Summary:

- AT&T shares surged 4.6% after Q3 2024 results, with adjusted earnings beating forecasts, despite revenue falling short and continued debt reduction.

- Mobility and Consumer Wireline operations showed strong performance, offsetting the decline in Business Wireline, which remains a challenge.

- The company’s net debt reduction and potential upside compared to Verizon suggest significant growth potential, especially with ongoing cost-saving measures.

- I maintain a ‘strong buy’ rating for AT&T, expecting further stock appreciation and attractive distributions while monitoring debt reduction and cash flow growth.

jetcityimage

October 23 ended up being a really fantastic day for shareholders of telecommunications giant AT&T Inc. (NYSE:T). Shares of the company closed up 4.6% after management announced financial results covering the third quarter of the company’s 2024 fiscal year. Management did report revenue that fell short of analysts’ expectations. But adjusted earnings per share exceeded forecasts. This, combined with continued debt reduction and management reaffirming guidance for the 2024 fiscal year is likely what sent the stock moving higher.

For me, personally, this is great. Those who follow my work closely know that I run a very concentrated portfolio. In my large portfolio, I currently only have six holdings. That excludes three different sets of options contracts, two of which are for companies that are under the six stock holdings that I have. In this portfolio, AT&T is one of the smaller ones, accounting for only 10.7% of my assets. But it has been a fantastic performer. Since I bought the stock, I am now up a solid 50%. And if we include dividends in the mix, I am up 67.9%.

At some point, I will end up selling some or all of my shares. But I don’t see that occurring just yet. With shares at $22.49 apiece, I think I can get a couple more dollars out of the business and I can collect the attractive dividend while I wait. And depending on how things go moving forward, especially as the company continues to pay down debt, it’s very possible that I may even increase my expectations for a cash-out price. But for now, I think that keeping the company rated a ‘strong buy’ if only slightly so, is logical.

A great day for AT&T

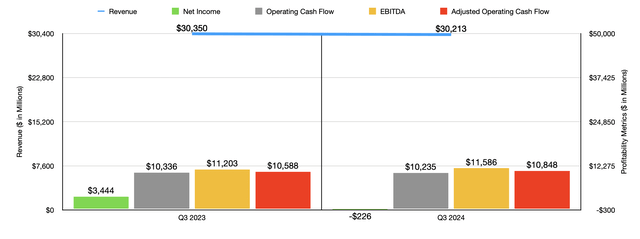

To start with, we should probably touch on how AT&T performed from a revenue perspective. For the third quarter of the 2024 fiscal year, the company reported sales of $30.21 billion. This was a weak spot for the business, with revenue actually coming in below the $30.35 billion that management reported for the same time last year and coming in $250 million lower than what analysts were hoping to see. Digging into the numbers, we can see where the strengths and weaknesses are. Most of the pain for the business during this time came from a unit of its Communications segment.

Author – SEC EDGAR Data

According to management, revenue associated with this segment came in at $29.07 billion. This was 0.6% below the $29.24 billion the company reported one year earlier. But all of this pain was centered on the company’s Business Wireline segment. Revenue there plunged 11.8% year over year, falling from $5.22 billion to $4.61 billion. This is a part of the company that I identified as AT&T’s ‘problem child’ when I reaffirmed the company as a ‘strong buy’ in September 2023. I stated that this part of the company will continue to weigh on the firm and its results. And at the end of the day, all management can do is really extract what value it can from it while managing its decline.

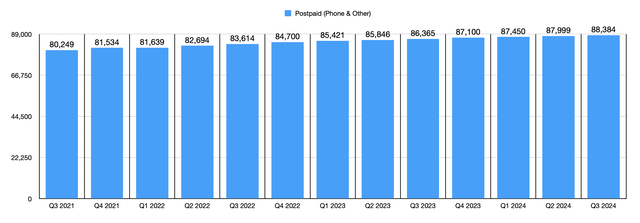

Author – SEC EDGAR Data

*Thousands

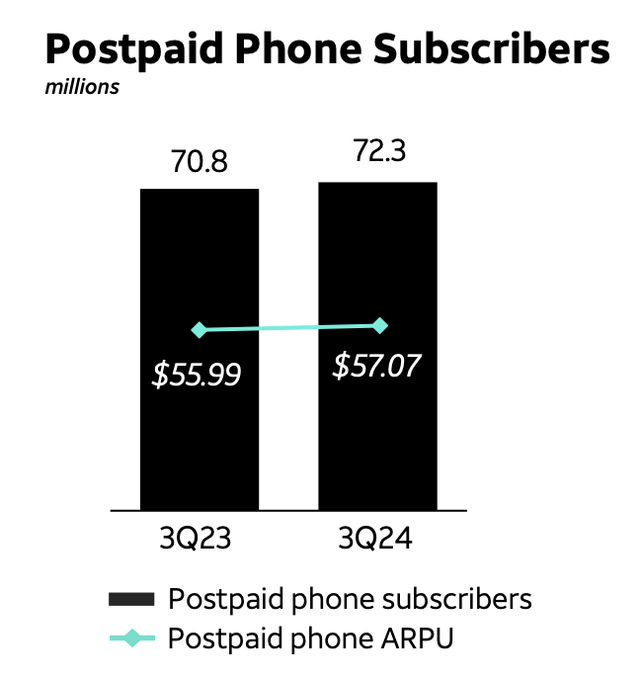

I’m not surprised in the least to see this part of the company proving to be the problem child today. But there were other parts of the company that performed exceptionally well. Within the Communications segment, the Mobility unit reported a 1.7% increase in revenue from $20.69 billion to $21.05 billion. This was largely the result of an increase in the number of Mobility subscribers to 116.07 million. By comparison, at the same time last year, this number was 112.86 million. Postpaid growth has been particularly impressive, with a 2.3% increase year over year from 86.37 million to 88.38 million. This was mostly because of postpaid phone growth from 70.76 million to 72.29 million. During the third quarter on its own, the company saw 403,000 postpaid phone net additions. That brings results for the first nine months of this year up to 1.17 million on a net basis. I would also like to point out that the postpaid phone ARPU for the most recent quarter was $57.07 per month. That’s an increase over the $55.99 per month reported one year earlier. This difference, while seemingly small, would add up to an extra $78.1 million in revenue for the company on an annualized basis.

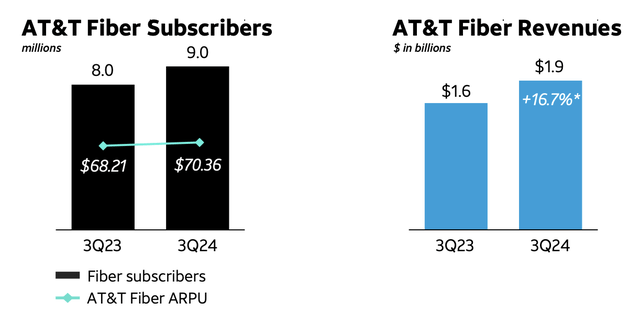

AT&T

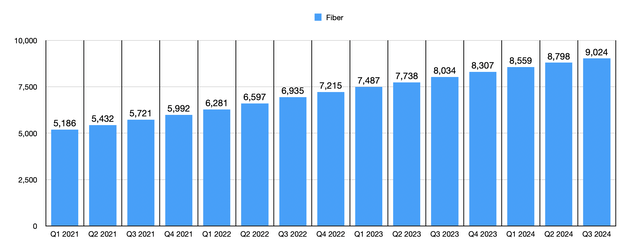

On the Consumer Wireline side of things, the company also experienced some growth, with revenue climbing from $3.33 billion to $3.42 billion over the last year. This is not a large increase. But the company did benefit from continued growth in the number of fiber connections. This number hit 9.02 million in the latest quarter. That represents a sizable increase over the 8.8 million reported for the second quarter of the year, and it is above the 8.03 million that the company had during the third quarter of 2023. Year-over-year, the monthly ARPU for the fiber subscribers increased from $68.21 to $70.36. That helped to bring quarterly revenue up from $1.6 billion last year to $1.9 billion this year.

Author – SEC EDGAR Data

*Thousands

There are other aspects of the company as well that saw expansion. For instance, the Latin America segment reported a rise in revenue from $992 million to $1.02 billion. This was driven in large part by a 10.8% surge in postpaid wireless subscribers in Mexico from 5.09 million last year to 5.63 million this year. And for the third quarter on its own, the company saw net additions for the postpaid category of 139,000.

AT&T

The decrease in revenue is disappointing, but not terribly unexpected. On the bottom line, the picture is more complicated. The firm actually generated a loss of $226 million for the quarter. That’s down materially from the $3.44 billion in profit generated at the same time in 2023. But this was the result of a $4.42 billion impairment charge that the company took because of its Business Wireline operations. This brought the company’s profit from $0.48 per share last year to negative $0.03 per share this year. But if we look at adjusted earnings, we actually would see a much smaller decrease year over year from $0.64 per share to $0.60 per share. Even though I don’t like seeing a decline year over year, it is worth noting that these adjusted earnings came in at $0.03 per share greater than what analysts expected.

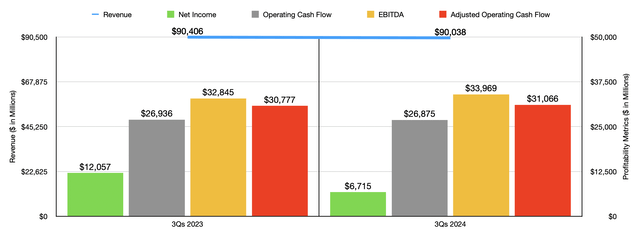

Author – SEC EDGAR Data

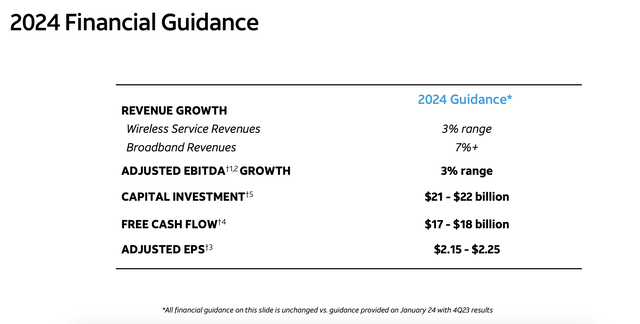

Other profitability metrics for the business saw mixed results. But for the most part, they were better year over year. The one exception to this was operating cash flow, which fell from $10.34 billion to $10.24 billion. But once we adjust for changes in working capital, we get an increase from $10.59 billion to $10.85 billion. And lastly, EBITDA for the company grew from $11.20 billion to $11.59 billion. These are not large improvements, but they are improvements all the same. As the chart above illustrates, these mixed results do seem par for the course when you consider how the business performed for the first nine months of its 2024 fiscal year. And fortunately, the results were strong enough that management decided to keep guidance for the 2024 fiscal year. They currently expect EBITDA to come in about 3% higher than what it was last year. And operating cash flow should be somewhere around $39 billion.

AT&T

At this point, it is very important for me to point out the most recent article that I published about AT&T. This article came out in late September of this year. In it, I talked about the firm’s decision to sell off the 70% stake in DIRECTV that it had retained up to that point. The deal was ultimately valued at $7.6 billion, but it will not be completed until sometime next year. Naturally, this will impact things quite a bit. In particular, it will reduce overall leverage for the company.

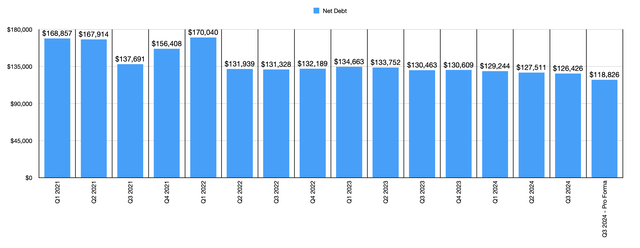

Author – SEC EDGAR Data

In the chart above, you can see the overall net debt picture for AT&T for the last couple of years. The last two columns in this table look at net debt as we saw at the end of the most recent quarter and look at net debt after accounting for this aforementioned asset sale. If we factor the net debt picture into the equation, we would end up with a figure of $118.83 billion. But even without doing that, we should end up with $126.43 billion. For context, the business ended the second quarter of its 2024 fiscal year with $127.51 billion. This translates to a $1.09 billion reduction in net debt in a single quarter. Also, for the purpose of analyzing this company, I will be using the adjusted figure that factors in the asset sale. Seeing as how guidance remained unchanged following this earnings release, I am also using my adjusted operating cash flow and adjusted EBITDA figures for the company that factor in a full year of not having the DIRECTV assets on the company’s books.

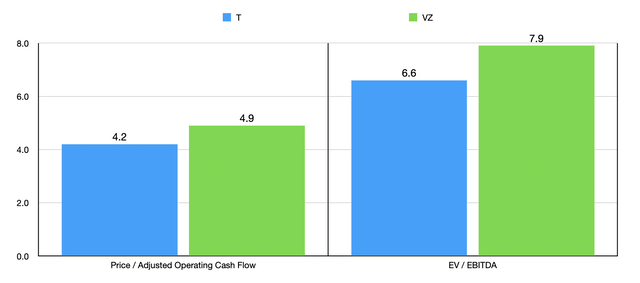

Author – SEC EDGAR Data

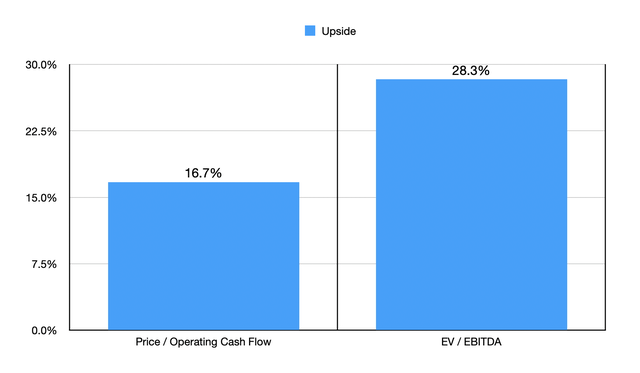

Making these adjustments, we should end up with EBITDA this year of about $44.70 billion on a pro forma basis. Meanwhile, operating cash flow should be around $38.20 billion. Using these estimates, we can see in the chart above how the stock is currently priced. This chart also compares the business to rival Verizon Communications Inc. (VZ). As you can see, AT&T is cheaper than its competitor. In the chart below, you can see what kind of upside shares AT&T would offer if the company were to trade to have the same multiples as its competitor. On a price-to-operating cash flow basis, investors would have an upside of about 16.7%. Using the EV to EBITDA approach, we get a reading of 28.3%. With the prospect of organic growth moving forward, plus with management forecasting additional incremental cost-savings of $2 billion (on an annual run-rate basis) to be achieved by the middle of 2026, even more upside could exist moving forward.

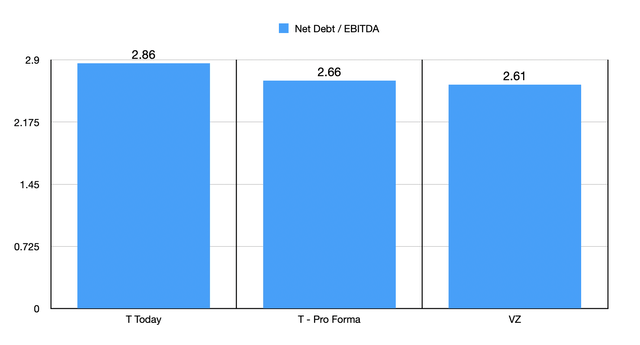

Author – SEC EDGAR Data

Of course, some might argue that there are differences between these companies. And that is a perfectly fair argument to make. The most notable difference might be leverage. But it is not as big as it used to be. In the chart below, you can see the net leverage ratio for AT&T using the assumption that the proceeds from the DIRECTV sale are already factored into the picture. In this case, the firm would have a net leverage ratio of 2.66. But even without this being factored in, we get a reading of 2.86. By comparison, Verizon Communications has a net leverage ratio of 2.61. And yes, that is after factoring out $24 billion worth of asset-backed debt. Without factoring in the proceeds from the DIRECTV sale and all the adjustments that go with it, the company would need to pay down its net debt by another $11.05 billion to match the net leverage ratio that Verizon Communications has. And if we factor the aforementioned asset sale into the picture, this drops to only $2.24 billion. With the management team at AT&T projecting free cash flow for this year in its entirety of between $17 billion and $18 billion, with $12.81 billion already realized for the year, this is something that the company could cover rather quickly.

Author – SEC EDGAR Data

Takeaway

From all that I can tell, AT&T is doing a really phenomenal job right now. Yes, we continue to see the pain associated with the Business Wireline business. But the good news is that, since that part of the company is shrinking every year, and since the rest of the company is expanding, it should become less significant as time goes on. Everything else within the business seems to be doing quite well and shares look very cheap. At some point, I will end up selling my stock. But unless we see shares rise by a couple of more dollars, it probably won’t be this year. In fact, if the company continues to pay down net debt and can show that for next year additional cash flow growth is on the horizon, I could hold on even longer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!