Summary:

- McDonald’s faces a severe health crisis, similar to Chipotle’s past issues, which may cause a significant but potentially temporary stock price decline.

- Investors should be cautious and patient, as major news events often lead to prolonged stock price trends rather than immediate recoveries.

- Valuation scenarios suggest that McDonald’s could offer an 11.5% annualized total return.

- McDonald’s is currently a hold; further research and monitoring are essential before considering a buy, the author is targeting $281 or $250 for personal entry, depending on further research.

spflaum1

Introduction

McDonald’s Corporation (NYSE:MCD) was hit with the worst kind of news a restaurant chain can face: A major interstate E. coli outbreak has infected at least dozens and likely many more people and killed at least one person. First things first, people are seriously ill, there has been at least one death, and more people may die from this or require hospitalization. It’s important to recognize the human aspect of this story before getting into the investing angle.

That said, we are here to talk stocks and make money, and MCD will almost surely sell off substantially from where it is today. The question is how much and when it becomes a buy for brave investors looking for long-term outperformance.

Investors need to understand the big picture regarding something like this. This has happened before and, in times past, has been a great buying opportunity. The first thing I thought of when hearing this news was what happened to Chipotle Mexican Grill, Inc. (CMG) in 2015 and 2016. The same situation might play out for MCD. It’s also important that investors understand the initial selloff may just be the beginning of MCD’s share price decline. The severity of illnesses, how widespread the outbreak is, and who and how MCD is to blame, are all key factors that will impact the stock price. How the company handles the crisis will also matter.

For anyone tempted to jump in immediately, consider this: Major news events that cause a sudden drop or spike in a stock price are often just the beginning of a trend for some weeks or months. The breaking news is often followed by further declines or increases in stock prices as investors absorb key information, consider liability and damages, and revise earnings estimates. For this reason, it’s unlikely anyone needs to rush into buying the stock.

Parallels With Chipotle

We can look to the CMG case to find parallels and differences in each story as the MCD outbreak unfolds. It’s too early to understand the whole picture, but we can probably find something to help inform us what might happen to MCD.

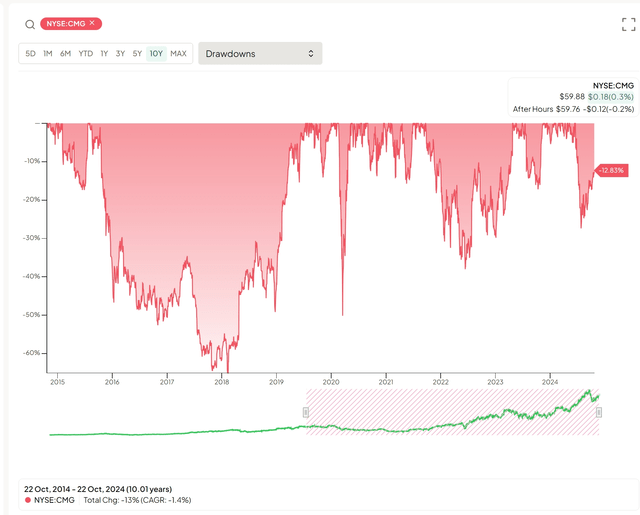

Chipotle’s food safety crisis, in 2015, unfolded over a period of months and involved several separate incidents of different illnesses. At first, there was a norovirus outbreak in California in July 2015. Then, in August 2015, a salmonella outbreak occurred in Minnesota. Matters got far worse in October and November 2015, as an E. coli outbreak started in Washington and Oregon and spread to 11 states in total. That December, there was another norovirus outbreak at a Boston area Chipotle, and by February 2016, all CMG restaurants were closed for safety precautions and company-wide safety improvement measures. Some 500 people were sickened at Chipotle restaurants, and the company’s reputation was severely damaged. Its stock price cratered around 60% before gradually staging a comeback.

Chipotle (CMG) Stock Drawdown following E. Coli and foodborne illness outbreaks (FinChat)

It may be too early to tell, but if McDonald’s can limit this to this one outbreak, and it doesn’t end up being extremely large, this may work out much differently for McDonald’s than it did for Chipotle. Chipotle was a much younger company with a less certain future at the time, and the reputational harm was likely much greater than what MCD would face. I would also argue that MCD has a moat through its brand, economies of scale, and low-cost production, while at the time CMG had its crisis, it likely did not have a strong moat.

Chipotle stock fell roughly 60% from before the crisis, and I don’t think we should expect McDonald’s to fall 60% from earlier today. However, we can lay out some prices where the stock might be a great long-term buy so that we’re ready if and when the stock gets to those prices.

I doubt that McDonald’s won’t return to being a stalwart company in the long term, and I doubt that the long-term financial picture for the company will change based on what happened this week. But it might be safe to model slower growth for the next year.

Valuation

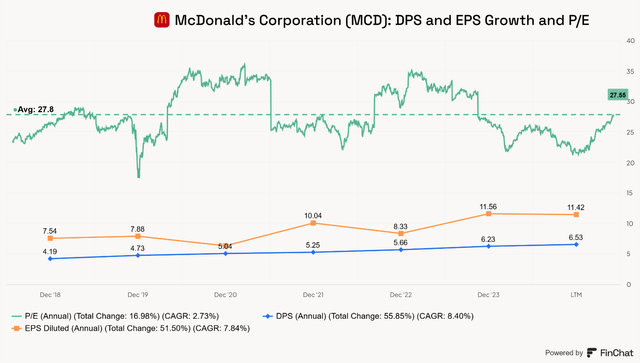

MCD has grown EPS at a CAGR of 7.8% since 2018. Its dividend per share has grown at a CAGR of 8.4% during this time. MCD’s average trailing P/E has been 27.55x since 2018.

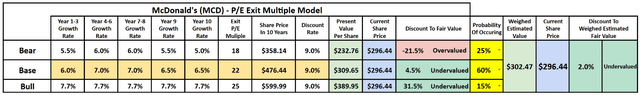

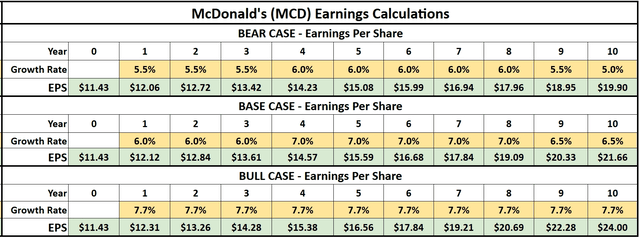

I’m using a 3-scenario EPS exit multiple model to value the company.

Even if we assume that MCD’s EPS growth rate slows somewhat, it appears that MCD will be trading in a reasonable range following its after-hours drop.

In my base case, I factored growth rates of 6.0% for years 1-3, 7.0% for years 4-8, and 6.5% for years 9-10. The estimated exit multiple used is 22x earnings, a discount from its historical average.

In my bear case, I factored projected growth rates of 5.5% for years 1-3, 6.0% for years 4-8, and 5.5%, and 5.0% for years 9 and 10. The estimated exit multiple used is 18x earnings, a significant discount to its average P/E.

In my bull case, I factored projected growth rates of 7.7% for years 1-10, which is slightly lower than MCD’s CAGR since 2018. The estimated exit multiple used is 25x earnings, roughly in line with its current multiple.

The discount (hurdle) rate used is 9.0%, representing the annualized share price return if the model comes out as a 0.0% discount to fair value.

McDonald’s Exit Multiple Model (Author-generated DCF/Valuation Model)

Based on these inputs and the after-hours price of MCD as of 10/22/2024, the stock could be fairly valued for a 9.0% price appreciation plus its current dividend yield, which is roughly 2.5%. The EPS calculations can be seen below.

Author-generated DCF/Valuation Model Calculations

Risks

The full damage to MCD’s reputation and financials will not be clear for some time. It is possible this will be quite substantial. In a worst-case scenario, it could take years to recover. I caution all investors to be patient or purchase with a large margin of safety.

My model is not based on in-depth knowledge of MCD’s cash flows and should be treated as an illustration of potential stock returns and not a definitive projection of cash flows or earnings.

Conclusion

MCD stock will fall based on this news, I believe it could become a buy soon, but want to either wait for more information on the severity of this outbreak or buy with a significant margin of safety. My model shows the potential for a roughly 11.5% annualized total return, given my inputs.

MCD is likely to trade lower for some time, and my plan of action is to watch closely and potentially open a position if the price falls roughly 5% below $296, which would be roughly $281 per share. However, I might wait for an even lower price, depending on how the market reacts and what kind of news comes out. A share price below $250 may make it easy to buy the stock.

Either way, I plan to do more thorough research in the coming days before making any purchases.

For now, I consider MCD a hold, but this may change to a buy quickly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I will not make any transactions in the mentioned stocks for at least 72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.