Summary:

- A strong Q3 earnings report on October 28, 2024, could trigger a breakout, driven by strong delivery accomplishments and a potential EPS beat.

- Ford’s raised its full-year FCF guidance in Q2 which I expect the company to confirm. Solid Q3 EV sales, especially with regard to the Lightning F-150, signal strong earnings potential.

- Ford’s Q3 EPS estimates have seen 10 upward revisions in the last 90 days, indicating a favorable revision trend.

- Shares could break out to the upside if Ford’s earnings are better than expected, alleviating investor concerns about profit margins and earnings growth.

Vera Tikhonova

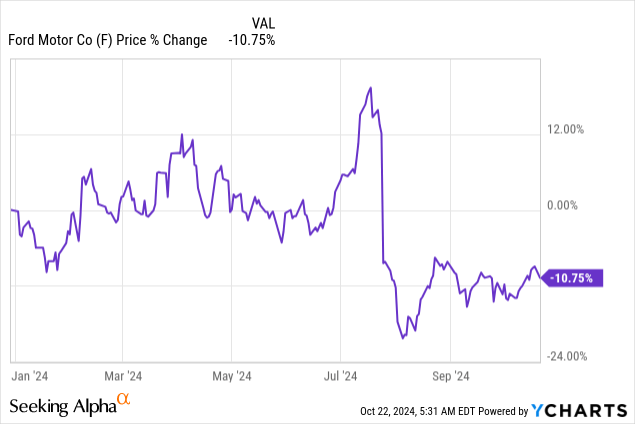

Ford (NYSE:F) is set to submit its third-quarter earnings sheet for the third fiscal quarter on October 28, 2024, which could potentially set the automaker up for a breakout to the upside. After Ford reported second-quarter earnings, shares crashed 17% and opened up a huge gap in the stock chart which is in dire need of closing. I believe Ford could be set for a strong Q3 earnings release later this month, in part because the auto company is seeing decent momentum for its EV sales. Ford’s EPS estimate revision trend is also decidedly positive, indicating that analysts expect the automaker to stick to its current earnings and free cash flow guidance. Since shares are still very cheap, I see a very skewed risk profile ahead of the company’s third-quarter earnings report.

Previous rating

I rated shares of Ford a strong buy after the automaker reported second-quarter results that fell widely short of expectations. Nonetheless, Ford increased its full-year adjusted FCF guidance to $7.5B to $8.5B which was a positive take-away that led me to confirm my strong buy rating at the time: 18% FCF Yield, I Am Buying The Crash Hand Over Fist.

Ford’s Q3 delivery accomplishments were quite solid, with the company seeing 4% year-over-year growth in retail sales in the third-quarter, driven by growing EV volumes. While the EV market will remain challenging going forward, I believe Ford has demonstrated strong delivery results that could result in a handsome earnings beat later this month.

Strong EV sales, despite market challenges

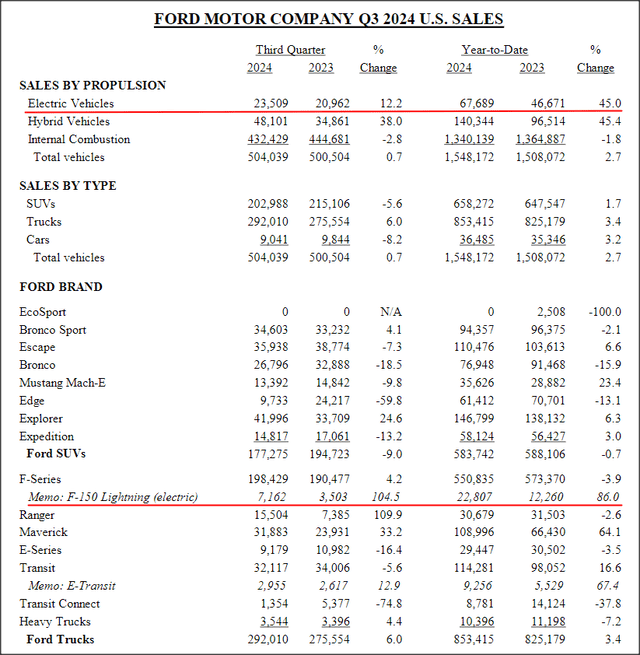

Ford reported Q3 sales at the beginning of the month which showed that auto sales increased 1% year-over-year and 4% year-over-year on a retail basis. Especially well did hybrid and electric vehicles which the company has aggressively pushed in recent years as a means to diversify its revenue streams and participate in the surging growth of the electric vehicle industry.

Ford’s electric vehicle sales soared 12.2% year-over-year with the company’s top EV product, the Lightning F-150 pick-up truck, seeing a 105% Y/Y growth in U.S. sales. The overall EV picture is a bit more mixed, however, as other products, such as the Mach-E SUV saw a 10% drop-off in sales compared to the year-earlier period. Moderately positive momentum was realized in the e-Transit business which is where sales volumes increased 13% year-over-year.

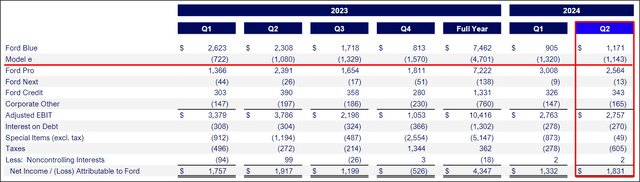

EV sales have broadly increased in the third-quarter with Tesla also seeing some positive growth here. Since EV sales grew at double-digits in Q3, Ford has surprise potential in the electric vehicle division, which is called Ford Model e. In the second-quarter, Ford generated a wide loss here of $1.1B, indicating to investors that it may take years for Ford to achieve profitability on its EV sales. Ford itself guided for a full-year loss of $5.0-5.5B, but may guide for lower losses given its consistent momentum in U.S. EV sales. As shown above, EV sales are especially solid in the pick-up truck and commercial van segment.

Favorable EPS estimate revision trend

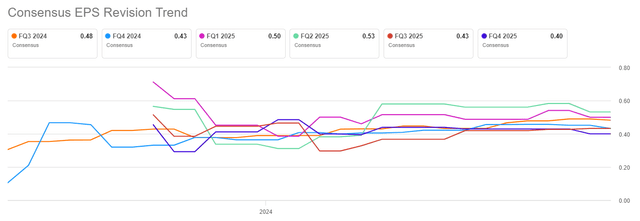

Ahead of the third-quarter earnings report, Ford’s estimates are moving in the right direction. In the last 90 days, shares of Ford have seen 10 EPS estimate upside revisions compared against 1 EPS downside revision. Analysts on average expect $0.48 per-share in adjusted earnings for the third-quarter which would imply 24% year-over-year growth.

Ford’s shares trade at a large discount to fair value

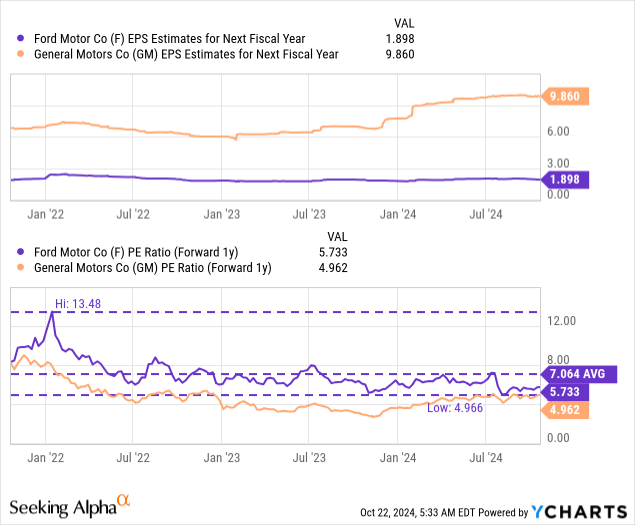

Shares of Ford are widely underpriced ahead of Q3, in my opinion, which is largely due to the post-Q2 earnings drop from which shares have not yet recovered. The automaker is trading at a P/E ratio, based off FY 2025 earnings, of 5.7X, which is well below the company’s 3-year average P/E ratio of 7.1X. General Motors (GM), which is Ford’s largest rival in the U.S. auto market, is priced at only 5.0X earnings. But just because General Motors is cheaper — and strong value as well — doesn’t mean that investors should ignore Ford: The automaker raised its guidance for adjusted free cash flow by $1.0B in the last quarter and is seeing reasonably decent momentum in EV sales… all of which makes a guidance revision for full-year FCF at the end of the month unlikely.

In the longer term, I believe Ford could revalue to 7-8X forward earnings which would bring the firm’s valuation a bit more in-line with its historical valuation: the fair value range here is $13.50 and $15.40 per-share. Ford’s current share price is $10.88. A strong Q3 report, consistent execution in the EV business and lower EV division losses could be catalysts that could lead to a stock price reversal at the end of the month.

A better than expected Q3 report could also lead me to gravitate to the high-end of Ford’s fair value range, or potential raise my FV target: if Ford manages to guide for strong FCF on accelerating EV momentum, analysts are likely to revise their EPS estimates further upward. A strong beat in terms of EPS estimates could also lead to a vital sentiment shift that is necessary for an upside revaluation.

Risks with Ford

Ford is a large automaker and the company is still overly reliant on ICE vehicles. This, in my opinion, mitigates risks for investors. Nonetheless, waning EV demand and growing pressure on profit margins, as well as the potential for persistent losses in the electric vehicle segment, are serious risks that investors in Ford should be aware of. What would change my mind about Ford is if the company were to see a contraction in its free cash flow as well as falling ICE vehicle sales in the coming quarters.

Final thoughts

Ford’s post-Q2 sell-off was driven by concerns about the company’s electric vehicle sales trajectory and profit margins. The automaker’s Q3 sales results, however, showed that Ford is seeing solid demand in the EV segment, which should lead to a confirmation of the company’s full-year profitability targets. Ford raised its free cash flow guidance by $1.0B in the last quarter to a new range of $7.5-8.5B, which I expect the automaker to confirm. Strong Q3 delivery volumes, especially with regard to the Ford Lightning F-150 pick-up truck and the Mach-E SUV, indicate that Ford could be set for a much stronger earnings report than in Q2… which could push shares into a new up-leg. For those reasons, I believe a speculative long position ahead of the third-quarter earnings report can be justified.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F, GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.