Summary:

- I’m initiating Snapchat with a buy because I expect an upside surprise sometime in the last two quarters of FY24.

- I think the worst got priced into the stock price after the sharp decline post-Q2 results and while the stock has shown volatility, there should be limited downside ahead.

- Snap has some unrealized growth catalysts, including the Direct Response ad platform and its AR glasses. It should also benefit from any TikTok ban in the U.S.

- I hereon share my positive sentiment on Snap and why I think the odds will work to the company’s benefit over the next two quarters.

Chalabala/iStock via Getty Images

Investment Thesis

Snapchat (NYSE:SNAP) will report earnings on October 29th. I’m initiating it with a buy before earnings. Despite the soft revenue guidance for Q3, further exacerbating what I’d call shaky investor confidence with an over 18% dip after the fact, I think the market has priced in the negatives. With the stock hitting a 52-week low of $8.29 on August 7th, I think a rebound is due. The stock’s relative strength index is at 40, and it’s edging closer to oversold territory. All these parts align to make me believe the worst has already happened, and Snap should see some upside. The disclaimer that goes with my buy rating is that Snap isn’t a stock for the faint-hearted. I see more upside in 2HFY24, as the stock’s movement proved possible over the last year. If there’s one thing Snap has proven year to date, it is its stock’s ability to really snap up or plunge after earnings.

I believe Snap has a couple of growth catalysts working in its favor, two of which are making me a buy. The first is management’s investments in the Direct response ad platform, which, I think, will show up on top-line in the short term, despite competition from Meta (META) and TikTok. The latter is facing the pressures of being banned in the U.S., and if that happens, I expect it would return some of the migrated users back to Snap.

The other reason why I’m a buy on the long-term is I expect heightened engagement as a result of the company’s investments in their augmented reality platform or AR, along with their strides in AI since launching My AI last year and the recent partnership with Google’s Gemini on Vertex AI. Thomas Kurian, CEO of Google Cloud, said that Snap was one early leader in the world that helped people communicate…:

now it is at the forefront of using generative AI to build agents that create new value for its community. Gemini models on Vertex AI are now powering millions of multimodal interactions in the Snapchat app every day that allow Snapchatters to better engage with My AI – with built-in accuracy and safety features.

Snap In A Snap: The Stock Performance

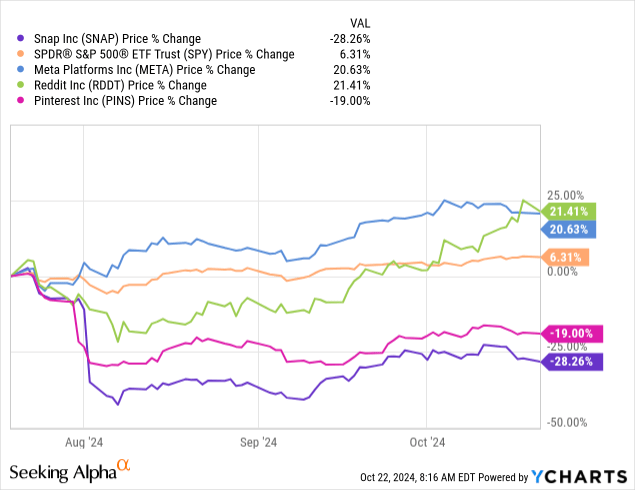

On the three-month chart, as seen below, the stock movement shows a negative market sentiment. The stock is down 28.2%, underperforming the S&P 500, which is up 6.3%. Its peer, Pinterest (PINS), is down 19%, but Meta (META) is up 20%, and Reddit (RDDT) is also up 21.4%. I think there is a limited downside from here and growth catalysts that haven’t been priced in yet.

Seeking Alpha Chart

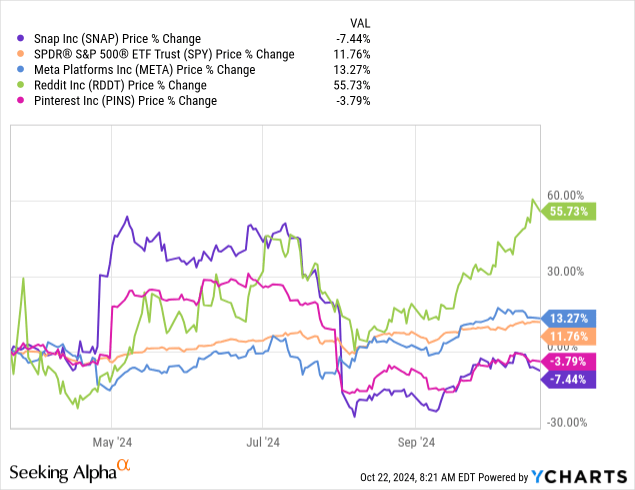

The year-to-date chart offers an illustration of a normal day for Snap’s stock movement, which proved to be volatile. On the year-to-date chart, Snap is underperforming its peers and the S&P 500. The stock is down 7.4%, against the S&P 500, which is up 11.7%, Meta is up 13.2%, Reddit is up 55.7%, and Pinterest is down 3.7%.

As seen below, the stock plunged over 30% in early February on weak 1Q24 guidance due to the war in the Middle East. Fast-forward to late April, after 1Q24 results beat analysts’ expectations, and revenue growth returned to double digits; the stock soared over 23% in extended trading. The last dip was that of two months ago, in early August, as the company reported 2Q24 earnings, and the stock dipped over 20% on weak 3Q24 guidance. With all said and done, I think the stock has an upside ahead after the company guides higher than investor expectations on the next earnings report with already low market expectations. I think that’s going to happen for two main reasons, which I’ll discuss in a second.

Seeking Alpha Chart

DR Ad Growth To The Rescue

DR advertising revenue increased 16% year-over-year in Q2, which is in line with the 17% in Q1, regardless of the tough comparison. The nature of brand businesses is very volatile, and marketing investments can be limited according to the ongoing economic situation. This can be seen in Q2 North America revenue that grew as little as 12% year-over-year due to the “impact of weaker brand-oriented demand” that’s mainly concentrated in the region. Despite that, DR was a bright spot in the region, backed by strong growth in the SMB customer segment, which I’ll get to in a second. Now, back to the tougher economic environment, it affected certain marketing investments in verticals where the company has had really good performance in direct response. An example of that is last quarter’s restaurants vertical, which witnessed a tough environment in certain cases, but according to management, since DR is based on performance,

that’s a category that continues to grow for us on the DR side in the current quarter because we’ve got great performance for those advertisers, and they’ve been able to continue to invest and grow their business on the back of that.

Due to the macro volatility I mentioned earlier, management is now more focused on investing to counter that volatility from all sides, and I’m optimistic about that. The company is seeing good momentum on its 7-0 Pixel Purchase Optimizations. On the advertisers’ side, there has been a great benefit of the 7-0 optimization for app installation and app purchases, which showed good results during testing last quarter. CAP adoption is up 300% year-over-year, further indicating improved performance. That, along with the increase in total active advertisers to more than double year-over-year last quarter, should reflect in continued growth in DR advertising revenue in 2H24.

While we’re on the SMB segment, management is focusing a big chunk of investments in the coming year on this segment. I share management’s sentiment and think it “leverages the strength of our scale with our community and also our ability on the product and engineering side to drive results for advertisers.” I think this will help with long-term growth and give the company a diversified revenue stream.

Valuation

Snap has a market cap of 17.41 billion and an enterprise value of 18.30 billion. Market sentiment on the stock is generally cautious, with over 72% of Street Analysts giving it a hold rating. Around 4.5% of Street analysts give the stock a strong buy, and ~16% give it a buy. Only 6.8% of analysts give the stock a sell.

The PT median and mean both notice a downward trend, reflecting investor caution and a dash of pessimism about the stock. The PT median was at $16 in late July and went down to $13 in August. The downward trajectory continued into September at $12 and is currently maintaining that. The mean PT was around $15 in July and was also down to $12.9 in August. It continued downwards to $12.6 in September, currently at $12.4. According to data from Refinitiv, Snap’s EV/Sales (TTM) is 3.56, and its EV/Sales is 3.31, significantly lower than Meta’s EV/Sales (TTM) at 9.7 and EV/Sales at 8.97.

Free cash flow was negative $73 million last quarter, down 38% from a year ago quarter, still reflecting the seasonality of lower revenue in Q1. I expect the numbers to improve now that headwinds from seasonality are behind us and management is focusing on balanced investments to sustain a positive cash flow. Net loss saw an improvement in Q2, at $249 million compared to the net loss of $377 million in a year ago quarter. I think the headcount reduction related to restructuring recently reflected positively on expenses. I believe such tactical reduction in expenses positions the company for continued profit down the line, accompanied by strategic investments. Speaking of which, for Q3 investment plans, management is prioritizing investments carefully to “deliver against the cost plans we have set out for our business, while investing prudently to deliver for our community and our partners.”

What’s Next: Annual Snap Partner Summit

AR

Last quarter, the number of users sharing AR Lens experiences increased by 12% year-over-year due to AR experience optimizations and AI Lenses’ popularity. A clear indication is the ML Scribble World Lens, which was viewed over 1 billion times during the same quarter. At the annual partner summit event in mid-September, management revealed the fifth generation of its AR glasses, along with enhancements that add to its competitive edge. With creator-driven content taking a more significant chunk of attention for management, the number of creators “posting publicly has more than tripled over the past year,” with over “15 billion interactions between creators and their fans.” In his remarks, the company’s CEO Evan Spiegel discussed VR sets in comparison to AR sets, in a way throwing shade at rivals Meta and Apple (AAPL). He said:

VR headsets…feel like you’ve got a laptop taped to your face, and they’re isolating, they make people feel motion sick, they’re heavy, they’re uncomfortable. But AR glasses have see-through lenses. They allow you to share experiences together with your friends in the real world, and they’re lightweight and wearable.

AI

At the summit, the company also introduced an AI-generated tool to creators in an effort to enhance its AI and machine learning capabilities for a better user experience. After unveiling My AI last year, a GPT-3 chatbot for Snapchat+ subscribers. According to Snapchat’s vice president of products, Ceci Mourkogiannis, the new tool will help creators “make engaging videos with AI from a simple text, or soon, image prompt.” I believe Snap is one step ahead of Meta and ByteDance’s TikTok, which are yet to have their own AI-generated video capabilities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.