Summary:

- I initiated my Alibaba stock position at its lowest point in January 2024, and it has since grown by 51.5%, outperforming the S&P 500.

- Despite recent declines, I maintain a “Buy” rating for BABA, expecting continued growth as China’s economy recovers and Alibaba’s diverse business segments show promise.

- Alibaba’s Q1 2025 report showed mixed results, but strong international commerce and cloud growth, alongside a robust balance sheet, support long-term potential.

- The forward PEG ratio, which accounts for P/E weighted on future EPS growth rate, indicates an undervaluation of nearly 28%. The cash-to-market cap ratio is still above 35%.

- I think Alibaba’s strategic investments and undervaluation present a compelling buy opportunity ahead of its fiscal Q2 report.

maybefalse/iStock Unreleased via Getty Images

My Thesis Update

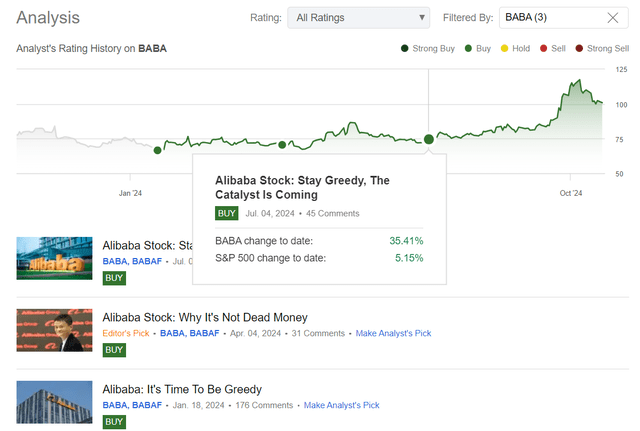

I was fortunate to initiate my coverage of Alibaba Group (NYSE:BABA) (OTCPK:BABAF) stock at the end of January 2024, during its lowest local price point. So in a way, I luckily managed to catch the local bottom for BABA stock at the time, and since then, it has grown by 51.5%, whereas the S&P 500 index (SPX) has increased by almost 22.4%. In my last bullish update on BABA, when the stock had only risen 8.8% since I began my coverage, I called for buying the dip as I believed Alibaba remained one of the most undervalued yet highly attractive opportunities available at that time. I saw a promising catalyst on the horizon that could “represent a turning point for Alibaba and the entire Chinese stock market.” And so it happened – China’s party leadership announced massive measures to stimulate the economy, enabling Chinese equities to make a huge comeback. Against all this backdrop, BABA stock couldn’t help but react with a sharp price rise:

Seeking Alpha, Oakoff’s coverage of BABA stock

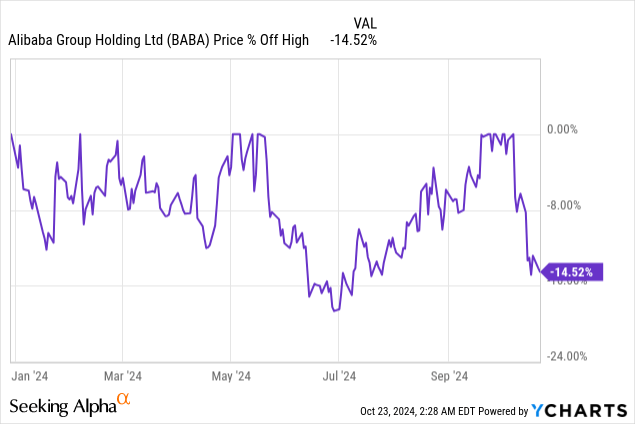

Recently, however, we have seen the stock’s sharp rise followed by a slight decline – the relief of the rally began in early October and continues to this day, with BABA stock down about 14.5% off its 2024 high:

However, I don’t believe that this relief will last long: In my opinion, BABA should continue to rise as investors return to China and the economy and the company’s diverse business advantages show signs of a sustained recovery. The upcoming Q2 numbers shall provide an additional catalyst to convince investors that BABA deserves buying. Hence, my “Buy” rating today, with a call to buy this little dip.

My Reasoning

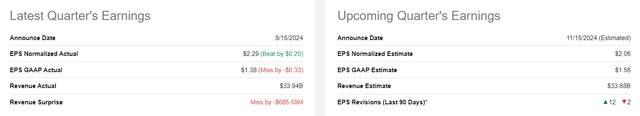

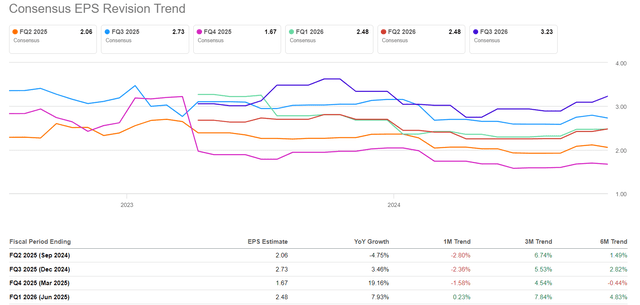

Alibaba Group’s Q1 FY2025 report (calendar Q2 2024) revealed mixed signals, with modest growth and resurgent challenges. The firm generated RMB 243.2 billion in revenue, a 4% growth over last year, but below the RMB 246 billion consensus forecast. In US dollars, revenue came in at $33.94 billion, which is also up 4% YoY but falls short of the $34.6 billion expected. Non-GAAP earnings per share of RMB 2.05 was down 9% YoY, but normalized $2.29 per ADS beat the consensus of $2.09, according to Seeking Alpha Premium. So we could see that the economic problems of China – such as high unemployment and declining consumer demand – continued to hit Alibaba’s main e-commerce business. On the other hand, Wall Street analysts started to revise their forecasts for Q2 FY2025 more actively, which is generally a good sign:

Breaking down the segments’ performance, we see that the Alibaba Chinese retail business (including Taobao and Tmall Group) went down by ~1% to RMB 107.4 billion, now accounting for ~47% of total revenue. This was mainly due to a 9% decline in direct sales despite a 1% increase in customer management. Adjusted EBITDA for this business declined 1% to RMB 48.8 billion, and EBITDA margin slightly rose to 43.1%. The strategic shift from a user-centric perspective and pricing wars have put pressure on margins, which typically fell between 40-60%. However, Alibaba’s management now expects that higher GMV will eventually increase revenue and margins. Prospective estimates are what we should care about the most, as the stock prices usually reflect the forwarding projections, not the past results.

The international commerce segment remained Alibaba’s star, with revenues up 32% to RMB 29.3 billion year-on-year, fueled by a 38% increase in international retail sales. Yet, this area recorded a negative margin of -12.7% which is a drastic decline from -1.9% at the same time last year, but I believe as the GMV expands, the margins should follow eventually.

Alibaba Cloud, another major area of interest for us, experienced a 6% growth in revenue at RMB 26.6 billion. Alibaba Cloud is focusing on increasing revenue quality by eliminating lower-margin contracts and taking advantage of the strong demand for public cloud and AI solutions. We already see some initial successes: Cloud’s EBITA jumped 155% YoY, and margins increased from 3.6% to 8.8%. I believe more to come, as the Western peers tend to earn times more in terms of margins (Amazon’s (AMZN) AWS makes 38% in EBIT margin, for example).

In spite of these growth opportunities, in the last few years, Alibaba has struggled a lot, especially in the e-commerce sector. It’s been falling short in market share to its peers such as PDD Holdings (PDD) and Douyin, who have penetrated into Alibaba’s longtime areas of dominance: beauty and fashion. Between March 2022 and March 2023, Alibaba’s market share in China’s online retail sales of merchandise declined from 72% to 62%, according to Morningstar Premium data (proprietary source, August 2024). This is due to increased competition and the move to Taobao, which has a lower take rate than Tmall. In the long term, these competition pressures will likely drive down the company’s monetization rates. But I think the GMV growth should smooth out the negative effect over time. In addition to that, the cloud opportunity, as well as the international commerce’s marginality expansion should make BABA’s financials stable enough for its management to keep rewarding the shareholders through buybacks and dividends.

Alibaba’s balance sheet looks quite healthy, in my opinion, with high cash resources and a strong cash flow mix from its e-commerce stores. The company is announcing a large share buyback program that it expects to expand by $25 billion to $35.3 billion over the next 3 financial years. This move is in line with the wider strategy to drive ROIC and remit more capital to shareholders. So this way, based on my calculations, Alibaba may repurchase nearly 15% of its market capitalization from the market over the next 3 years. Coupled with a small yet stable dividend of over 1%, this strategy should provide a comfortably attractive total shareholder return.

I believe Alibaba’s economic moat, the combination of a strong network effect and operational expertise, hasn’t been demolished in this competitive environment. The company is still monetizing its platform well and still has higher adjusted EBIT margins than other players such as JD.com (JD) and Pinduoduo.

For fiscal Q2 FY2025, BABA forecasts a gradual alignment of its core China commerce revenue with GMV growth. Alibaba also predicts strong revenue growth in the cloud, which will be driven by AI-related and core public cloud demand. The company is also geared towards streamlining its services and improving cross-selling between public cloud and AI solutions. So despite the difficult macroeconomic conditions in China, which are now expected to improve over the next few years, Alibaba remains determined to improve and capitalize on growth in the cloud and outside China.

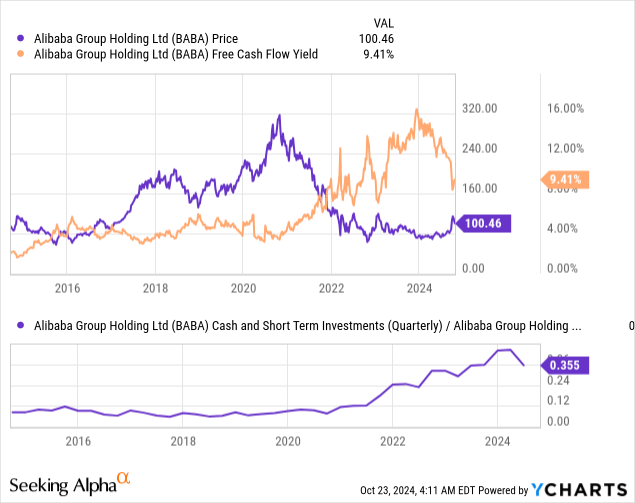

Despite its strong growth over the past several weeks, the BABA stock remains quite undervalued, in my view. Although its free cash flow to market cap ratio (i.e., FCF yield) has declined from ~16% at the beginning of the year to ~9.4% today, the total cash on the company’s balance sheet still exceeds 35% of its market cap. This suggests that the market continues to underestimate the company and remains skeptical of its recovery potential.

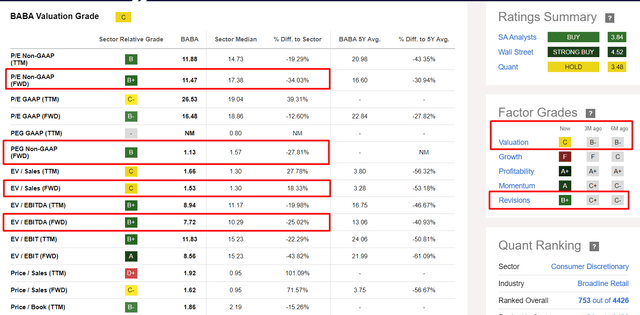

Meanwhile, if you examine Seeking Alpha Quant rating concerning Alibaba’s Valuation, you’ll notice it has shifted over the past 3 months indeed (while it’s not overly negative, BABA has become slightly more expensive). However, according to the key valuation metrics I focus on (I highlighted them below), it remains quite undervalued. For instance, the forward PEG ratio, which accounts for P/E weighted on future EPS growth rate, indicates an undervaluation of nearly 28%. Additionally, the company’s forwarding EV/EBITDA is 34% below the sector median. So I believe Alibaba would need to grow by about this amount to eliminate its margin of safety.

Seeking Alpha, BABA, Oakoff’s notes added

I think we might see an additional catalyst in the form of the company’s fiscal Q2 report (scheduled for release on November 15, 2024) to see the recovery’s continuation. Analysts are expecting BABA’s EPS to decline by almost 5% YoY, according to Seeking Alpha data. Furthermore, recent changes in EPS estimates suggest that Wall Street has become increasingly cautious about the company’s EPS growth prospects through the end of fiscal 2025:

I believe that, given the positive internal factors I’ve outlined above, the current environment is favorable for Alibaba to exceed analysts’ forecasts in Q2 at least. In my opinion, this could serve as a positive catalyst, potentially leading to a continued recovery in the medium term.

Risks To My Thesis

One risk lies at the macroeconomic level. The incentives recently announced by the Chinese Communist Party are a strong catalyst for market growth, as they’re expected to boost retail investor activity in the mainland’s stock market and stimulate the real estate sector. However, it’s important to remember that the debt burden in the Chinese real estate sector remains a major problem. So those incentives may only address the symptoms and not the causes of the economic challenges. If this is the case, I don’t believe that the negative effects plaguing the Chinese economy will disappear anytime soon.

The second risk relates to strong competition and Alibaba’s role in its niche markets. While the company’s broad diversification and growth in certain segments paint an overall positive picture, it can’t be ignored that Alibaba continues to lose market share to faster-growing Chinese companies in its key areas. If this trend continues, its stock price could stagnate or even fall further.

I also come to the conclusion that the company is undervalued. In my opinion, however, undervaluation alone is not a sufficient reason to buy the stock. Alibaba has remained cheap over the last two years, but this has not prevented the stock price from falling further and becoming increasingly undervalued. So there is a risk that this trend may continue.

Your Takeaway

Despite the numerous risks mentioned above, I believe that investors should consider adding to their positions in Alibaba stock after it has fallen slightly since the beginning of October. Although the company is indeed facing difficult times, I believe it has a clear plan for developing its key segments, increasing GMV, and improving profitability in areas that are currently unprofitable or marginally profitable. Given the scale and moat of the company and the significant investment it is putting into its further growth, I believe it’s inevitable that management will succeed in these efforts. This should result in the fundamentals eventually becoming a driving force for the stock’s growth in the medium term. The undervaluation that I identified about 3 months ago has decreased slightly but is still significant enough to warrant investors’ attention. Buying the stock today could still provide a margin of safety, in my view.

With all of this in mind, I believe the stock will continue to rally over the medium term, and the company’s fiscal second-quarter report could serve as a catalyst for that rally, especially if it beats forecasts as I expect it.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.