Summary:

- AGNC Investment Corporation is a well-managed mortgage REIT poised to benefit from the central bank’s recent rate cuts, enhancing its 14% dividend yield.

- AGNC’s Q3 profit exceeded expectations, with a 5% QoQ book value growth, driven by favorable interest rate environments for mortgage-backed securities.

- Lower borrowing costs and higher valuations of mortgage-backed securities should support AGNC’s book value growth and net interest income trajectory.

- AGNC’s steady $0.12 monthly dividend since May 2020 and favorable risk/reward profile make it a compelling choice for passive income investors.

filo

AGNC Investment Corporation (NASDAQ:AGNC) is a well-managed mortgage real estate investment trust whose investment business is poised to profit from the central bank’s first rate cut last month. AGNC Investment’s third quarter profit was higher-than-expected and the trust enjoyed 5% QoQ book value growth.

AGNC Investment is presently selling for a premium to book value of 5% and since interest rate cuts are good for mortgage real estate investment trusts that own mortgage-backed securities, I think that AGNC Investment is a compelling trust to own for its 14% dividend yield.

My Rating History

My last stock classification for AGNC Investment was Strong Buy primarily because the mortgage real estate investment trust was poised to profit from lower short-term interest rates.

The central bank indeed slashed interest rates by 50 bps in the prior month and with more rate cuts set to come investors’ ways, I think that the risk/reward relationship for AGNC Investment is skewed in favor of passive income investors.

Portfolio Review

AGNC Investment reported quarterly profits for its third quarter of $0.63 per share which surpassed the Wall Street estimate of $0.51 per share by twelve cents. Though AGNC Investments can prove to be extremely volatile over time, the mortgage real estate investment trust has so far maintained a rather stable dividend profile.

AGNC Investment is, next to Annaly Capital Management, Inc. (NLY), one of the two biggest mortgage real estate investment trusts focusing primarily on mortgage-backed securities.

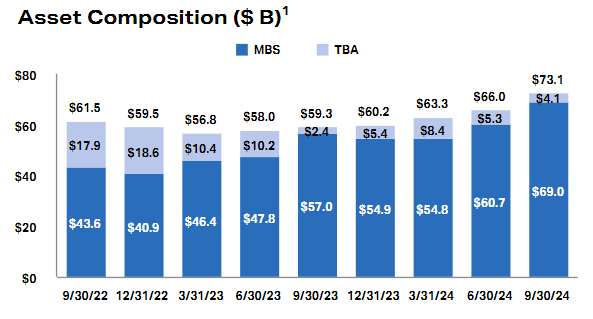

AGNC Investment’s portfolio as of September 30, 2024 included a total of $73.1 billion in assets in the third quarter, up 11% QoQ, mainly agency mortgage-backed securities. These assets are set for a major rerating as the central bank kicked off a process of sequential rate cuts that are beneficial for mortgage-backed securities: MBS work like bonds in the sense that falling interest rates grows their values. As such, a protracted rate cut scenario would support valuation gains for AGNC Investment’s mortgage-backed securities.

Asset Composition (AGNC Investment Corporation)

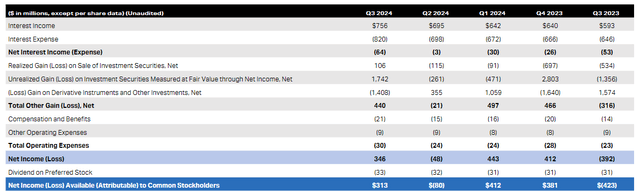

AGNC Investment’s trajectory in interest income is positive as well, but its interest expenses have also increased substantially compared to the year ago period. In 3Q24, AGNC Investment earned $756 million in interest income, reflecting a YoY increase of 27%.

On the flip side, its interest expenses amounted to $820 million, reflecting a YoY increase of 27%. AGNC Investment’s net interest income amounted to ($64) million which was only $11 million worse than in 3Q24.

Moving forward, the central bank is going to trigger additional rate cuts which could be a positive for AGNC Investment’s net interest income trajectory.

Lower borrowings costs should provide relief to AGNC Investment in terms of lowering its interest expenses and at the same time, mortgage-backed securities are poised to experience a catalyst for a higher valuation. Together, these effects could help AGNC Investment return to a growing book value and a stronger net interest spread.

Net Investment Income (AGNC Investment Corporation)

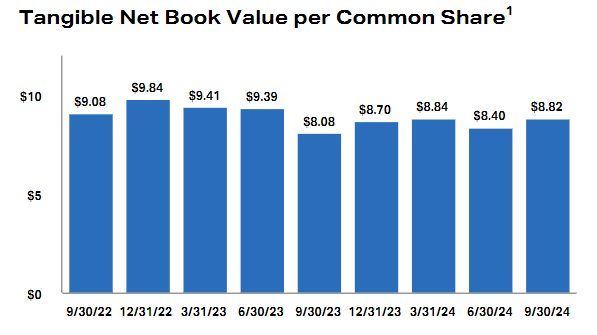

AGNC Investment’s Book Value Growth And Multiple

AGNC Investment’s net book value as of September 30, 2024 was $8.82, reflecting a $0.42 jump QoQ, and also an increase of $0.74 per share YoY. In the last two years, the net book value trend has been profoundly negative, but with the central bank moving for the first time last month in terms of cutting short-term interest rates, I am moderately optimistic that the mortgage real estate investment trust could break out of this pattern and return to a period of a growing book value.

For the same reason, I think that Annaly Capital Management is a compelling choice for passive income investors. At the time of writing, Annaly Capital Management has not yet reported earnings for its third quarter, but with AGNC Investment reporting stable net interest income YoY and a positive book value growth impulse, I would anticipate NLY to report similar results for its 3Q24.

Tangible Net Book Value Per Common Share (AGNC Investment Corporation)

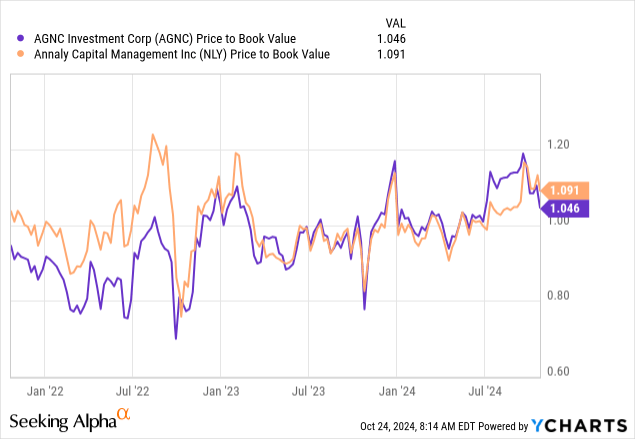

AGNC Investment is presently selling for a 5% premium to GAAP book value while Annaly Capital Management is selling for a BV premium of 9%. Both mortgage real estate investment trusts are poised to profit from the central bank’s quantitative easing and should experience positive valuation effects on their mortgage-backed securities portfolio.

If the Fed continues to lower rates, both AGNC Investment and Annaly Capital Management could report successive growth in their portfolio and GAAP book values moving forward.

Why My Investment Thesis Might Be Wrong

A series of rate cuts would obviously benefit AGNC Investment’s portfolio of mortgage-backed securities, which tend to react sensitively to changes in benchmark interest rates. Thus, rate cuts should be a catalyst for a re-rating of AGNC Investment’s mortgage-backed securities. The wild care here, however, is how aggressive the central bank is going to be with the implementation of rate cuts.

If the central bank takes its time and lowers interest rates only very slowly, to mitigate risks of upsetting investors, it may take a while before mortgage real estate investment trusts fully enjoy lower benchmark interest rates.

My Conclusion

AGNC Investment is a compelling passive income vehicle for investors as the central bank is poised to turn out to be the biggest catalyst for the mortgage trust: With benchmark interest rates now having begun to fall, AGNC Investment’s portfolio of agency mortgage-backed securities is poised to increase in price which may lead to a higher book value and possibly a higher stock price.

Lower funding costs are also obviously beneficial for mortgage real estate investment trust, which rely on low-cost debt and leverage their investment dollars for maximum benefit.

I think that the risk/reward relationship here is still pretty much favorable for AGNC Investment. The mortgage trust has also paid a steady $0.12 per share monthly dividend since May 2020 and the 14% yield remains highly compelling for passive income investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.