Summary:

- Shares of 2U rallied 10% after the company posted better-than-expected Q1 results.

- Investors primarily cheered the company’s positive adjusted EBITDA and its raised EBITDA expectations for the full year FY22.

- However, growth continued to disappoint, with organic growth sinking to the single digits in Q1.

- 2U continues to propound a structurally low-margin business model that is difficult to scale.

- The deep leverage on its balance sheet, undertaken to execute acquisitions like edX, also can’t be ignored.

Alistair Berg/DigitalVision via Getty Images

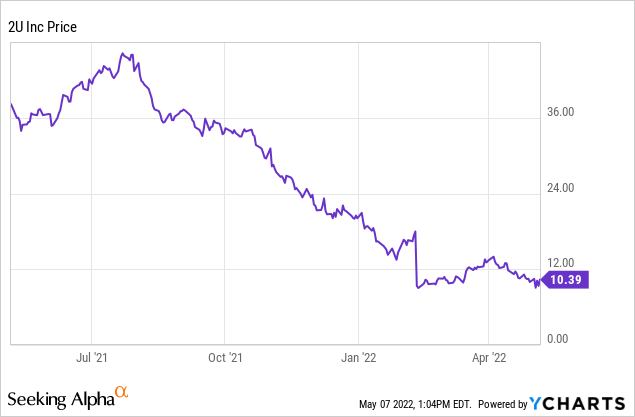

While I think few of the sharp corrections we’ve seen year to date in the tech sector have been justified, 2U’s (NASDAQ:TWOU) fall from grace has been more than appropriate given the company’s’ recent fundamental circumstances. The online education company, which recently also purchased popular e-learning website edX, has struggled with growing its enrollments at a time when schools have reopened, the labor market is tight, and workers have more of an incentive to land high-paying jobs than go back to get degrees.

Year to date, shares of 2U have crashed more than 50%, while the stock also remains down more than 85% relative to highs above $90 notched in 2018.

2U just posted Q1 results, and after a disastrous Q4 in which the stock shed half of its value for posting very disappointing 2022 growth guidance, the ~10% rally post-Q1 came as a nice relief to bulls.

The main cause for the post-earnings spike is 2U’s improved profitability, though I must add the caveat that the improvements are rather minuscule and don’t really save this struggling story.

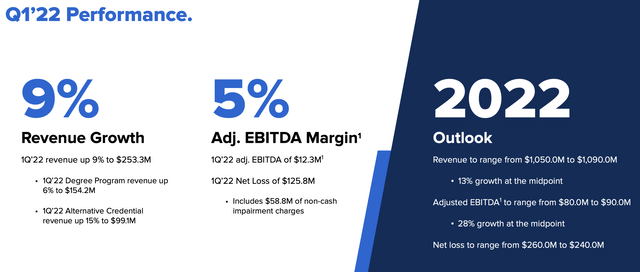

2U FY22 outlook (2U Q1 earnings deck)

For FY22, while 2U held its initial growth outlook of 13% y/y growth (which devastated the stock when the guidance was introduced in Q4), the company has upped its adjusted EBITDA guidance to $80-$90 million, up $10 million on both ends from a prior view of $70-80 million. The upside represents roughly ~1% of adjusted EBITDA margin bump, to a range of 7.6%-8.3%.

While it’s understandable why slightly more favorable profitability metrics moved the stock so sharply in a time where investors are chasing safety, I still remain bearish on 2U – to me, this remains a company with sinking prospects.

The problem with 2U

There are two main issues I see with 2U that prevent me from ever being sanguine about the company’s future.

The first is the company’s reputation. While 2U brands itself as enabling online learning, it essentially is a for-profit university. While it partners with reputable universities (its first client was USC), it effectively generates its revenue from a cut of tuition fees.

Last year, 2U’s business model was widely exposed in a Wall Street Journal profile that claimed 2U and USC used predatory marketing tactics to lure students into very expensive ($115,000) degree programs that yielded low-paying jobs in the end, saddling these students with crippling debt.

Given the ill-repute that 2U has already generated, it’s difficult to believe that 2U can ever really become a standard mode of education that can find a mainstream student base.

The second issue is with 2U’s business model itself. When it partners with a university to set up a new course, 2U shoulders all the costs of digitizing the course content, setting up the online education platform, and even the cost of marketing the program to students, in exchange for a cut of tuition fees. 2U’s business model really isn’t all that different from being a franchise operator of a larger brand.

Where this differentiates 2U from other software companies is that each engagement must be customized. Whereas most software companies can build one product that can be sold to all of its customers, 2U’s setup costs are incurred only for a particular course – which may or may not see successful enrollment. As such, I find it difficult to believe that 2U can substantially improve its bottom line.

Q1 results show slowing growth, indebted balance sheet

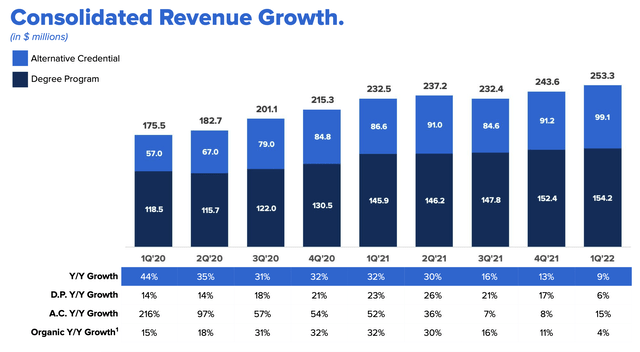

2U’s most recent results don’t really show a vibrant story, either. Take a look at the company’s revenue trends through Q1 in the chart below:

2U Q1 revenue (2U Q1 earnings deck)

Overall revenue in the quarter grew 9% y/y to $253.3 million, basically matching Wall Street’s estimates – but decelerating four points quarter over quarter.

More to the point above, note that the majority of that revenue growth was inorganic as well. Organic revenue only grew at a 4% y/y pace, decelerating seven points quarter over quarter and the worst organic growth rate in years.

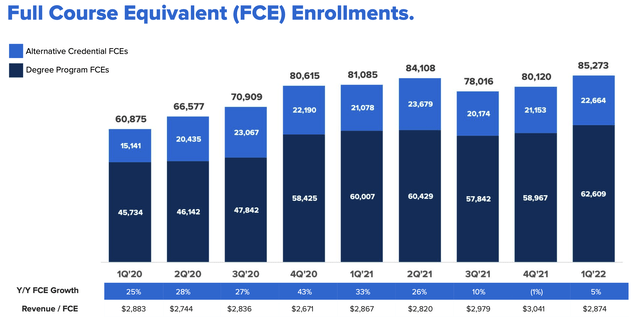

Full course enrollment growth has also been relatively sluggish, growing 5% y/y as shown in the chart below (driven primarily by lower-revenue alternative credential programs, up 8% y/y in enrollment, versus 4% growth for full degree programs):

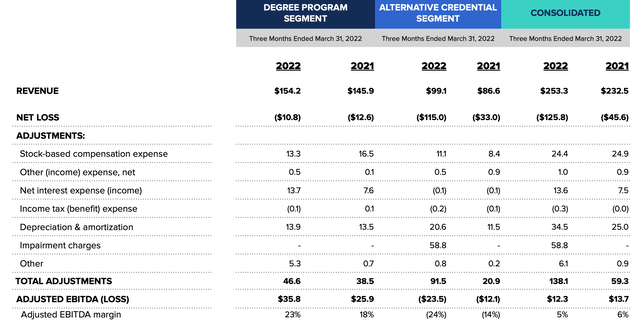

2U’s adjusted EBITDA margins have also slipped year-over-year. Total adjusted EBITDA in Q1 declined -10% y/y to $12.3 million, while adjusted EBITDA margins of 5% slipped by one point year over year. This was driven by ballooning losses in the alternative credential segment (which, unfortunately, is also the segment fueling 2U’s growth at the moment):

2U adjusted EBITDA by segment (2U Q1 earnings deck)

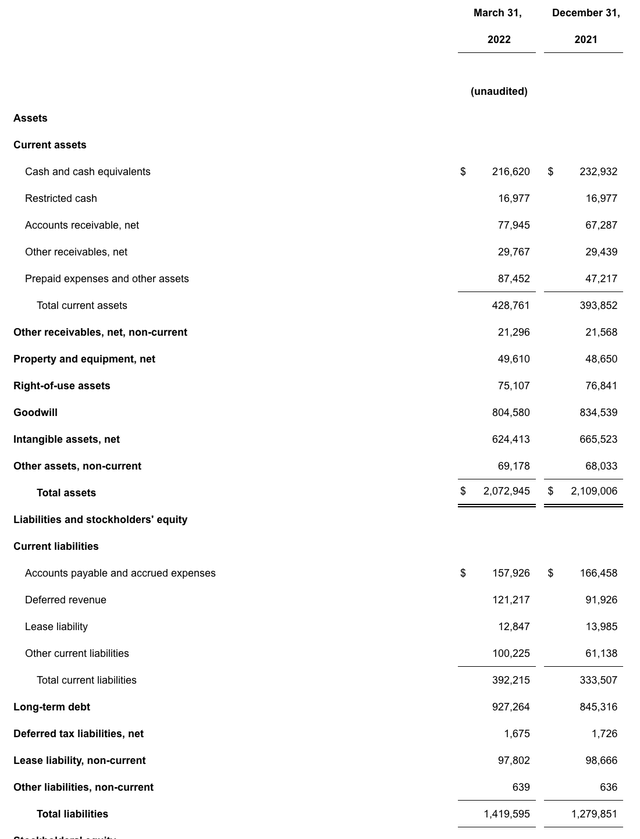

It’s worth calling out that 2U’s souring profitability strains an already-tight balance sheet. As of the end of Q1, 2U has $216.6 million in cash on its books alongside a massive $927.3 million debt load – or $710.7 million in net debt.

2U balance sheet (2U Q1 earnings deck)

Versus the midpoint of the $80-$90 million of adjusted EBITDA that the company is expecting to generate this fiscal year, 2U’s leverage ratio stands at 8.4x adjusted EBITDA – which is incredibly leveraged; the standard definition for a “highly leveraged” company usually indicates a threshold of ~3x adjusted EBITDA.

Declining organic growth, slow enrollment progress, decaying adjusted EBITDA margins, and a huge leverage profile – is there really anything positive about the 2U story?

Key takeaways

2U remains an incredibly risky story. Despite the dramatic fall from highs and the fact that 2U is barely trading over ~1x forward revenue now, I remain skeptical about both the longevity of the company’s brand and the sustainability of its business model. Continue to steer clear here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

For a live pulse of how tech stock valuations are moving, as well as exclusive in-depth ideas and direct access to Gary Alexander, subscribe to the Daily Tech Download. Highly curated focus list has consistently netted winning trades of 40%+.