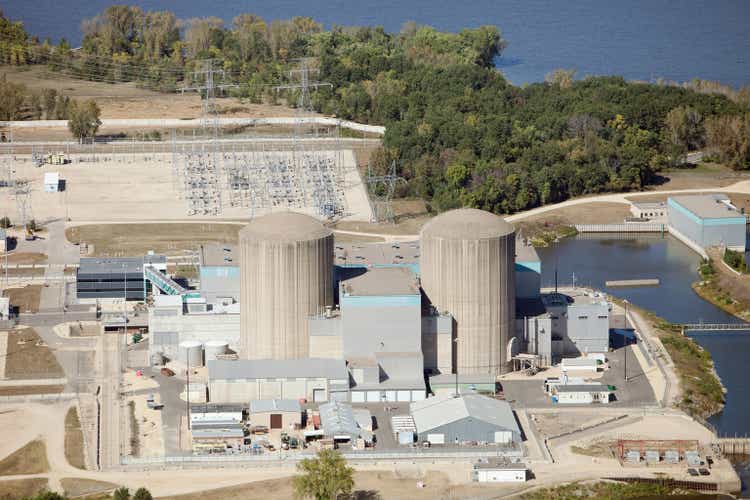

BanksPhotos/E+ via Getty Images

Many big U.S. technology stocks (IYW) have announced new investments in nuclear energy and partnerships for power security, as the rise of artificial intelligence is driving secular electricity demand in the U.S.

Almost all hyper-scalers are focused on energy security and demand is driving the nuclear momentum, Manish Kabra, head of U.S. equity strategy at Societe Generale, said in a note.

U.S. electricity demand is expected to exceed supply by next year without more grid investment, said Kabra. “Total U.S. electricity demand is 4K TWh and is growing by 60 basis points per year, and AI will add another 50 basis points to annualized growth, adding the equivalent of three New Yorks to the grid.”

Last year, Microsoft (MSFT) and Google (GOOGL) alone consumed 48 TWh of electricity. That is more power consumed of over 100 countries. Data center load may make up 30-40% of the net new power demand by 2030.

In addition, hyper-scale data centers, such as those used by Microsoft (MSFT), Google (GOOGL) and Amazon (AMZN) are responsible for 60-70% of all data center energy use.

Microsoft said it plans to eliminate its carbon emissions by 2030, but they have actually increased by around 40% in the past four years because of data center growth.

Google’s (GOOGL) carbon emissions have grown by about 48% in the last five years.

Amazon (AMZN), on the other hand, plans to neutralize all of its data center energy use with renewable power.

According to Bernstein Research analysts, “if AI inference reaches the scale of Google Search, data center electricity demand will see a CAGR of 5% globally and nearly 10% in the U.S.”

These are big U.S. tech companies announcing investments and partnerships focused on small modular reactors:

- Constellation Energy (CEG) – It has signed a 20-year power purchase agreement with Microsoft (MSFT) to restart the Three Mile Island Nuclear Station Unit 1.

- Microsoft (MSFT) – Announced a $3.3B AI infrastructure plan in May to grow U.S. data center capacity.

- Meta Platforms (META) – Also invested $37B in digital infrastructure last February.

- Google/Alphabet (GOOGL) – The company is working on large-scale data centers that would use more than 1 gigawatts of power. It has also announced $3.3B in investments in two new data centers in South Carolina.

- Amazon (AMZN) – Last May, it secured a 100% nuclear-powered data center in Pennsylvania to leverage clean energy from the Susquehanna Steam Electric Station, and in March, AWS announced the acquisition of Talen Energy’s data center campus.

- Oracle (ORCL) – The company said it has secured building permits for a trio of Small Modular Reactors to power a datacenter with over a gigawatt of AI compute capacity.