Summary:

- I discovered Etsy during the COVID-19 pandemic and enjoyed the platform, despite the long delivery.

- The company does not have very high-growth rates in terms of new customers and in terms of revenues.

- The management team lacks a clear strategy for enhancing the business operations and continues to offload shares.

- The current stock price is undervalued with respect to the company’s fair value, but it is too risky: I assign a “Hold” rating.

georgeclerk

Like most people, I also discovered Etsy during the COVID-19 pandemic. I bought a personalized kitchen apron for my mom; I enjoyed the platform, the graphic was neat and lovely, and the payment was smooth, but I remained troubled with the delivery time. It took almost two weeks to receive the package. Fortunately, I was looking for the gift a lot of time earlier than her birthday because, during the pandemic, there was a lot of free time. After receiving the apron, I deleted the app and never installed it again.

It was not because I did not like the overall experience, but simply because once things got back to normal, I do not have time anymore to plan for gifts three weeks in advance. I remember what I said to my mother in 2020: “If the company can improve its operations, particularly the shipping side, it could be a good investment”.

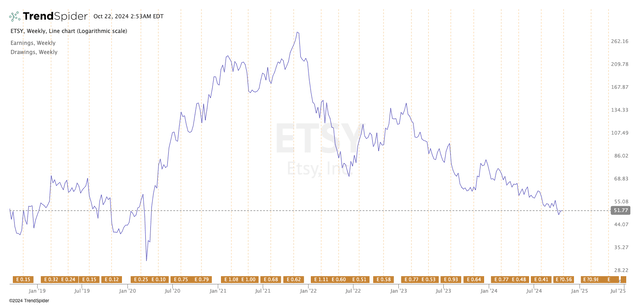

Since then, the stock price has increased to almost $300 per share and the reasons are twofold:

- The market rebound after the COVID collapse

- The enhanced performance of the company is mainly due to the arrival on the platform of people like me who just made one or two purchases and then uninstalled the app.

In the article I will first discuss the business strategy of the company, I will then analyze its financials, study the risks, and finally, I will conclude with a valuation.

Strategy

For those who do not know it, Etsy connects people looking for unique and personalized goods with independent sellers around the world. That is the unique strength of the brand, unlike other e-commerce, on Etsy, you can find something that is often handcrafted, personalized, and original.

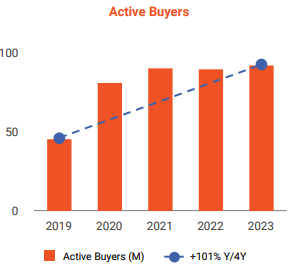

It is pretty straightforward to understand that the two most important assets of the company are the sellers and the buyers. Considering the company’s 2023 financial report it has around 7 million sellers and 92 million active buyers.

Both figures have increased a lot with respect to 2019, mainly due to the pandemic effect that forced people to buy stuff online. In particular, in 2023, the number of sellers increased 29% with respect to 2022 and 176% with respect to 2019.

The situation is similar for the buyers who have increased by around 3% from 2022 and around 101% with respect to 2019.

Active Buyers Trend (Etsy 2023 Financial Report)

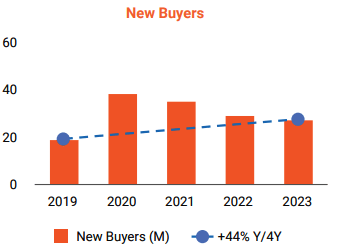

Let’s put it that way: the company did a very good job of retaining the highest number of buyers possible after the pandemic, but the number of new buyers is slowing. It looks like the company is not able to attract new customers, even though marketing expenses have increased by around 17% over the last couple of years.

New Buyers Trend (Etsy 2023 Financial Report)

More than marketing, I believe that keeping fees tight and reducing the delivery time is the best way for Etsy to attract new customers and enhance the GMS performance.

However, fees have always increased and have reached pretty high levels. You can find a lot of forums online or YouTube videos of people complaining about it. In particular, transaction fees are at 6.5% and every seller has a listing fee of $0.20 for every item listed for sale on the company website.

Competitors, on average, do have relatively lower fees. Facebook marketplace, for instance, has selling fees of 5% while on Vinted there are no fees at all for the sellers. This difference causes sellers to prefer these cheaper alternatives and inevitably buyers follow. After all, a marketplace is only as vibrant as the sellers who populate it. If sellers find better conditions elsewhere, the flow of both products and customers shifts with them, creating a domino effect.

The situation is not so different when taking into account the delivery time. The company estimates 3 to 7 business days for domestic deliveries in the U.S., while 10 to 30 business days for international shipments. I believe that in 2024, it is unacceptable to offer such a low standard for shipments, particularly in a very competitive industry such as e-commerce.

How can Etsy compete with Amazon Handmade, which, thanks to the Amazon fulfillment service, anything that you order arrives the following day?

Etsy used to have a competitive advantage some years ago, being the first e-commerce connecting artisans and small entrepreneurs with people looking for original and unique items. Now that other alternatives have arisen and offer either faster shipment or lower selling fees, I perceive that this competitive advantage has disappeared and the company will end up losing market shares in the future.

Financials

I prefer to observe the bigger picture rather than focus on quarterly results. At the end of the day, my investment strategy revolves around the long term rather than the short term.

Income Statement

To do things properly, I’ve decided to re-engineer the financial statements to have a clearer idea of the main accounting numbers.

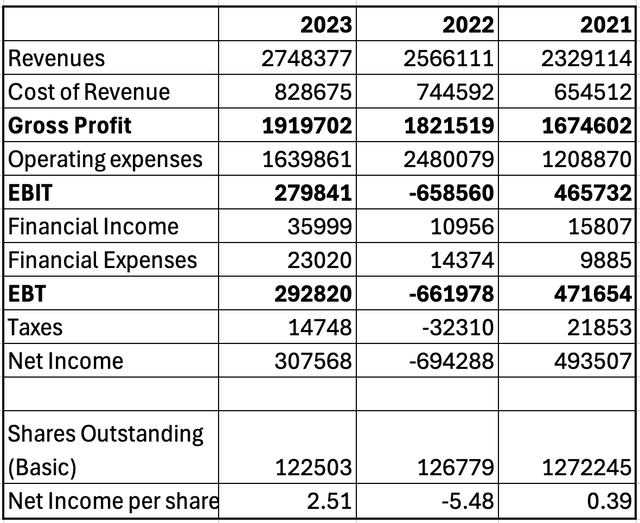

Re-engineered Income Statement (Author’s Calculations)

Since 2021, revenues have grown by 18%. This could be seen as a good result for someone, but it is not that good actually if we consider the inflation rate in the U.S. was pretty high over the last years: 4.7% in 2021, 8% in 2022, and 4.1% in 2023. In other words, the amount of products sold was pretty much the same in 2023 as in 2021, what increased was the price of the products sold, and the commissions retained from the sellers.

Both the cost of revenue and the operating expenses increased more than the revenues and, therefore, ended up lowering profitability margins.

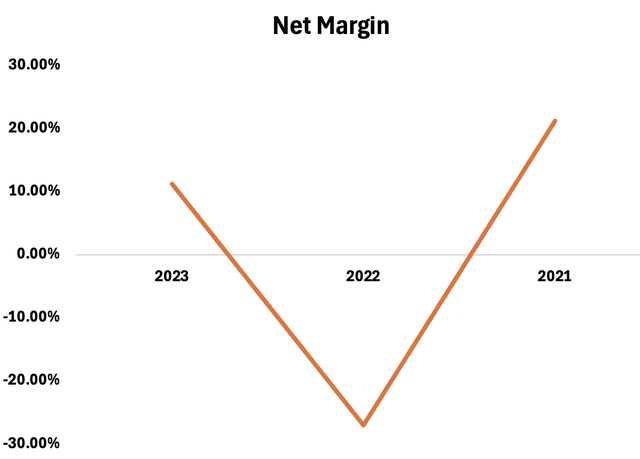

Net Margin Overview (Author’s calculations)

The situation is not so different when analyzing the 2024 first six months’ results. Revenues increased only 1.9% with respect to 2023 while net income decreased around 15% from the previous year. Considering the management’s forecasts and the general macroeconomic conditions, I do not see any major reverse of this trend anytime soon.

Balance Sheet

Etsy is a light capital business, unlike manufacturing or construction companies, it does not need a lot of assets to operate. This allows the company to have a lot of flexibility, reacting quickly to market changes or new opportunities that arise, but to be exposed to low barriers to entry that allow other companies to take part in the market segment without huge investments.

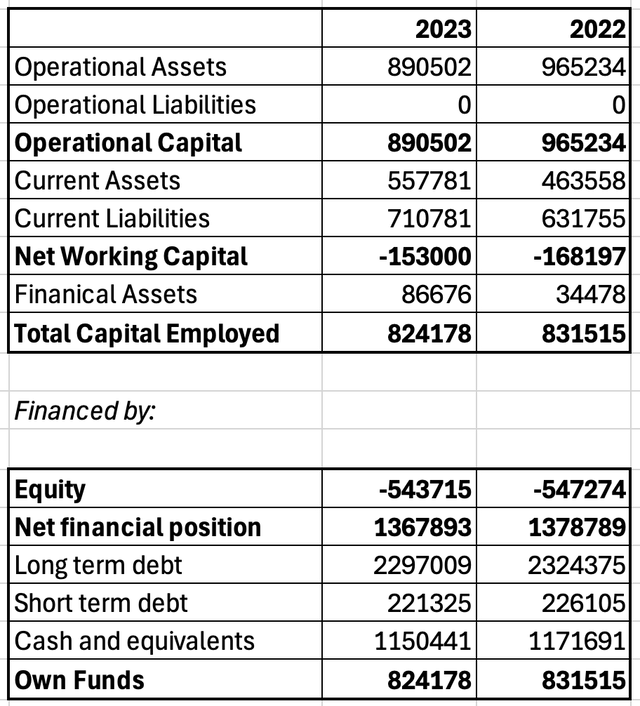

Re-engineered Balance Sheet (Author’s Calculations)

The real strength of the balance sheet is the negative net working capital. This means that the company has a lot of contractual strength with its suppliers and clients. This is perfectly in line with the company’s business model: the money is immediately collected from clients when they purchase, while the company pays the suppliers (the sellers in this case) later, usually between 14 and 20 business days.

The long-term debt is quite high and is approaching the maximum limit I’m willing to allow for a company: its debt-to-equity ratio is slightly over 2. However, I have to say that the interest on debt is not so high, it does not contribute so much to lowering the company’s profitability. To be precise, the company has three rounds of debt:

- 0.125% convertible senior notes due 2026

- 0.125% convertible senior notes due 2027

- 0.25% convertible senior notes due 2028

I believe that even though the amount of debt seems high at first glance, it is fine considering that the interests the company has to pay on it are very low.

Cash Flow Statement

Being light capital allows the company to limit its investments in capital expenditures, moreover considering its ability to have a negative working capital allows the company to have a very good cash conversion cycle, therefore obtaining a positive free cash flow.

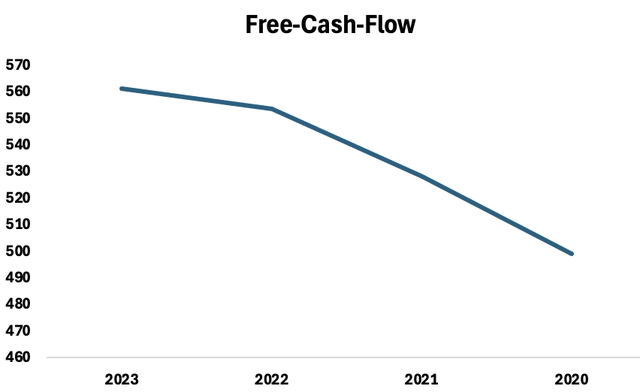

The company’s free cash flow has grown at just below 3% CAGR over the last 4 years. The TTM free cash flow right now stands at $600 million, which represents a solid 7% growth from 2023. Considering the company’s contractual strength, and its light capital business model that does not require major investments in CAPEX, its free cash flow can continue growing at a good pace also in future years.

This good result in the free cash flow, however, could be misleading for what concerns the company’s valuation, as we will see in the valuation paragraph.

Free Cash Flow overview (Author’s Calculations)

Risks

As usual, a complete list of risks can be found in the company’s annual report.

In this paragraph, I would like to shed some light on the management team’s ability to perform well in the future. I try to explain my idea a little bit better.

First of all, if you have a proper look at the 2023 financial report, on the opportunity side, you can find some very interesting hints about the prospects of the company. In this section, I would like to report three:

- Capturing more of our total available market;

- Continuing to expand beyond our top geographies;

- Continuing to retain and reactivate lapsed buyers.

Each of these points is then explained in detail in a paragraph; the problem is that the company spends all the words talking about the outcomes of such strategies rather than how to implement them effectively. It seems like a fairy tale in which the managers try to sell to themselves first and to shareholders later.

This situation reminds me of the Tattooed Chef failure in 2022. The management team at the time was similarly trying to sell a narrative that ultimately turned out to be completely hollow. Here, the situation is different because the company brings solid financial results. However, the guide imposed by the current management team does not really inspire me, and I would prefer to see a clearer long-term plan before deciding to invest in the company.

I see Etsy as a company with great potential to expand and grow, but I do not see the current management team as good enough to seize the opportunity.

Moreover, the company is subject to a pretty high level of insider trading, with a lot of directors and officers selling their shares. Even the CEO has sold a lot of shares during 2024, for a total value of almost $5 million. Seeing company officers dump shares in a young company with strong growth potential is one of the things I dislike the most. It makes me immediately steer clear of its stock.

Insider trading Etsy (TrendSpider)

Valuation

Considering the positive and growing free cash flow that the company can generate, I believe that the best way to analyze the company is through a dcf.

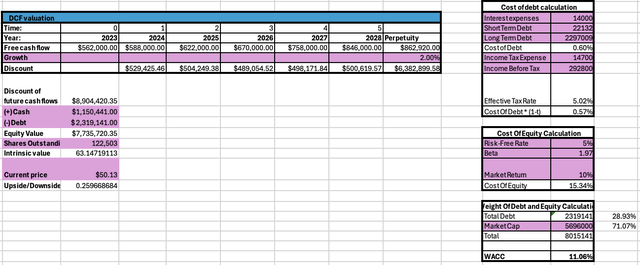

First of all, I computed the WACC as demonstrated on the right-hand side of the sheet, and I obtained an 11.06% as a result.

I went ahead by estimating the future free cash flows of the company. Considering that over the last 5 years, the company had a free cash flow margin of around 20.1%, I projected that multiple on future revenue estimates, obtaining the free cash flows reported in the table below.

Considering the WACC as our discounting multiple, projecting a 2% perpetual growth rate, and considering the net financial position of the company, I obtained an equity value of $7.7B. The result is around 25% higher than the current price, therefore concluding that the company looks slightly undervalued to its intrinsic value.

However, I feel like a 25% discount is not enough for me to pull the trigger when considering that the company management team lacks a clear strategy for enhancing the business operations and continues to offload shares. Moreover, the company already has high debt, and revenue growth continues to stagnate. That is the reason why I assign a “hold” rating to the company, and I wait for further price drops or a clear sign of operational improvements.

Etsy Valuation (Author’s Calculation)

Conclusion

Even though the stock price is compelling, I prefer to wait on the sidelines. At the end of the day, the only rule that you must follow as an investor is to not lose your money, and Etsy and its management team do not make me feel confident enough to pull the trigger.

I would prefer to see the company return to higher growth rates through a clear and efficient long-term strategy. I have to admit that, operationally, not much has changed since I was last interested in the company back in 2020. To conclude, I’d like to pose a question to the readers: Do you think the company would benefit from a new CEO?

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.