Summary:

- Caterpillar reached new all-time highs in September.

- Earnings are steady despite tough conditions; upcoming report may cause volatility but won’t alter CAT’s strong performance and profitability.

- Central bank rate cuts and China’s significant stimulus package are expected to boost economic activity and CAT’s revenue growth.

Marina113/iStock Editorial via Getty Images

Caterpillar (NYSE:CAT) broke to new all-time highs in late September in a strong rally with 4 major catalysts. This article looks at these drivers and what they could mean for the outlook for next year.

1. Earnings

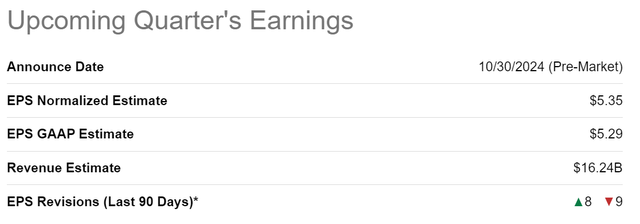

CAT will report earnings on the 30th October.

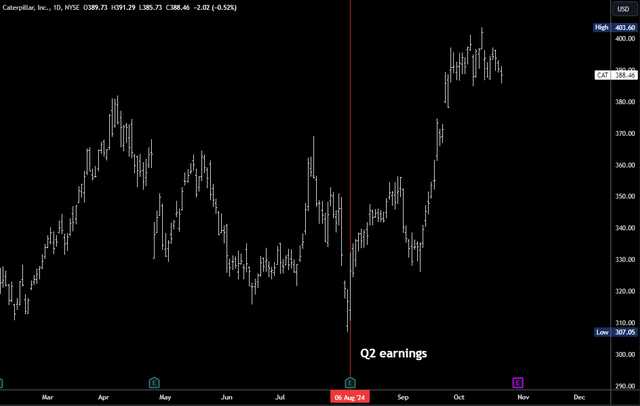

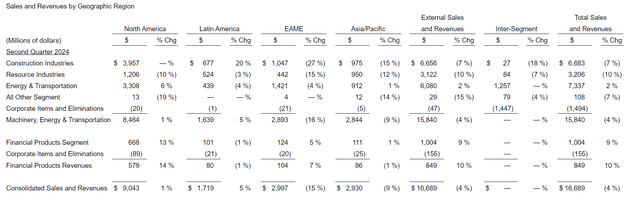

Q2 earnings were well received after, despite a drop in sales.

Markets were warned in April about lower volumes, so the slowdown was not a surprise. It’s a tough environment for CAT and the sector.

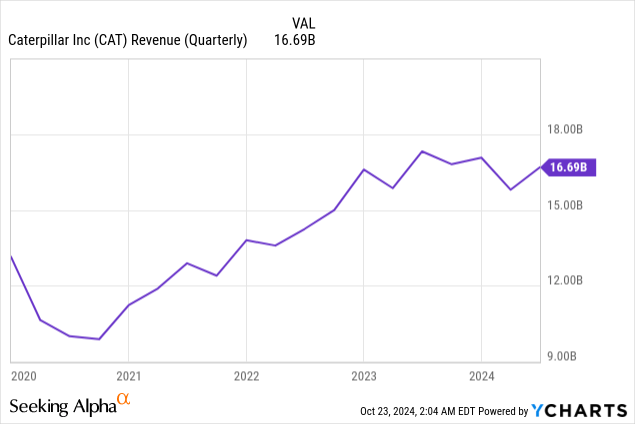

Revenues are stagnant, but steady.

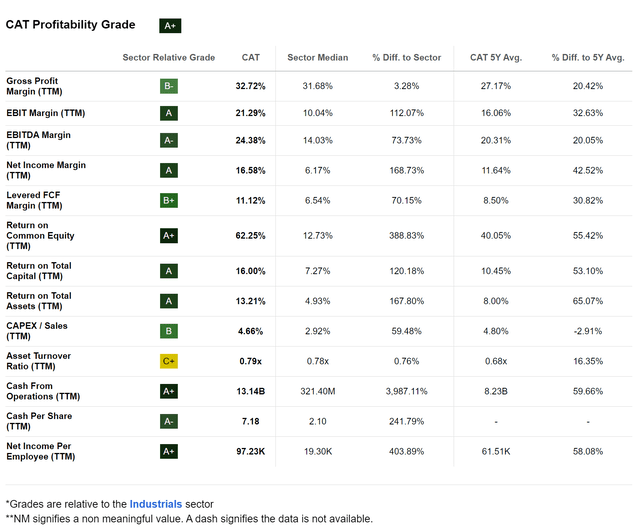

Overall, earnings suggest CAT is performing well in a very tough environment. This is a well-run company with great profitability metrics and margins.

This positive view isn’t likely to be changed much by next week’s earnings, and while the release may cause some short-term volatility, macro factors may be a larger influence into the end of the year. CAT is not at fault for slowing sales.

2. Central Bank Policy

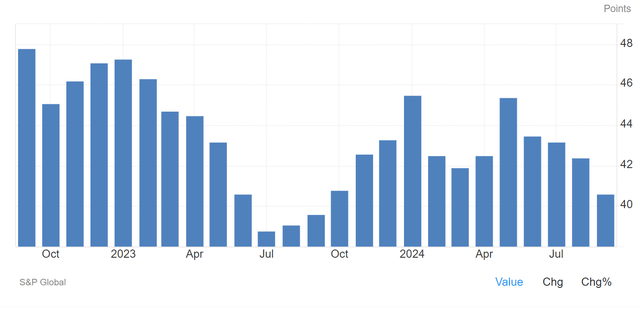

Q2 earnings revealed a -27% slump in construction industry sales in Europe and the Middle East.

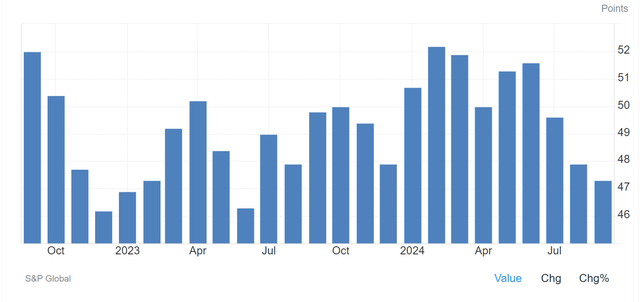

Manufacturing in the EU has been in contraction territory for several years. Germany, once the industrial powerhouse of Europe, looks in trouble according to PMIs.

Germany PMIs (Trading Economics)

Note: figures under 50 show contraction in the sector.

The ECB finally seems to be taking this seriously. They have recently shifted their focus from tackling inflation to growth, much in the same way the Fed did in July. This means a faster pace of cuts towards the neutral rate, and they have already cut 3 times. Markets are even speculating on a 50bpos cut in December.

US manufacturing seems to be heading in the same direction as the EU, with 3 readings below 50 in H2.

The good news is that the sector is much steadier and the Fed is on course to ease rates by 100bps into the end of the year. That should support economic activity. CAT sales in the US actually rose 1% according to the Q2 report, and that has plenty of room to improve.

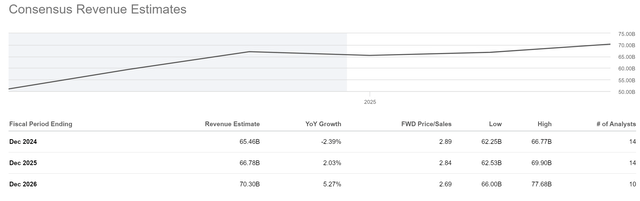

Forward estimates project better growth in 2025 and sales to increase 5.27% in 2026.

3. The Election

I don’t want to delve too much into politics, but it is clear neither party is determined to cut deficits or tighten spending. Trump has talked about tariffs again (like 2016) and tax cuts, both of which may be positive for CAT in the US.

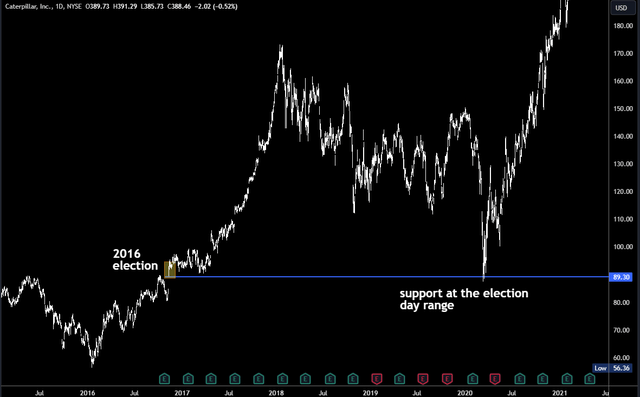

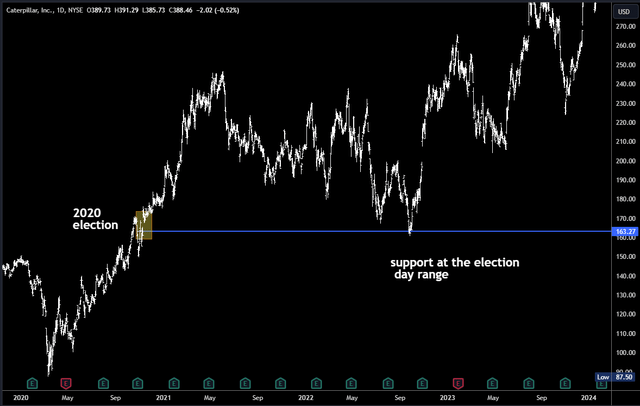

What strikes me is how important the last two elections have been for CAT. It’s reflected in the charts – not only have there been a post-election rallies, but the range set the day after the election has been strong support in later declines.

The two charts are clearly quite similar. However, this time around the rally leading into the election has been much stronger and CAT is trading at new all-time highs. This was not the case in 2016 or 2020. Also, the elections in 2016 and 2020 had much more focus on infrastructure and US industry, with the 2020 election leading to the Infrastructure Investment and Jobs Act (IIJA). The talking points are quite different in 2024.

While the election outcome may seem important for CAT, clearly it can rally under either party. I don’t think the election effect will be the same as previous occurrences, but it’s still an idea to mark the post-election levels on your chart in case there is a rally that drops back down again. It may provide a good buying opportunity.

4. China

Asia/Pacific revenues are around a third of US revenues, and China is a big part of that. However, it is also key to global demand of commodities and mining, and the recent stimulus could be a major driver of activity.

It seems President Xi and the PBoC have had enough of the (most self-inflicted) de-leveraging and underperforming stock markets, and they have introduced some major policy changes since September.

The stimulus package was the largest since the pandemic. Rates were lowered and measures taken to revive the property market. Borrowing regulations were eased and funds, insurers and brokers now have easier access to funding in order to buy stocks. This certainly boosted the stock markets, and the Hang Seng rallied nearly +40% from the September low.

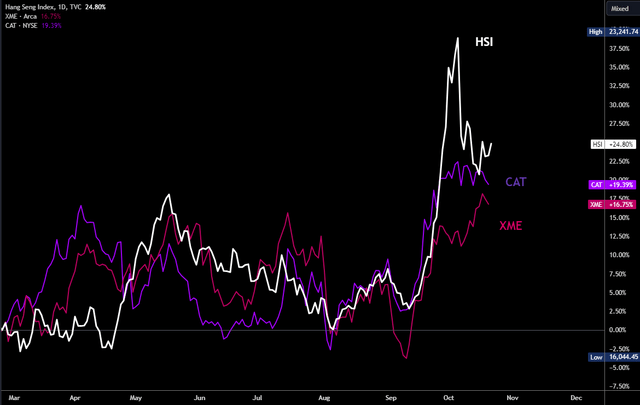

The Chinese stimulus has lifted sentiment in global mining and commodity prices. There’s quite a clear correlation between the advance of the Hang Seng Index, the SPDR® S&P® Metals & Mining ETF (XME), and CAT.

Some commentators, including US Treasury Secretary Yellen and the IMF Chief Economist, have suggested the stimulus is not enough to have a sustained effect. Perhaps there is more to come. I certainly see it as a positive.

Putting It All Together

Earnings will be a short-term driver – I can’t say which way – but I don’t think they will change the fact CAT is a well-run company which is performing well in a challenging environment. Similarly, the election could ignite some volatility, but CAT can clearly function well under either party. Should either event lead to a dip, it could be a buying opportunity.

Central bank policy and China’s stimulus are likely to be the two main drivers over the longer-term. There is optimism that lower rates can help activity and CAT revenues can return to growth. Some of this optimism may be priced in, however, as CAT is trading near all-time highs and with a forward PE ratio of 17.5. I think there is room higher, but I rate CAT a “hold” near $400 and a buy on any large dip back under $350.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.