Summary:

- Tesla, Inc.’s stock surged post-earnings due to better-than-expected EPS and margins, highlighting its strong profitability and growth potential.

- Despite mixed reactions to the “We Robot” event, Tesla’s innovative products and services could significantly boost future revenues and profitability.

- Tesla’s improved efficiency and profitability metrics suggest potential for upward EPS revisions and stock price upgrades to the $300-350 range by 2025.

- Tesla remains a strong buy due to its market-leading position, substantial growth prospects, and potential for higher-margin business activities.

Brandon Woyshnis/iStock Editorial via Getty Images

Tesla, Inc.‘s (NASDAQ:TSLA) stock surged after hours on Thursday as the EV giant reported better-than-expected EPS, margins, and other profitability-related metrics, soothing recent investor concerns. I recently discussed Tesla and why it remains a strong buy, and I reiterate my strong buy thesis.

While some people found the recent “We Robot” event underwhelming, I thought it was fascinating (while a bit rough around the edges). It’s typical to see a lack of concrete projections at a “futuristic” Tesla event. Historically, this dynamic has not prevented Tesla from making considerable sales and profits from its products and services.

Driverless cybercabs, robovans, and dancing humanoid robots may not be enough for some people. However, this dynamic doesn’t change the relatively high probability that these products and services could contribute considerably to Tesla’s top and bottom lines in future years.

Additionally, Tesla has not yet benefited from its “Model 2 moment” and could experience a substantial sentiment shift once more details and a potential timeline for the mass market budget vehicle are announced. Tesla has significant potential in FSD, robotics, AI, advanced energy generation and storage solutions, and more, which make its ecosystem extraordinarily unique and highly valuable.

Perhaps most importantly, we see that Tesla can become increasingly more profitable. The company cranked up its profitability, delivering a sequential 180 bps increase (195 bp increase YoY), providing a 19.8% gross margin, substantially higher than most analysts expected.

This dynamic illustrates that the Street may be dramatically behind the curve regarding Tesla’s highly explosive growth and significant profitability potential. Therefore, the recent EPS and sales estimates likely need upgrades. Moreover, many price targets for Tesla appear predicated on relatively low margins and EPS estimates.

Tesla’s estimates will likely undergo a round of upgrades as higher profitability must be factored in. This dynamic could lead Tesla’s stock price to $300 — 350 or higher by early to mid-2025. Moreover, we could see substantial gains in 2025 as Tesla reports higher-than-anticipated growth and EPS and releases more details regarding its future projects and projections regarding future revenues and profitability increases. Due to its dominant market-leading position, excellent growth prospects, and other elements, Tesla remains a strong buy in the intermediate and long term.

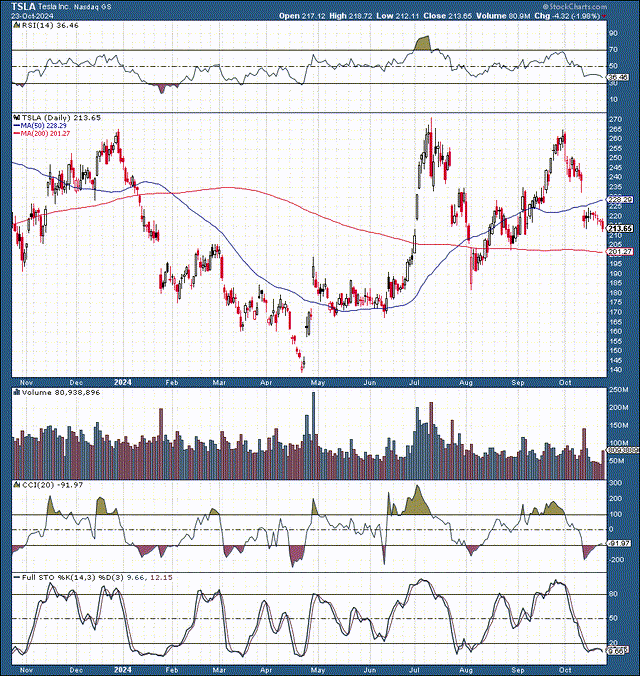

Tesla’s Solid Technical Set Up

Tesla could open around $235-240, closing the gap from the robotaxi event. However, we have several challenging resistance levels around $240-250 and $270-300. On the downside, we have solid support, around $220-200. Therefore, the potential near-term consolidation range could be around $220-240, but there is a high probability of a breakout soon.

Tesla’s stock has been dogged lately. The sentiment became particularly horrid following the “disappointing” We Robot event. The CCI declined to about -200, and the general price action became very bearish recently. Thus, we may see a sentiment shift to a more positive technical momentum soon, which is what the full stochastic, moving averages, and other technical indicators illustrate.

Earnings — A Home Run For Tesla

While sales could have been a bit higher, Tesla did an excellent job increasing its profitability over the last quarter. Tesla announced sales of $25.18B, missing the consensus estimate by about $490 million or roughly 1.8%. However, Tesla’s EPS was $0.72, $0.12 better than the consensus estimates, illustrating a solid EPS outperformance rate of 20%.

Moreover, Tesla posted a substantial 19.8% gross profit margin, much higher than the 17.9% a year ago or 18% in the previous quarter. Tesla posted its best profitability metrics since Q4 2022 despite continuing with a relatively low average selling price “ASP” for its vehicles.

Furthermore, the increased profitability is not all due to regulatory credits. Tesla recognized $739M in regulatory credit revenue last quarter. While this was greater than the $554M in regulatory revenues recognized in the same quarter one year ago, it is not where all the increased profitability came from. Also, regulatory credit revenue decreased from the previous quarter’s $890M.

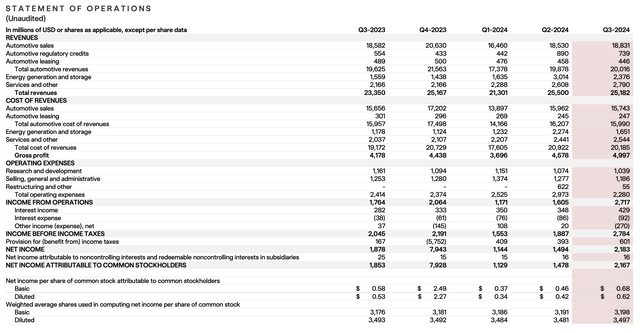

Statement of operations (static.seekingalpha.com )

Tesla’s “pure” automotive sales gross margin increased to 16.4% from 15.7% in the same quarter one year ago and only 13.8% in its previous quarter. Therefore, we witnessed a 260 bps increase in Tesla’s pure automotive sales gross margin QoQ, which is rather remarkable.

Tesla’s energy generation and storage is also becoming increasingly profitable, posting a solid 30.5% gross margin last quarter. The energy segment’s gross margin improved substantially from 24.5% in the previous quarter. Services and other gross margins improved from 6.4% to 8.8% QoQ and 5.9% in the same quarter one year ago.

Therefore, we see widespread margin improvements in many of Tesla’s segments as the company bounces back from its temporary slowdown. Moreover, we could see continued improvements in Tesla’s gross margin and other profitability metrics as Tesla benefits from its market-leading position and scale.

Tesla also demonstrated improved efficiency on the operational side of its business. Despite providing higher revenues (roughly an 8% increase), Tesla’s operating expenses (excluding restructuring costs) declined by 8% YoY. R&D and SG&A costs declined by 5% from the previous quarter.

We witnessed general efficiency increases relative to production and improvements concerning Tesla’s operating expenses. This dynamic suggests that the Cybertruck production challenges have likely passed, and Tesla could continue improving profitability metrics as we advance.

Moreover, as more of the company’s future revenues could come from higher-margin segments like AI, full self-driving (FSD), robotics, and more, its “total” profitability could improve. In addition, Tesla’s auto manufacturing efficiency could expand due to economies of scale and other competitive advantages.

Tesla’s Results Vs. The Estimates

I provided my estimates about two weeks ago, and it appears my ASPs were still high. My automotive sales estimate was $19.34B, but Tesla provided $18.83B in automotive sales revenue instead. Therefore, the Model 3/Y segment ASP was probably closer to $39,000 last quarter rather than my projected $40K price range.

Tesla had $739M of regulatory credit revenue instead of my estimated $500M. My automotive leasing estimate was very close ($446M vs. $460M EST.). My energy segment and services/other revenues estimate was slightly higher than the one announced. So, the revenue of $25.18B was lower than my $26.23B sales estimate.

However, Tesla’s profitability increase was substantially better than I had expected. I predicted an 18.2% gross margin and a gross profit of $4.77B. Despite the lower-than-expected revenue, Tesla delivered a 19.8% gross margin and a gross profit of $5B.

Also, I projected relatively modest operating costs of about $2.45B, but Tesla only utilized $2.28B in operating expenses, including a $55M restructuring/other cost. Therefore, I forecasted an operating margin of 8.8%, but Tesla smashed that by 200 bps, delivering a 10.8% operating margin instead.

My non-GAAP net income estimate was $2.1B, but Tesla proved $2.167B in its GAAP results, offering about $2.5B in non-GAAP net income, and delivering $0.72 in its non-GAAP EPS vs. my $0.65.

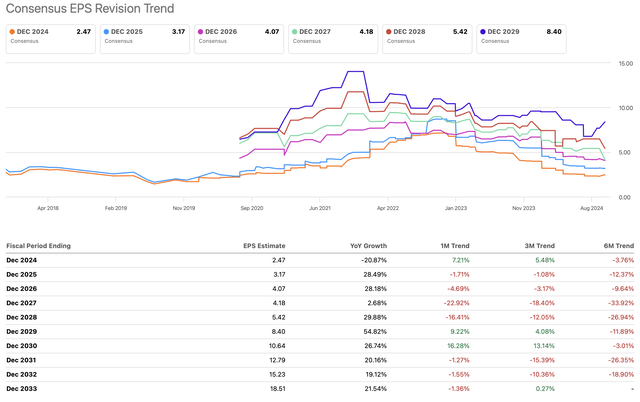

Upward EPS Revisions Now Highly Likely

EPS revisions (seekingalpha.com )

Analysts have recently pressed EPS estimates lower and lower. However, provided the excellent profitability turnaround, these very low-balled figures will likely be revised substantially higher in future quarters. In 2022, when Tesla’s profitability was notably higher than the recent period, its consensus 2025 EPS estimate was around $9, much more than the recent $3-4 range.

Tesla’s much more robust than expected profitability metrics could enable estimates to begin a long climb back to $7-10 for the 2026-2028 time frame. This EPS range is much higher than the current lowballed $4-6 EPS range. Furthermore, there have been 16 negative revisions vs. only three positive earnings revisions for Tesla in the last 90 days, and this metric could flip, as many analysts will likely revise higher after the recent earnings results.

The Bottom Line

The market may have become too negative regarding Tesla and was likely overly critical of its We Robot event. Tesla’s growth story is alive and well, and despite not making concrete projections, its robotaxi, FSD, AI, robotics, products, and services could provide enormous sales and profitability in the years ahead. Moreover, Tesla provided much better profitability metrics, highlighting its ability to become highly efficient and profitable when necessary.

Now that higher profitability should be factored into future estimates, Tesla could go through upward EPS revisions and likely stock price upgrades, enabling its share price to break out to the $300-350 range soon. Tesla also has remarkable intermediate and longer-term potential due to its market-leading position, substantial growth and profitability potential, and other constructive elements, making it a top buy-and-hold stock for the next 5–10 years.

Where Tesla Stock Could Be In The Future

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $102 | $133 | $164 | $200 | $244 | $293 | $345 |

| Revenue growth | 5% | 30% | 23% | 22% | 22% | 20% | 18% |

| EPS | $2.70 | $5 | $8 | $12 | $17 | $22 | $28 |

| EPS growth | -13% | 85% | 60% | 50% | 42% | 29% | 27% |

| Forward P/E | 60 | 57 | 55 | 53 | 52 | 50 | 48 |

| Stock price | $300 | $456 | $660 | $900 | $1,144 |

$1,400 |

$1,600 |

Source: The Financial Prophet.

These are my moderately bullish case estimates for Tesla because of the aggressive EPS growth and elevated P/E ratio. However, Tesla’s sales growth projections are modest, and in a more bullish outcome, they could increase more than my estimates imply. Furthermore, Tesla should garner a relatively high multiple as more revenues come from higher-margin business activities relative to its automotive segment.

Risks To Tesla

Despite my favorable assessment, Tesla faces several risks. There is a constant risk of competition from legacy automakers and EV startups snapping at Tesla’s heels. The most significant competition could come from China, from another EV juggernaut, BYD Company (BYDFF). BYD is a solid company, and both Tesla and BYD can succeed. There is also the risk of poor demand for EVs. A worse-than-expected economy or a recession could also negatively impact Tesla’s sales and profitability. While Tesla demonstrated margin improvement, it must show that it can achieve sustainably higher margins in its auto segment. Investors should examine these and other risks before investing in Tesla.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!