Tesla Jumps On Q3 Margin Surprise

Summary:

- Tesla, Inc. missed street estimates for Q3 revenues, but stronger than expected margins led to a huge bottom-line beat.

- Management still believes it can grow vehicle deliveries for the full year in 2024, implying a best-ever period in Q4.

- TSLA’s valuation remains high compared to competitors, driven by the potential for autonomous vehicle profits rather than delivery increases.

Xiaolu Chu

After the bell on Wednesday, we received third quarter results from Tesla, Inc. (NASDAQ:TSLA). The EV giant has struggled so far to grow deliveries this year, thanks to high-interest rates in the US and a soft economy in China. With overall expectations a bit muted after four straight quarterly misses on the bottom line, Tesla shares jumped after the latest report as strong margins led to a huge adjusted EPS beat.

Previous coverage on the name:

It was back in July when I last covered Tesla, with that article coming at the company’s Q2 earnings report. The numbers weren’t that impressive, as a top-line beat was really overshadowed by a considerable jump in regulatory credit revenues. Margins weren’t that great when excluding that large benefit, and a huge restructuring charge took a toll on GAAP profits.

Guidance for the year was only maintained at that point, which dented the bull camp hopes for a major update on more affordable vehicles. Thus, the bears pounced on the status quo remaining, as it seemed that Tesla could report a year-over-year decline in vehicle sales this year. Since I last covered the name, Tesla shares have lost about 5%, compared to a 5% gain for the S&P 500 (SP500).

The Q3 earnings report:

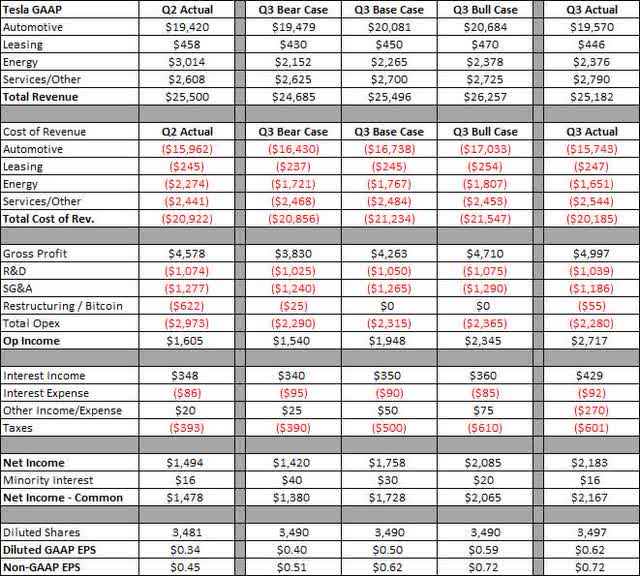

A couple of weeks ago, Tesla reported deliveries of more than 462,000 for the third quarter. This was up about 27,000 units year over year, as last year’s period was impacted by the Shanghai factory being down to upgrade the Model 3 lines for the new version of that vehicle. With some decent growth from Tesla Energy as well, Street analysts went into Wednesday expecting nearly 10% revenue growth to $25.67 billion. However, lower prices and the Cybertruck ramp were set to impact margins, so non-GAAP EPS were forecast to decline by almost 9% to $0.60 per share. In the table below, you can see how Tesla fared against the usual three cases I provide, with dollar values in millions except per share amounts.

Tesla Q3 Results (Q3 Shareholder Letter, Author’s Estimates)

The company actually missed both mine and the Street’s overall revenue estimates. This was due to a roughly $1,500 sequential decline in revenues per delivered vehicle (including leases and regulatory credits), mostly due to ongoing promotions as well as product mix. Tesla reported $739 million worth of credit sales, its second highest ever, but this wasn’t as much as seen in Q2. On the flip side, energy and services revenues were fairly decent as those segments continue to become a larger portion of the company’s total.

The expense side is where things get fascinating. Automotive margins excluding credits were up nearly two full percentage points to over 17%. Management stated that the Cybertruck achieved positive gross margins for the first time, while costs in Berlin and Shanghai both declined sequentially. I’m guessing a bit of this was due to the continued decline in lithium prices, and management did talk about lower raw materials costs in addition to lower freight and one-time expenses. Some margin progress was likely due to increased FSD revenue recognition in the quarter, which management did mention in the shareholder letter but did not provide a numerical value for. I’m expecting analysts to ask about that on the call.

With margins across the board coming in much higher than expected, Tesla smashed estimates for operating income as well as net income. On the bottom line, non-GAAP EPS beat the Street’s average by 12 cents per share. After four straight quarters of adjusted bottom-line misses, investors certainly cheered here, with the company beating quite handily.

Balance sheet update and guidance:

Perhaps Tesla’s biggest strength currently is its balance sheet. The company finished Q3 with more than $33.5 billion in cash and investments, against a little less than $8 billion in debt and finance leases. For the period, free cash flow $2.742 billion, but I should note that accounts payable and accrued liabilities were up $2.583 billion on a sequential basis. Stretching out payments to suppliers definitely helped improve free cash flow in the period, despite a record $3.5 billion plus in capital expenditures in Q3.

When it comes to guidance, there weren’t any major changes. Management is still calling for a slight increase in vehicles delivered this year, implying a record period of more than 515,000 in the current quarter. More affordable vehicles are expected to go into production in the first half of 2025, with the Tesla Semi going into higher volume production later in the year.

Looking at the valuation:

Tesla has always traded at a premium to other automakers based on its potential growth profile. In the past, investors were hoping for significant revenue growth from increasing deliveries, but now most of those hopes are more on the profits associated with autonomous vehicles. In the chart below, you can see how Tesla matches up on a price to expected sales basis for 2026 vs. other EV names as of Tuesday’s close — Lucid (LCID), VinFast (VFS), Rivian (RIVN), XPeng (XPEV), BYD (OTCPK:BYDDF), NIO (NIO), and Polestar (PSNY).

2026 Price To Sales (Seeking Alpha)

Tesla closed Wednesday trading at a little more than 5 times its street estimated revenues for 2026. That’s a substantial premium to the comparison group listed above, who only average a little more than one time their projected sales. None of these EV competitors even go for half the valuation that Tesla does, and let’s not forget traditional US automakers only go for around 0.3 times their expected 2026 revenues.

Final thoughts and recommendation:

In the end, the headline numbers were mostly good for Tesla. The automotive revenue picture was a bit disappointing, but the company definitely made up for it on the margin side. The balance sheet remains strong, and 2024 guidance was maintained, so we’ll see if Tesla can now deliver a record Q4 delivery print. Shares jumped about 9% in the after-hours session, erasing some of their recent losses sustained after the recent robotaxi event.

For now, I’m going to maintain my hold rating on shares. There wasn’t enough in Wednesday’s report to move the needle for me in either direction, and we need to get further clarity on a couple of items. I want to see if these margin gains can be held, especially if Tesla continues its large discounts already seen in Q4. Once we get a more concrete view of how 2025 will look in terms of deliveries and what some of these new vehicles will be, I will take a look at potentially changing my rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.