Summary:

- I reiterate a ‘Strong Buy’ rating on Tesla with a one-year target price of $303 per share, despite recent disappointments.

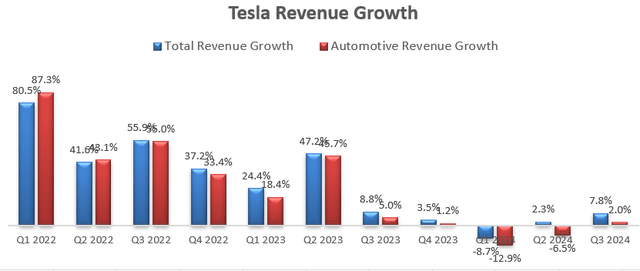

- Tesla’s Q3 results beat market expectations, showing 7.8% revenue growth and 24.1% adjusted EBITDA growth, indicating a moderate market recovery.

- I believe Tesla will sustain 25% revenue growth due to progress in Cybertruck production, AI-based FSD software, and energy transformation.

- While the Robotaxi event was disappointing, I remain confident in Tesla’s FSD AI training and positive outlook for FY24 vehicle production and delivery.

Hiroshi Watanabe

I reiterated a ‘Strong Buy’ rating on Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA) in my previous article published in September 2024, discussing their in-house 4680 battery technology. The market was disappointed by Tesla’s Robotaxi event on October 10th as the company didn’t present significant progress in their FSD and robotics technology. Despite these near-term disappointments, I remain confident that Tesla’s FSD will benefit from their massive AI training. Tesla delivered a robust Q3 result beating the market expectations. I reiterate a ‘Strong Buy’ rating with a one-year target price of $303 per share.

Disappointing Robotaxi Event and NHTSA Probe

Tesla hosted their Robotaxi event on October 10th and Elon Musk revealed that their robotaxi will be available by 2027 at a price under $30,000. In addition, they presented their humanoid Optimus robot and projected the robot will cost around $20,000 to $30,000 over time. It is reported that these robots were remotely controlled by humans during the event. Overall, I think the market was disappointed with the Robotaxi event, and Tesla has not proved any significant progress in their FSD technology as well as AI trainings.

As discussed in my previous article, I am confident that Tesla can leverage their massive real-road driving data to perform AI training, and the next version of FSD will be powered by AI inference capabilities.

On October 18th, the National Highway Traffic Safety Administration (NHTSA) started to probe the failure of Tesla’s FSD equipped EVs, covering about 2.40 million vehicles that include 2016-2024 Model S and X, 2017-2024 Model 3, 2020-2024 Model Y, 2023-2024 Cybertruck equipped with FSD, as reported by the media.

Interestingly, it is not the first time NHTSA initiated a probe into Tesla’s autonomous driving software. In 2021, NHTSA opened a probe into Tesla’s Autopilot software due to its repeated collisions with parked emergency vehicles. As a result, the agency pushed Tesla to recall more than 2 million vehicles, nearly all the vehicles it had sold at that time.

The government probe is a long process, taking several years. I guess Tesla might need a recall again sometime in the near future. If it is just software updates, Tesla could easily offer a software update to solve the whole problem. Overall, I think the NHTSA probe is manageable.

Q3 and Outlook

Tesla released its Q3 result on October 23rd after the market closed, reporting 7.8% revenue growth and 24.1% adjusted EBITDA growth, as shown in the chart below.

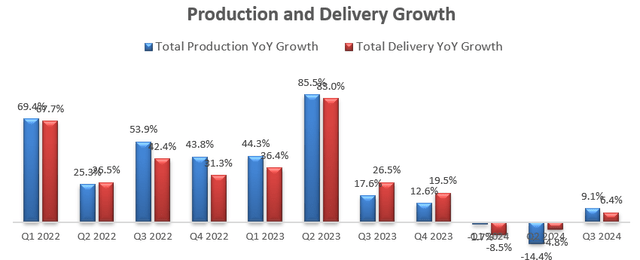

My biggest takeaway from the quarter is that Tesla expects slight growth in vehicle deliveries for FY24, demonstrating a moderate market recovery in the EV market. As shown in the chart below, Tesla reported a positive growth in production and delivery during the quarter, following two consecutive quarters of decline.

For the near-term growth, I continue to believe Tesla will sustain 25% revenue growth for the following reasons:

- Automotive: Tesla has made significant progress in its Cybertruck production ramp, which could potentially contribute significant growth to their overall production and delivery. I think Tesla’s differentiation comes from their future AI-based FSD software and in-house battery technologies. I project their automotive business growing in line with overall EV growth, delivering 23% year-over-year growth from FY25 onwards.

- Energy & Storage: I continue to forecast energy transformation will drive the business growth in Energy & Storage. I project the segment will grow by 50% in the near-term, considering the business is still in the infant stage.

- Services: I model the business sustain their 20% growth momentum, aligned with their recent trends.

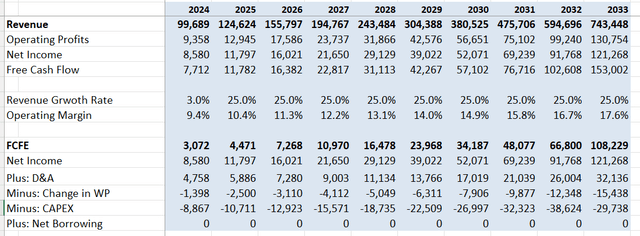

Putting together, I calculate Tesla can sustain 25% growth momentum in the near future.

I continue to model 90bps margin expansion for the DCF model. As discussed in my previous article, their in-house battery technology could potentially improve their gross margin over time. Tesla is still in the process of ramping the productions for Cybertruck and Model 3. With the production ramping up, I assume the company will begin experimenting margin expansion from the economy of scales. I project 60bps gross margin improvement and 30bps operating leverage from SG&A.

Due to the recent NHTSA probe, I set aside $100 million for the potential recall and penalties.

The cost of equity is calculated to be 16.8% assuming: risk-free rate 3.6%; beta 1.89; equity risk premium 7%.

With these assumptions, the free cash flow from equity (FCFE) can be calculated as followings:

Discounting all the future FCFE, the one-year target price is calculated to be $303 per share, as per my estimates.

Key Risks

While Elon Musk forecasts that robotaxi will be available by 2027, the robotaxi still has lots of hurdles including road safety policy changes, autonomous driving technology, insurance, and other potential third-party liabilities. In addition, the product launch of robotaxi will be dependent on Tesla’s AI-based FSD technology. In the near future, Tesla might postpone the timeline for their robotaxi launch, which could pose near-term pressure on their stock price.

Verdict

While Tesla’s Robotaxi event was a bit disappointing to the market, I am confident that Tesla is making progress in their FSD AI training. Tesla provided a positive outlook for their vehicle production and delivery for FY24, which could become a major catalyst for their stock price. I reiterate a ‘Strong Buy’ rating with a one-year target price of $303 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.