Summary:

- Cisco Systems is poised for growth in 2025 and beyond due to strong fundamentals, AI investments, and attractive valuations as interest rates decline.

- Despite past underperformance, Cisco’s recent earnings beat estimates, and management is focused on growth in AI, cloud, and cybersecurity.

- Cisco’s strong balance sheet, double-digit product order growth, and strategic acquisitions like Splunk support a buy rating with potential upside to $62.

- Risks include inventory issues and declining segment revenue, but management expects these to be resolved, making Cisco a solid long-term investment.

- Risks for Cisco include losing market share to its closest competitor, Arista Networks, who entered into its fifth cloud deal this year.

cagkansayin

Introduction

With 2024 coming to a close, I’ve been wondering what stocks are currently trading at decent valuations that I foresee doing well in 2025 and beyond. Of course, a lot can happen between now and then, but with interest rates likely to continue trending lower, what will happen with the market?

Will we enter the third year of the bull run? Will the economy enter into the recession that, so many have been calling for the past few years? It’s tough to say, and that’s why it’s important to invest in quality businesses that are likely to withstand any and every event.

In this article, I discuss CSCO’s latest earnings and full-year performance, fundamentals, and why I think they are poised to see further upside in 2025 and beyond.

Previous Thesis

I last covered Cisco Systems (NASDAQ:CSCO) (NEOE:CSCO:CA) this past May, shortly after announcing their Q3 earnings, assigning the stock a buy rating off the strength of their AI potential. Additionally, Q3 saw them raise revenue guidance to $53.6 billion – $53.8 billion, up from $51.5 billion – $52.5 billion prior.

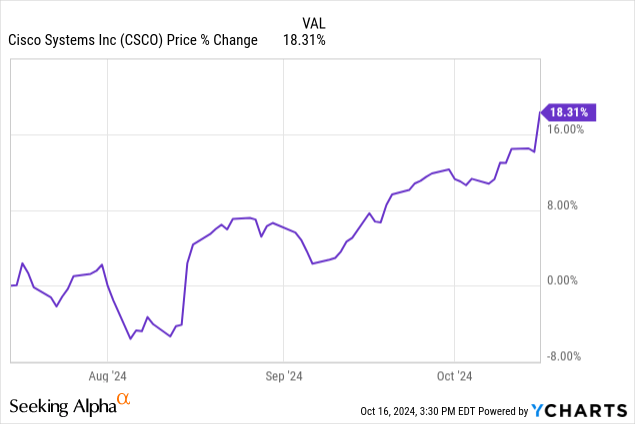

I also discussed the company’s margin improvements within their geographic segments. Product gross margins slightly improved to 66.9%, up from 66.5% at the beginning of the fiscal year. And despite declining segment revenue, which continues to be an issue, the stock has handily beat the S&P, up 18.25% in comparison to 10.54% for the index.

What Will Happen With The Market?

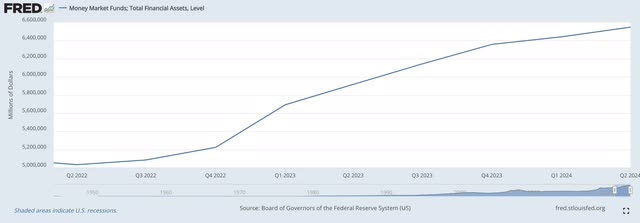

If you read the news, then you’re likely to believe the stock market will end any day now. With so many doom and gloom headlines, new investors are likely to stay on the sidelines. But as interest rates continue to lower, I think this will push capital back into the market, potentially pushing it much higher.

Moreover, those same investors will likely seek to find solid companies with strong fundamentals that are also trading at a good value. With the Technology sector (XLK) crushing it the past few years, what will happen when this slows a bit? I suspect quality dividend stocks with attractive valuations will see their valuations expand.

Why? Because with tech companies being so expensive, investors will likely look for those with strong fundamentals and attractive yields. This is because fixed-rate investments that were deemed safe the past few years will be less attractive. So, why not go for companies with strong business models and those attractive yields?

In the chart below, you see the inflow of capital into money market accounts at the start of rate hikes in March of 2022. But what happens when interest rates are much lower, say over the next year or two? It’s logical to think a reversal will happen. And if so, where is that money going to go? In my opinion, companies like Cisco Systems will likely benefit going forward.

Solid Earnings Growth Ahead

After disappointing investors for so long, Cisco’s earnings are expected to see solid growth after this fiscal year, with an average rate of 6.235% by 2029. Earnings are projected to come in at $3.57, a $0.16 decrease from last FY that saw earnings come in at $3.73. Including their AI potential and investors rotating back into the market, this should push Cisco’s share price higher over the next few years.

During their Q4 earnings this past August, CSCO managed to beat estimates on both their top and bottom lines, with EPS of $0.87 beating by $0.02 and revenue of $13.64 billion beating by $100 million.

This was similar to Q3 that saw the networking giant beat estimates as well with earnings per share of $0.87 and revenue of $12.79 billion. Year-over-year, both declined from $1.14 and $15.2 billion, respectively. Despite the decline, Cisco’s management team is confident in the years ahead. Here’s what they had to say during earnings:

Looking ahead, we remain laser-focused on growth and consistent execution as we invest to win in AI, cloud, and cybersecurity. To focus on these key priority areas, today, we announced a restructuring plan to allow us to both invest in key growth opportunities as well as drive more efficiency in our business.

And management is seemingly making good on their promise, signing several $100 million plus deals with global enterprises. Most notably, they entered into a deal with a global logistics company to create an intelligent and efficient logistics network using their switching, routing, and security. This will enable customers to automate networks using AI-powered robotics and enhance supply chain visibility.

Regarding their geographic segments, the networking giant was able to grow their gross margins despite declining revenue in each segment.

This growth was due to the Splunk acquisition and increased product orders. The Americas segment product orders were up 15% year-over-year, while the EMEA & APJC segments were up 12% and 16%, respectively.

|

Q4’24 |

Rev/Gross Margins |

Q4’23 |

Rev/Gross Margins |

|

Americas |

8,068 / 67.7% |

Americas |

9,075 / 65% |

|

EMEA |

3,511 / 69.2% |

EMEA |

3,926 / 68.4% |

|

APJC |

2,064 66.4% |

APJC |

2,203 / 65.3% |

Should Benefit From Rapid Growth In AI

I know for long-term shareholders CSCO has seemingly been dead money, but I like where the stock seems to be headed, investing heavily to capture growth in the AI space. Moreover, the market seems to like it too as CSCO’s share price has been rallying lately, up a solid 18.31% in the past 3 months.

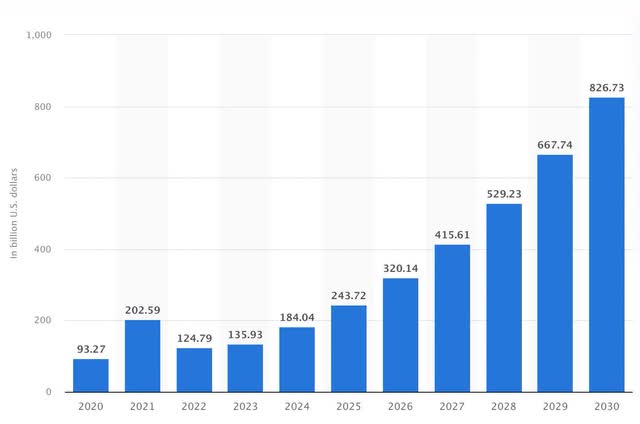

Below, you see the market size of the AI market is expected to grow to roughly $827 billion over the next 7 years. Moreover, I expect CSCO to benefit as they continue to make investments in the space. For FY24, Cisco made more than $1 billion in AI orders and expects an additional $1 billion this fiscal year.

Wrapping It All Up

The company ended their FY24 with revenue coming in at the high end of their guidance range of $53.8 billion. Gross margins also reached their highest in 2 decades at 67.5%. This was in comparison to their closest peer Arista Networks (ANET) who saw their gross margins expand from 61.3% to 65.4% year-over-year. CSCO’s product order growth was double-digits at 14% and 6% excluding Splunk.

For the fiscal year, Cisco returned $3.6 billion to its shareholders, with $1.6 billion of this comprised of dividends and the rest share repurchases. And the company is able to do this due to their strong balance sheet. They ended with $7.5 billion in cash and $19.6 billion in long-term debt, minimal compared to their market cap of nearly $216 billion.

Double-Digit Upside Potential > $62

Cisco offers much higher upside to its high price target of $78 a share. Although this may seem a bit too optimistic for the networking giant, I do believe as interest rates come down over the next few years, and they continue to make investments in the AI space, they will likely see some solid upside into the $60’s at a minimum in the foreseeable future.

The market has been very positive regarding the network giant recently. And Citi upgraded them on their AI potential. The firm upgraded Cisco’s price target from $52 to $62 on their potential to capture growth in artificial intelligence.

FAST Graphs has a similar price target of $62.65 by 2027, 10.4% upside from the current price of $56.76 a share. Furthermore, I wouldn’t be surprised to see Cisco’s share price blow past this in the next 12 – 24 months.

Risks

Cisco is still facing inventory issues, as seen by the 15% decline in total product revenue. Management is certain they can move through what they consider the final quarter for these issues. As previously mentioned, segment revenue declined in the previous quarter by 19%.

As a current shareholder and for those looking to start a position, this is something to watch for and keep a close eye on going forward. Their largest product category, Networking, was also down double-digits compared to the prior year at 28%. But moving forward, management expects this to be a non-issue in the foreseeable future.

Another risk for the company is losing market share to their close peer ANET who continues to land deals with major cloud clients. They recently entered into an agreement with powerhouse Meta Platforms (META), it’s fifth this year alone.

Conclusion

For a company like Cisco, I think it’s best to take a buy and hold approach. All companies go through periods of underperformance. More so, for mature companies like Cisco Systems, this can be frustrating as they’ve had a long track record for disappointing its shareholders.

But the tide has seemed to turn, and I expect the networking giant to continue making large investments in the AI sector in the coming years due to their strong balance sheet and cash position.

Additionally, as management continues to integrate Splunk into their operations, they should benefit from this with increased revenues within their segments.

This, along with continued investments in artificial intelligence should drive price appreciation. Due to the expected growth in AI, CSCO’s fundamentals that includes ample liquidity, and solid earnings growth ahead, I continue to rate Cisco Systems a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.