Summary:

- Taiwan Semiconductor Manufacturing Company Limited’s AI train isn’t slowing down, even as its foundry peers falter.

- TSMC’s technological edge, capacity advantages, and “insane” AI demand are expected to sustain growth.

- Geopolitical risks and AI overinvestment are critical risks but likely overstated.

- TSMC is still attractively valued, notwithstanding its recent surge.

- I argue why the stock remains well-poised to continue its rally, bolstered by its fundamentally strong thesis and appealing valuations.

JHVEPhoto

TSMC: Surged To A New High On AI Growth

Taiwan Semiconductor Manufacturing Company Limited aka TSMC (NYSE:TSM) investors have enjoyed a robust Q3 earnings release, which saw the stock reach new highs last week. I assess the market’s optimism as justified, as TSM notched an incredible one-year total return of 120%. Hence, TSM has strengthened its bullish thesis against its leading-edge foundry peers, driven by its market leadership in advanced process nodes. In addition, the reported struggles of Intel (INTC) and the challenges faced by Samsung (OTCPK:SSNLF) have likely convinced investors about TSMC’s fundamentally strong bullish proposition. With the AI infrastructure investments anticipated to be in the early stages of a multi-year expansion, I assess investors mustn’t jump off the TSM bandwagon so quickly, notwithstanding the potential of a near-term pullback.

In my pre-earnings article on TSMC, I highlighted why the market had anticipated a robust Q3 scorecard that the Taiwan-headquartered semiconductor leader didn’t disappoint. I also emphasized TSM’s relative undervaluation to its tech sector peers (XLK) as a potential re-rating opportunity. While the stock has pulled back from its recent highs as investors digested its recent post-earnings spike, I will enunciate why investors should consider adding more shares as its AI growth prospects take center stage.

TSMC: AI Foundry Prospects Increasingly Critical

In TSMC’s Q3 earnings release, management telegraphed its belief that the AI growth inflection is far from over. TSM also doubled down on its AI expectations that it would continue to build up capacity to meet the “insane” demand for AI chips, as indicated by Nvidia (NVDA) CEO Jensen Huang. As a result, AI revenue is expected to reach the mid-teens in 2024, propelling the growth prospects of its high-performance computing segment. The foundry leader has also underscored its commitment to strengthen its Foundry 2.0 framework as it pushes further into advanced packaging. Given the increasingly complex AI chips, TSMC’s advanced packaging is expected to be a critical growth vector, underpinning its non-wafer revenue in the years ahead.

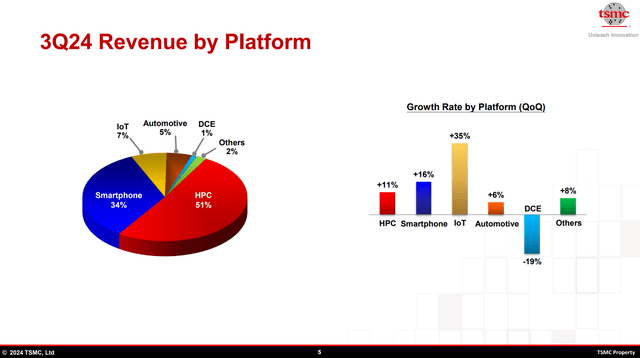

TSMC Q3 revenue segments (TSMC filings)

Although TSMC alluded to cyclical weakness in non-AI revenue segments, it seems increasingly likely that we could be close to a cyclical low. Texas Instruments (TXN) highlighted in its Q3 earnings release that downstream industrial and automotive customers have continued to digest their excess inventory.

In addition, Apple (AAPL) has experienced a revival in its China iPhone sales, driving improved investor sentiments in its pivotal CQ4 quarter. HPC’s growth has overtaken TSMC’s smartphone revenue segment and is expected to remain the most crucial driver. However, investors shouldn’t understate the transition to AI smartphones, spurring a potentially significant upgrade cycle for Apple in the upcoming years.

TSMC’s Technological Edge And Capacity Advantages

Moreover, TSMC’s bullish thesis has also been strengthened due to the struggles faced by its foundry arch-rivals (Intel and Samsung). While the deceleration in logic net bookings has impacted ASML Holding’s (ASML) EUV deliveries, TSMC could benefit from being able to potentially negotiate for lower prices. The foundry leader is also expected to continue “repurposing” its fab equipment to improve efficiencies and potentially lower the need to invest more aggressively in the near term in more expensive High-NA EUV lithography systems. Given the struggles of its arch-rivals, I assess that it should afford TSM more flexibility in its CapEx investments through 2026.

The company is expected to begin volume production with the leading edge nodes in Arizona in 2025. Hence, it should assure investors of its ability to diversify its production base and seek to mitigate the US-China geopolitical tensions.

Furthermore, TSMC’s technological edge and production capacity over its peers should help exercise the necessary pricing levers to maintain or even lift its gross margins over time. While margin dilution is anticipated as it scales its overseas fabs, it’s not expected to hurt its structural margins accretion opportunity. As the company continues to be at the forefront of the AI surge while its rivals struggle, it should benefit from improved yields. Hence, I expect TSMC to continue benefiting from increased capacity utilization on its leading-edge nodes.

TSMC: Upgraded Outlook Lifts Sentiments

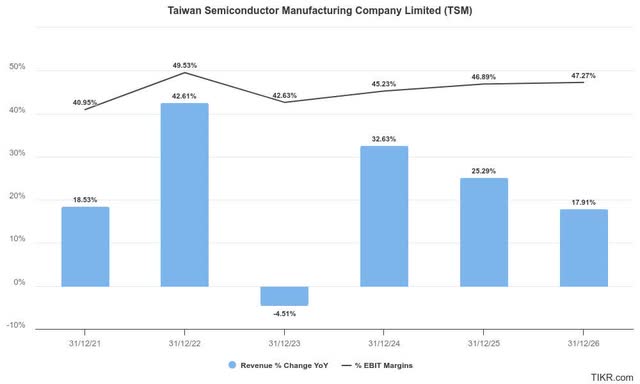

The foundry expects to deliver Q4 revenue between $26.1B and $26.9B. Wall Street estimates on TSMC have been lifted to reflect its upgraded outlook. Despite that, analysts expect revenue growth to decelerate through 2026, suggesting some pessimism has been priced into the stock.

The caution is justified, even as the AI growth inflection could intensify. Downstream AI monetization has become increasingly important, although the momentum remains uncertain. The recent underperformance in Microsoft’s (MSFT) stock likely underscores the market’s worries about how it could convert its massive hyperscaler CapEx into sustainable AI revenue opportunities.

Despite that, the iShares Expanded Tech-Software Sector ETF (IGV) has surged to a new high, suggesting the market isn’t unduly concerned with the pure-play SaaS companies. Hence, the market’s optimism on IGV forebodes well for TSM’s long-term AI growth prospects. In addition, the potential cyclical bottom of its non-AI segments and more robust AI smartphone upcycle metrics should continue to undergird its bullish proposition.

I assess TSM’s forward adjusted PEG ratio of 0.92 as too pessimistic, given its robust fundamentals (“A+” profitability grade) and growth prospects (“A-” growth grade). Investors are likely still concerned with geopolitical risks that could implicate its buy thesis. The recent report suggesting TSMC could have produced an advanced AI chip for Huawei could lift these concerns. However, TSM has refuted the allegations, corroborating its compliance with US export sanctions. Given the potential for more aggressive export restrictions against China, these uncertainties might affect a further valuation re-rating for the stock in the near term.

Is TSM Stock A Buy, Sell, Or Hold?

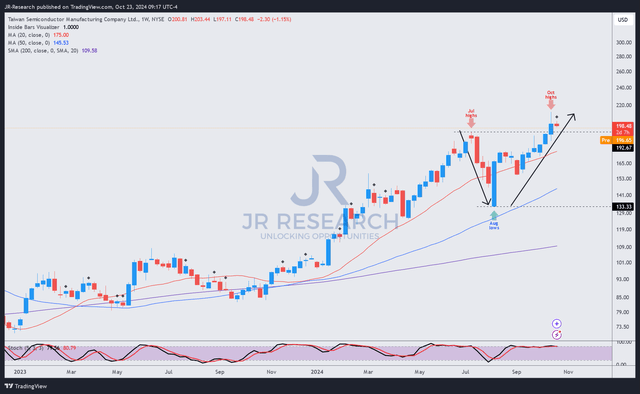

TSM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

TSM’s price action demonstrates a clear uptrend bias, with a potentially decisive breakout above its July 2024 highs. While still early, more conservative investors can consider assessing for a possible pullback to determine the subsequent consolidation levels.

However, I’m confident about its fundamentally strong thesis, undergirded by a relatively attractive PEG ratio. While AI overinvestment could torpedo its growth prospects, it isn’t my base case, given the robust demand dynamics from the hyperscalers. In addition, improved buying sentiments on the leading SaaS companies suggest the market is increasingly confident about the downstream monetization opportunities, proving another critical layer of support for TSM. As a result, I assess a possible near-term pullback in TSM as a solid buying opportunity for investors seeking to invest in the world’s leading pure-play foundry.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, NVDA, AAPL, META, ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!