Summary:

- Tesla, Inc.’s Q3 EPS exceeded expectations, with a significant EPS beat and margin improvement, despite a slight revenue miss.

- Tesla’s guidance for up to 30% delivery growth in FY 2025 and strong free cash flow margins support a strong buy rating.

- Tesla’s FCF grew 28X faster than its consolidated top line, gross margins expanded as well.

- Tesla’s valuation could rise significantly, potentially reaching a fair value of $293 per share, driven by delivery gains and improved profitability.

- Key risks include a potential failure to meet delivery growth expectations.

jetcityimage/iStock Editorial via Getty Images

Tesla, Inc. (NASDAQ:TSLA) reported better than expected results for its third quarter on Wednesday and delighted investors with its guidance for FY 2025, which includes strong projected delivery growth. Tesla beat bottom-line expectations by a good margin and convinced also in terms of its margin trajectory… which in recent quarters has become an issue of concern for some investors. With gross margins growing by almost 2 PP quarter-over-quarter and free cash flow margins materially improving, the risk profile for investors here remains widely skewed to the upside, in my opinion.

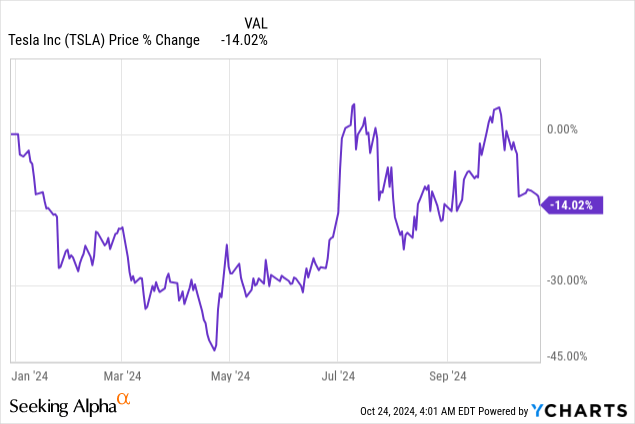

With shares dipping after the robotaxi event, but surging 12% after the Q3 earnings report, I believe investors may still be underestimating Elon Musk’s execution abilities.

Previous rating

I rated shares of Tesla a strong buy ahead of the company’s robotaxi event earlier this month, which ended up not meeting my expectations and which caused the electric vehicle company’s share price to drop: Strong Buy Before Robotaxi Event (Rating Upgrade). However, Tesla’s third-quarter deliveries were robust and the firm’s outlook for FY 2025 delivery growth made a very positive impression. Tesla’s guidance for next year as well as free its growing cash flow margins continue to support a strong buy rating, in my opinion.

Tesla’s blowout Q3 ’24 creates a narrative shift

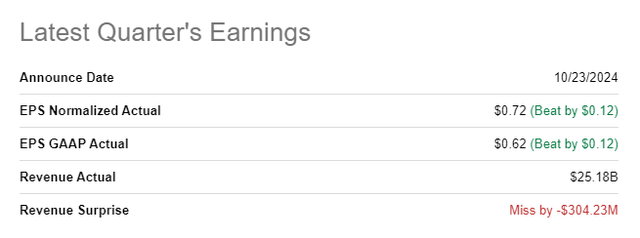

Tesla easily beat bottom-line estimates for the third-quarter: the electric vehicle company reported $0.72 per-share in adjusted EPS for the third-quarter on revenues of $25.18B. The top line, however, missed the average prediction by $304M.

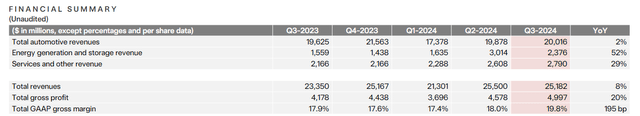

While Tesla missed top-line estimates and saw only a relatively small top-line growth rate of 2% related to its electric vehicle business, energy generation and storage boosted the revenue growth rate to 8% year-over-year. Importantly, Tesla benefited from a focus on cost reductions resulting in stronger margins, which have been at the center of growing concerns for the electric vehicle company over the last year. This is because more EV companies are now competing in the market, leading to price cuts that have affected the entire industry negatively. Yet, in the third-quarter, Tesla’s gross margins expanded to 19.8%, showing 1.8 PP growth quarter-over-quarter.

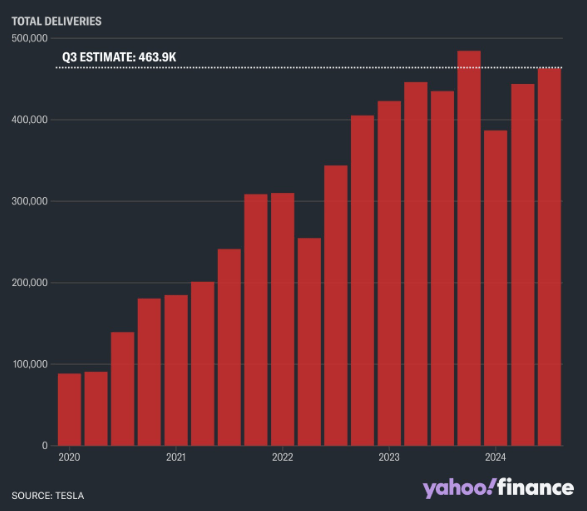

Tesla delivered 462,890 electric vehicles in the September quarter (+6% Y/Y) and has seen two consecutive quarters of delivery growth in Q3 ’24. Importantly, CEO Elon Musk clarified on the earnings call that he expects lower-price EVs to be produced in the first half of FY 2025. Further, Elon Musk projected that Tesla could see 20-30% production growth next year, which would fundamentally change the narrative for the electric vehicle company.

With Q3 ’24 deliveries growing only 6% Y/Y, in a difficult market, investors have been concerned about the company’s production and delivery trajectory (and the margin trend). An up to 30% annual production growth rate changes the narrative drastically because it would firmly establish Tesla as a growth play again. For the current fiscal year, Tesla expects to generate “slight growth” in deliveries, but since the market is forward-looking, the blowout guidance was a significant contributing factor to Wednesday’s 12% increase in Tesla’s share price in extended trading.

Yahoo Finance

Tesla made considerable progress in terms of its free cash flow (margin) as well, which was the second major take-away from its Q3 ’24 earnings release. The electric vehicle company generated $2.7B in free cash flow in the third fiscal quarter, showing 223% growth. This means that Tesla grew its free cash flow about 28X faster than its consolidated top line.

At the same time, Tesla’s free cash flow margins more than doubled quarter-over-quarter to 10.9% and increased 200% year-over-year. This growth in free cash flow profitability highlights Tesla’s underlying investment value, in my opinion, and together with its strong outlook for FY 2025, driven by lower-cost EV models, contributes to a major narrative change for Tesla.

| $ in millions | Q3’23 | Q4’23 | Q1’24 | Q2’24 | Q3’24 | Y/Y Growth |

| Total revenues | $23,350 | $25,167 | $21,301 | $25,500 | $25,182 | 8% |

| Net cash from operating activities | $3,308 | $4,370 | $242 | $3,612 | $6,255 | 89% |

| Capital expenditures | ($2,460) | ($2,306) | ($2,773) | ($2,270) | ($3,513) | 43% |

| Free cash flow | $848 | $2,064 | ($2,531) | $1,342 | $2,742 | 223% |

| Free cash flow margin | 3.6% | 8.2% | -11.9% | 5.3% | 10.9% | 200% |

| OCF-FCF conversion | 25.6% | 47.2% | -1045.9% | 37.2% | 43.8% | 71% |

(Source: Author)

Tesla’s valuation

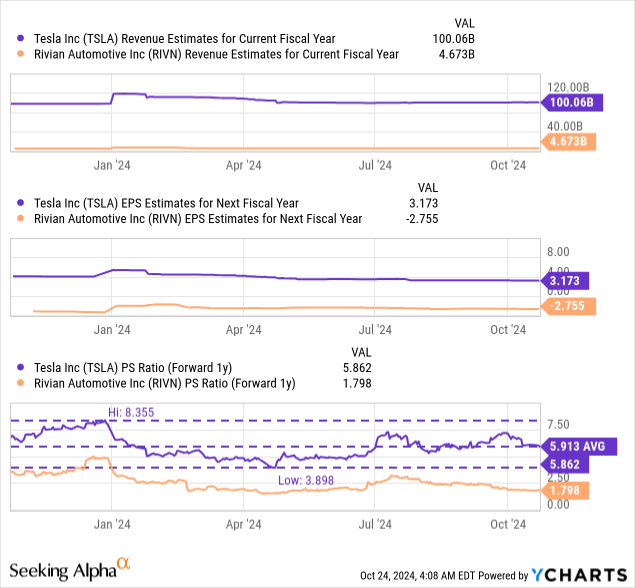

Tesla has been highly valued, despite recent margin concerns, as investors appreciate the dominant market position that Tesla has as well as its large delivery volume. The stock is currently valued at a forward (FY 2025) price-to-revenue ratio of 5.86X, which is below the company’s 3-year average P/S ratio of 5.91X, but only slightly. Rivian Automotive (RIVN) is trading at a much lower P/S ratio, but the EV company is not yet profitable and recently lowered its production guidance drastically, causing me down-grade Rivian’s shares to hold.

When investor sentiment regarding Tesla was better than recently, like at the beginning of FY 2024, shares of the electric vehicle company traded at a forward P/S ratio as high as 8.4X. Given the strength of Tesla’s most recent Q3 earnings release — driven by gains in terms of free cash flow, margin improvements and a blowout outlook for FY 2025 — I believe that Tesla could return to its previous valuation range.

If Tesla were to revalue to an 8.0X forward price-to-revenue ratio, shares could have a fair value of $293 per-share, implying 37% upside revaluation potential. In my last work on Tesla, I derived a fair value estimate of $288 per-share, based off Tesla’s 5-year historical P/S ratio of 7.8X. Given that Tesla is seeing margin growth, both in terms of gross and free cash flow margins, I also expect analysts to update their revenue and EPS estimates in the coming weeks, which could further support Tesla’s momentum.

Risks with Tesla

Elon Musk has been known to make optimistic forecasts in the capital markets, but overly rosy projections can quickly come back to bite you. Tesla has made significant strides in the last two quarters, however, and now finally managed to grow its gross margins and profitability. If the company fails to achieve Tesla’s optimistic outlook for FY 2025 delivery growth, investors are likely going to punish Tesla with a potentially brutal valuation draw-down. What would change my mind about Tesla is if the company were to see falling free cash flow and gross margins, or if Tesla were to delay the production start of its lower-cost EV models.

Closing thoughts

Elon Musk taught investors yet another lesson on Wednesday: Tesla, despite its gross margins flat-lining in the last year, is still very much a growth play. There were 3 major takeaways from Tesla’s third-quarter earnings release especially, in my opinion:

- Tesla reported a surge in earnings in the third-quarter, highlighting to investors that the electric vehicle company is already a widely profitable enterprise,

- The FY 2025 production is a major improvement for the investment narrative as well, and

- Tesla’s free cash flow growth and margin improvements are worthy of applause.

Tesla more than doubled its FCF margin Q/Q in Q3 ’24 and its overall profitability, both in terms of earnings and free cash flow, has improved considerably. The guidance for FY 2025 is likely the most impactful piece of information, as it could lead to a strong estimate revision trend for both revenue and EPS in the coming weeks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.