Summary:

- Meta Platforms, a top performer in 2023, passes all five of my Five Factor Model metrics, indicating strong growth potential and reasonable valuation.

- Key growth areas include AI content generation, smart glasses, Threads, and the metaverse, each with significant revenue potential and user engagement.

- I expect Meta’s Q3 earnings and revenues to come in slightly ahead of forecasts, driven by AI ad efficiencies and stable economic conditions.

- Despite risks like monetization challenges and smart glasses adoption, Meta’s diverse revenue streams and strategic R&D investments justify a “Strong Buy” rating.

Derick Hudson

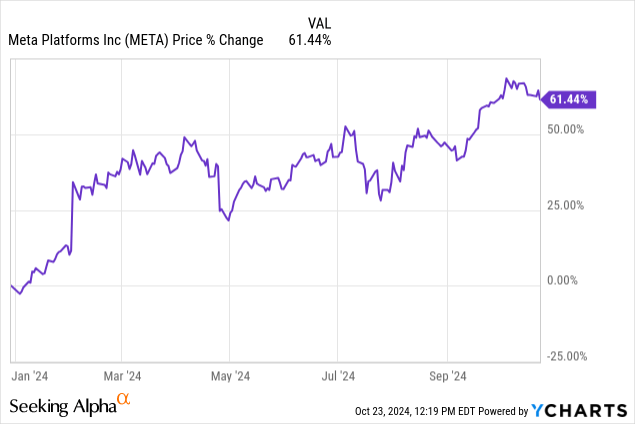

Much has been discussed on Meta Platforms (NASDAQ:META), the world’s premiere social media conglomerate. The company remains one of the Magnificent 7 performance stars of the year, returning 61.44% year-to-date, which many investors see as a recovery from it’s incredible crash in 2022.

With so much value taken off the table following this run-up, I want to review Meta’s strengths, growth opportunities, expectations for next quarter, and risks to rate whether there is still value left for investors going forward.

Five Factor Model

In my article, The Five Factor Model: A Screen Of Ultimate Quality For Reasonable Valuation, I discuss five metrics I use as a starting place to differentiate quality companies from ordinary ones. In doing so, the model also helps provide a review of the business model, management, importance of the company, growth prospects and valuation. The article explains why I chose these metrics. Of course there are exceptions to be made – not every company needs to pass every test to be a good investment – but for Meta Platforms, few are needed.

- The Company is Important – Meta remains one of the most important companies in the world, facilitating advertisements, ecommerce, communications (users and businesses), and other social interactions across the internet. Messenger alone transmits 100 billion messages daily. Instagram facilitates the sharing of 1.3 billion photos daily. There are also 200 million businesses that advertise on Meta’s platforms. Given this level of dependence, Meta Platforms is a very important company and gets a pass.

- The Company is Founder-run, or the Founders are on the Board – Mark Zuckerberg founded Meta Platforms as “Facebook” in 2004, took the company public May 18, 2012, and continues as its CEO and largest shareholder today, with 13.5% of the total outstanding shares. He has a string of incredible business successes, including developing Facebook, seeing Instagram’s potential and buying the company for only $1B in April 2012, his purchase of WhatsApp for just $19B, now sporting 2 billion users, the success of Threads which has 200 million users after only 14 months since its launch, and a few key new prospects in the works. Mark is clearly a talented manager with a large personal stake in the company, so Meta gets a pass here as well.

- Gross Margins are Over 60% – Meta’s gross margins have ranged between 80.6%-86.6% over the last ten years, easily clearing this hurdle. Again, high gross margins are not critical for a successful investment, but they provide optionality for a company during a downturn. There are several other reasons why I prefer high gross margins, which I explain in the article. Meta gets a pass on gross margins.

- Reasonable Exception of 15% Revenue Growth Over the Next 3 Years, with Similar Historic Growth – From 2018-2023, Meta Platforms grew revenues 19.29% annually, and in the current year the trend has continued, with expected revenue growth of 19.97% this year. Forward revenue is forecasted at 14.22%, though analysts have been wrong here before, with average analyst projections as low at $136B for 2024 compared to the actual result of nearly $162B. Meta gets a pass on stable and high revenue growth.

- Valuation – 4% Earnings Yield: (Fwd R&D+EBIT)/EV – This is my preferred valuation metric as explained in the article, but it needs to be applied cautiously. Meta continues to invest deeply in compute power, now sporting far more Nvidia (NVDA) GPU chips than even the next company at 350,000 GPUs, and further, expecting to have 600,000 GPU chip equivalents (counting both H100- and GB200-series chips) by the end of the year. This spending on R&D is not captured in the earnings, but it is drawn from earnings, indicating profitability above where the earnings sit. Despite the run-up in stock price, Meta still sits at a forward (R&D+EBIT)/EV of 9% at a share price of $564, indicating that if Meta cut all research and development and paid all forward earnings out as a dividend at a 100% payout ratio, that dividend yield would be 9% on pre-tax, enterprise value basis. Clearly, Meta passes on valuation.

Passing all five tests for quality at reasonable valuation, let’s take a closer look at Meta’s growth prospects.

Meta’s Future: Bright in Several Spots

AI Content

Similar to the strategy I noted in my article on Pinterest, Meta is already leveraging AI for enhanced content generation. Meta AI, Meta’s main AI user interface, is embedded in both Instagram and Messenger. It can generate pictures which users can post on social media platforms such as Instagram and Facebook. Further, AI agents can now create content in a streamlined/customized form for specific profiles or accounts. Imagine you’re an Instagram influencer – you will be able to get an AI agent to review your profile and produce imagery, or even videos, with the same likeness and ascetic as the rest of your human-made content, but doing, acting, or depicting content which you wouldn’t or can’t create on your own. The foray into AI content, especially from talented influencers and content creators with a strong vision, could vastly expand the volume of interesting content on Meta’s platforms, increasing user engagement.

Meta AI and Open Source Models

Meta AI is also something like a chatbot, which can converse, educate, console, debate, and do most of what a normal human can do via a conversation. Monetization methods for this new medium aren’t clear yet. What is clear are the increasing users, nearing 500 million at this point and more than twice ChatGPT’s 200 million user count. If history repeats itself, monetization of this vast and growing user base could include business advertising in the course of conversation, recommendations, actual visible ads, charging businesses for chatbot use for internal development and customer conversations, and more.

AI Pushing Advertising Efficiencies

Across Meta’s more traditional platforms of Facebook and Instagram, computing via the aforementioned increasing GPU strength is going to aid in data analysis on a significantly larger scale, helping to connect the right content with the right user. Even more-so, Meta will use AI and bigger data computing to connect superior AI content with the right user, increasing viewership for more advertisements. Already, nearly half of Instagram users already report shopping weekly on Instagram, a product of successfully connecting the right content with the right user which happens through ads paid for by businesses and orchestrated by Instagram’s ad-matching programming.

As impressions, likes, comments, and scroll speed variations continue to build Meta’s various datasets towards what constitutes quality or shareable content, the virtuous circle of better content connecting more strongly with more engaged users can be expected to continue, generating more advertising revenues for Meta.

Smart Glasses

AI may in fact be secondary to another hidden gem being developed by Meta: its Ray-Ban-partnered smart glasses. Controlled by gestures and voice, this product has the potential to replace smartphones. You can watch videos, access social media, and do other tasks on the smart glasses and they have built-in speakers. They are nearly identical to the hyper-successful Ray-Ban sunglasses, indicating they will have widespread visual appeal, and you can also use them as normal sunglasses. Further, the smart glasses are prescription-enabled and functional with contact lens.

Review from here:

Of course, with any radical new technology form, uncharted territory is loaded with uncertainties. It’s not clear yet how interested the public is in smart glasses, especially with the relative failure of Google Glass. But I can imagine that ditching the block you carry around in your pocket for a pair of stylish glasses might be hundreds of millions of peoples’ cup of tea. One tech writer compared an iPhone with Meta’s smart glasses during a trip. She found that the convenience, picture quality, and discreteness of the smart glasses, as well as Instagram Stories and other applications on the smart glasses, made the new technology a “game changer”, herself leaning into the idea that these glasses may one day replace smartphones.

It’s too early yet to qualify how Meta’s smart glasses will affect earnings and valuations, but we know the potential use cases are huge:

- General use by the public;

- Driving and long-haul assistance;

- Pilot assistance;

- Surgery recording and assistance;

- Police, security, fire recording and assistance;

- Workflow assistance;

- Tourism;

- Translation

The use cases are perhaps as expansive as those of a smartphone. While the market is incredibly young and the technology needs to be tested and developed further, the opportunities here are staggering. Three estimates of TAM size and growth estimate 17%, 23%, 27%, annually several years into the future. However, I believe that Meta will have to translate its smart glasses technology into various business, personal and professional use cases, in a few more varieties for differing tastes, in order to capitalize on such growth prospects. If this is executed sufficiently, the functionality is superior to smartphones and the price is notably up to $1000 USD less, it’s hard to imagine why the TAM isn’t as large, or larger, as the userbase for smartphones – into the billions.

Threads Monetization

Threads launched barely a year ago, and has been an overnight hit – especially with disgruntled X users. The new social media platform is text-based, geared towards sharing ideas, conversations, debates, news, and other dialogue. While the platform is still extremely young, I expect management to focus on growing its userbase. This inherently means offering a seamless, ad-free experience, stronger content recommendations, and cross-offering Threads content in its other platforms to drive traffic and habit. Monetization will need to come after this point, such that there are enough users that the impact to the average user experience required to generate sufficient ad revenue will be relatively small.

Nevertheless, Meta Platforms was able to spin Threads out in just five months, a site which, when monetized, will likely yield significant revenues, potentially on the order of $5-10B in revenues once user growth slows. I calculate that as follows:

- On a comparative basis, X produced $600M in the first half of 2024. Annually, that is $1200M from 368 million monthly active users, or $3.26 dollars per user.

- I believe with Meta’s vast experience, flexibility and history of incredible monetization, the company could potentially generate more than X’s revenue per user, perhaps into the $5-10/user range.

- If Threads reaches a billion users in the coming 3-5 years, as Mark Zuckerberg himself is betting on, that could be $5-10B in revenues annually if Mark’s team can reproduce its history of superior monetization for Threads.

- At the market cap level, that should be a little more valuable than the rest of Meta Platforms, perhaps trading slightly above the 10x sales which the company at large has been valued at, on average, in the last decade, translating to an additional market cap contribution of up to $120B.

Such a realization of value is still a long way off. For now, threads further diversifies Meta’s vast social media platform network and is a testament to not only Meta’s engineers and its visionary management, but the company’s ability to think quickly on its feet, find a need in the social media text-based market, and produce a successful social media franchise.

Metaverse

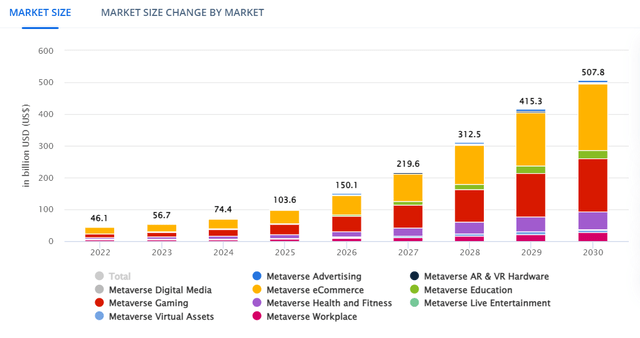

Much has already been discussed concerning the metaverse and it’s adoption. Despite plenty of negative press on the venture, Meta’s Quest 2 and Quest 3 combined represent nearly 55% market share in the VR space, with the next competitor, Valve Index, cited at 15% market share. Further, the Tangible Addressable Market is expected to grow substantially, with sub-markets in ecommerce, gaming, health and fitness, education, and workplace.

Metaverse TAM Growth (Statista)

The metaverse should be seen as a potential, and not as a certain. Just like any mentions of “AI” in 2014 might’ve landed on deaf ears, with critics explaining how far away real applications of AI were at the time, the metaverse is equally distant, but no less promising. If anything is clear from Meta’s history, the company is geared towards constantly evolving the way humans connect, and there is no reason that can’t extend to virtual office spaces, virtual social gaming, virtual stores, experiences, and more. As a personal anecdote, I often user Google Street View to learn and discover all kinds of interesting places in the world. There is no reason why the metaverse can’t develop a better platform for such a market – virtual tourism. Outside of anecdote, as several countries are committing public and private funds towards metaverse development, the opportunity should be considered soberly by investors.

Like Meta’s Ray-Ban smart glasses, and Threads, the Metaverse project is years away from revenues that might “move the needle” for Meta Platforms, and perhaps more than a decade away from any version of profitability. As always, investors can expect Meta management to prioritize building the ecosystem and user experience, followed by gaining market share before any consideration is granted to revenues or earnings. Still, Meta’s large market share in the current metaverse, which is a rapidly growing market, is a prospect investors should not discount when considering Meta’s business lines.

WhatsApp Monetization

WhatsApp is a 2 billion user messaging platform. It already monetizes its userbase through various forms:

- WhatsApp Business API, which offers business services and insights, automated responses, notifications to customers and more;

- Business accounts, charged per 24h conversation per customer;

- WhatsApp Payments, allowing businesses, customers and users to send and receive payments in select countries;

- Advertising: originally launched in 2018 and shelved in 2019 after user backlash, WhatsApp business ads were reintroduced and now provide businesses with direct advertising channels to prospective customers.

- Enterprise Solutions and API Integrations: large enterprise solutions for customer contact and engagement.

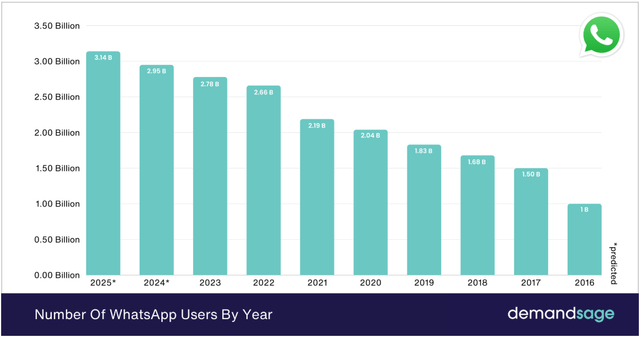

As can be seen below, WhatsApp’s userbase continues to grow, experiencing 8.72% user growth annually in the past five years, with similar growth rates expected in the coming years.

WhatsApp User Growth (demandsage)

As this user base continues to grow, businesses will have greater opportunities to reach customers, as well as greater interactions with employees on the platform. With further potential in business cross-selling of analytics and customer integrations through various channels, and with advertising and user base growth, WhatsApp offers investors in Meta Platforms yet another way the company can diversify revenue streams while growing its bottom line.

Q3 Earnings Report – Expect Another Revenue Beat

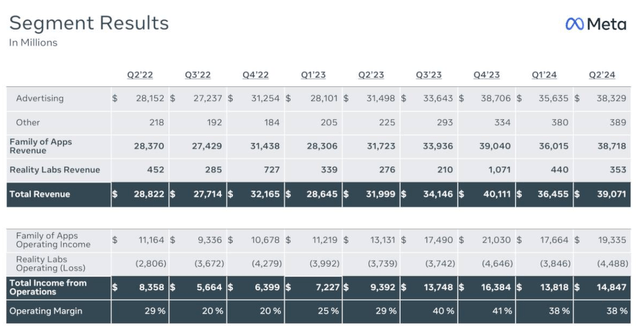

Meta’s revenues surprised some investors and analysts in quarter 2 with both increased revenues beyond expectations, and decreased business costs.

Meta Platforms’ Q2 Earnings Report (Meta Platforms’ Q2 Earnings Report)

Meta Quarter 2 Financials (Meta Platforms Investor Relations)

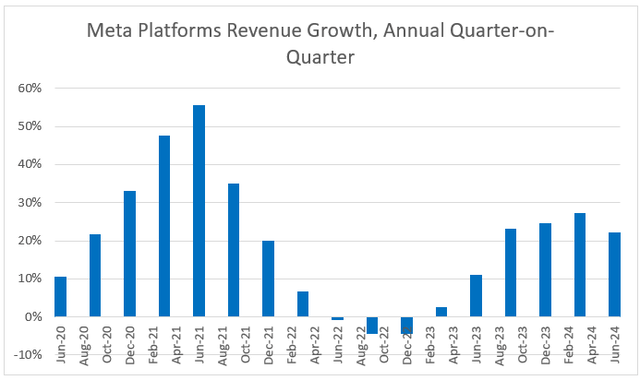

I calculated the quarterly revenue growth year-over-year for the previous seventeen quarters, found below.

Meta’s Revenue Growth (Author’s Work Based on Earnings Reports)

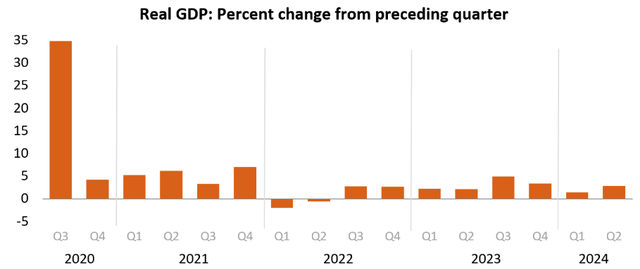

Even during large swings in the economy, such as during the Covid-19 pandemic lock-downs and subsequent economic boom, changes in quarterly revenue growth rates largely follow macro-economic trends. This is because advertising dollars are spent more-so in economic boom times, and withheld more-so in economic bust times. As such, let’s investigate quarterly GDP growth in the last few quarters.

Recent U.S. Quarterly GDP Growth (U.S. Bureau of Economic Analysis)

In analyzing the US GDP growth rates (Meta’s largest geographical revenue contributor at 43% in Q2 2024), US economic growth continues to hum along relatively steadily. There is no indication from economic data to support the idea that advertisers are weary of spending.

Management has guided for $38.5B-$41B in revenues for Q3, which would represent a year-over-year increase of 12.75-20%. They have also guided for $96-99B in total costs for the year on $162B in expected revenues, figures for which they remain on-track. Factoring in tax rates and capital expenditure guidance, analysts have guided for $5.27/share in earnings for the upcoming quarter with 37 upwards revisions and only one downward revision.

Given Meta’s revenue growth quarter-over-quarter of 22%, its other recent quarters also performing similarly in the 23-27% growth range and no notably wide disturbances in critical economic data, I expect revenues to come in at the high end, possibly topping 20% but not much more due to tough comparisons from both Q3 2023 revenues and GDP growth. Investors should not worry too much if growth comes only in-line with expectations as comparable from Q3 2023 are notably tough.

On the other hand, efficiencies found in AI ad allocation were noted on the call.

Eventually, we got to the point where our ad systems could better predict who would be interested than the advertisers could themselves.

Management also noted that AI content creation for advertisers is its next step forward in Meta’s value proposition to businesses. This is expected to be rolled out over time, but investors can expect that this service will incrementally affect earnings growth over both the short- and medium-term, potentially positively impacting growth in the upcoming quarter.

Risks

Despite passing all five tests in my Five Factor Model, Meta Platforms is a company which comes with risks. There are several known risks with Meta such as regulatory risk, key man risk and competition risk, but I’d like to highlight a few less discussed risks here.

- Monetization risk – having a captured audience in WhatsApp, Threads and Messenger that is not yet fully monetized is a wonderful spot to be in. However, exposing these groups of billions of users to new ads when they have long come to expect an ad-free experience will hurt the user experience of these platforms to an extent and potentially alienate some of the user base or user growth. Further, increasing costs to businesses to communicate with employees, will create financial pressure on businesses that wasn’t there before and could alienate some of the business base or business user growth. I certainly remember being turned off YouTube when the ads started coming regularly.

- Ray-Ban partnership failure – since Meta has gone quite far down the road with its smart glasses concept to full production units being sold on its site, the failure of the market to adopt them quickly could be quite impactful on Meta’s valuations, especially at current levels. Just as with Tesla and robots, it could be that the market has priced Meta to succeed with its smart glasses and as such, a failure to do so could cause a revaluation of the future earnings potential.

A Note on Valuation

The market has long discounted the value of both Meta’s various platforms, and its research and development investments. From my perspective, there can be only two outcomes for META’s valuations with respect to its research and development spending buffer:

1) The spending stops producing growth. Management would cut back R&D investments eventually and initiate capital return to shareholders in the form of debt repayment, share buybacks and dividends – as such, valuations would likely increase as earnings potential is realized on the bottom line;

2) The R&D investments do create excess growth, increasing GAAP earnings, and hence, the share price, albeit with more historic valuations.

My forward valuation of a 9% R&D+EBIT yield is a comfortable valuation level for myself, as an investor who expects to hold Meta Platforms long enough that capital return is the only viable strategy for value creation, while monetization and other projects highlighted develop revenues into the future.

Conclusion

Greater monetization across all platforms and several developing opportunities found in smart glasses, Threads, metaverse and AI content, demonstrate that management has created several promising opportunities for value creation. As demonstrated, all of Meta’s platforms are still growing in users and most exhibit mature or developing revenue streams.

Passing all five of my Five Factor Model screens, the company demonstrates all the characteristics of a quality business at a reasonable valuation. As such I rate it a “Strong Buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.