Summary:

- Amazon’s stock is up 14.42% since summer, driven by strong performance in AWS and resilient consumer spending in its retail division.

- Amazon’s focus on cost-cutting through long-term optimizations, including investing in mini nuclear reactors, aims to make AWS more efficient and lower energy costs.

- The investment in nuclear energy is expected to provide a stable, lower-cost power supply, enhancing AWS’s competitive moat and improving profitability.

- Despite potential public skepticism about nuclear energy, Amazon’s strategic move is seen as forward-thinking, making shares a strong buy.

Leon Neal/Getty Images News

Investment Thesis

Amazon’s (NASDAQ:AMZN) stock drifted higher since my last analysis, up 14.42% since I last covered the company over the summer.

Amazon continues to fire on all cylinders, with growth continuing to benefit from a handful of strong tailwinds. We’re really seeing this within Amazon Web Services (AWS) as well in their retail division, as US retail sales continue to power higher, reaching $714.4 billion in September – a 0.4% increase from the previous month and a 1.7% rise year-over-year.

Consumer spending feels far more resilient now, and I expect more investor confidence in Amazon’s retail operations as a result. This is not the biggest story going into earnings, however.

Amazon (as much as they are focused on growth) has become hyper-conscious on cost cuts. But these aren’t the normal ‘strip to the bone’ cost cuts we have seen at other Fortune 500 companies in their pursuit of higher EPS. Rather, these are long-run optimizations that are set to make their business fundamentally more efficient (and I think this will be a long-run cost advantage).

Amazon’s AWS has been looking to cut electricity costs as demand for data processing has exponentially increased due to the rise in demand for AI solutions.

Amazon is actively addressing these energy challenges by investing in the development of mini nuclear reactors to power their hyperscale data centers. Nuclear is increasingly becoming the preferred energy source. This has massive implications for data centers overall.

For Amazon, the $500 million investment ensures a stable and potentially lower-cost power supply. It comes at just the right time. Earlier this year, the company announced it will be spending $150 billion to build more data centers over the next 15 years.

With earnings around the corner, I think these investments are coming at just the right time. Amazon shares continue to be a strong buy as they invest more in the right types of innovation, and potentially increase the MOAT of AWS.

Why I’m Doing Follow-Up Coverage

Amazon continues to execute on many of the growth plans in AI that I outlined in my last piece back in August. As I noted in my previous research, Amazon is becoming one of the go-to places for companies to fine-tune their LLMs for their enterprise applications. It’s helping Amazon offset the fact they do not have a leading frontier LLM. Their cloud unit recently booked a 19% increase in sales amid an uptick in AI-driven projects in Q2.

I think there’s a lot of optimism surrounding AWS. But I think what is missing right now is how Amazon should (and looks like will) now prioritize cost management.

Electricity remains one of the single largest expenses for any data center, particularly with the increasing demand for computing power driven by AI applications. As I mentioned above, Amazon’s initiative to invest in small modular reactors (SMRs) will help mitigate their energy costs. I think this will lead to long-run better margins as nuclear allows them to better control the largest variable data center cost. On top of this, the barrier to entry for nuclear will help Amazon make it harder for new industry entrants to reach the economies of scale they enjoy.

The purpose of this follow-up coverage is to show how Amazon is building a new type of competitive moat with nuclear.

Why Nuclear Is A Big Deal

The AI revolution is in full swing at hyperscalers like Amazon. Data centers (like the ones owned at AWS) are expected to see their power demand multiply due to the surge in AI demand (and therefore electricity to power the GPUs that will host the AI models).

Many of America’s tech companies (now including Amazon) are investing in reliable carbon-free energy for their operations.

For Amazon, their investment agreements are specific. Amazon is investing in the development of nuclear energy around the deployment of multiple SMRs, which can be constructed and brought online faster than traditional nuclear reactors. Their broad investment plan includes collaborations with Energy Northwest to develop four advanced SMRs that could provide up to 960 megawatts (MW) of capacity. This will likely generate an expected 320 MW of capacity for the first phase of the project, with the potential to raise it to 960 MW total to support 770,000 homes in the country.

By some estimates, nuclear power is about 1/5th the cost to produce compared to gas (natural gas) generated electricity. And while it’s more expensive than renewable energy, it’s also more stable (in terms of supply).

According to an interview with AWS CEO Matthew Garman:

We see the need for gigawatts of power in the coming years, and there’s not going to be enough wind and solar projects to be able to meet the needs, and so nuclear is a great opportunity.

Also, the technology is really advancing to a place with SMRs where there’s going to be a new technology that’s going to be safe and that’s going to be easy to manufacture in a much smaller form

– Matthew Garman, CEO of AWS.

On the company’s official blog post, he also justified their decision:

Nuclear is a safe source of carbon-free energy that can help power our operations and meet the growing demands of our customers, while helping us progress toward our Climate Pledge commitment to be net-zero carbon across our operations by 2040…One of the fastest ways to address climate change is by transitioning our society to carbon-free energy sources, and nuclear energy is both carbon-free and able to scale-which is why it’s an important area of investment for Amazon. Our agreements will encourage the construction of new nuclear technologies that will generate energy for decades to come.

Earnings Preview

Amazon is set to report its earnings on October 31st after the bell, with consensus estimates indicating an EPS of $1.14 for Q3, reflecting a year-over-year growth of approximately 20.93%. Revenue is expected to come in at $157.27 billion, representing 9.91% growth.

While we are early into Amazon’s nuclear journey, I’ll be paying close attention to any nuclear mentions on the call.

Personally, given Amazon’s recent announcements in nuclear, I expect management to set the stage by talking about how much they pay for energy within AWS, so investors see this energy cost as a benchmark going forward.

As the demand for power increases, particularly with the growth of AI and cloud services, this benchmark will feed into management’s commentary on these nuclear projects and could provide us insights into their long-term cost control measures.

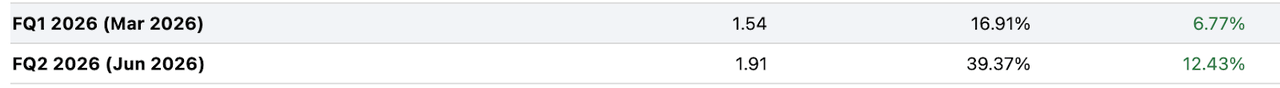

Personally, I think the market is already catching on (in part) to nuclear. EPS revision data for quarterly EPS tracking out into 2026 are starting to show a notable bump-up in EPS estimates over the last month. I think nuclear is helping power this (no pun intended).

Forward EPS Metrics (Seeking Alpha)

Valuation

Amazon’s current P/E is high when viewed through the lens of a traditional P/E ratio metric. The company currently sports a P/E of 40.17, well above the sector median of 17.16. To be clear, the market has rewarded Amazon with a forward P/E well above the sector median for years based on the expectation that forward revenue growth (and therefore EPS growth) would be strong. Now, based on cost efficiencies like going nuclear, I think the focus is going to shift from less on revenue powering a higher EPS, but now to EPS going up even as revenue growth slows based on efficiency gains.

Historically, Amazon has been underestimated on a PEG ratio. Their trailing 12-month PEG ratio of 0.2 is well below the sector median of 0.77. As a result, I think their forward PEG ratio should be about a 20% premium to the sector median to bake in the fact that the company will probably continue to beat expectations (now in part driven by nuclear) as a result.

The current forward PEG ratio is 1.81. If the forward PEG ratio were to increase by 20%, it would (obviously) imply a corresponding 20% increase in shares from here, and a PEG ratio of 2.17. Keep in mind, the median historical PEG ratio for Amazon is 3.12, so a 20% premium would not even mean the PEG ratio reaches the historical median.

Risks

I view Amazon’s relentless push for automation as forward-thinking and how they continue to live in ‘day-one‘ as founder Jeff Bezos describes his desire for the company to stay lean. However, in this case, nuclear power does not come without risks, particularly with lukewarm public perception and regulatory scrutiny surrounding the atomic energy form.

Nuclear energy remains a contentious issue here in the US. Historical incidents, such as the Three Mile Island accident in 1979, have left a lasting impression on public sentiment and brought real skepticism about the safety and viability of nuclear power.

Fortunately, for Amazon, public opinion is evolving. This evolution, in my opinion, may pave the way for greater acceptance of nuclear projects like the SMRs that Amazon is pursuing.

Bottom Line

Amazon (and their stock for that matter) has continued to execute both YTD and since my last piece of analysis, driven by strong performance in both AWS and rising consumer spending that has given investors confidence that the e-commerce giant can continue to trend higher.

Now, with their $500 million investment in nuclear energy to power their data centers, I think Amazon is taking the next necessary step in making their data centers far more efficient, lowering energy costs. Shares should benefit from this.

Nuclear energy presents a game-changing opportunity for Amazon’s cost structure.

Current estimates indicate that nuclear power can be produced for about 1/5th the cost of natural gas. This should lead to even more savings and help improve profitability at AWS as the data center service scales up from the immense demand for AI.

While some investors may be concerned that investments in nuclear energy could face the same negative public reception as the infamous Three Mile Island incident did in the US, I think the public in the US is now far more accepting of nuclear energy. We all know the effects of a warming planet (and also how unstable renewable energy can be). Amazon sees this too.

With this, I think shares continue to be a strong buy. Amazon continues to execute.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.