Summary:

- I see five catalysts for Palantir’s accelerated growth, including the launch of Warp Speed, new deals in healthcare and oil & gas, DevCon, and the emergence of a “Palantir Mafia”.

- Palantir’s new platform, Warp Speed, is a spin-off from AIP, aimed at manufacturing and supply chains. This expansion shows AIP’s scalability and opens new market opportunities.

- The upcoming DevCon, targeted at technical leaders, could accelerate Palantir’s commercial growth by engaging key technical decision-makers in prospective companies.

- Palantir’s rich valuation (Forward P/E above 100) could lead to a price correction if the company doesn’t significantly raise guidance. However, I view any dip as a buying opportunity.

- I have increased my stake to 1,860 shares and plan to reach 2,000 by November, reaffirming my bullish stance and $125 price target.

JHVEPhoto

I last covered Palantir Technologies Inc. (PLTR) in August, arguing how this company might be the world’s best AI stock and disclosing my plan to double my position from 1,000 to 2,000 shares.

I am updating my coverage of Palantir ahead of the next Earnings in early November, as I believe there have been significant developments on the product side and in terms of stock price action.

Thesis: 5 catalysts that lead me to think Palantir will report accelerated growth

Palantir is the single largest stock position in my portfolio. As such, I am a close observer of this company. Over the past three months, I’ve identified several key events that, I believe, will act as catalysts for accelerated growth. Here’s a breakdown of these developments, ranked by importance:

-

The launch of “Warp Speed”: A new backend software solution targeting manufacturing and supply chain issues.

-

The announcement of “DevCon”: A new developer conference, following the success of “AIPCon,” designed to showcase customer success stories.

-

New High-Profile Deals: Partnerships with industry leaders like Nebraska Medicine, APA Corporation, AT&T, Mount Sinai, and BP.

-

The emergence of a “Palantir Mafia”: A growing group of former employees successfully launching and scaling startups, similar to the PayPal Holdings, Inc. (PYPL) Mafia.

-

The 5th edition of AIPCon: The fifth commercial customer event of Palantir in just 18 months, displaying impressive customer results and success stories.

I will cover these elements in detail and explain why exactly I think they represent a catalyst for accelerated growth.

I still rate Palantir as a STRONG BUY, maintaining my long-term price target of roughly $125. I see the stock as an asymmetric bet on the company maturing rapidly and emerging as a leading AI SaaS player, potentially matching Salesforce in market capitalization.

However, a word of caution: Palantir’s current Forward P/E exceeds 100, suggesting that short-term growth expectations are already priced in. If the company reports any perceived weakness in the upcoming earnings, the stock could see a correction. I would view any post-earnings dip as a buying opportunity.

Catalyst #1: Warp Speed

Warp Speed is one of Palantir’s latest software platforms, specifically targeted at America’s manufacturing sector. Reportedly inspired by the operational strategies of industry leaders like Tesla, Inc. (TSLA) and SpaceX, Warp Speed should allow Palantir to address critical challenges in manufacturing and supply chains, offering advanced backend solutions that drive supply chain efficiency.

Close observers of Palantir will not be surprised about the company launching a platform dedicated to improving America’s supply chain in the manufacturing sector. Many of the success cases reported in AIPCon 4 had to do exactly with manufacturing and improving the supply chain operations of customers.

What interests me about the launch of Warp Speed is that it acts as a “spin-off” from Palantir’s AIP platform, which only launched in mid-2023. This, in my view, not only shows how AIP is scaling effectively and finding practical, real-world applications, but also positions Warp Speed to accelerate Palantir’s growth within the critical manufacturing sector.

In other terms, Palantir could have simply opted to keep selling AIP to manufacturing clients. Instead, it opted for spinning off Warp Speed to further accelerate its adoption. I would not be surprised to see further dedicated AIP “spin-off” platforms launched as more use cases become targetable in the upcoming months.

However, the main reason I view the launch of Warp Speed as the top catalyst is the range of markets it opens up for Palantir. Manufacturing is a broad term that encompasses virtually all operations involved in producing physical products. This sector is highly digitized and companies already utilize various software solutions, including the following:

-

Enterprise Resource Planning systems (ERPs) – a market worth roughly $55 Billion and growing at a CAGR of 11%.

-

Manufacturing Execution Systems (MES) – worth roughly $15 Billion and growing at a CAGR of 9%

-

Product Lifecycle Management systems (PLMs) – worth roughly $15 Billion and growing at a CAGR of 8%.

-

Programmable Logic Controller systems (PLCs) – worth roughly $20 Billion and growing at a CAGR of 6%.

I believe Palantir’s Warp Speed will, at the very least, complement existing solutions within these markets, much like it has done through its integration with Oracle‘s CRM software and certain of Microsoft’s Cloud solutions. In the longer term, Warp Speed or other Palantir solutions might even end up disrupting some of these markets by substituting existing legacy software altogether. This is part of a broader bullish scenario for Palantir that I am currently studying and that I might cover in future articles.

Catalyst #2: DevCon

In late September, Palantir announced DevCon, which the company defines as:

Palantir’s first Developer Conference for technical leaders and builders.

The reason I see this announcement as a potential catalyst is tied to how Palantir approaches the market and secures deals. Given the technical nature of its solutions, I believe key decision-makers at target companies will likely be Chief Technical Officers (CTOs) and other highly technical personnel.

Offering a dedicated event aimed at technical professionals could be a more direct approach to convincing key decision-makers and gatekeepers at prospective companies. I see this strategy as something that could potentially speed up the company’s ability to close new deals, leading to accelerated growth.

This contrasts with Palantir’s AIPCon events, which focus on showcasing real-world use cases and success stories to a broader commercial audience. I see AIPCon as a response to concerns about Palantir’s scalability. In contrast, I believe DevCon is specifically designed to drive faster commercial growth by targeting a technical audience.

While I’m not a developer and have a limited technical background, I plan to closely monitor DevCon in November to see if it leads to accelerated growth in attracting commercial customers.

Catalyst 3: New High-Profile Deals

I believe Palantir’s relentless commercial growth is also signaled by the sheer number of new deals that were announced in the past few months. While I obviously do not have a complete view of all deals closed by Palantir last quarter, I collected some commercial deals the company describes as “multi-million” contracts and I see them as of particular interest.

APA Corporation (APA) announced the renewal of a deal dating back to 2021 to expand the use of Palantir’s AIP within operational planning, supply chain management, maintenance planning, production optimization, and contract management. BP p.l.c. (BP), another leading oil & gas company, reported something similar, extending a strategic partnership with new AI capabilities.

I see these two deals as a sign that Palantir can drive growth not only by closing new customers, but also by retaining and upselling existing ones. Furthermore, the adoption of Palantir’s solutions by multiple oil & gas companies suggests to me that it is becoming a competitive advantage for those using it. In my view, this trend could lead to a ripple effect, where other companies in the sector may feel pressured to adopt Palantir’s solutions to remain competitive.

Nebraska Medicine and Mount Sinai, two healthcare companies, reported partnering with Palantir to improve patient throughput, expand claims reimbursements, and better monitor patient care. In the case of Mount Sinai, the company reported being able to shave off 1.5 days in average patient length of stay, resulting in a $1.5 Million ROI.

I am particularly interested in these two deals because I see Healthcare as a potentially underserved market that has a lot of potential in terms of digitization. I would not be surprised to see a healthcare-dedicated platform from Palantir in the future, if the company manages to keep penetrating this market in a scalable way.

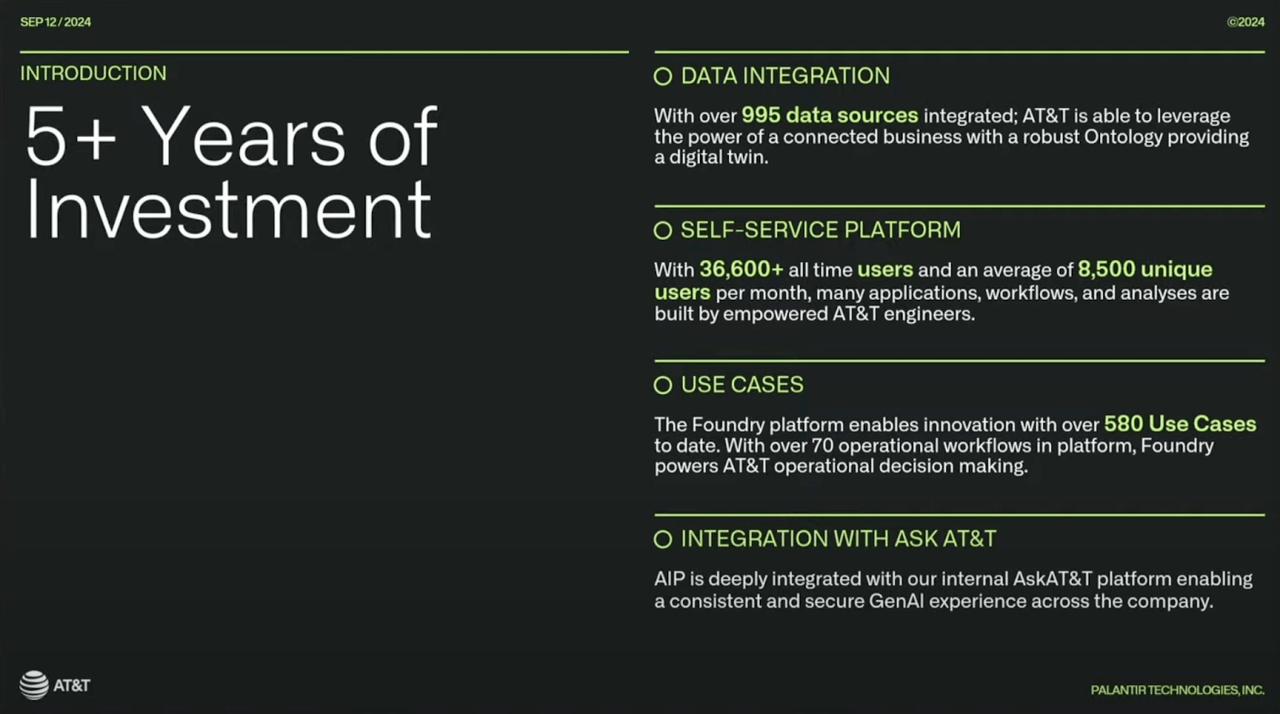

Palantir / AT&T deal details (Palantir.com)

While all the above deals are impressive, I am particularly impressed by Palantir’s deal with AT&T Inc. (T), whose details are reported in the image above and include data integration with almost 1,000 data sources and the deployment of an internal self-service platform that counts 8,500 users per month.

AT&T is a company that I see as hardly being an example of lean or particularly efficient management. The fact that Palantir was able to penetrate such a complex organization, I believe, is a testament to just how much value the company can add when integrating within existing systems.

Catalyst 4: “Palantir Mafia”

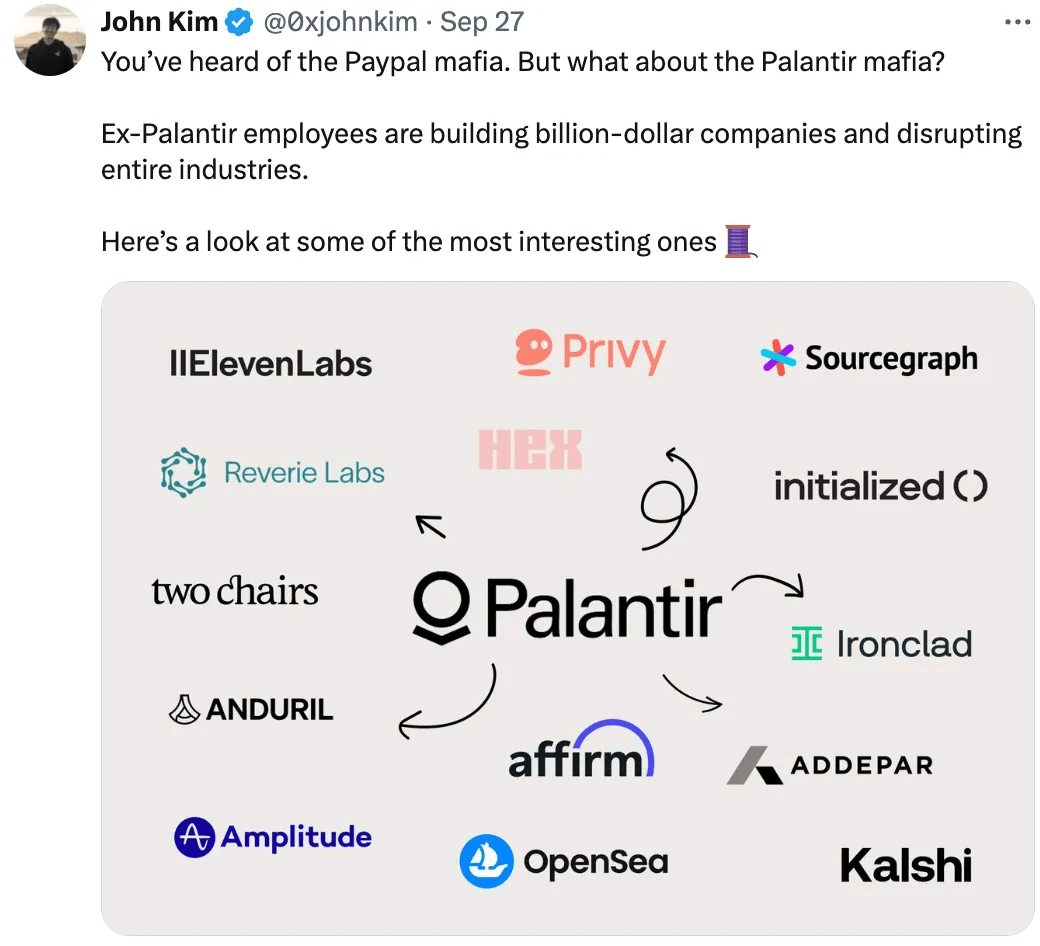

In the last few months, a similar phenomenon to the PayPal Mafia has emerged with what is being called the “Palantir Mafia.” This term refers to a group of former Palantir employees who have gone on to found or invest in successful startups, leveraging the experience they gained at Palantir. I see the rise of this group as a sign that Palantir has become a significant source of entrepreneurial talent, similar to how early PayPal employees later shaped the tech industry.

Companies founded by ex-Palantir employees (John Kim on X.com)

Several high-profile startups have been created by former Palantir employees. These include Amplitude, a product analytics platform that was co-founded by Spenser Skates, who worked at Palantir early in his career. OpenSea, the largest marketplace for NFTs, was co-founded by Alex Atallah, another former Palantir employee. Affirm, a buy-now-pay-later fintech company, co-founded by Max Levchin, whose network is closely linked to Palantir (and PayPal).

These former employees have not only launched successful ventures but are also attracting significant attention and capital in their respective industries. I think this is an indication that the skills and mindset developed at Palantir are highly transferable and valuable in creating scalable, impactful businesses. These companies are also building on technologies connected to data, analytics, and artificial intelligence, core areas of expertise of Palantir.

I see the emergence of the Palantir Mafia as an indication that the company is more than just a software provider or a “data visualization company”, as it was referred to in its early years. On the opposite, Palantir is cultivating a generation of entrepreneurs who are now shaping different industries.

Catalyst 5: AIPCon 5

More than 100 customers attended AIPCon 5, Palantir’s fifth commercial, customer-focused event held in September. I won’t go into detail about all the presentations, as that’s beyond the scope of this article, and I’ve already covered the major announcements in previous sections.

I mention AIP Con 5 as a catalyst because AIP, launched specifically for commercial users in April 2023, has already driven significant engagement. In just 18 months, Palantir has hosted five editions of this event, showcasing success stories and proving the platform’s scalability and traction.

With the recent launch of Warp Speed the event name might even have been made redundant (since “AIP” has seen its first spin-off, and it is not anymore the main platform for commercial clientele).

I see these events as a testament to just how quickly Palantir can scale its commercial customer base, and proof that Alex Karp knows what he is talking about when he says the company can 10X from current levels.

My expectations for November Earnings

Palantir is expected to report its Q3 earnings on November 4th. Given the five catalysts I outlined in the previous sections, I believe Palantir will at the very least meet analysts’ expectations, which are currently as follows:

-

EPS of $0.09 (vs. $0.09 reported in Q2).

-

Revenue of $703.69 Million (vs. $678.13 Million reported in Q2).

While I’ll be closely watching Q3 results -and wouldn’t be surprised if Palantir beats expectations- I’m particularly interested in what the company will say about the rest of the year. I expect Palantir to raise its guidance for Q4 2024, driven by the recent launch of Warp Speed and the successful scaling-up of its solutions for commercial customers.

I expect Palantir to report solid earnings, but I also anticipate volatility due to the stock’s significant appreciation in recent months, which, I believe, is now pricing in a best-case scenario of earnings beat and guidance raise. This is also the main risk to my thesis, which I will address in the next section.

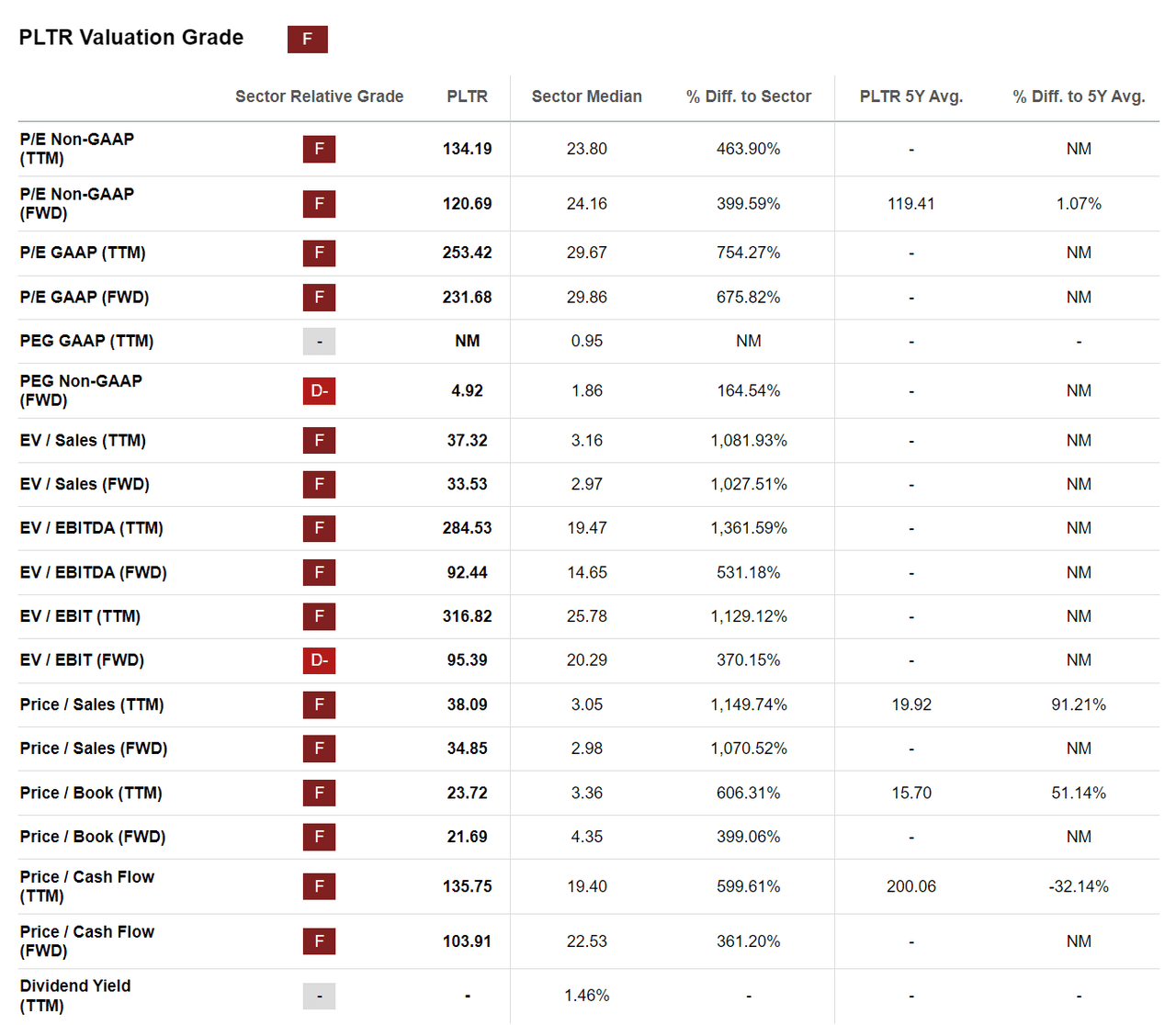

Risks to my thesis: Palantir’s valuation is (very) rich

No matter the way I look at it, I believe Palantir’s recent run has made the company very expensive based on current financials.

Palantir Valuation Grades (Seeking Alpha)

Unsurprisingly, Seeking Alpha assigns Palantir an F for valuation, as its sector-relative valuations are in the top percentiles.

To be clear, I’m not concerned with short-term volatility or whether the stock is already pricing in accelerated growth. I still believe the company has the potential to grow to match Salesforce’s market capitalization, which aligns with my target of $125 per share. I detailed this thesis in my first article on Palantir.

However, for investors who are cautious about volatility, I believe entering Palantir at these levels might not be ideal. While I do not expect a miss on either revenue or profit, I believe the current valuation could still warrant a correction. That might happen even if the company doesn’t significantly raise its guidance in the next earnings report.

Personally, I would view any correction as a buying opportunity, given my long-term target. Still, the stock’s rich valuation is a point of caution that potential investors should carefully consider.

Conclusion (and a note about my current position)

I believe Palantir has demonstrated impressive growth in expanding its commercial customer base. The fact that they are already spinning off a dedicated commercial platform from AIP, with the launch of Warp Speed, is a catalyst that, I think, is currently underestimated by most investors and analysts.

Additionally, I see several other catalysts (including new high-profile deals in key markets) that convince me of my original investment thesis and price target of $125 per share. This represents roughly 3X from current levels, and that’s why I keep rating Palantir as a STRONG BUY, seeing it still as an asymmetric investment opportunity.

Personally, I have increased my stake in Palantir from 1,000 shares in August to 1,860 shares at the time of writing. While I haven’t yet fully doubled my position as I planned, I expect to reach that goal by adding more shares in November.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.