Summary:

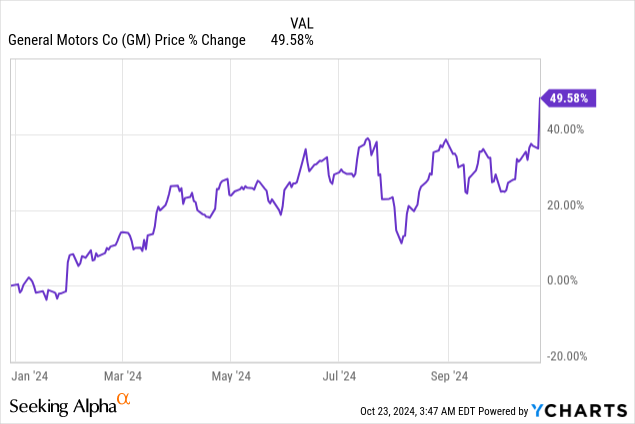

- General Motors shares surged 10% after Q3 results exceeded expectations.

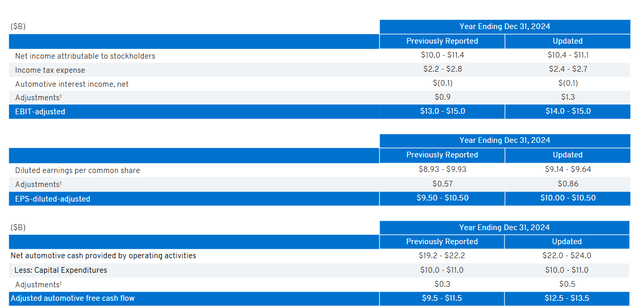

- GM raised its full-year guidance for the third time, projecting adjusted EBIT of $14-15B and free cash flow of $12.5-13.5B for FY 2025.

- General Motors’ electric vehicle deliveries surged 60% year-over-year, indicating strong momentum and improved profitability prospects in the EV segment.

- Despite hitting new 1-year highs, GM’s valuation remains attractive with a forward P/E ratio of 5.4X, presenting a favorable risk profile.

Richard Drury

Shares of General Motors (NYSE:GM) surged 10% on Tuesday after the automaker reported better than the expected results for the third fiscal quarter. For the third time this year, General Motors raised its full-year outlook in terms of EBIT and free cash flow, and the company saw some solid momentum in terms of electric vehicle deliveries in the third-quarter as well. EV sales surged 60% compared to the year-earlier period, and the company maintains its outlook to produce and wholesale 200k electric vehicles this year. General Motors continues to trade at a very attractive valuation, despite shares just hitting new 1-year highs, and I see an overall favorable risk profile for investors.

Previous rating

I aggressively recommended shares of General Motors as a strong buy after the automaker disappointed with its second-quarter earnings sheet in July: Buy The Drop, High Safety Margin. The main reason for my rating and my strong buy recommendation was that General Motors raised its full-year outlook for adjusted EBIT and saw positive free cash flow momentum as well. General Motors raised its FY 2024 guidance again and confirmed its EV goals. With EV sales surging, General Motors is set to experience an inflection point in its business.

General Motors crushes earnings, EV business is nearing inflection point

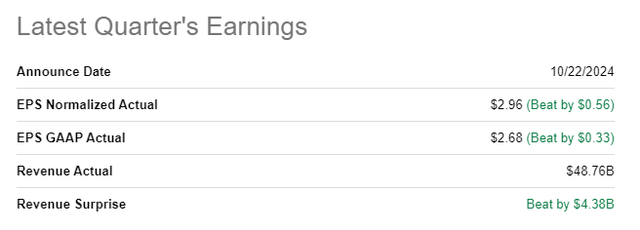

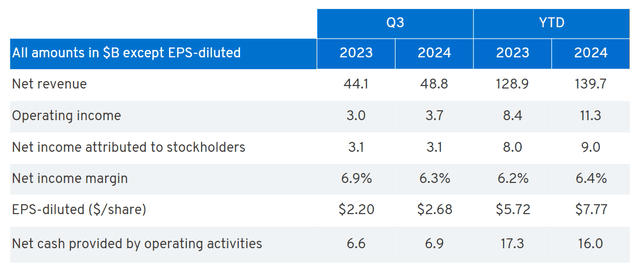

The automaker beat expectations easily on the top and the bottom line for Q3’24: General Motors had adjusted earnings of $2.96 per-share, which beat the consensus estimate by a massive $0.56 per-share. The top line came in at $48.8B, beating the average prediction by an impressive $4.4B, on strong ICE and electric vehicle sales.

The third-quarter was a strong quarter for the auto company: General Motors generated $48.8B in net revenue in Q3’24, showing 11% year-over-year growth, which crushed consensus estimates. General Motors’ net income was $3.1B and earnings were supported by a strong sales environment: General Motors’ North America especially saw a robust performance, with the geography benefiting from 14% adjusted EBIT growth on higher wholesale volumes.

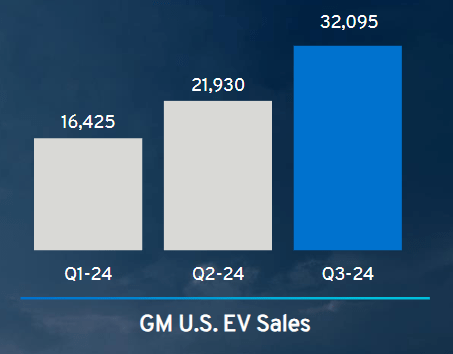

While General Motors’ ICE sales are booming as well, the auto company is starting to crush it in electric vehicle sales as well. The automaker reported that it sold 32,095 electric vehicles in the third-quarter, showing an impressive 60% year-over-year growth rate as well as 46% quarter-over-quarter growth.

General Motors

This momentum has staying power, in my opinion, as the company is gearing up to launch new electric vehicle models in FY 2025 which could boost the segment’s overall performance. Electric vehicles like the Cadillac Escalade IQ and the Chevrolet Equinox EV have the potential to sustain GM’s growth in the EV segment. The automaker also confirmed that it was targeting to build and wholesale 200k GM-branded electric-vehicles this year in North America.

With momentum building in the EV segment, General Motors could achieve an important inflection point in its business next year. GM said that it could be profitable on a 200k annual production volume (based off of contribution margin) which is the target set out for this year. In FY 2025, General Motors could therefore really see a boost in EV segment profitability, which may be a catalyst for shares to go into a new up-leg.

Revised guidance for FY 2024

General Motors raised its guidance for the third time this year and now projects adjusted EBIT of $14-15B (+$1B at the low-end of guidance) and free cash flow of $12.5-13.5B, compared to a previous guidance of $9.5-11.5B. General Motors revised guidance, especially in terms of free cash flow, is significant and can be credited for the market’s strong and positive reaction on Tuesday.

General Motors’ valuation

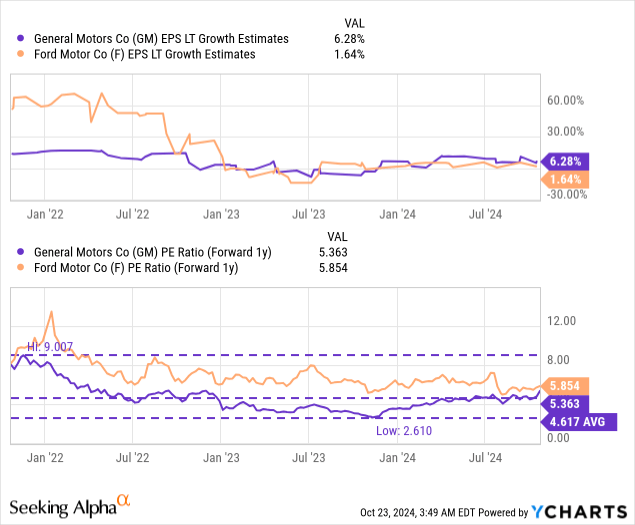

General Motors continues to trade at what, I believe, is an excessive earnings yield of 19%. The automaker is priced at a forward price-to-earnings ratio of 5.4X, which makes General Motors even cheaper than Ford Motor (F).

Ford Motor, which is General Motors’ most significant high-volume, ICE-focused rival in the U.S. market, is trading at a forward price-to-earnings ratio of 5.9X. Ford’s valuation implies a similarly impressive earnings yield of 17%. Both Ford and General Motors are still overly focused on their ICE segments, but EV momentum for both companies is pointing upward… which indicates that both companies could see growing EV earnings momentum next year.

General Motors is now trading above its longer term, 3-year P/E average and shares just climbed to a new 1-year high in response to the better than expected Q3 earnings sheet. In my last work on General Motors, I argued that shares could revalue to a 6-7X forward P/E ratio, considering that GM raised its guidance for FY 2024 on strong sales momentum across its auto brands. I believe with a third consecutive guidance raise, General Motors could indeed revalue to a fair value P/E ratio of 6-7X. This multiplier range implies a fair value for General Motors’ shares of $60-70 per-share (based off of a consensus estimate of $10.02 per-share for FY 2025).

Risks with General Motors

GM is still overly focused on ICE vehicles, as only about 5% of its sales are electric vehicles. Nonetheless, the EV sales figures for the third-quarter clearly show that the automaker is considerable momentum in its EV division. This indicates to me that the risk profile has improved since my last work on the automaker in July. What would change my mind about General Motors is if the company were to miss its 2024 EV targets of 200,000 units, or if the company failed to see continual momentum in its important EV division.

Final thoughts

Buying the drop after General Motors Q2 results proved to be a very lucrative strategy for investors. General Motors is nearing an important inflection point in its business as well: with volumes in the EV segment surging, the company is looking at a period of strong earnings growth. General Motors’ electric vehicle sales surged 46% Q/Q in Q3’24, indicating that concerns over a slowdown in this segment may be exaggerated. The most important take-away from the Q3 report was that General Motors raised its outlook yet again, especially in terms of free cash flow. With a 19% earnings yield available, I believe shares of General Motors, despite hitting a new 1-year high, are undervalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.