Summary:

- On the surface, AT&T Inc. reported a mixed quarter, with a slight miss on revenue and a marginal beat on earnings.

- The quarter, however, showed some operational progress being made, and this is likely to support the share price in the near term.

- Long-term investors, however, should not get carried away by the current optimism around the stock as more progress is needed.

wdstock

AT&T Q3 Earnings Review

After Verizon Communications Inc. (VZ) reported its third quarter results yesterday and the stock fell by more than 5% on the day, the share price response to AT&T Inc.’s (NYSE:T) Q3 earnings appears to be radically different.

On the surface, the quarter was not very different from that of Verizon – a slight beat on earnings and a slight miss on revenue. The positive share price reaction, however, suggests that there is more going on underneath the surface.

Seeking Alpha

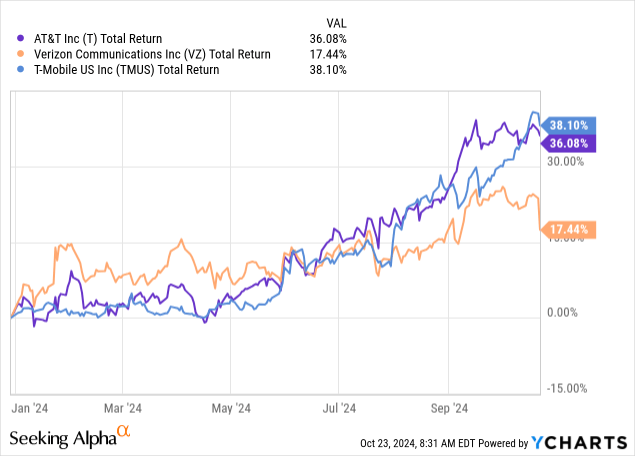

But before we jump into all the details of this quarter, we should acknowledge that AT&T’s turnaround seems to have gathered momentum in 2024. So far, the stock has returned more than 36% on a year-to-date basis and is just inches away from T-Mobile US, Inc. (TMUS).

AT&T’s relative performance to its peers should not come as a surprise, as the company seems to have already moved on from its fiasco of capital misallocation related to DirecTV and WarnerMedia. Although such events tend to linger for long with investors, back in 2021 I warned that these developments should not weigh on sentiment.

Then in October 2023, I took a deep dive into AT&T’s business and showed why the “nightmare” for shareholders is finally over. Even though I wasn’t trying to time the market, the analysis coincided with the stock’s multi-year bottom when it was trading just slightly above $15 a piece.

So far, it appears that AT&T’s management continues to make the right steps towards turning the business around by focusing on mobility in its home market, as opposed to other ventures outside its core business. The third quarter results seem to confirm this trend, albeit I wouldn’t read too much into it when it comes to extrapolating medium and long-term trends.

Optimism Is Back

While AT&T’s third quarter results appeared quite similar to those of Verizon’s yesterday when we look at EPS and revenue numbers relative to expectations, AT&T fared far better from an operational perspective.

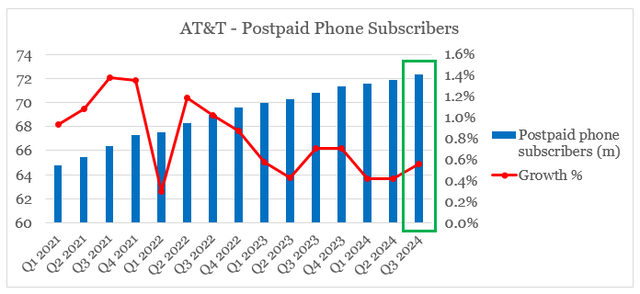

Postpaid phone subscribers’ growth came in slightly higher than the one reported in Q2 2024, which helped dispel some fears that growth will soon stall to zero.

prepared by the author, using data from earnings releases

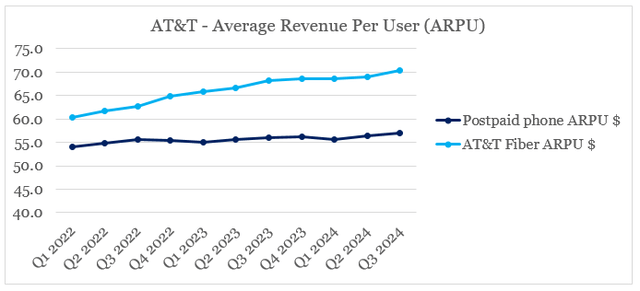

Growth in postpaid phone average revenue per user (“ARPU”) was not spectacular during the quarter, but Fiber ARPU noted a large jump to above $70. This trend is likely to continue, as AT&T’s management also reported an intake Fiber ARPU of around $75.

prepared by the author, using data from earnings releases

Although the share of wireline revenues is small in comparison to mobility, these trends will likely allow AT&T to continue to increase its margins going forward.

In comparison to a year ago, EBITDA margins improved both in mobility (from 55.9% in Q3 2023 to 57.4% this quarter) and in consumer wireline (from 31% in Q3 2023 to 32.8% in the current quarter). This expected improvement in margins was one of the key points that I made a year ago.

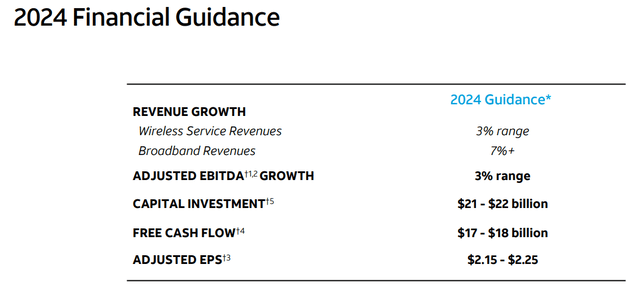

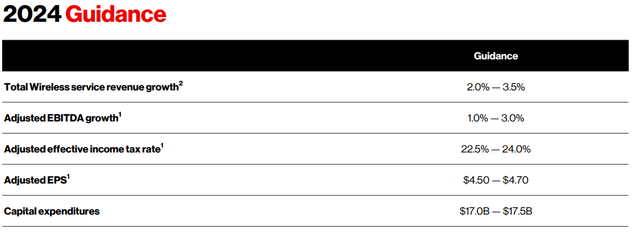

In terms of FY 2024 guidance, there weren’t any changes, and it is quite similar to one of its major peers – Verizon (see below).

AT&T 2024 guidance (AT&T Investor Presentation) Verizon 2024 Guidance (Verizon Investor Presentation)

However, we should keep in mind that AT&T is smaller than Verizon in terms of revenue, which shows that the former will invest more in capex this year relative to its sales.

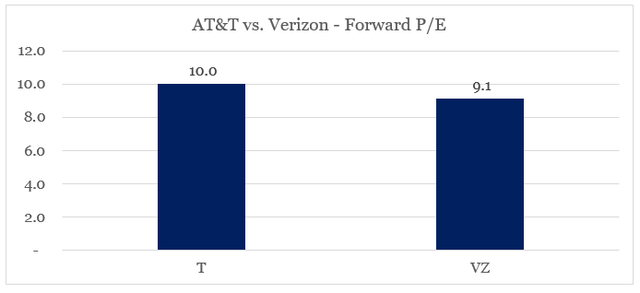

Given the expected adjusted EPS figures for 2024, it appears that AT&T is now trading at a notable premium to its competitor after the two stocks moved in opposite directions over the past month or so. This is to be expected given the slight divergence in operational performance between the two companies during the most recent quarter. However, a quarter does not set up a trend, and so far, I don’t see a reason for a major divergence in the valuation of these two companies.

prepared by the author, using data from SEC Filings and Investor Presentations

The Two Elephants In The Room

Despite the relatively good operational performance during the quarter, developments related to the company’s dividend and debt remain as the key considerations for most investors.

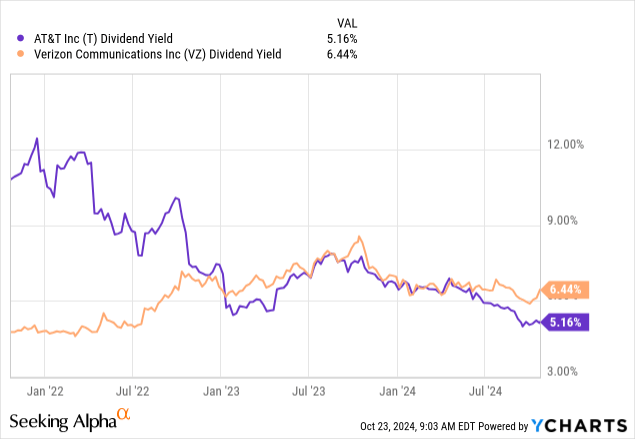

After years of being the highest-yielding stock in its peer group, AT&T’s dividend yield has now fallen below that of Verizon and the stock presently trades at a yield of slightly above 5%.

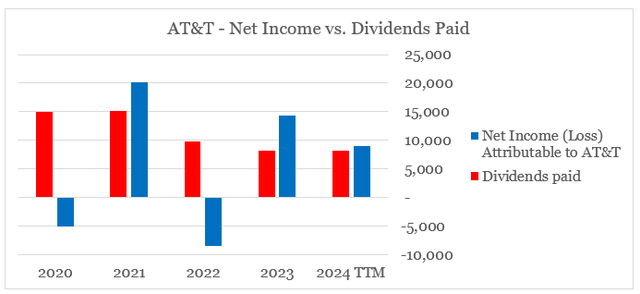

To an extent, this is related to the recent changes related to WarnerMedia, but it is also closely related to AT&T’s better share price performance than that of Verizon. When evaluating the safety of the dividend, things do not look pretty on a GAAP basis, with the annual net income figure being subject to wild variations.

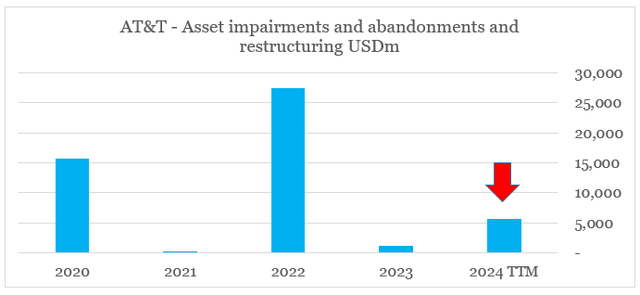

prepared by the author, using data from SEC Filings

Of course, we should account for the non-cash impairment charges recently, which have a significant impact on the final net income figure. Both 2020 and 2022 results were impacted by such impairments and just as things looked as if there would be no more such charges, AT&T’s management reported yet another round of roughly $4.4bn of impairments and restructuring charges.

prepared by the author, using data from SEC Filings

These charges are related to assumptions regarding the company’s legacy services and higher-than-expected operating expenses.

Operating expenses increased primarily due to a $4.4 billion non-cash goodwill impairment in the current quarter associated with our Business Wireline unit based on faster than previously anticipated industry-wide secular decline of legacy services. Also contributing to higher operating expenses was accelerated depreciation on wireless network equipment associated with our Open RAN network modernization efforts, and our continued network upgrades.

Source: AT&T 10-Q SEC Filing (emphasis added).

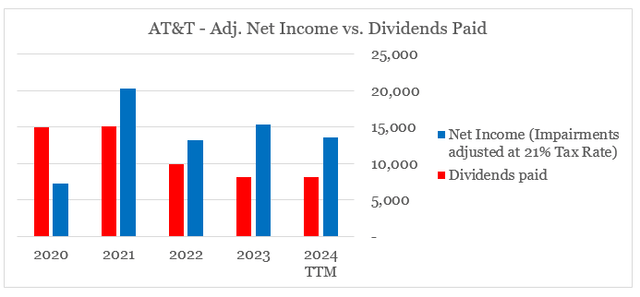

The market has mostly ignored these impairments as they relate to goodwill recorded as a result of previously made acquisitions. Nonetheless, they do send a signal to investors that returns on investments are likely to suffer as management assumptions about the future change. Moreover, even if we adjust AT&T’s net income figure for all these non-cash charges (after tax), we end up with lower dividend coverage in comparison to FY 2023.

prepared by the author, using data from SEC Filings

With AT&T’s lower dividend yield, this is not a very positive sign for dividend-oriented investors.

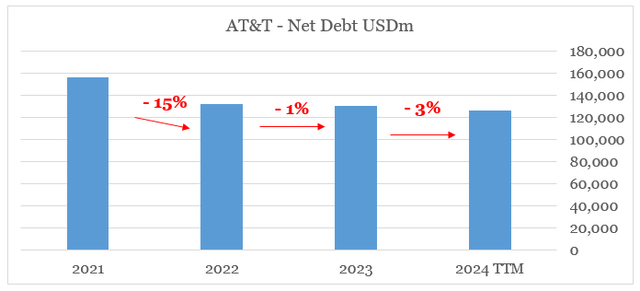

In terms of debt, AT&T’s management seems to be focused on the current capex cycle and the higher fiber investments expected in the coming year. As a result, debt repayments are not a priority currently, and that’s why we see net debt falling down by low single digits.

prepared by the author, using data from SEC Filings

At the same time, however, interest expense increased marginally during the quarter from a year ago, which highlights the risks associated with such large debt levels at a time when interest rates are rising.

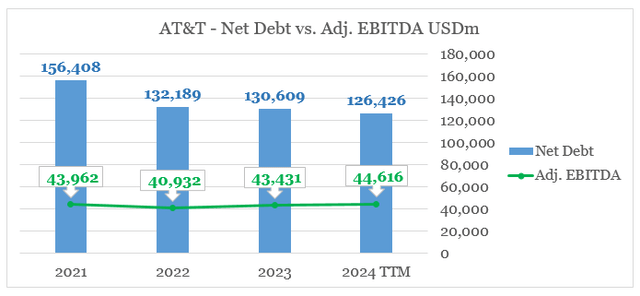

Given the slight improvements in adjusted EBITDA, AT&T’s leverage ratio is improving, albeit not at the rate needed in the current environment to reduce interest expenses and dispel the debt-related fears of investors.

prepared by the author, using data from SEC Filings

Conclusion

AT&T Inc. reported a relatively good quarter, but nothing material to justify a change in narrative. From an operational standpoint, T appears to be doing slightly better than Verizon, but investors should not get carried away by quarterly results. The valuation and dividend yield gap between the two stocks is widening, and this could ultimately favor VZ shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.