Summary:

- Apple’s latest iteration of iPhone has not seen demand which matches the hype created by analysts.

- Any underperformance in iPhone segment in the upcoming earnings could cause a significant correction in the stock.

- Apple’s VR bet is also falling behind, with low demand for the pricey Vision Pro and a strong product lineup of Meta.

- The recent $17 billion fine by EU could cause a domino effect of new regulations and fines which will hurt the margins.

- Apple is trading at the highest valuation multiple among the big tech peers while having a low revenue and EPS growth trajectory, which leaves little upside for investors.

Nikada/iStock Unreleased via Getty Images

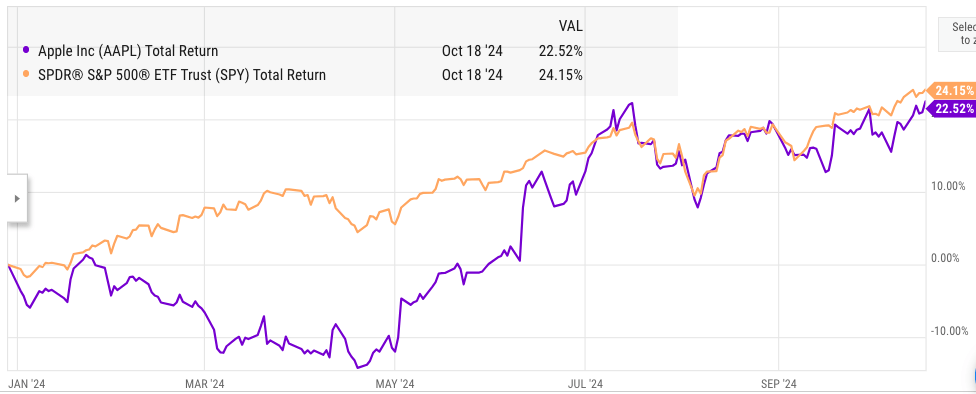

Apple (NASDAQ:AAPL) (NEOE:AAPL:CA) has made some big announcements this year, but the stock has performed modestly compared to the broader S&P 500 index. For YTD, Apple’s 22% total returns are slightly below the 24% total returns of S&P 500. Some analysts have noted that the demand for iPhone 16 is sluggish despite the hype around Apple Intelligence. Apple’s upcoming earnings date is on 31st October. If the earnings data shows a YoY decline in iPhone revenue, we could see a big bearish sentiment towards the stock. In the previous article, it was mentioned that Wall Street is getting more cautious with the company’s AI hype.

Apple is already facing headwinds against its Vision Pro device which is competing against Meta’s (META) lower-priced products. Meta has reported annual losses of close to $15 billion in its Reality Labs segment for the last few years and Apple would need to invest similar resources if it wants to gain a reasonable market share in this segment. Apple is also facing massive fines from EU and is already lobbying in order to get them reduced.

Apple’s valuation multiple is one of the highest among the big tech peers. On the other hand, Apple’s forward revenue and EPS growth projection are quite modest. If the earnings numbers are below expectations, we could see a major correction in the stock. Apple’s stock looks too pricey at the current valuation compared to other options available.

Sluggish demand can cause correction

Apple had hyped its new Apple Intelligence iPhone for some time. However, all the external data shows that the demand has been sluggish. According to TF Securities analyst Ming-chi Kuo the Y/Y pre-orders for pro models has been negative. A lot of bullish sentiment towards Apple stock relies on successful demand trajectory within the Intelligence iPhone lineup. If the YoY iPhone revenue declines in the upcoming quarter, it can cause a significant bearishness towards the stock. A YoY iPhone revenue decline of more than 3-4% can cause a big change in the narrative and may cause a strong correction.

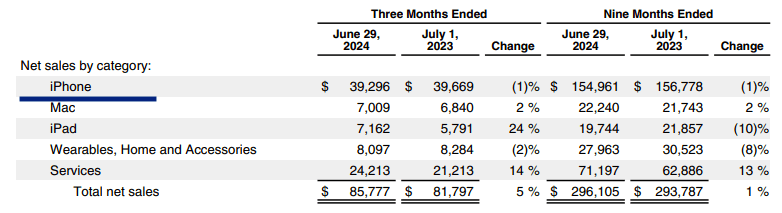

Apple Filings

Figure: Apple’s iPhone revenue in the last few quarters. Source: Apple Filings

Apple’s iPhone segment has already reported YoY 1% decline in the last quarter and for the first three quarters of the latest fiscal year. Apple still relies on iPhone segment for close to 50% of its total net sales. Apple’s iPhone forms the backbone for all other products and services within the ecosystem. A decline in this segment, despite the hype of AI services, could be a big headwind for the company.

Apple is already facing currency headwinds as mentioned by the management. Higher competition in China which contributes close to 18% of the total revenue is another challenge for the company.

YCharts

Figure: Apple’s stock performance compared to the S&P 500. Source: YCharts

Despite the bull run, Apple’s stock performance in YTD has been lagging behind S&P 500. Most of the stock price growth has been due to multiple expansion in the valuation. This increases the risk of a correction if key metrics come below the expectations.

Apple’s Vision Pro dilemma

Earlier this year, Apple had hyped the launch of its Vision Pro. Back in March 2024, I forecasted that the device would see modest demand. This has proven right as Apple reduced the orders for this device. Apple will find it difficult to compete against Meta’s product lineup in this segment. In the recent Meta Connect event, Meta reduced the price of its Quest 3S to $299. It is difficult to see how customers would be willing to pay 10X the price for Apple’s Vision Pro compared to Meta’s alternatives.

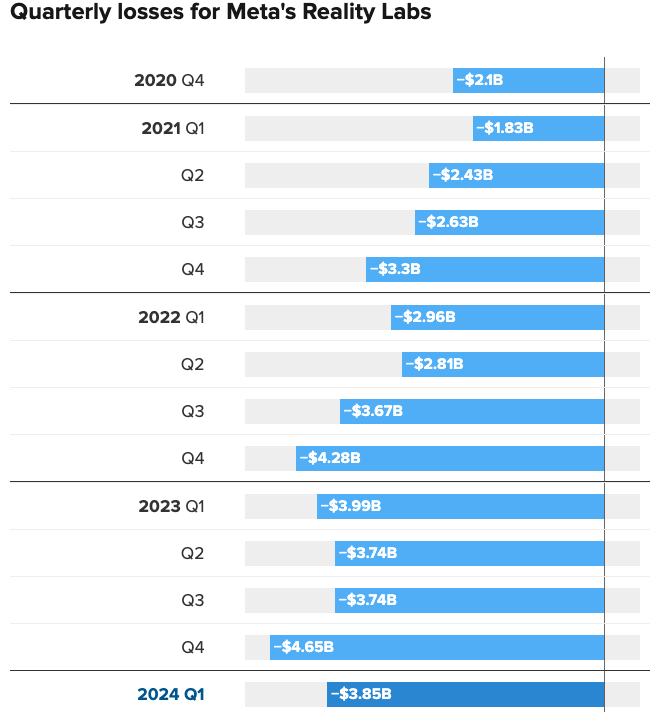

Meta has reported annual losses of close to $15 billion for the last three years. Apple would need to at least make a similar investment in order to build its VR segment. Apple’s management has been trying to protect its margins, and it is highly unlikely that the company would be able to absorb similar losses in order to build its VR business.

CNBC, Meta Filings

Figure: Meta’s losses in Reality Labs for the last few quarters. Source: CNBC, Meta filings

Even a cheaper Vision Pro might not be able to compete against Meta. We have already seen the poor performance of Apple’s smart speaker segment which was trying to compete against Amazon (AMZN) and Google (GOOG).

Pricey Valuation

Even the most bullish analysts for Apple will accept that Apple’s valuation is quite high compared to its historical average. The PE ratio of the last 10-year median for Apple stock is 20 while it is 28 for the last 3 and 5 years. On the other hand, the current PE ratio is close to 36. The forward EPS growth projection is nowhere close to justifying this elevated valuation level.

Figure: Historical PE and PS ratio of Apple. Source: YCharts

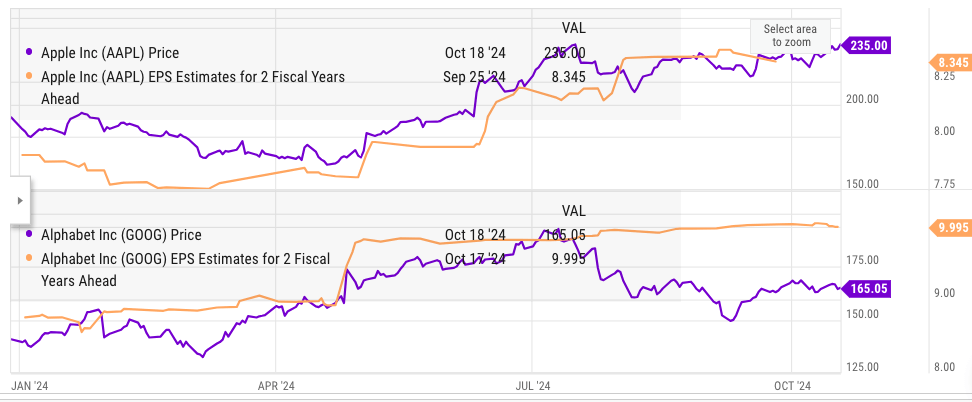

Seeking Alpha

Figure: EPS estimate of Apple for next two years. Source: Seeking Alpha

A simple comparison of forward EPS estimate of Apple and Alphabet shows how high Apple’s valuation has become. Alphabet’s EPS for 2 fiscal years ahead is $10 which makes the forward PE ratio equal to 16.5. Hence, Apple’s forward PE ratio of 28.1 for fiscal 2026 is 75% higher than Alphabet’s.

YCharts

Figure: Comparison of price and EPS estimate of Apple and Alphabet. Source: YCharts

Within the big tech group, Apple has one of the highest forward PE ratio. Even Meta, despite the recent bull run, has a forward PE ratio of 20 for the fiscal year ending 2026.

Apple’s revenue growth projection is lower than all other big tech players. Apple is also facing headwinds due to new fines and regulations. EU has recently announced a $17 billion fine on Apple, which can take up a big chunk of its EPS if it is finalized. Apple’s juicy commissions from App Store and licensing rights are also under threat from different regulators. At the same time, Apple’s China revenue base continues to be under threat due to geopolitical tensions and strong local competition.

Investors looking for a long-term buy-and-hold play in Apple stock need to consider these challenges. Any decline in iPhone sales or poor performance in Services can cause a correction in Apple stock from the current elevated levels.

Investor Takeaway

Apple has hyped up its recent iPhone iteration due to new AI services. However, external data shows that the demand has been sluggish. If Apple reports another quarter of YoY iPhone sales decline, we could see a big correction in the stock. Apple’s Vision Pro is also facing intense competition from Meta, which has invested over $15 billion annually to build the VR segment. A modest performance of Vision Pro can be another red flag for the company.

Apple’s forward PE ratio of fiscal year ending 2026 is 28 compared to only 16.5 for Alphabet. According to this metric, Apple is 75% more expensive than Alphabet while showing a significantly lower revenue growth trajectory. Apple’s current valuation is also elevated when we look at recent historical average for the stock. This increases the risk for investors and lowers the margin of safety. I believe there are few upsides to the stock at the current price while the company continues to show big risks due to fines, regulations, and higher competitive pressure.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.