Summary:

- Starbucks faced a leadership change amidst operational challenges, including union issues and founder interference, impacting investor confidence.

- New CEO Brian Niccol, known for his success at Chipotle, aims to address internal tensions and improve barista conditions.

- Q4 earnings are expected to be poor, with declining comparable sales and revenues, and suspended FY2025 guidance adding to uncertainty.

- Despite high current valuations, long-term growth prospects and dividend increases suggest potential future value, but caution is advised until a clear turnaround is evident.

RiverNorthPhotography/iStock Unreleased via Getty Images

Starbucks’ Woes

One of the most anticipated earnings is coming. For the first time, we will see Starbucks (NASDAQ:SBUX) report its earnings under the leadership of Brian Niccol, who took the role of CEO on September 9, 2024.

Most of us are aware of what happened. The former CEO Laxman Narasimhan, appointed on April 1, 2023, reported disappointing earnings for several quarters and disappointed investors when he first issued a positive FY24 guidance to then revise it downwards a quarter thereafter. The stock plunged 15%, and we have all watched the disastrous interview on CNBC that worsened the situation. Well, this was the perfect ground for activist investors to step in, and Elliott Management took a sizable stake in Starbucks. Soon afterward, the new CEO was announced, and the stock jumped up into the $90s, exactly where it was at the beginning of the year.

I was a Starbucks shareholder, but I sold in May. Although the stock has recovered since then, I don’t regret selling. Uncertainty around the company’s leadership, increasing competition, issues with unions, struggles in China, and the interference of the founder and former CEO Howard Schultz didn’t make me comfortable anymore with this holding that I once considered a lifelong one.

To Starbucks’ credit, we have to acknowledge that the company was quick to make changes. As said, Mr. Niccol, widely known for his successful tenure as Chipotle’s CEO, soon tiptoed into sensitive issues such as unionization and wrote he is committed to engaging constructively with the union. A positive dialogue between Starbucks’ management and its workers would ease some of the internal tensions. After all, in his first message as CEO he clearly stated that his priority would be to empower baristas to take care of Starbucks’ customers, both through providing the right tools and time to craft great drinks and by making Starbucks a better place to work than it is now.

Another positive news of normalization comes from the news of the Seattle-based coffee giant slowly pulling back on promotions and discounts which were launched in late spring and over the summer. This change may be more important than what we may think. If Starbucks will be able to keep its traffic, a less promotional environment means only one thing: higher profits. This may have a little impact on September, but it might surely help Starbucks’ next quarter, which, by the way, will be its Q1 (Starbucks ends its FY in September).

Let’s get to the earnings release. I think investors should not overwhelm Niccol by demanding a turnaround in Q4. There simply wasn’t the time. But, for sure, if Starbucks can report a stop in its bleeding comparable store sales numbers, some positivity will be triggered. However, we should be aware that Q4 still faces tough comps. In Q4 2023, in fact, Starbucks reported 8% YoY growth in North America comparable store sales, 2% coming from transactions and 6% from tickets. The operating margin a year ago was 23.2%.

Fast-forward three quarters, and we have North America comparable sales down 2% at the end of Q3, driven by a 6% fall in transactions. The operating margin was 21%.

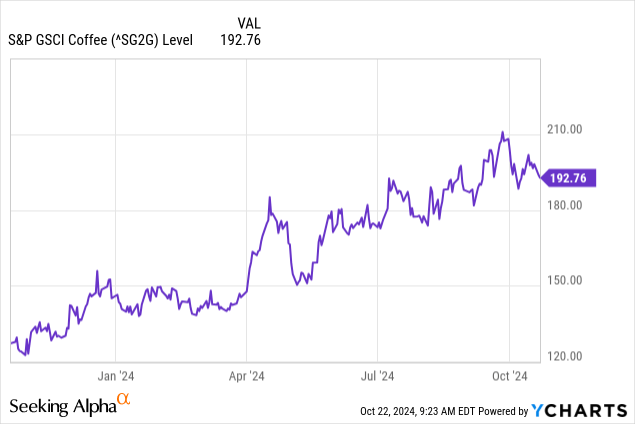

Now, to be honest, the picture of Starbucks’ margins doesn’t look exceptional. Coffee keeps being expensive among concerns over a supply crunch. Brazil’s weather seems now more favorable, with new rainfall coming and mitigating the risk of extended droughts. But, surely, the picture shows that coffee will be expensive for some time.

Starbucks’ Earnings Preview

So, for the upcoming earnings, I am not expecting sudden relief on margins. Moreover, we should remember that Q4 saw many discounts and promotions.

In approaching these earnings, we have the preliminary report already available. Well, the picture doesn’t look promising.

First of all, comparable sales declined 7%, and revenues were down 3% to $9.1B. The consensus was expecting $9.37B. EPS are down 25% YoY to $0.80.

Softness in North America persists, with sales down 6%, due to a 10% decline in traffic, partially offset by a 4% increase in tickets. And, pay attention, Starbucks had to admit that (bold is mine):

The accelerated investments in an expanded range of product offerings coupled with more frequent in-app promotions and integrated marketing to entice frequency across the customer base did not improve customer behaviors, specifically traffic across both Starbucks Rewards and non-SR customer segments, resulting in lower-than-expected performance.

China declined 14%, both because of traffic and tickets.

For FY2024, net revenues are up 1% to $36.2B and EPS are down 8% to $3.31 as a result of a “pronounced traffic decline”.

So, the FY24 guidance issued three months ago seeing the company’s revenue grow in the low single digits while operating margins should be flat YoY seems to be at peril. FY EPS was forecasted to be flat to low single digits but will actually be down in the high single digits. Not a great picture, to say the least.

This brings us to another problem: FY2025 guidance is suspended. We don’t know if the earnings call will be the right time to see it, or if we will have to wait a couple of more quarters.

The current consensus expected Starbucks to report $9.37B in revenue, which is a -0.08% YoY growth. But we know by now that Starbucks will fall short of expectations.

The tricky part comes when we look at Starbucks’ EPS forecast. For FY2024, EPS are expected to come in at $3.55, which is a 0.18% YoY growth. Since Starbucks already told us it will report FY2024 EPS of $3.31, we have the stock trading at a fwd PE above 28, considering the 4% post-market dip to $92.75. To me, this multiple is high. But Starbucks’ prospects are improving and analysts expect EPS growth in the double digits: +10% in 2025; +13.5% in 2026; +17.7% in 2027, +15% in 2028. With this growth trajectory, Starbucks is trading at a fwd 2025 PE of 24.7, a fwd 2026 PE of 21.8, a fwd 2027 of 18.5, and a fwd 2028 PE of 16. So, prospectively, the stock bought today should become a nice deal in five years, not counting dividends and capital gains. However, Mr. Niccol will be pressured to deliver quickly a strong double-digit growth.

Let me spend a few words on Starbucks’ dividend, which is currently graded with a D in safety and yield. The company increased it from $0.57 to $0.61 per quarter. This is a 7% increase. However, Starbucks’ payout ratio was almost 64%, which is quite high for a business that needs to invest in new growth. Now the payout ratio will be even higher since the company’s profits are declining and its dividend is increasing. Starbucks wanted to show its confidence in long-term growth. But it is a risky move. In addition, the company’s total debt is $25.3B, while its EBITDA is $7.1B. This means the leverage is 3.6x. Mr. Niccol will need to deleverage the balance sheet if he wants to protect the company from hardships and unexpected challenges.

Mr. Niccol released a 6-minute video of prepared remarks together with the preliminary results, explaining how he plans to focus immediately on the U.S. market to resume growth. I suggest watching it because, although it shows why Mr. Niccol could be the right man in the right spot right now, it also paints a clear picture of Starbucks’ current struggles, which I don’t expect to be fixed in one or two quarters.

Conclusion

While the market may give Starbucks and Mr. Niccol the benefit of the doubt, I believe we have enough data to expect a poor Q4 earnings call, where investors will either see a clear and feasible trajectory for Starbucks’ financials, or they will punish the stock. Right now, I suggest staying out of Starbucks and selling out until it is clearer if Mr. Niccol has been able to ignite the long-awaited turnaround.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.