Summary:

- AT&T’s stock has surged over 36% in 2024 while the company steadily delivers its wireless and fiber growth strategy.

- The company’s higher-paying, lower-churn customers drive EBITDA growth compared to peers.

- Exiting DirecTV and focusing on core businesses will help AT&T achieve debt reduction goals and potentially increase dividends in 2025.

- Despite a higher P/E ratio, AT&T’s strong earnings and future dividend growth make it a Buy for income investors over Verizon.

franckreporter

Steady Company Performance, Outstanding Stock Performance

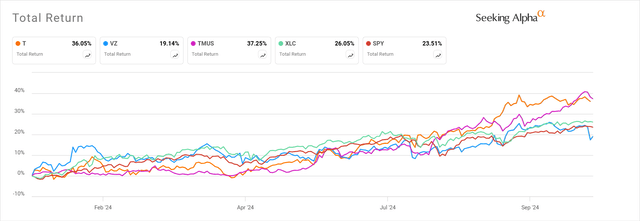

It’s been six months since I last covered AT&T (NYSE:T) on Seeking Alpha. The company remains committed to its strategy to grow its wireless and fiber broadband businesses and manage the decline in legacy wired voice and business services. As we see in 3Q 2024 results, AT&T continues to steadily deliver on this strategy. The stock performance, on the other hand, has been much more exciting than the company’s operational performance. AT&T stock has delivered a total return of over 36% so far in 2024, most of it coming after my last article in April. This far surpasses AT&T’s closest competitor, Verizon (VZ), especially after the negative reaction to Verizon’s 3Q results. T stock also outperformed the S&P 500 index fund (SPY) and the Communication Services Select Sector SPDR (XLC) despite the inclusion of high-flying companies like Google (GOOG) (GOOGL) and Meta (META), commonly thought of as “tech” stocks in that ETF.

After suffering through years of underperformance caused by ill-timed and overpaid entries into media production and distribution through its ownership of Warner Bros. (WBD) and DirecTV, the 2024 stock performance may seem too good to last. Some readers may have already skipped right to the comments to dispute my characterization of AT&T as a “winner” in the title. However, with 3Q results, we start to see more clearly how the growth portions of the company are starting to offset the declining legacy businesses. Additionally, with the heaviest capital investments now behind the company, free cash flow growth should improve in the year ahead. Combining this with cash from the recently announced sale of AT&T’s remaining stake in DirecTV, the company is on track to reach its debt reduction goals in 2025, setting it up for a possible dividend raise in the second half of next year. While it may feel tempting to sell after “getting back to even”, AT&T stock remains a Buy as the attractive returns may be just getting started.

Wireless: Growth Engine With High-Quality Customer Base

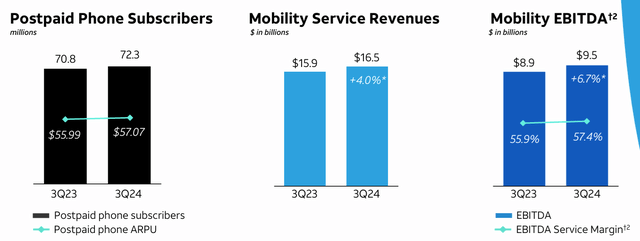

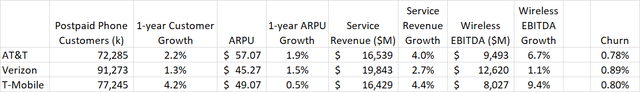

AT&T doesn’t have the most subscribers in its peer group, or the fastest growth. However, the company has been successful at converting subscriber growth into earnings by growing revenue per user and reducing costs. In 3Q 2024, we see that the company has 72.3 million postpaid phone connections, a 2.1% improvement from a year ago. However, AT&T also grew ARPU by 1.9% to $57.07. Some price increases were put through in 3Q, so we should see even more ARPU growth in 4Q results when they reflect a full quarter of higher prices. This combination of subscriber and ARPU growth gives AT&T a service revenue growth rate of 4%. Further, costs have come down and margins have come up, resulting in Mobility EBITDA growth of 6.7%. AT&T is best in class at churn rate, reducing the need to market to new customers or offer discounts to encourage sign-ups. Churn was just 0.78% in 3Q.

With its high-paying, loyal customer base, AT&T is growing wireless earnings faster than Verizon (VZ) and is competitive with T-Mobile (TMUS) even though it lags T-Mobile in new customer growth.

Note: Customer count, ARPU, and Churn are for postpaid US phone subscribers only (the largest and most profitable customer segment). Data sources are Verizon 3Q results and T-Mobile 2Q results.

Looking forward, the strong 3Q revenue growth of 4% and the recent price increases will allow AT&T to at least meet its full-year mobility service revenue growth target of 3% after slower growth in the first half. Equipment revenue may also increase in 4Q as Apple’s (AAPL) iOS 18 software release is due on October 28, making the recently released iPhone 16s more attractive to consumers as they will then be able to use Apple AI.

Broadband: Fiber-Led With Fixed Wireless Where Useful

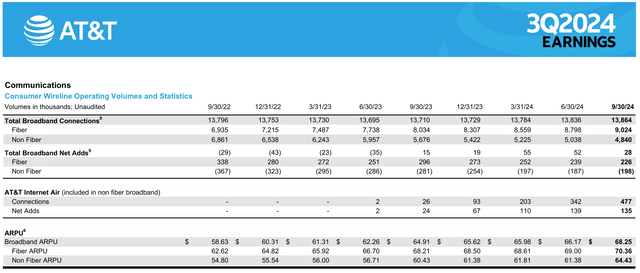

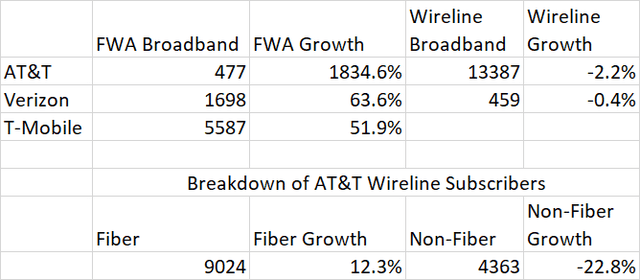

AT&T is the leader in broadband data service among the three big telcos, and it is unique in that their focus is on fiber, rather than fixed wireless internet. If we look at total Broadband connections, growth appeared stagnant until 2023, but this is because decline in older technologies, like DSL, was offsetting growth in fiber customers. Fiber earns about $6 more per month in ARPU, which exceeded $70 in 3Q. In the past 5 quarters, fiber customer growth has even surpassed non-fiber decline.

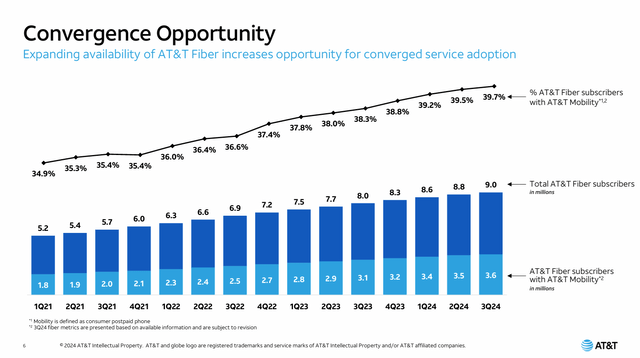

The company has been steadily building out its fiber network. In the past year, fiber connections were available to 2.3 million more locations, and actual subscribers grew by 1 million, with penetration reaching 40%. Even with hurricanes in the southeast US limiting expansion last quarter, AT&T still managed to add over 200,000 fiber subscribers in 3Q. AT&T is also adding fiber subscribers outside its own geographic area through the Gigapower JV with BlackRock (BLK).

As we see in the table above and in the comparison with other telcos below, while AT&T has the most subscribers, they are growing subscriber count more slowly because of their slow adoption of fixed wireless, which they only rolled out a year ago.

AT&T’s FWA product, Internet Air, is the fastest growing of the three, although it is from a small base as the newest offering. While not the main broadband service from AT&T, Internet Air nonetheless serves an important function. It is a bridge service, allowing customers to go to AT&T for their data needs in areas where fiber is not yet available. It is also a substitute for legacy copper-wired voice service for both consumers and businesses. As customers and businesses with landlines convert to FWA, AT&T can shut down portions of its copper wired network, saving on related maintenance costs.

The goal is to get these customers to eventually subscribe to fiber broadband, which a growing percentage of users are also bundling with wireless service. This creates the most loyal and highest-revenue customer of all.

AT&T’s investments in fiber over the last several years have been validated by Verizon’s move to buy Frontier Communications (FYBR) to expand their fiber footprint. Verizon is spending $20 billion on this acquisition, around a year’s worth of free cash flow that AT&T does not have to shell out all at once, as they have been expanding their fiber business all along. This will continue to allow AT&T to surpass Verizon on cash generation and debt reduction.

DirecTV: The Final Exit From Non-Core Business

DirecTV has been a drag on AT&T since it overpaid for the satellite TV provide in 2015. AT&T began taking steps to exit the business in 2021 when it sold a 30% interest to TPG (TPG). Since then, AT&T has deconsolidated these results from the financial statements but does record equity income and cash flow from the remaining investment. The business has continued to decline since 2021, generating about $900 million of cash per quarter in 2022 and 2023, but is now down to about $620 million per quarter this year.

At the end of September, AT&T announced a plan to sell the remaining 70% stake in DirecTV to TPG for $7.6 billion in cash in several installments between 2024 and 2029:

The cash payment of $7.6B from DirecTV and TPG will include $1.7B of pre-tax quarterly distributions in the second half of 2024; $5.4B of after-tax cash distributions and other payments not subject to tax in 2025; and $0.5 billion of final payments in 2029 of after-tax proceeds.

With the bulk of the cash to be received in 2025, AT&T should be able to reach its target of getting to a 2.5 net debt/EBITDA leverage by the second half of next year. The negative is that the sale reduces the cash flow to AT&T from DTV as an ongoing business by about $2.4 billion per year as well.

Capital Management

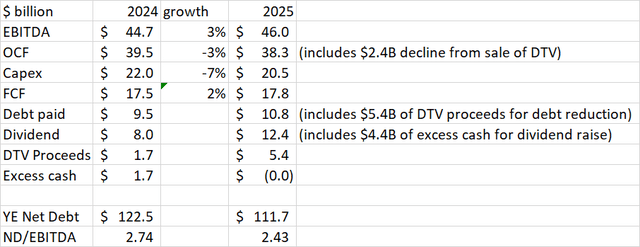

Not much has changed this quarter as far as AT&T’s financial guidance for 2024. Capital investment is now expected to be at the high end of the range, or $22 billion, but free cash flow is still expected to be at the midpoint of $17.5 billion thanks to good performance in Mobility and Consumer Wireline, partially offset by poor performance of Business Wireline.

I have updated the 2024 and 2025 cash flow forecast from my last article. For 2024 I incorporated the small changes above from company guidance, plus $1.7 billion of cash inflow from the DTV sale. For 2025, I am continuing to show base EBITDA growth of 3%, but this is now offset by the loss of the DirecTV distributions, around $2.4 billion. Capital investment goes down in 2025 as the company is no longer paying off large amounts of vendor financing. I assume the $5.4 billion of DTV sale proceeds is applied to debt reduction. This is sufficient to get net debt/EBITDA below the target of 2.5. That leaves $4.4 billion of excess cash that could be applied to dividend increases. The $10.5 billion available for dividends works out to $1.72 per share, or $0.43 quarterly. That is a 55% increase from the current dividend of $0.2775 quarterly.

I expect AT&T management to be more conservative with the dividend raise, waiting until later in the year and retaining some cash to make sure business is progressing according to this plan. Still, I expect some significant dividend raise in 2025, which should make the stock more attractive to income investors, further supporting the share price.

Valuation And Peer Comparison

The 2024 earnings estimate for AT&T remains at $2.20 per share per company guidance. At $22.50, AT&T is now valued at 10.2 times earnings, a jump from 7.6 times when I wrote my last article. Verizon’ EPS guidance is also unchanged at $4.60. With less multiple expansion than AT&T over the last 6 months, Verizon now has a lower P/E than AT&T, at 9.3 times. It appears that analysts have incorporated the loss of DTV income into their estimates for 2025, as AT&T is now estimated to earn $2.28 next year, or 3.6% growth. Verizon EPS growth estimates are still a bit lower, with analysts estimating $4.74 in 2025, or 3.0% growth. With its lack of legacy wireline assets weighing, it down, T-Mobile has a much higher P/E than either of the other two, at 23.4, and its EPS growth rate is also higher at 15.2%.

Looking at the debt picture of the three companies, AT&T has net debt/EBITDA of 2.8 at the end of 3Q, although this will be below 2.5 by the end of 2025 as noted above. Verizon has a reported leverage of 2.5, but this has not changed much in the past year and excludes secured debt. If we include the secured debt, leverage is around 3.0. T-Mobile reports leverage of 2.4, excluding tower obligations. If we include the tower obligations, T-Mobile’s leverage is around 2.6. T-Mobile has been making slight deleveraging progress, as the 2.4 compares to 2.7 a year ago.

When it comes to dividend yield, Verizon is the winner at 6.3%. Unlike AT&T, Verizon avoided a dividend cut and has been growing the dividend at about 2% per year. However, at a forward value of $2.71 per year, the payout ratio is 57% of next year’s earnings. AT&T now yields 4.9%. The dividend has not been growing, and in fact was cut by 47% at the time of the WBD spinoff. The payout ratio is a bit more conservative at 48.7% of next year’s earnings. Dividend growth prospects look better for AT&T, however. If the company went to the $1.72 per year discussed previously, the yield would be 7.6%, but the payout ratio would be uncomfortably high at 75.4%. If the company instead increased the dividend to a 60% payout ratio, the payment would be $1.368, for a yield of 6.1%, more in-lime with Verizon’s yield. With a recent 35% increase to $0.88 quarterly, T-Mobile now yields 1.6%, and the payout ratio remains low at 32% of 2025 earnings.

Conclusion

AT&T stock has made a nice run in the last 6 months while the company continues to pursue its growth strategy in wireless and fiber broadband. The company has been able to count on more loyal, higher-paying customers than its competitors to drive EBITDA growth in a competitive business. The upcoming final exit from DirecTV completes the divestment of non-core businesses and provides the cash injection to hit the 2.5 leverage target, enabling dividend growth to resume.

Considering the better earnings and future dividend growth of AT&T relative to Verizon, I now consider AT&T to be fairly valued with respect to its peer despite its higher P/E. The prospect of a decent dividend raise in the next year makes it my Buy pick for income investors. Total return investors may prefer T-Mobile due to its superior earnings and dividend growth despite its lower starting yield.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.