Summary:

- Meta Platforms, Inc.’s stock has surged 62% YTD, driven by improved fundamentals, AI integration, and higher user engagement.

- Despite Meta’s strong Q2 performance and potential for 40-42% operating margins by 2025, ballooning CAPEX and Reality Labs’ losses pose risks.

- Meta’s core advertising business remains robust, but the stock’s forward returns are limited, with the valuation getting ahead of its fundamentals.

- I recommend caution with Meta’s stock at current levels, but I would consider buying if it pulls back below $500/share.

Robert Way

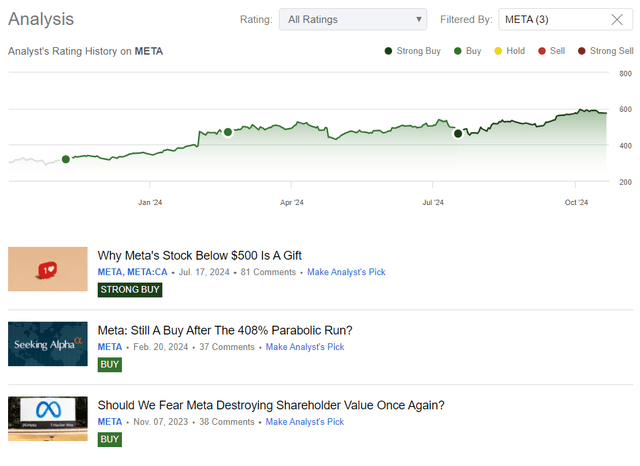

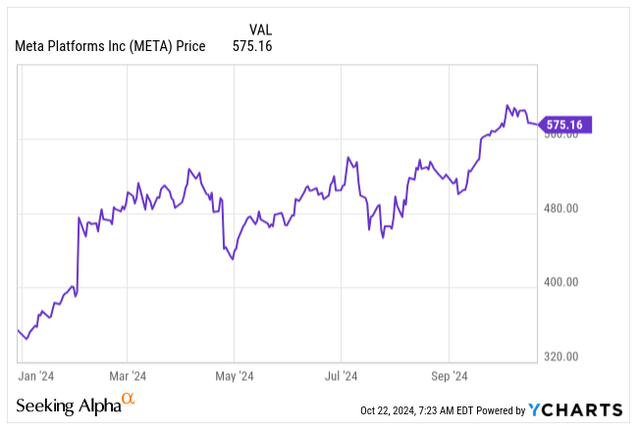

Since I wrote my last coverage on Meta Platforms (NASDAQ:META) (NEOE:META:CA) stock, “Why Meta’s Stock Below $500 Is A Gift,” the stock has been up 24.5% in a span of three months.

In fact, I have continuously been bullish on Meta’s stock as the advertising market recovered from its slump in 2022/23. During this time, Meta’s profitability improved amidst cost-cutting efforts, and Meta started materially benefiting from AI integration via improved content recommendation, driving higher user engagement and higher price per ad.

If you have followed my research since November, when I covered Meta’s stock for the first time on Seeking Alpha, you would be sitting today on an 80% gain compared to the border market, which is up “only” 34%.

Previous Coverage (Seeking Alpha)

In my last coverage, I praised Meta’s improving profit margins, even as the CAPEX spending ballooned, building state-of-art AI data centers weighing on the stock’s performance, allowing investors to accumulate the shares at an attractive valuation.

However, the situation has changed, and despite Meta firing on all cylinders, the price gains are outperforming the underlying fundamentals, and investors should exercise caution, particularly as expectations are sky-high heading into Q3 earnings.

Meta’s Business Keeps Delivering

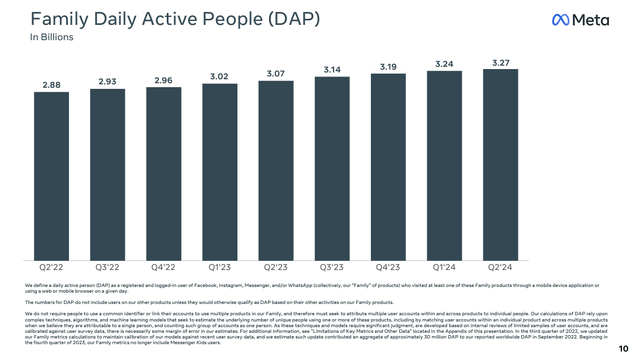

Meta’s app ecosystem—Facebook, WhatsApp, Messenger, and Instagram—is unmatched in the social media space. Personally, I know hardly any people who don’t use at least one of these products, giving the company a dominant position with over 3.27B daily active users, worldwide.

If we look at Meta’s business from a broader perspective, the company is somewhat of a one-trick pony, lacking diversification with social media advertising as its core cash cow, particularly if we gauge it against other juggernauts.

For instance, Alphabet, a parent company of Google (GOOGL), is a more diversified business that is still predominantly advertising-based, nonetheless generating revenue from Cloud, YouTube, Android, and many more avenues.

That’s not to say I do not like Meta’s businesses, but I enjoy Google’s diversified revenue streams better. That’s why I own Google in my portfolio instead, even in the face of the adverse DOJ lawsuit threatening to break up the company.

What I particularly like about Meta’s business is that the company is a clear leader in AI integration and monetization, enhancing its ad-targeting capabilities, with up to 50% of Instagram’s content being recommended by AI and 30% on Facebook.

These AI investments, which are partially viewed negatively by investors as they increase CAPEX spending, can strengthen Meta’s core business, leading to continuous competitive advantages. Yet, I remain skeptical about the future of Reality Labs. This division could, in theory, benefit from AI integration, particularly Meta’s VR headsets, but it faces stiff competition from Apple (AAPL). In my opinion, reckless spending is not value-accretive.

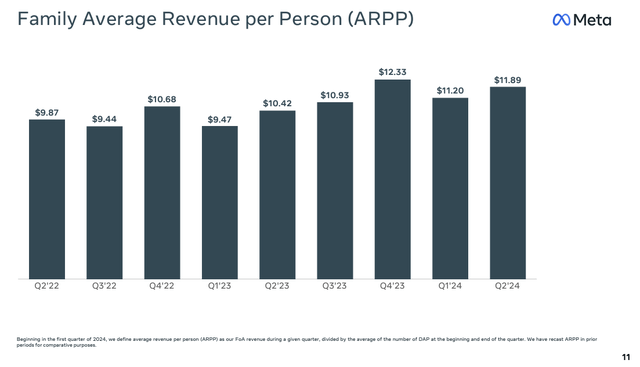

Meta’s business has improved significantly in the last few years, with higher average revenue per user as a result of the following:

- The company has capitalized on improving the product lineup with new features such as Reels, Stories, and the new Threads app. This has boosted user engagement and enabled the drive of higher ad revenue by integrating a more natural flow of ads into the features.

- The higher engagement in return makes Meta’s product line-up attractive to businesses of all sizes, placing their ads in front of an engaged audience. Businesses benefit from Meta’s continuous investments into ad-targeting algorithms, which in return drives better advertisers’ returns, and Meta’s higher revenue per user.

Average Revenue Per Person (META IR)

The improved metrics are a testament to Meta’s improving fundamentals, partially responsible for the 62% year-to-date stock price surge.

Price Per Share (Seeking Alpha)

Even though the release of Q3 results is just around the corner, let’s look at a few highlights of Q2 earnings reported in the summer.

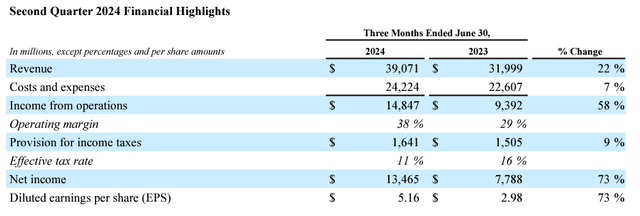

During Q2, Meta reported $39.07B in revenue, a 22% YoY increase, outperforming analysts’ expectations of $38.26B.

The EPS was also better than expected: $5.16, up 73% from the prior year and beating the forecast of $4.72.

Most of all, I am continually impressed by Meta’s ability to improve the efficiency of its operations. During Q2, the Operating Margin reached as much as 38%, compared to 29% in the same quarter last year and 25% back in 2022.

In my opinion, with Meta’s revenue increasing at a double-digit rate and costs and expenses remaining in check, not growing more than mid-single-digit, Meta’s business could potentially achieve a 40-42% operating margin in 2025.

In the earnings release, Mark Zuckerberg was optimistic about the company’s Q2 and the pace of AI deployment, stating:

“We had a strong quarter, and Meta AI is on track to be the most-used AI assistant in the world by the end of the year. We’ve released the first frontier-level open source AI model, we continue to see good traction with our Ray-Ban Meta AI glasses, and we’re driving good growth across our apps.”

The Q2 highlighted the strength of Meta’s social media advertising, particularly Facebook and Instagram, which are the main cash cows of the business, with ad impressions and the average price per ad both increasing as much as 10% YoY.

Moving forward, Meta is expected to release Q3 earnings on Wednesday, October 30th after the market close, and the company previously shared a guidance of $38.5-$41B in revenue with a FX creating 2% headwind.

The total expenses for 2024 are expected to remain between $96-$99B. However, Reality Labs is projected to see increasing operating losses due to continued product development and ecosystem expansion. This is something that I do not like to see, as I already stated my concerns about its benefit to the overall company.

Management has also increased the 2024 CAPEX expectations to a range of $37-40B, which was forecasted at the beginning of the year at only $30-37B. In 2023, Meta’s actual CAPEX was $30.9B.

Here, we can see Meta’s commitment to continuous AI infrastructure spending. We can very likely expect further CAPEX growth in 2025, particularly as Meta aims to start deploying NVIDIA’s (NVDA) Blackwell platform to support more advanced recommendations models and scaling capacity for generative AI training and inference.

Meta’s management will share their 2025 CAPEX spending forecast during the Q4 earnings call. Still, I expect the spending to balloon to around $40-47B, which may weigh on investor’s sentiment and potentially send the stock lower, where I would be a buyer if the stock pullbacks below $500/share again.

Even though Meta’s US and European markets are already more saturated, I still see significant opportunities for the business in the Middle East, Africa, and Asia, where rising middle classes present opportunities for better-than-average ad monetization.

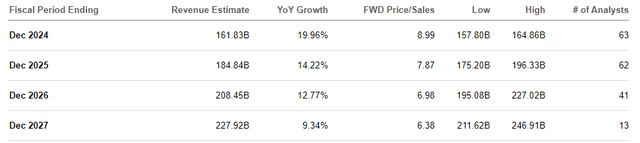

Analysts expect sales growth of around 9-14% over the next three years, which is absolutely feasible.

Revenue Projection (Seeking Alpha)

The key growth driver for the business remains its advertising business, and I expect Reality Labs to continuously weigh negatively on the company’s profitability.

Naturally, higher CAPEX spending also affects profitability, but I view AI investments as value-accretive, mainly because they help the business build its competitive advantages.

If the spending falls on the lower end of the range of my expectations for 2025, Meta would have a chance to expand the operating margin even beyond the 40-42% that I already mentioned.

However, let’s not forget it’s not all a walk in the park. Meta’s business is facing a monopoly case against its business in the US, which could potentially force the business to break up, especially if Google’s remedy would follow a similar path. However, I view this as very unlikely as it would be very difficult to implement such a solution for complex businesses as Meta and Google are.

Another area of concern I have is the extent to which Meta’s business benefited from Chinese retailers such as Shein and Temu’s entry into the US and European markets. A slowdown in their spending may negatively impact Meta’s revenue growth.

Anchor On Potential Returns

The best time to buy Meta’s stock was perhaps back in 2022, during the slump, when it hit rock bottom of $88/share, trading at 9.7x its earnings.

Unfortunately, I did not pull the trigger at the time, missing 5.6x ROI.

Today, Meta’s shares are no longer the bargain they once were, even compared to my previous coverage, in which I shared my bullish view.

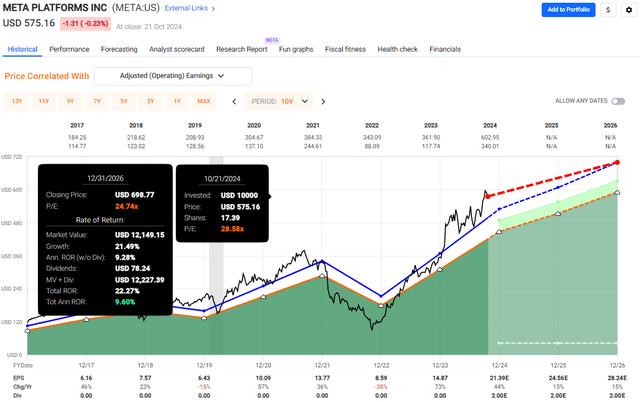

Currently, Meta’s shares are priced at a Blended P/E of 28.6x, which is a 16% premium over its 10Y P/E average of 24.7x.

Over the past decade, Meta’s EPS grew at an annualized rate of 20.9%, and the growth is expected to continue, albeit at a slower rate, particularly beyond 2024:

- 2024: Expected EPS of $21.39, 44% YoY growth.

- 2025: Expected EPS of $24.56, 15% YoY growth.

- 2026: Expected EPS of $28.24, 15% YoY growth.

Although Meta continues to benefit from AI integration, continuous efficiency gains boost its operating margins, and impressive user engagement drives revenue growth, the stock’s forward returns are limited. The strong year-to-date rally has pushed the stock ahead of its fundamentals, prompting me to downgrade Meta to “Hold” from a previous “Buy” rating.

Naturally, for those sitting on significant gains, there is no reason to panic and sell shares of this wonderful business. However, buying the shares here presents a risk of buying at the top and the potential of a few years of underperformance.

My view is that the ROR (incl. dividends) potential is currently around 9.6% over the next two years, which is far too low to justify buying the shares at today’s price. I would potentially be a buyer if the stock pulled back below $500, where it would trade at 20.6x its 12-month forward earnings.

Investor’s Takeaway

Meta Platforms, Inc.’s 62% year-to-date rally has rewarded its shareholders handsomely. The company continuously improves its fundamentals by expanding operating margins, driving better user engagement through higher-quality product offerings such as Stories, Reels, and Threads, and keeping costs in check at least outside CAPEX.

Q3 earnings are around the corner, and once again, I expect Meta to deliver better-than-expected earnings. However, the stock may be pulled back by negative sentiment, particularly if CAPEX spending continues to balloon as Meta aims to strengthen its competitive advantages via AI integration.

Since my last coverage, the company’s valuation has gotten ahead of its fundamentals, prompting me to revise by rating downwards to “Hold.” I advise caution as expectations are sky-high, and the returns over the coming years appear limited. However, I would be opportunistic on any weakness, pulling the stock below $500/share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.