Summary:

- Eli Lilly and Company has shown rapid growth, driven by its weight loss drugs Mounjaro and Zepbound, with significant revenue increases.

- Despite impressive growth, I maintain a ‘hold’ rating due to the stock’s high valuation, which I find prohibitive.

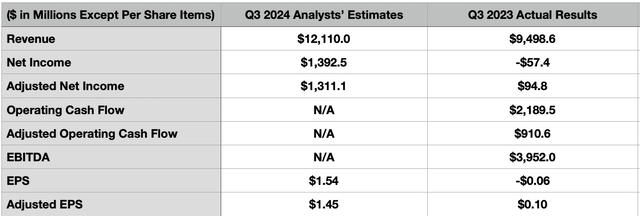

- Analysts expect strong Q3 2024 results, with projected revenue of $12.11 billion and adjusted net income of $1.31 billion.

- Management’s optimism and increased revenue guidance indicate a continued growth, but the stock remains too expensive for an upgrade from ‘hold’.

JHVEPhoto

Those who follow my work closely know that I have been a big fan of pharmaceutical firm Eli Lilly and Company (NYSE:LLY) for a little while now. My first article about the company, published in June 2023, touted it as a solid ‘buy’ candidate. From that time until I downgraded it to a ‘hold’ in February of this year, shares shot up 56.2% compared to the 12.3% increase the S&P 500 saw over the same window of time. Since then, things have gone better than expected. You see, when I rate a company a ‘hold’, I am stating that I think that shares will perform more or less along the lines of the broader market. After reaffirming my downgrade of the stock, shares have risen another 24% compared to the 16.1% rise the S&P 500 experienced.

In my most recent article about Eli Lilly and Company, I reaffirmed the company as a ‘hold’ candidate. This was in spite of the fact that the business had achieved a big win in China and that growth was likely to continue for the foreseeable future. Ultimately, I could not get past how pricey the stock had become. However, I remain committed to the idea of flexibility. And as new data comes in, my opinion on the matter could change.

It just so happens that, before the market opens on October 30th, the management team at the enterprise will announce financial results covering the third quarter of the 2024 fiscal year. Leading up to that time, analysts had high expectations when it comes to revenue and profits. In the event that something changes significantly for the better, I could very well upgrade it again. But considering how expensive the stock currently is, I think that a ‘hold’ rating is the absolute best I can justify right now.

Expect more growth

In all likelihood, when the management team at Eli Lilly and Company announces financial results for the third quarter of the 2024 fiscal year, that growth will be considered rather significant. For a non-technology company with a market capitalization of $818.6 billion as of this writing, rapid growth is rare to come by. However, this isn’t just me saying it. Analysts are also optimistic. For the quarter, they are forecasting sales of $12.11 billion. Should this come to fruition, it would translate to an increase of 27.5% compared to the $9.50 billion the company reported at the same time in 2023.

On the bottom line, growth is also very likely. For the third quarter of the 2023 fiscal year, the company reported a loss per share of $0.06. That translates to a net loss of $57.4 million. On an adjusted basis, the company booked a per-share gain of $0.10, which translates to adjusted net income of $94.8 million. Analysts are currently expecting the company to report $1.54 in earnings per share, which would translate to $1.39 billion in profits. And on an adjusted basis, the $1.45 that they anticipate would translate to adjusted net income of $1.31 billion. In the table above, you can also see some other profitability metrics for the company for the third quarter of the 2023 fiscal year. In all likelihood, these will increase as well.

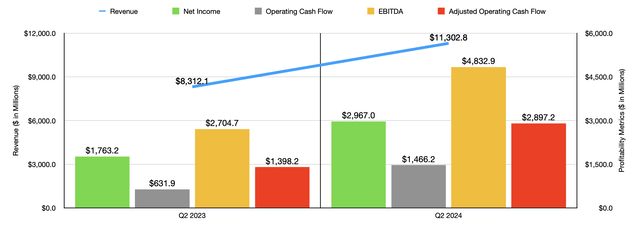

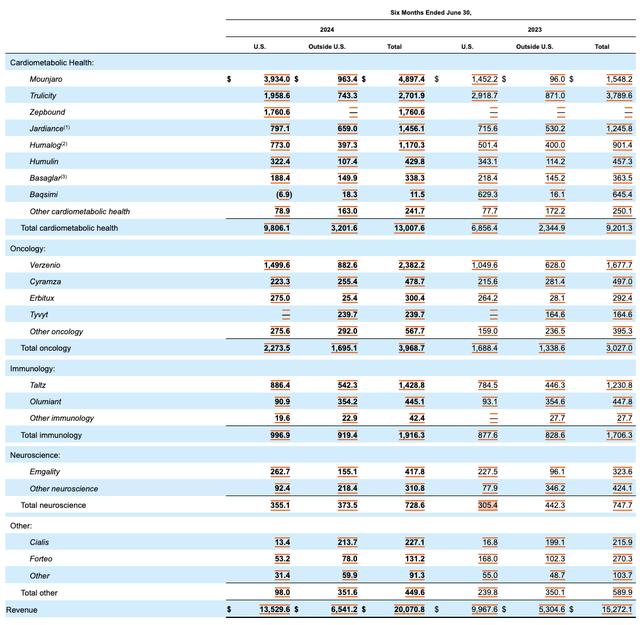

My optimism centered around the growth prospects of Eli Lilly and Company comes from the rapid growth the company has experienced as of late. For the second quarter of 2024, revenue for the business totaled $11.30 billion. That’s an increase of 36% compared to the $8.31 billion the company reported at the same time in 2023. This truly is rapid growth. And when you dig into the numbers, you can understand what is driving this. The fact of the matter is that some of the newest weight loss drugs in the company’s portfolio are being described as ‘miracle drugs’ because of how quickly and easily they help patients lose weight.

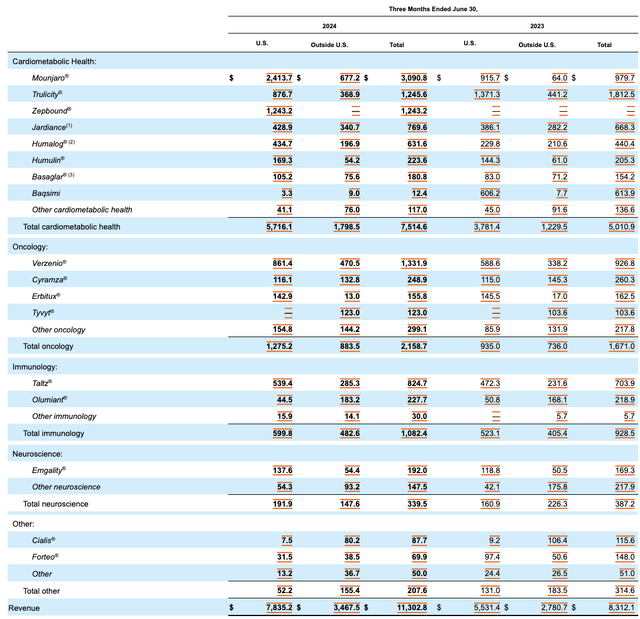

For better or worse, this has had a remarkable impact on the firm’s revenue. Take its hallmark product, Mounjaro, as an example. For the second quarter of 2024, the business generated $3.09 billion in revenue associated with this product. This was more than triple the $979.7 million the company reported for the drug at the same time last year. Another brand that is likely to see similar growth as time goes on is Zepbound. This is the exact same formulation as Mounjaro, but instead of being dedicated to those with diabetes, it is focused on those who are overweight and do not have diabetes. The company generated nothing in the way of revenue from this product during the second quarter of 2023. By the same time this year, the product was responsible for $1.24 billion worth of revenue.

While Mounjaro and Zepbound are Eli Lilly and Company’s leading growth plays, there are others that are contributing to the upside. One example of this is Humalog, which is a fast-acting insulin that can be used to control high blood sugar in individuals with diabetes. Year over year in the second quarter, revenue associated with this jumped from $440.4 million to $631.6 million. This is not to say that all of the drugs that the company has that are focused on things like diabetes and weight loss have been performing well. The rise of these new miracle drugs has resulted in a rather significant drop in demand for some of the older medications that the company has.

Trulicity is the best example, with revenue falling from $1.81 billion last year to $1.25 billion this year. In addition to this, a nasal drug called Baqsimi reported a plunge in revenue from $613.9 million to only $12.4 million. But this was not because it is being replaced by something better. Rather, it’s because, back in 2023, the management team at Eli Lilly and Company decided to sell the drug in exchange for $625 million, plus up to another $450 million in sales-based milestones. That deal closed in the third quarter of 2023. Outside of the weight loss category, Eli Lilly and Company did experience some growth and some key areas. The most meaningful example would be Verzenio, which falls under the oncology category. Revenue for it jumped from $926.8 million to $1.33 billion.

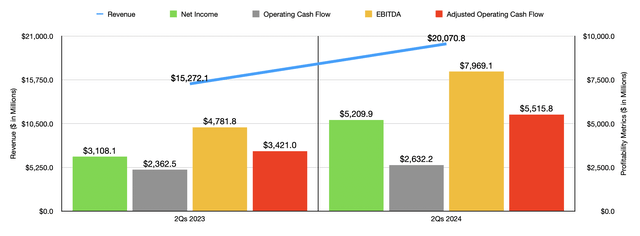

On the bottom line, the company has also exhibited some rather impressive growth. Net income popped from $1.76 billion to $2.97 billion a year over year. Operating cash flow more than doubled from $631.9 million to $1.47 billion. And if we adjust for changes in working capital, we get an improvement from just under $1.40 billion to just under $2.90 billion. In the chart above, you can also see results for the first half of 2024 compared to the same time of 2023. As was the case in the second quarter on its own, the first half of this year was much better than the first half of this year was, across the board.

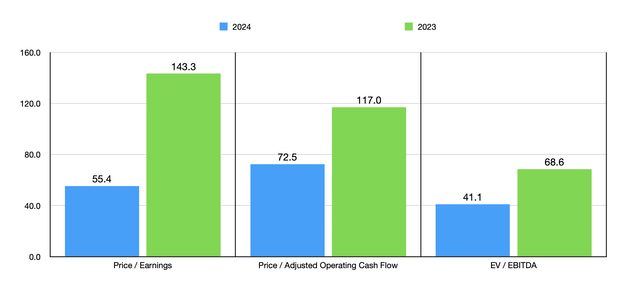

Management certainly seems optimistic that growth for the company will continue throughout the rest of this year. In fact, when they announced results for the second quarter of 2024, they increased revenue guidance by a whopping $3 billion. That should take sales up to between $45.4 billion and $46.6 billion. To put this in perspective, revenue for the company last year was $34.12 billion. So clearly, we are talking about some rather strong growth. They are also now anticipating adjusted earnings per share of between $16.10 and $16.60. At the midpoint, that would translate to adjusted profits of $14.78 billion. If we annualize the other profitability metrics for the company, we would expect adjusted operating cash flow of $11.29 billion and EBITDA of $20.52 billion.

Using these figures, we can see in the chart above just how the stock is priced. This is based on the estimates for 2024 and historical results for 2023. These are some incredibly high multiples. In fact, they are much higher than I would typically be comfortable with. If it wasn’t for the fact that the company was growing so rapidly, I would consider this downgrade-worthy.

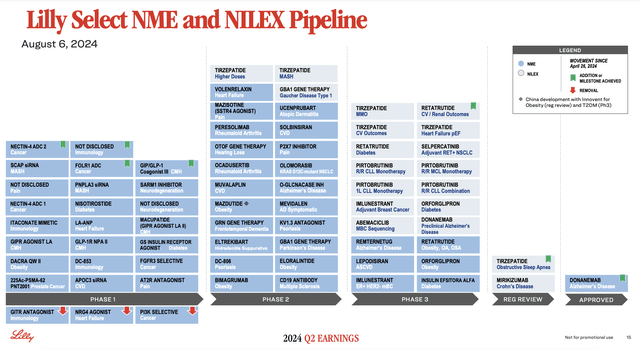

Outside of the rapid growth the company has experienced, there is also the potential for further meaningful expansion. In the image above, you can see the firm’s current pipeline of products and the phases that each one happens to be in. Some of these involve getting approval for drugs the company already has for other indications. For instance, tirzepatide is the drug known as both Mounjaro and Zepbound. Currently, it is in Phase 3 trials for helping with heart failure, MMO, and CV outcomes. It’s also under regulatory review for obstructive sleep apnea. But there are also newer drugs that could help to boost sales as well. As I have written about in the past, retatrutide is very much like tirzepatide. However, studies so far have shown that it is far superior. The company is currently undergoing Phase 3 trials for this drug for both diabetes and obesity more broadly.

If everything does go according to plan and Eli Lilly and Company can benefit tremendously, then management wants to put the capital it’s generating to use in ways that should boost sales even more going forward. On October 2nd of this year, the management team of the business announced a new $4.5 billion site aimed at driving innovation in drug production and also aimed at making medicines for clinical trials. This facility, called the Lilly Medicine Foundry, is expected to open in late 2027 and will increase the company’s exposure to Lebanon, Indiana, to more than $13 billion. This is not the only move recently. Back in May of this year, the firm announced an additional $5.3 billion worth of funding to focus on boosting capacity for the production of active pharmaceutical ingredients for some of its newer drugs. In September of this year, management announced another $1.8 billion worth of projects split between two different parts of Ireland.

Takeaway

At this point in time, Eli Lilly and Company is doing a phenomenal job. The company is growing rapidly thanks in large part to its miracle drugs in the obesity and diabetes space. Down the road, I expect this trend to continue. But this doesn’t necessarily mean that investors could bank on the stock continuing to rise like it has in the past. Shares look very expensive as things stand, and that is proving prohibitive for me. But I can also understand why somebody might want to hitch a wagon to one of the fastest growing. However, when you consider how expensive the stock is, this for me is an easy pass right now. As a result, I’ve decided to keep the company rated a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!