Summary:

- Verizon and AT&T, major internet and cellular providers, are compared for yield and total return, with AT&T leading in year-to-date performance amongst my comparative measures.

- Both companies are considered fixed income proxies, akin to utilities, with potential rate sensitivity that could be intensified or muted depending on the US President’s new administration.

- Verizon wins in dividend comparisons and short-term reflexive patterns, while AT&T excels in free cash flow payout ratio, earnings expectations, and valuation.

- Overall, AT&T emerges as the better value, selling at 53% of fair value compared to Verizon’s 59%.

We Are

Internet is the new utility

With earnings coming up/out for the two biggest cellular and internet data providers, it seems like an ideal time to compare the two and see which one is superior, particularly for yield and valuation. Verizon (NYSE:VZ) and AT&T (NYSE:T) have been compared to junk bonds, which have more volatility. They pay out pretty massive dividends compared to the rest of the stock market and if you catch them at the right time, they can provide a total return better than any corporate bonds or preferred stocks. However, grab them at the wrong time and the downward price destruction can wipe out all the expected yield for the year as well.

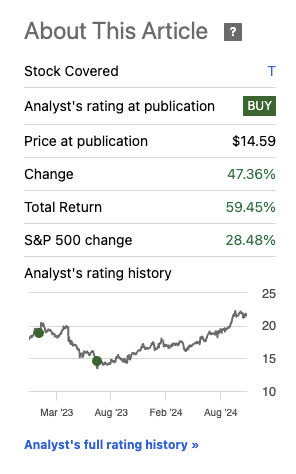

Having last covered AT&T back in July of 2023, the total return since that period on that dip to $14 has been market beating:

Seeking Alpha

AT&T has also been the winner in total return year to date, but is it the better value with all things considered? I have not covered Verizon individually in the past, but am excited to comprehensively compare the two in this piece.

I will break down each of the steps I normally go through when doing a comparative analysis for a buy and pick a winner. I will mark the winner in each category or issue a tie. At the end, we’ll tally up the points and see which one is the better selection.

A note about rate sensitivity in a Trump VS. Harris administration

Before we begin, I’d also like to point out that both of these companies are thought of as a fixed income proxy. They aren’t going anywhere and although both are categorized as communication services, they should really be re-labeled as utilities. Internet and cellular service is something that none of us can live without just like water, electricity and waste service.

With rates already falling and the election on the horizon, these could be particularly hot stocks, especially in a Trump presidency as he has expressed his thoughts about being more active in expressing his opinion about rate cuts whereas the Biden administration barely uttered a peep. I consistently like to remind everyone that with Trump being a real estate developer and having a circle of constituents in that same vein, they primarily view rates as the leading factor in creating more cash flow, that is their go-to thought process and solution for economic stagnation, get a lower interest rate.

We should see rate cuts in either scenario, a Trump or a Harris administration, I just personally feel we will see them faster in a Trump administration.

Revenue exposure for both

Data courtesy of FactSet

| AT&T | |

| REVENUE SEGMENT | % of revenue |

| Wireless services | 68.60% |

| Wireline services | 27.82% |

| Pan Americas mixed telco | 3.21% |

| other | 0.37% |

| VZ | |

| REVENUE SEGMENT | % of revenue |

| Wireless services | 75.86% |

| Telecommunication Carrier Services | 22.48% |

| Other | 1.66% |

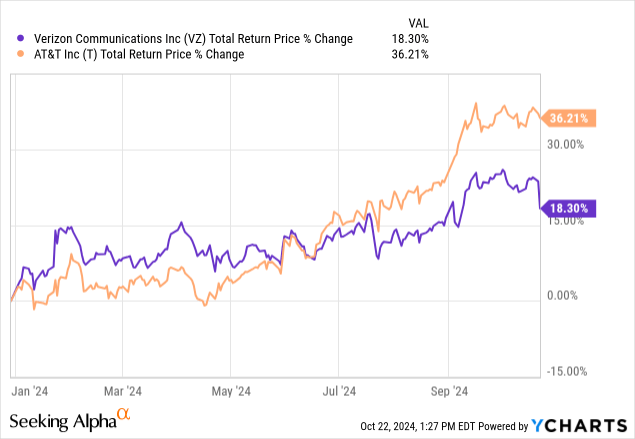

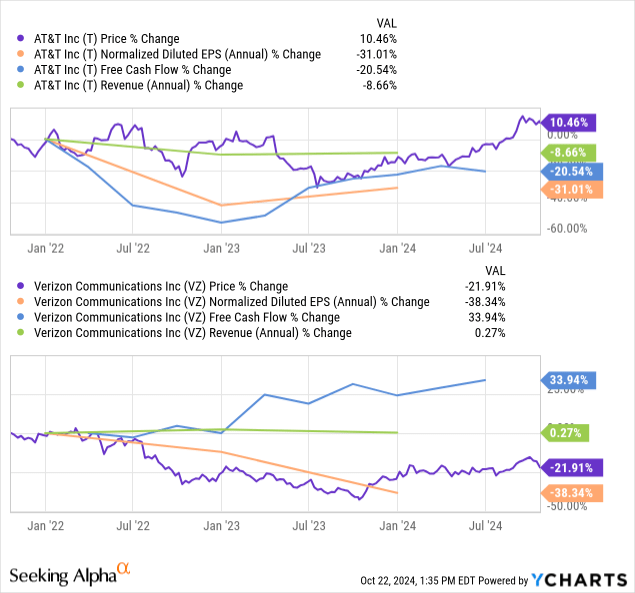

Year to date total returns

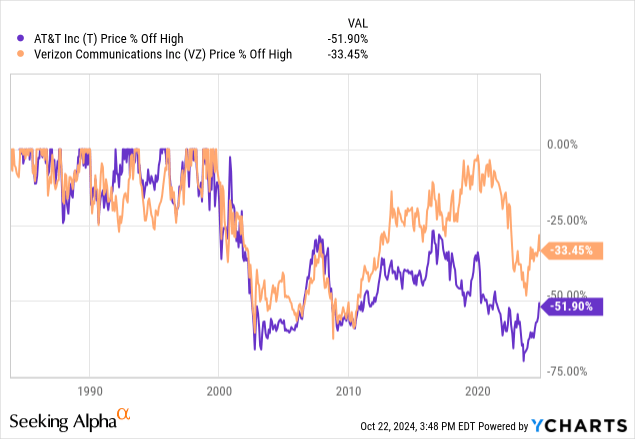

Total return wise, AT&T has been the clear winner on a year to date basis but also the stock that has been thrashed the hardest in respect to the negative percentage off of it’s all time highs.

A lot of this of course has to do with the poor decision to try to integrate Warner Brothers Discovery (WBD) into its business [AT&T] which destroyed more value than it created. Some of the stock’s value was sloughed off as a stock dividend to investors [I personally sold my shares and rolled them back into AT&T], but a lot of it was just poor management and a load of debt.

Verizon held up better, remaining a true cellular and internet provider. Now that AT&T is back to its roots, these are two of what is becoming a triopoly along with T-Mobile (TMUS). As we compare these two behemoth companies, we’ll find that the economic trends mimic each other in many ways.

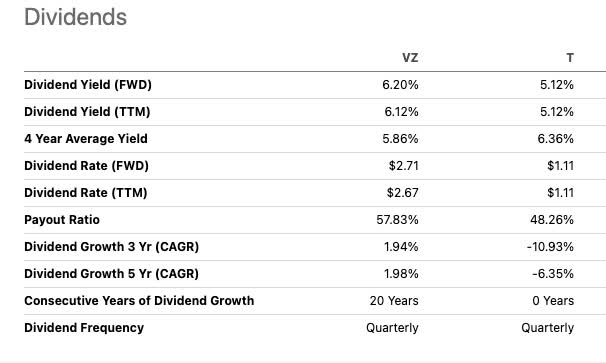

Dividend comparisons side by side

Seeking Alpha

Verizon still has the larger dividend, not cutting it as AT&T did post Warner Brothers spin, and has longer-term growth because of it. I expect both to be able to pay and raise slightly from here on out if they stick to their business rather than try to diversify into non-regulated ones to chase growth.

“Winner Verizon”

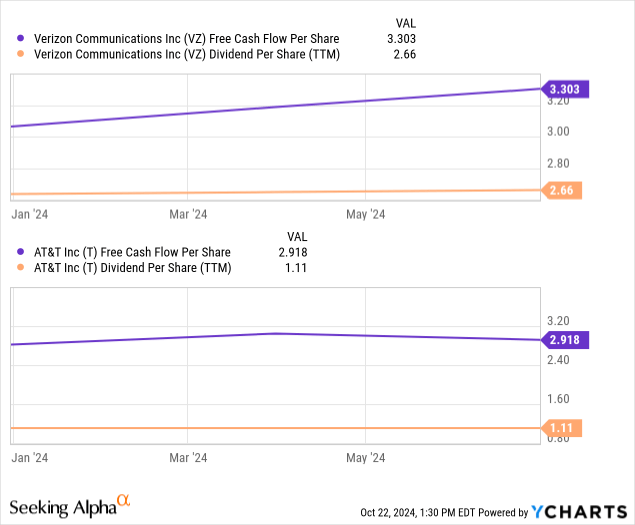

Comparing the dividends to free cash flow

- Verizon free cash flow payout ratio trailing year: 80.5%

- AT&T free cash flow coverage trailing year: 38%

AT&T with the lower dividend payout per share has an advantage in this position. They have much better dividend coverage at current based on their free cash flow per share. AT&T CEO John Stankey recently noted at the Goldman Sachs Communacopia conference that their 3 year turnaround is coming to fruition, they’re growing free cash flow and paying down debt.

Stankey attributes a lot of this to getting ahead of competition in replacing legacy assets, investing more than competition in new fiber assets.

“Winner AT&T”

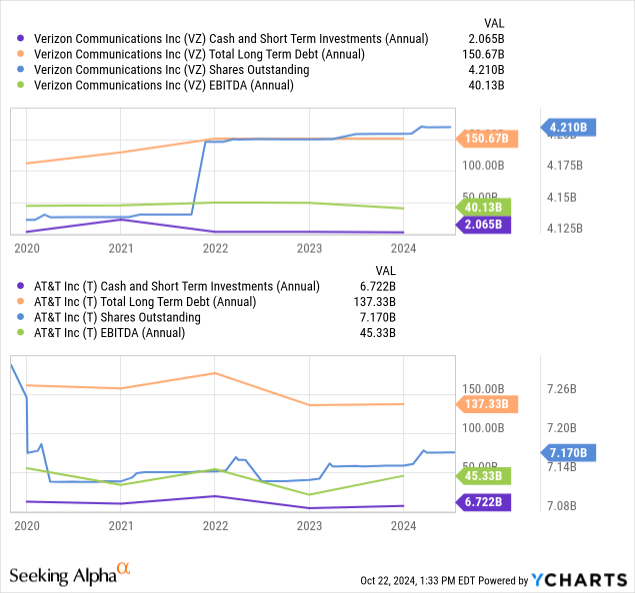

Comparing the balance sheets

In these two charts I compare a few of my must know balance sheet items.

- Shares outstanding

- Long term debt

- Cash and short term investments

- Number of turns LT debt is compared to EBITDA [credit quality]

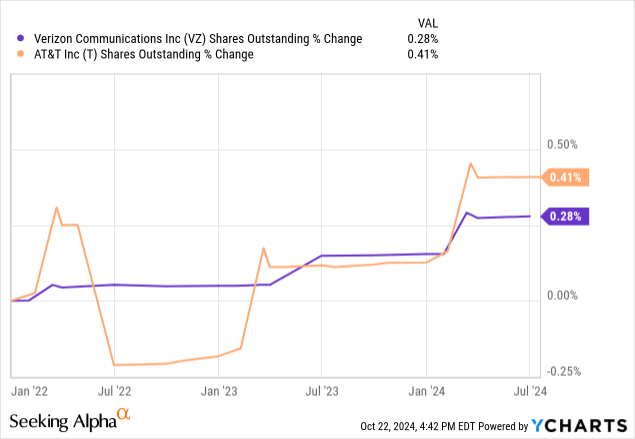

Zooming in on shares outstanding, the float on AT&T has increased only slightly more than Verizon with both about flat.

Long term debt is now higher for Verizon at $150.76 Billion, a moniker that AT&T was branded with when analyzing this sector prior who now has less debt at $137.33 Billion by comparison.

LT debt is now 3.029 X EBITDA for AT&T and it is 3.75 X for Verizon.

Cash and short-term investments stand at $6.72 Billion for AT&T and $2.065 Billion for Verizon.

AT&T is the winner here with a clearly superior balance sheet.

“Winner AT&T”

Comparing the short term reflexive patterns

In the case of which is demonstrating better growth in profitability metrics versus price appreciation, Verizon now appears undervalued on this metric with price in the negative over the past 3 years whilst free cash flow and revenue are positive. The main crunch to their numbers has been the decreasing in GAAP EPS.

AT&T is harder to measure with this data due to the decoupling of Warner Brothers Discovery, but we will still give this round to Verizon nonetheless.

“Winner Verizon”

Earnings expectations

AT&T FY 2024-2025 expected EPS growth rate: 3.6%

Verizon FY 2024-2025 expected EPS growth rate: 3%

Let’s be blunt, both of these have paltry earnings growth and basically grow alongside inflation, if at all. Analysts are expecting a tad more growth out of AT&T. They win this round but we should be glad that both have expectations for next year that are not negative.

“Winner AT&T”

Valuations

In this model, I use the classic Warren Buffett “Owner Earnings” model. Similar to discounted cash flow, except this takes into account taxes, interest and stock-based compensation. This model uses GAAP net income as it’s base profitability metric and then adds back depreciation and amortization. Finally, TTM CAPEX is deducted.

This is all discounted by the risk-free rate using the 10-year Treasury. Buffett argued that if a company could predictably grow earnings from the point of entry into the future, then an investment in the evaluated stock would be better than an investment in a risk-free alternative like the 10-year Treasury since that is a fixed return versus a growing one for said company. Currently, the risk-free rate sits around 4.2%, and I will use this as my discount rate.

AT&T Owner Earnings valuation

| AT&T | amount in millions usd |

| net income | 12725 |

| deprecation and amortization | 16656 |

| CAPEX | 17366 |

| Owner earnings | 12015 |

- $12,015 discounted at 4.2%= $286,071 fair market cap

- Divided by 7,170 shares outstanding = $286,071/7,170= $39.89 share

- Selling at 53% of fair value.

Verizon Owner Earnings valuation

| VERIZON | amount in millions usd |

| net income | 11252 |

| deprecation and amortization | 17854 |

| CAPEX | 16768 |

| Owner earnings | 12338 |

- $12,338 discounted at 4.2%= $293,761 fair market cap

- Divided by 4,209 shares outstanding =$69.79 fair value

- Selling at 59% fair value.

Versus The Graham Number

Since both of these are companies that trade at a very low value in respect to their book values, I also like to compare these two using the Graham Number.

This value metric described in The Intelligent Investor by Benjamin Graham takes into account both the asset value and earnings power in creating a price model. Not many companies are relevantly priced with this metric as intellectual property can now get much higher ROA than tangible assets. Communications, financials and some industrials still rely on tangible assets almost solely and this metric still remains a good measure in those sectors.

The equation is simply the square root of (EPS X Book Value X 22.5) where the goal is to buy a stock where the P/E ratio X the P/B ratio does not exceed 22.5:

| AT&T | |

| BV | 14.69 |

| 2024 expected EPS | 2.2 |

| GRAHAM NUMBER | $26.96 |

| Selling at % of fair value |

79.7% |

| VZ | |

| BV | 22.85 |

| 2024 expected EPS | 4.57 |

| GRAHAM NUMBER | $48.47 |

| Selling at % of fair value | 85.61% |

On both valuation metrics, Owner Earnings and The Graham Number, AT&T is also the clear winner in this category.

“Winner AT&T”

Earnings week

Verizon Q3 earnings 10/22/2024:

Full transcript on Seeking Alpha:

EPS of $1.19 beats by $0.01 | Revenue of $33.33B (-0.02% Y/Y) misses by $90.06M

The market had a negative -5% reaction to the top line miss by Verizon.

Here are some notes from CEO Hans Vestberg:

Initially, in some of the states, we had challenges, especially with power, but I think that our team did a fantastic job to get our networks up pretty quickly. So, again, this is things that are happening constantly around the world right now in hurricanes and natural disasters. For us, building the networks, as we are always doing, is extremely important to see the resilience and on the network during this time.

Looking at the financial, growing 2.7% in the wireless service revenue is great. I’m also proud to report the biggest profit EBITDA in the history of Verizon, $2.5 billion in the quarter, which is really good and its multi-factors.

On the operational side, we started getting an even better balance on the postpaid side. We were 239,000 net adds positive.

All in all the takeaway from Vestberg’s opening remarks were better profitability and cash flow and top line issues were largely avoided with some mentions of natural disasters and hurricanes as a possible excuse for top line results.

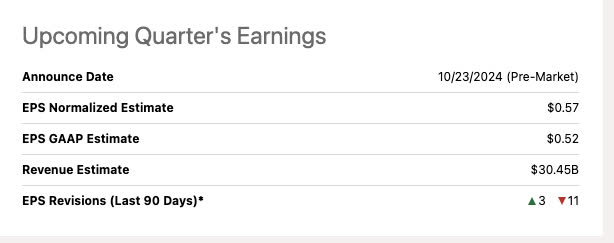

AT&T earnings expectations 10/23/2024:

Seeking Alpha

With 11 revisions downward in the last 90 days, there shouldn’t be an extremely high bar to pass and a surprise beat also becomes more likely when rolling into a print with low expectations.

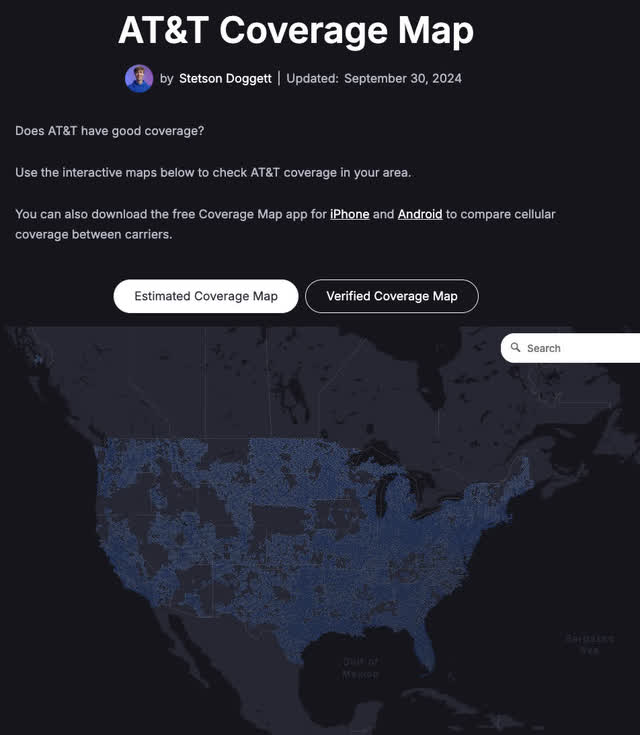

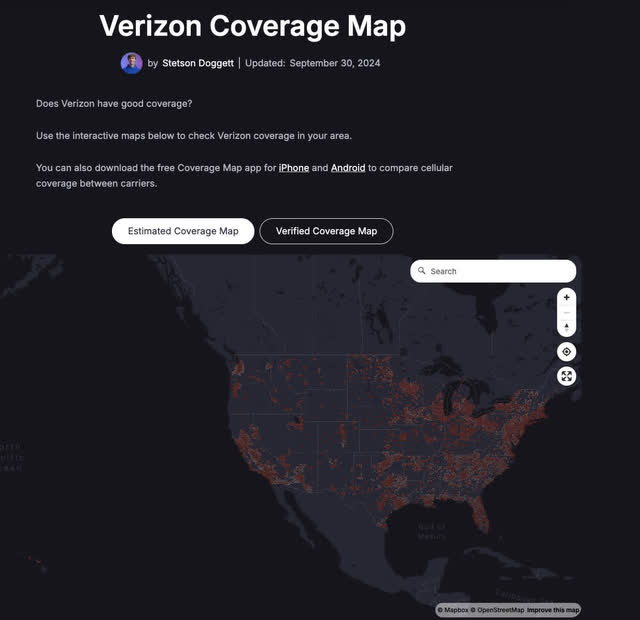

As noted in the Verizon call, power outages and natural disasters could be affecting internet and cell usage. On an LTE basis, both companies have a completely saturated map. However when looking at 5G, AT&T has a much larger investment in that network and higher concentration and overall signal density in regions recently hit by hurricanes, thus we may see a bigger top-line hit to AT&T than Verizon:

AT&T 5G coverage estimate

coveragemap.com

Verizon 5G coverage estimate

coveragemap.com

The winner of the versus battle is AT&T

In my estimation, AT&T wins as the better stock. They win in my following head-to-head categories:

- Dividend coverage by free cash flow.

- Balance sheet strength.

- 2025 Earnings Expectations.

- Valuation on both owner earnings and the Graham Number.

Verizon won in two categories.

- Dividend yield

- Reflexive profitability patterns.

Summary

Both of these are high-yield utility-like stocks. I equally weighted both a few years ago and have decent returns. As a person who has zero bonds in his portfolio, these fill the bond proxy void for me. AT&T is the buy for now with a clear turnaround being executed by CEO John Stankey.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.