Summary:

- Pfizer’s Q3 consensus estimate is likely to be exceeded as the successful integration of Seagen assets and the deleveraging efforts should lead to stronger EPS growth in the coming quarters.

- In Q2, we saw that management’s approach is effective as they have successfully reduced operating costs relative to sales, resulting in higher margins.

- PFE has raised adjusted EPS guidance for 2024, now expecting adjusted EPS of $2.45-2.65, up from $2.15-2.35, moving the middle of the range up $0.30.

- When focusing on key valuation multiples for the upcoming year (i.e., on a forwarding basis), Pfizer shares are trading at a 28-48% discount compared to the medians of the healthcare sector.

- Overall, I maintain my bullish rating on PFE stock and look forward to the company’s Q3 2024 results.

georgeclerk

My Thesis Update

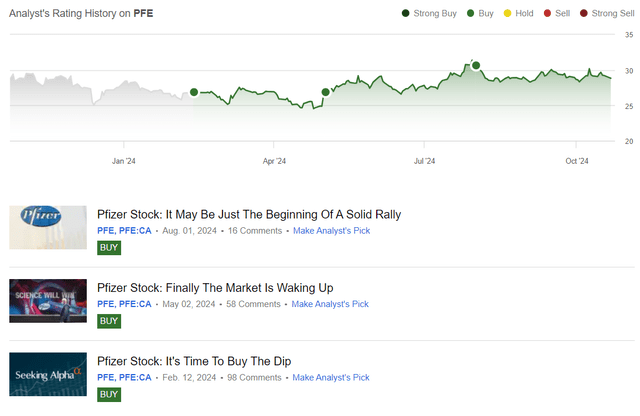

I initiated coverage on Pfizer (NYSE:PFE) stock with a “Buy” rating, stating that the company’s low valuation and strong product pipeline make it the ultimate buying opportunity for income investors in the healthcare sector. In early May, I updated my thesis, noting that the market started to finally wake up on PFE’s prospects of continued growth from non-COVID drugs and potential margin expansion. My last bullish update came out in early August, not long since the firm released its Q2 FY2024 results. In that research piece, I argued that PFE’s cost management initiatives seemed to be progressing faster and more efficiently than one would have thought a few quarters ago. At that point, however, Wall Street analysts were still giving very modest EPS growth forecasts for the next few years, setting the stage for a potential EPS beat in the coming quarters. Unfortunately, my buy recommendation in August came to nothing and the stock underperformed the broader market:

Seeking Alpha, Oakoff’s coverage of PFE stock

Despite that underperformance over the past 2 months, I believe Pfizer stock still deserves its “Buy” rating. In my opinion, the company is likely to exceed the third-quarter 2024 consensus estimates, as they still appear quite low to me.

Why I Remain Bullish On Pfizer Stock

Since Pfizer hasn’t yet provided the market with new financial data for analysis, I’d like to briefly revisit my analysis from 2 months ago (for more details please take a look at my previous article, linked above).

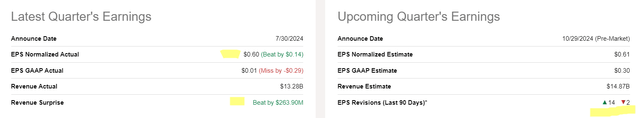

As you may recall, PFE reported revenue of ~$13.28 billion and adjusted EPS of $0.6, beating market consensus estimates by 2.02% and 30.19%, respectively, according to Seeking Alpha Premium data. These results led to massively positive corrections – 14 out of 16 analysts raised their expectations for Q3:

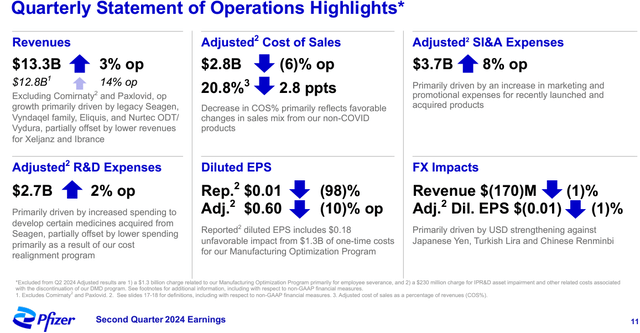

In my opinion, Pfizer’s Q2 results showed the trajectory looking positive for the company even with COVID-19 products excluded. PFE’s revenue grew for the first year in a row since Q4 2022 (was up 14% YoY), and the majority of the increase was attributed to products like Nurtec, Vyndaqel, and Eliquis, plus Seagen’s portfolio. Their Oncology segment in particular was quite fast and is on track to close out at $4 billion in sales and the Specialty Care segment hit the $4 billion mark for the first time since late 2021.

The consolidated gross margin (on an adjusted basis) increased from 76% to 79% due to a good mix of revenues and cost control. OPEX (operating costs) were up slightly (+5% YoY), which is a sign of better cost management if you ask me. The company’s Manufacturing Optimization Program and cost realignment efforts are on pace to provide substantial savings, at least $4 billion in net cost savings by the end of FY2024, the management noted. This efficiency-focused focus, paired with Pfizer’s targeted product launches and market share lead in areas such as paediatric vaccines, point to ample margin potential.

So all that strength in high-growth areas enabled Pfizer to exceed estimates and compensate for gaps in Primary Care. I believe the strategic focus on these markets and the company’s integration of Seagen put it in an excellent position for growth going forward, especially as it shifts its focus away from COVID.

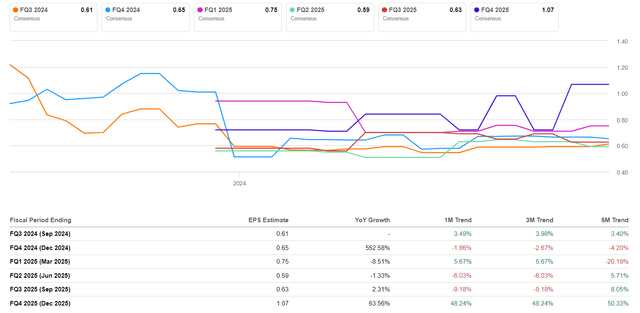

Now, one of the most important points is how market expectations have shifted regarding the success of Pfizer’s product pipeline in 2024/2025. I want to avoid exaggeration here – the next-quarter estimates improved indeed (marginally though, by just 3.4% over the past 6 months). However, what I noticed is that for FY2025, the market isn’t making any grand plans or expecting outstanding results from Pfizer. Yes, we see that Wall Street expectations for Q4 2025 have increased by ~50% over the past 6 months. However, for Q1, Q2, and Q3 2025, we see a decline in expectations when considering the medium-term horizon:

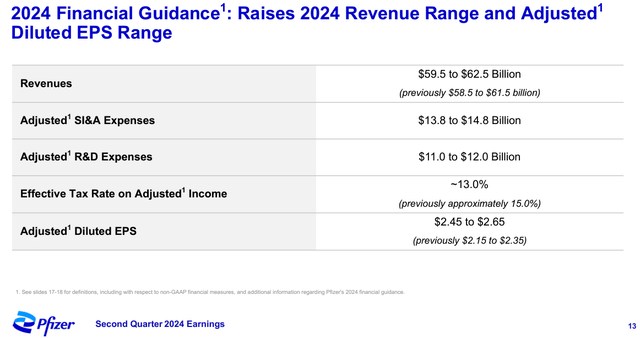

Based on quite strong Q2 results, we know that PFE raised its adjusted EPS guidance for 2024: they now expect adjusted EPS of $2.45-$2.65, raised from a prior $2.15-$2.35, thus lifting the midpoint of the range by $0.30. It also raised its guidance for revenue to $59.5 billion-$62.5 billion, from the prior $58.5 billion-$61.5 billion. Including contributions from Seagen and excluding COVID products, Pfizer now expects revenue growth of 9%-11%, raised from a prior view of 8%-10% (that was provided in January).

With the Q2 results being very solid, we now know that PFE has raised adjusted EPS guidance for 2024: adjusted EPS $2.45-2.65, up from $2.15-2.35, moving the middle of the range up $0.30. It also raised revenue guidance to $59.5-62.5 billion from $58.5-61.5 billion earlier. Including Seagen contributions (COVID products excluded) Pfizer now projects revenue growth of 9-11% versus earlier estimates of 8-10% that were announced in January:

So I don’t view the increase in Q3 2024 consensus estimates as particularly extraordinary or overly optimistic from Wall Street’s side. On the contrary, considering the management’s own upward guidance adjustment and the strong Q2 results, the Q3 consensus increase over the past few months might not fully reflect the company’s true potential. In other words, I believe Pfizer has a good opportunity to positively surprise investors when it announces its results on October 29, 2024.

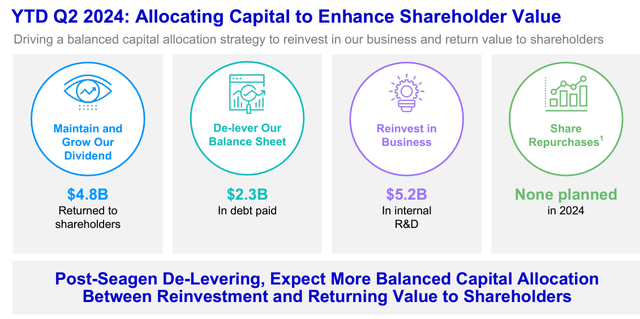

In the medium term, I expect continued integration of Seagen’s assets, particularly in clinical and research areas. The CFO David Denton indicated recently that this area presents significant opportunities for growth and expansion, which should ultimately contribute to a substantial increase in the consolidated company’s revenue growth rate. Also, Pfizer is focused on paying down debt following its major acquisition of Seagen and has set a leverage target of 3.25x by 2026, which I believe is quite feasible. Once this goal is achieved, the management plans to balance further between dividends, CapEx, and share buybacks. Historically, the company has managed this balancing act well, and I anticipate that in the future, it will allocate more funds to reward its shareholders.

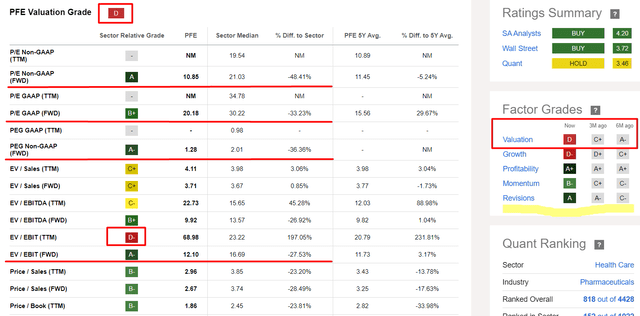

In my earnings preview, it’s essential to discuss the current state of the company’s valuation. According to Seeking Alpha’s Quant System, Pfizer’s Valuation grade has decreased over the past 3 months from “C+” to “D”. However, a closer look reveals that this decline is primarily due to a single multiple – EV/EBIT on a TTM basis. When focusing on key valuation multiples for the upcoming year (i.e. on a forwarding basis), Pfizer is trading at a 28-48% discount compared to the medians of the healthcare sector. Meanwhile, the EPS and sales estimates have consistently been raised recently, therefore, I don’t see any clear negatives here.

Seeking Alpha, PFE’s Valuation, Oakoff’s notes added

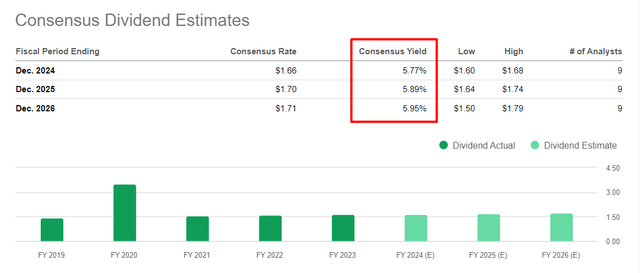

Regarding the company’s dividend yield, two months ago, I noted that the consensus dividend yield for 2025 was ~5.64%, which seemed quite favorable at the time. Today, this yield has increased by 25 basis points to 5.89%. This means that Pfizer stock has become even more attractive than it was back in August.

Seeking Alpha, PFE’s Dividends Estimates, notes added

Based on all of the above, I conclude that Pfizer still deserves a ‘Buy’ rating ahead of its Q3 2024 report.

Risks To My Thesis

The risk factors I mentioned last time haven’t changed that much, to be honest – I still think that every potential and existing investor should be very careful with the risks surrounding Pfizer so far.

One of my major worries is that key products may be getting hit with patent expiration and that Pfizer could lose sales because of generics cheaper than its drugs. Pfizer is losing its patents and exclusivity for a handful of drugs that had a combined $17 billion peak sales from 2025-2030, according to Argus Research (proprietary source, September 2024). Such loss of exclusivity could mean sales plummeting if Pfizer doesn’t invent and introduce blockbuster new drugs. As you probably know, the pharmaceutical sector has very long product development cycles, and clinical trial failures or regulatory delays can prevent new drugs from coming to market and hurt Pfizer’s growth.

Moreover, Pfizer, as well as other companies, are also at risk of losing reimbursement for its drugs: US insurance companies and national health authorities abroad may refuse to cover certain expensive medications, reducing the number of patients receiving them, which cuts into Pfizer’s bottom line.

Of course, a new risk to my thesis is the company’s ability to meet current market expectations in terms of EPS and sales. While I believe that the increased expectations over the last few months aren’t significant enough to be a problem for Pfizer by the end of October, there’s still a risk that the market is too optimistic today. In that case, the multi-month decline in Pfizer’s stock would likely continue.

Your Takeaway

Despite the numerous risks I mentioned above, I still believe that the probability of Pfizer beating the Q3 consensus estimate is greater than the risk that it will not. In Q2, we saw that management’s approach is effective as they have successfully reduced operating costs relative to sales, resulting in higher margins. In addition, the integration of Seagen’s assets appears to be progressing well. Against this backdrop, and given the company’s efforts to reduce its debt burden, I expect strong growth in earnings per share, which could exceed current market expectations for quarters to come. This should serve as an excellent catalyst and add momentum to Pfizer’s recovery, in my view. Therefore, I maintain my bullish rating and look forward to the company’s Q3 2024 results.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.