Summary:

- Ford will soon report its Q3 earnings, and investors wonder what the numbers will look like.

- Ford’s Q3 sales report looked promising in terms of volumes.

- However, the macroeconomic environment is deteriorating and Ford’s profitability is under pressure.

- In this article, we gather all the available data and make an educated guess on what the main numbers of Ford’s report could be.

Tramino

Among the Detroit Big Three, only GM seems to be sailing through a difficult market with some degree of success. On the other hand, Stellantis (STLA) and Ford (NYSE:F) (NEOE:F:CA) have their headaches to face. After all, S&P Global has recently warned about the tough road ahead of the auto industry due to credit deterioration and weaker-than-expected sales.

As we approach Ford’s Q3 earnings report, some pieces of the puzzle we need to solve when shaping a preview is already available. In particular, in addition to Ford’s guidance at the end of Q2, we already know Ford’s Q3 sales.

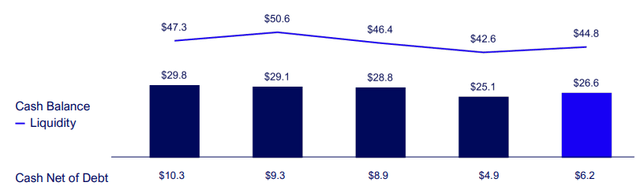

At the end of Q2, Ford updated its FCF guidance for FY2024, increasing it by $1B to $8.5B and targeting a return between 40% and 50% of its FCF to shareholders. Thanks to a strong balance sheet with $27B in cash and $45 in available liquidity, Ford’s returns seem sustainable. Net of debt, Ford holds $6.2B, which is decent.

F Q2 2024 Earnings Presentation

However, at the end of Q2, Ford’s EBIT was down by 27% YoY to $2.8B, with an EBIT margin of 5.8%. In particular, the company’s electric vehicle business is still unprofitable and reported a negative $1.1B in EBIT in just one quarter. For the first half, EBIT was negative by $2.5B, which is quite a hit. Ford, on the other hand, has a highly profitable business in the pro segment, where its EBIT margins hover around 16%. In other words, Pro is financing EVs. This was the focus of a topic Ford Pro CFO Navin Kumar was asked by Adam Jones at Morgan Stanley’s 12th Annual Laguna Conference:

Year-to-date, Ford Pro’s first-half EBIT is $5.6 billion. Ford’s total company EBIT is $5.5 billion. Ford Pro, again, I’m brilliant at math, is over 100% of total company EBIT. A common criticism from investors, including many in this room, is that Ford Pro generates all the damn cash, all the cash of the company and that, that money is going to pay for loss-making EVs and warranty costs. Is that fair?

The question was left unanswered.

Ford reported a 4% retail sales increase in the third quarter, which contrasts with flat sales in the U.S. market. Hybrid vehicles are being favored, with a 38% YoY increase to 48,101 units, while EVs increased only by 12% YoY. However, Ford sold 67,689 EVs through September and claims to be second only to Tesla in the U.S.

Ford’s leadership in trucks, with its F-series sales outselling the Chevrolet Silverado by 138,000 units and the Ram by a whopping 282,000 trucks. Moreover, F-150 hybrid sales were up 64% YoY to 20,129 units, topping even the Ford Maverick, whose sales rose 22% to 16,561.

ICE vehicles, on the other hand, saw their sales decrease by over 12,000 units to 432,429 in the quarter, a 2.8% YoY decline. YtD, ICE sales are down 1.8%, but total vehicle sales are up 2.7% to 1,548,172 units. In a softening market, this is a very good result. Ford has three main types of vehicles: SUVs, trucks, and cars. Their sales are all up YtD, but in Q3, SUVs reported a 5.6% decline and car sales were down 8.2%. However, cars are a minor segment, with only 9,000 units sold in the quarter. It is the segment that reports the Mustang sales. Trucks take the lion’s shares with 292,010 vehicles of the 504,039 Ford sold in the third quarter (58% of the mix). Lincoln brand seems recovering and reported a 26% YoY increase in sales, thanks to the Nautilus and the Aviator.

Compared to Ford’s sales report in Q3 2023, inventory is up from 424,400 units to 587,700. This confirms the trend we had read in Ford’s quarterly reports, with the TTM inventory up to $17.18B vs. $15.65B at the end of FY2023. What we see from the Q3 sales report is a 38.5% YoY increase in units, and I am expecting the earnings call to address this trend with an explanation of what the company plans on doing to keep it under control. While Ford Pro has the margins to discount a bit, the rest of Ford can’t afford more discounts if it wants to run at a profit.

While we read the October sales report, we should not, in any case, overlook an issue that eroded Ford’s profitability in Q2 and might probably have an impact on Q3 as well: increased warranty costs associated with its EV division. Just to give an idea, the word “warranty” occurred 26 times in the last earnings call, and Ford’s President and CEO Jim Farley could only say the company is trying to improve its quality but still anticipates higher warranty costs down the road for this fiscal year. In an environment where a pricing war seems to be ramping up rapidly with the aggressive moves of Chinese OEMs, it is not a great thing to have this kind of cost.

Now, Ford’s balance sheet is in good shape, with $18.7B in industrial debt and over $26B in cash and available liquidity. But if its profits keep being eroded, and we see its EBITDA plunge below $6B we would have its industrial debt/EBITDA ratio spike up above 3x, which is not a good sign. In this case, we might be seeing Ford reconsider once again a dividend cut. After all, Ford is indeed guiding for FCF of $8.5B, but it also spends around $8B in R&D.

Ford Q3 Earnings Preview

So, the picture is mixed. Ford sales seem to be holding up quite well, but we have its profitability under scrutiny. After all, for the last 3 months, we have 18 analysts releasing an EPS down revision while only one increased its estimates. At the same time, Ford’s revenue has 8 up revisions and 4 down revisions. This means analysts are mainly expecting a deteriorating profitability.

In Q3, Ford should report around $42B in revenue, which would be close to a 2% YoY growth. I believe we might actually see Ford top this threshold, given the strong performance of Ford Pro. However, I think the current EPS estimate of $0.48 for Q3 might be a bit too optimistic since it represents a 23.5% YoY growth.

After all, Ford’s net income margin is around 2-3%. Therefore, we could expect around $1B in net income. Considering Ford has 4B shares outstanding, we would have Ford’s Q3 EPS around $0.26, which would mean flat growth YoY. Now, it is true that Ford is guiding for $2B in manufacturing savings this year, thanks to lower inflation and cheaper raw material prices. So, it would not be absurd to assume Ford could report a 4% net income margin, which would make Ford report $1.68B in net income. If we consider that there might be a probable headwind coming from warranty costs, let’s place our estimate at $1.5B in Q3 net income. In this case, our EPS estimate jumps up to $0.38. I think this is a more reasonable forecast than the current consensus. What does this mean? That the FY EPS estimate might fall short of the $1.87 analysts are expecting, which puts Ford at a 6 fwd PE. The fwd PE might actually be closer to 6.5. Now, although this may seem dirt cheap, it is not. Remember, we are talking about an automaker. A cheap PE in this industry is a 2 or a 3. Above a 6 we are somewhat talking about a premium. Of course, Ford Pro is a strong business. But, as we have seen, it is being diluted by Ford’s other two business lines.

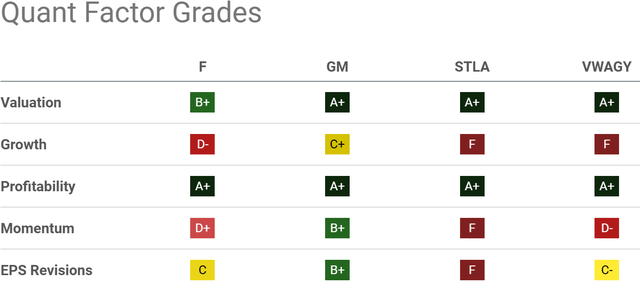

Not by chance, Ford is one of the few automakers not earning an A+ as its Quant Factor Valuation Grade. GM, which is currently performing better, trades at a fwd PE just above a 5. The same is true with the more troubled Stellantis. Volkswagen trades at a fwd PE of 3. This means Ford is twice as expensive as Volkswagen right now. But I find this valuation hard to justify.

Seeking Alpha

As a result, although I really like the Ford Pro business, I don’t see great value right now in this stock. These earnings, in addition, may see the stock go through some volatility since investors might get nervous if Ford’s warranty issues keep being reported. Given the current environment and the available data, I would stay neutral. Therefore, I rate the stock as a hold heading into earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.