

Looking forward, I expect Amazon to continue to maintain its leadership as the largest e-commerce platform worldwide, as it has the highest number of users and superior fulfillment capabilities. However, macroeconomic headwinds can continue to put short-term pressure, especially as the Fed’s monetary easing plan is uncertain, that can weigh down on consumer sentiment, especially if the labor market starts to weaken from its current levels. Given that this is the largest revenue segment, contributing 65% to Total Revenue, a slowdown in sales performance can hurt overall profitability.

Tying it together: It’s a “buy.”

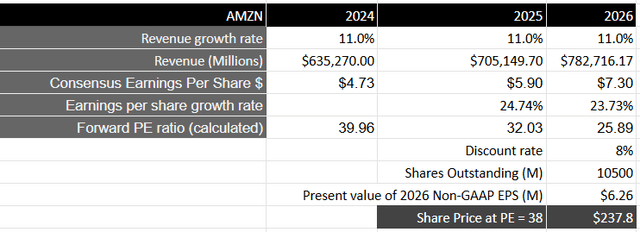

Looking forward, if I take the consensus estimates for revenue and earnings projections for the next 3 years into account, where revenue is expected to grow in the low teens at 10-11% every year, it should generate close to $782.7B by FY26. I believe this will be driven by a combination of its Stores, Advertising and AWS business. While I expect its Stores business to contribute the largest share to Total Revenue over the next three years, I believe AWS and Advertising will contribute a larger share given Amazon’s growth initiatives that I discussed above.

Meanwhile, from a profitability standpoint, taking the consensus estimates for non-GAAP EPS of $7.30 in FY26, we can see that it will be growing at more than twice the rate of overall revenue growth, which, I believe, will be made possible as its more profitable segments, such as Advertising and AWS start to contribute a larger share of Total Revenue, while the company simultaneously improves its efficiency on its Stores Business at the same time. This will be equivalent to a present value of $6.26 when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies increase their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Amazon should trade at least 2.25-2.5 times the multiple, given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 38, or a price target of $237, which represents an upside of 25% from its current levels.

Author’s Valuation Model

My final verdict and conclusions

Although there is some uncertainty surrounding the sales growth of Amazon’s Stores Business as macroeconomic uncertainties continue to persist, I believe the company’s long-term growth narrative becomes clearer when I zoom out. With ongoing investments towards improving efficiencies in its Stores business, I expect operating margins will improve in the segment in the coming years, while Amazon will continue to maintain a leadership position in e-commerce as they attract users with greater selection, lower prices, and faster delivery speeds.

In the meantime, its two growth engines, Advertising and AWS, should continue to scale and contribute to a larger share of overall revenue, which will also help boost overall profitability. In the Advertising business, I expect its investments in Prime Video will continue to drive a higher share of US TV time with its expanding content catalog, which in turn will attract higher advertising spend on the platform with superior outcomes for advertisers, while its AWS business should continue to see renewed momentum ahead as enterprises bring more workloads to the cloud and tap into the power of GenAI.

Therefore, assessing both the “good” and the “bad,” I rate the stock a “buy” at its current levels with a price target of $237, representing an upside of 25% from its current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.