Summary:

- Airbnb’s strong financials, including $11B in cash and $1B+ quarterly FCF, highlight its robust business model and market dominance.

- Airbnb’s capital-light, lean operations and effective cash management, including $428M interest income, contribute to its financial health and shareholder returns.

- While international growth potential remains, cautious investment is advised until post-earnings performance clarifies future trajectory.

Flashpop

Raise your hand if you have already planned and booked your Christmas holiday. If you have, chances are you used Airbnb (NASDAQ:ABNB) or Booking (BKNG). After all, they hold the vast majority of the global vacation rental industry. In this article, we will focus on Airbnb, which is estimated to have a market share above 20%, with over 8M active listings that make it the largest short-term rental website.

Airbnb has been a strong conviction of mine since 2022 when I repeatedly bought it during its pullback from the ATHs above $210 into the $80s. Funny fact, while I had previously been a guest using the platform, I got more and more interested in it after reading Costco’s (COST) and Target’s (TGT) earnings reports that openly disclosed a surge in luggage sales.

Besides its healthy financials, currently sporting $11B in cash and holding another $6B in funds on behalf of its guests, while carrying only $2.3B in total debt, the company checks many of the criteria I use to identify long-term compounders. It has an enviable dominance, given by the network effect of its platform. We are constantly reminded that Airbnb grew mainly through word of mouth and guests enjoying so much their stays that, once home, they turned into hosts. Right now, Airbnb has the scale and the network to keep competitors out of this market. This is strengthened by the sense of community hosts and guests have when using the platform. It is an immaterial asset, but it is highly valuable because it creates stickiness.

Let me spend a few words on the cash held on behalf of customers. This is a free financing source. Airbnb receives the payment for a stay from guests right away after booking, but gives it to the host once the stay starts. So, Airbnb knows exactly for how long it will hold a certain sum. This implies that the company knows when it needs to credit it back to the host. In the meantime, it can do whatever it wants with that money. In a high-rate environment, Airbnb earned an interest income of $428M in H1 2024. Considering the company reported $819M in net income for the same period, we understand why these funds are a key part of Airbnb’s business model.

In addition, Airbnb still has to fully unfold its potential internationally: markets such as Germany, Brazil, and South Korea are still seeing their early innings.

Only recently has Airbnb started spending more on marketing, though it is earning the reputation of a cost-conscious company. In fact, while it spent $1.76B in FY23 vs. $1.1B in FY18, in FY23 sales and marketing spend as a percentage of revenues was 17%, while back in 2018 it was over 30%. At the end of 1H24, the company reported sales and marketing $1.09B, or 22% of sales.

This leads us to another quality Airbnb has: it is a capital-light and extremely lean business. At the end of FY23, it paid almost no interest expense ($83M) and D&A of $18M. It employs only 6,900 employees. This means the net income per employee is a staggering $701k. Booking, for example, reports “only” $208k of net income per employee.

Finally, compared to 2019, short-term rentals are up 83%, according to the UN tourism tracker. As more economies develop and a new global middle class arises, the demand for travel increases.

However, after Airbnb reported its Q2 earnings, the stock dropped steeply close to its 52-week bottom of $110. Since then, it has recovered to $135, but investors will be weary as we approach this earnings report. In fact, what caused some concerns was the weak Q3 guidance Airbnb released. In short, the company said it expected to deliver revenue of $3.7B (9% YoY growth), talking also of “sequential moderation in the YoY growth of nights booked”. Moreover, the company disclosed “some signs of slowing demand from U.S. guests”. Since Q3 is traditionally the strongest quarter, driving almost 35% of total revenues, investors weren’t pleased to read that in Q3, Airbnb expected its EBITDA to be flat YoY.

After all, the company’s multiples are demanding: fwd PE of 33, fwd EV/EBITDA close to 20, and fwd P/FCF of 24.7. These multiples are justified if the company keeps growing. Otherwise, they will contract.

Surely, the recent release of the Co-Host Network is a great feature for the platform, enabling homeowners to simply list their property while finding an experienced host in that area who will manage it. But this won’t affect Q3 and to see its impact I think we will need to wait one fiscal year.

What may build momentum for the company’s earnings could be, however, a shift in consumer behavior. Recently, Ellie Mertz – CFO at Airbnb – talked about “extremely strong near-term booking activity”. This is why Airbnb increased its marketing spend: it knows many people out there are looking but not booking. So, many tourists could have booked their stay in Q3 for Q3, not falling therefore within the guidance released at the end of Q2. However, I am a bit in doubt as to whether this may be a game-changer for the quarterly results.

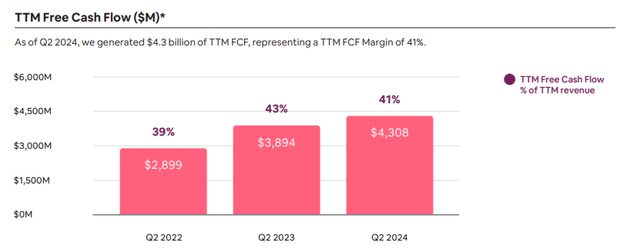

Let’s look at a few key financials, starting from the most important one. Airbnb is free cash flow positive, and it is generating a growing TTM FCF, averaging over $1B per quarter. If Airbnb’s FCF stays around 38% of the company’s revenue, we are probably going to see $1.4B in FCF for the third quarter. This means we could see FY24 FCF between $4.1B and $4.5B.

ABNB Q2 Shareholder letter

Most of this FCF is going to be returned to the shareholders. As Brian Chesky, co-founder and CEO of Airbnb, said during the Q2 earnings call

Our total trailing 12-month free cash flow was $4.3 billion, our highest ever. This strong cash flow allowed us to repurchase $749 million of our shares in the quarter. As of the end of Q2, we had $5.25 billion remaining on our share repurchase authorization program.

So, with a $5.25B share repurchase authorization, we can rightly expect a strong quarter from the point of view of buybacks.

The current consensus revenue estimate sees Airbnb growing 11.2% YoY for this fiscal year. But Q4 should report a 9% YoY growth to $2.42B. Let’s be aware that last year’s Q3 net income can’t be compared to this quarter’s because Airbnb had a tax benefit from the release of a valuation allowance of $2.8B. This means that Q3 EPS will be down by over 60% this year. But we should not be taken aback by the current consensus revenue estimate that sees Airbnb growing 11.2% YoY for this fiscal year. But Q4 should report a 9% YoY growth to $2.42B. Let’s be aware that last year’s Q3 net income can’t be compared to this quarter’s because Airbnb had a tax benefit from the release of a valuation allowance of $2.8B. This means that Q3 EPS will be down by over 60% this year. But we should not be taken aback by this number.

Regarding non-GAAP metrics, the most important one is GBV (gross booking value). At the end of Q2, it was $21.2B, representing an 11% YoY growth. Given what we have heard about softening activity and demand, we should closely watch this KPI and expect it to report double-digit growth. Last year, at the end of Q3, GBV was $18.3B and grew 17% YoY. Of course, the environment is normalizing, but if GBV doesn’t grow, the stock will be punished.

The bottom line right now is that Airbnb’s Q3 earnings are a bit dangerous. The stock trades at high multiples, with a lot of expectations baked into the price. A small downtick in its main – and healthy – financials and KPIs could send the stock back to $110 or lower.

The company is great, its business model is successful, its financials are superb, and its balance sheet is healthy, but here the risk is price. Currently, there is not a lot of margin of safety. Right now, I am not buying more shares before earnings, but I could if the stock dips once again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.