Summary:

- We reiterate our Buy rating on Verizon Communications Inc. stock despite mixed Q3 results.

- Verizon missed some of our key expectations, but wireless growth and broadband additions remained robust, with notable success in fixed wireless.

- VZ’s operating income and adjusted EBITDA are impacted by AI.

- You need to look at one key metric more than any other.

- What kind of investor are you?

imaginima/E+ via Getty Images

There is still an upside, and we reiterate our Buy rating on Verizon Communications Inc. (NYSE:VZ) shares today following the just-reported Q3 earnings. The earnings were not that great, especially compared to the earnings that competitor AT&T Inc. (T) dropped on us.

While we have had a buy rating on the stock since the low $30s, Verizon stock has stalled out since hitting the $40s, but we have stuck by it. We think you take advantage of this dip. While the numbers were not as strong as we had expected, and we will discuss that in this column, the cash flow numbers were positive. Let us discuss.

Verizon Q3 results in context

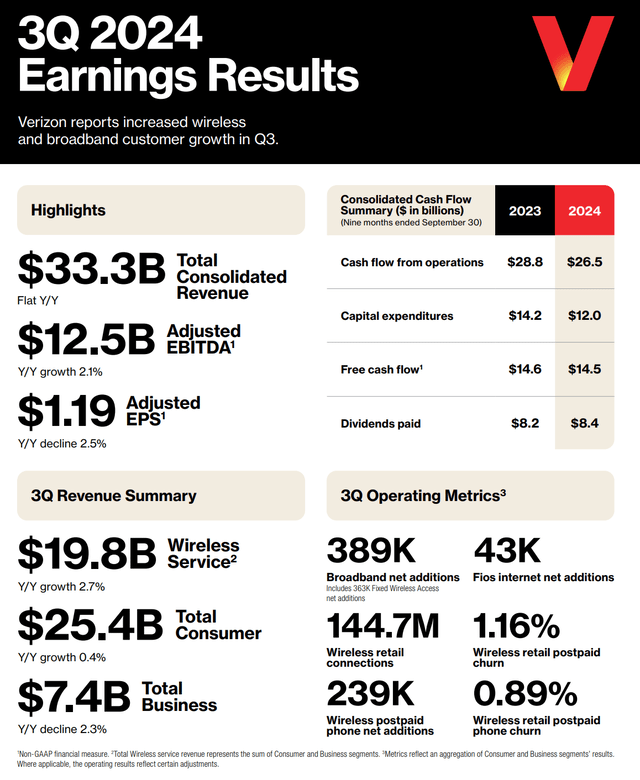

Even with this dip, when you look over the last few months Verizon stock has held up, while markets have been top-heavy with a few notable selloffs. But stability like this is great for a juicy income name like Verizon. That said, Verizon’s revenues were below expectations. While we thought Verizon may once again have difficulty with margins and earnings from being very promotional to attract customers, the earnings power was once again strong considering a revenue figure that missed expectations by $120 million. Revenue came in at $33.3 billion and was basically flat (-0.1%) from last year. See the Q3 infographic below:

The key metrics are largely summarized above. Wireless growth was positive, while business suffered once again.

Verizon’s Q3 2024 earnings revenue drivers

As we saw, revenues were about flat. For Q3, we are looking for $33.35-$33.80 billion, so Verizon certainly missed our more bullish view. Our expectations were missed by $275 million. What about customer additions? We were looking for retail postpaid net additions of 275,000+ and wireless postpaid phone gross additions to increase in low-single digits year-over-year. Furthermore, We were looking for phone churn below 1.0% for retail postpaid customers. For broadband, we were looking for net additions of 395,000 and were projecting 25,000+ Fios Internet net additions.

In wireless, we saw 2.7% revenue growth from last year to $19.8 billion. Retail postpaid phone net additions were 239,000, and retail postpaid net additions were 349,000. Retail postpaid phone churn was just 0.89%, well, within our expectations, while postpaid customer churn was 1.16%, a touch higher than we anticipated. Over in broadband, there were net additions of 389,000, about in line with expectations. Once again here in Q3 2024, we saw continued robust demand for fixed wireless and Fios products, though this missed our expectations slightly. There were 363,000 fixed wireless net additions. The company hit its target for fixed wireless subscribers 15 months ahead of expectations. That is positive.

This is the third quarter in a row of sub-400,000 broadband net additions. We do not see this as bearish, the growth remains strong and there are millions of subscribers. There were 39,000 Fios Internet net additions, also surpassing our expectations of 25,000 sizably. Overall, it was a good but mixed quarter, especially when you consider business lines continue to decline. The business losses for Verizon were less than competitor AT&T this season.

Verizon Q3 2024 earnings outperformance

For Q3, we had once again been expecting ongoing cost controls to continue to help earnings power. AI is being employed to improve the efficiency of the overall business and to boost customer service. Q3 2024 operating expenses were $27.4 billion while we were targeting operating expenses of $25.0 billion. Administrative expenses were up more than we expected accounting for the discrepancy versus our expectation. Severance charges of $1.7 billion related to separations under the company’s voluntary separation program for select U.S.-based management employees as well as other headcount reduction initiatives. These one-time items get adjusted out. We were targeting an operating income of $7.6-$7.8 billion. Verizon reported $8.1 billion in operating income.

For adjusted EBITDA, we were targeting $12.2-$12.4 billion. On a per-share basis, assuming our projections captured the results with relative precision, we saw EPS hitting $1.17-$1.19 for Q3. Analysts were looking for $1.18, the middle end of our target range. Well, despite the top-line miss, the company reported $1.19 in EPS, meeting the top end of our expectations. Adjusted EBITDA was $12.5 billion, also surpassing our expectations slightly. Again, a mixed report with some positives and negatives.

Verizon’s free cash flow

For Q3, we were looking for cash from operations of $9.8-$10.5 billion. Assuming capex and other expenditures were $4.5-5.0 billion, we were targeting free cash flow of $4.8-$6.0 billion. Keep in mind that the dividend was raised again. While a few years ago the dividend coverage had been questionable, with recent and near-term future performance expectations, we view the dividend as safe given our cash flow projections. Well, cash flow from operations was $9.9 billion, and Capex was just $4.0 billion.

Keep in mind that Verizon pays more each year to the dividend. Dividends paid were about $2.8 billion in Q2. Free cash flow was $6.0 billion, at the highest end of our free cash flow expectation. As such, the free cash flow payout ratio was about 46.7%. For the year, we are anticipating a payout ratio of less than 70%.

Update on the debt

The debt burden is large, make no mistake. Interest expense will continue to climb on new debt at higher rates in this climate, and we saw interest expense jump versus last year. Verizon’s total unsecured debt was $126.4 billion, a $1.1 billion increase compared to Q2 2024, and approximately $70 million lower year-over-year. The company’s net debt at the end of the third quarter of 2024 was $121.4 billion. This translates to a 2.5X debt-to-adjusted EBITDA ratio. We continue to watch the debt.

Final thoughts

We still love this stock for income. Smartphone demand was down, we saw the same thing with AT&T. The free cash flow was incredibly strong, and the company is reducing costs by reducing headcount. Fios and broadband growth remains positive. Fiber is becoming more of a focus, though the purchase of Frontier may be challenged. Still, we like that the company is generating strong cash flow. The debt remains an issue, and the company will always be in debt, but we would like to see leverage come down further. Still, we are happy to collect 6.5% here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Pay yourself dividends with outsized returns

Get more with our playbook to significantly grow your wealth by embracing a blended trading and investing approach at our one-stop shop.

Our prices go up November 1st, but right now we have a big sale on the current price. Join NOW and you can lock in 75% of savings versus the $1,668 some members pay, this sale will end when 3 more members sign up.

We invite you to try us out, with a money back guarantee if you are not satisfied (you will be). Let’s win together. Come take the next step. START WINNING!