Summary:

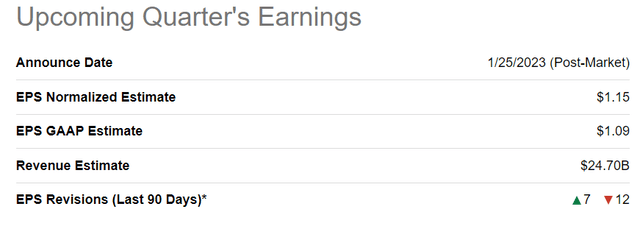

- Tesla is expected to report results for the December quarter 2022 on January 25th.

- I argue that investors should expect a disappointment as compared to current analyst estimates.

- For Q4, Tesla delivered ‘only’ about 405,000 cars, which is almost 35,000 lower than what the company produced.

- With discounts for Tesla’s best-selling Model 3 being as high as 15%, it is unlikely that Tesla will maintain >15% EBIT margin.

- Based on long-term estimates, however, I continue to calculate a fair implied price per share for TSLA equal to $294.19.

jetcityimage

Thesis

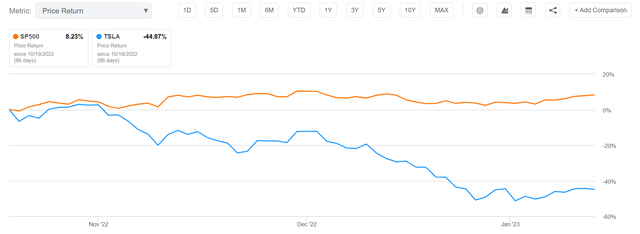

Tesla (NASDAQ:TSLA) stock is down approximately 45% since the company last reported earnings results on October 19th 2022, as compared to a gain of 8% for the S&P 500 (SPY). A lot has been written about Tesla’s various challenges that might have caused the sell-off, but a deteriorating earnings environment is most certainly a reason as well.

Tesla is expected to report results for the December quarter 2022 on January 25th and I argue that investors should expect a disappointment as compared to current analyst estimates. However, long term, Tesla remains a ‘Buy’.

Q4 Deliveries Point To Revenue Expansion, But Expectations Disappointment

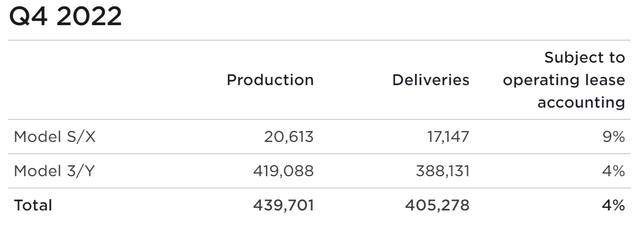

Tesla has already shared a key insight for Q4 — the company’s quarterly production and deliveries number. For the December quarter, Tesla produced approximately 440,000 cars, of which 440,000 are attributable to Model 3/Y. Although production grew by about 47% year over year to 1.37 million for FY 2022, market participants were arguably somewhat disappointed by the production vs deliveries dispersion. For Q4, Tesla delivered ‘only’ about 405,000 cars (nearly 40% year over year growth), which is almost 35,000 lower than what the company produced. And Tesla’s comment …

We continued to transition towards a more even regional mix of vehicle builds which again led to a further increase in cars in transit at the end of the quarter.

… failed to push up confidence. The disappointment about Tesla’s 40% delivery target is compounded by Elon Musk’s delivery target being 50% year over year growth.

Tesla Q4 Delivery/ Production numbers

In addition, Tesla’s deliveries also fell short of analyst consensus estimates. According to data compiled by FactSet, analysts had reported Q4 deliveries of 427,000, with the lower end of the estimate range being 409,000 — and thus still higher than what Tesla actually delivered.

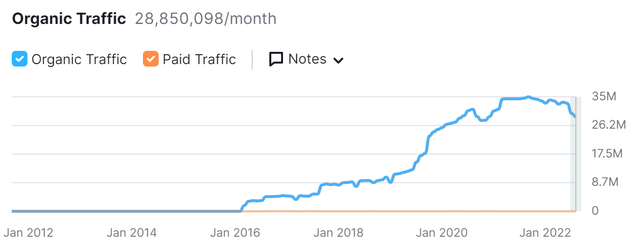

Thus, it is reasonable to expect that Tesla is having some kind of demand problems – in my opinion – and that the company could likely fail to deliver against analyst consensus revenue estimates of about $24.7 billion for Q4 2022. Notably, the assumption of demand challenges is supported by website traffic data from Semrush, which shows a decline in website traffic for Tesla’s cars.

A (Temporary) Margin Contraction Is Very Likely

Tesla’s topline concern is compounded by the fear of falling profit margins. In fact, the multiple price cuts in Q4 as compared to Q3 render a margin contraction highly likely. With discounts for Tesla’s best-selling Model 3 being as high as 15%, it is unlikely that Tesla will maintain >15% EBIT margin. According to my analysis, the higher volume of Tesla deliveries in Q4 vs Q3 will not support margins in any meaningful way, given that the volume expansion was pushed with significant price cuts.

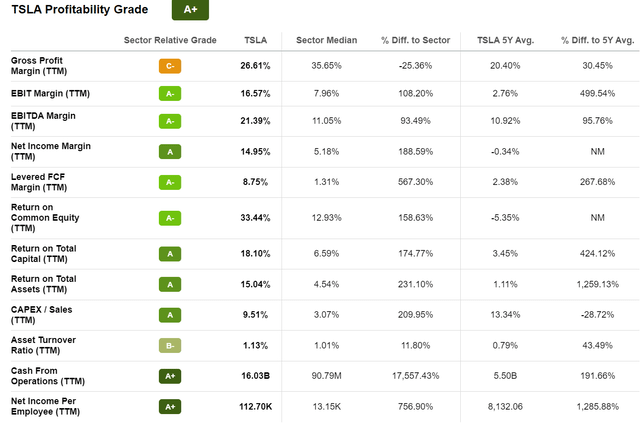

Arguably, Tesla’s profit margins are due for some kind of correction: For the trailing twelve months, Tesla has claimed a EBIT margin of 16.57%, which is more than 100% higher than the respective median margin for the industry. Similarly, Tesla’s net income margin at 14.95% and return on total capital at 18% are at a 189% and 174% premium respectively. Going into Q4 reporting, Personally, I expect that Tesla’s EBIT and net income margin will likely come down to between 12 – 14 per cent and to between 10 – 12 per cent respectively.

However, given Tesla’s brand value, it is reasonable that long-term Tesla will achieve above-industry margins due to above-industry pricing power (see Apple (AAPL), Starbucks (SBUX), Nintendo (OTCPK:NTDOY) etc). In addition, investors should note that as Tesla continues to expand deliveries, the company will be able to capture scale efficiency benefits. Thus, looking beyond the recessionary demand slowdown, Tesla may indeed find back to >15% EBIT margins.

What To Expect For Q4

If my assumptions regarding Tesla’s topline and profit margins are correct, then analyst consensus estimates for Q4 are too optimistic. According to data compiled by Seeking Alpha, Wall Street currently expects Q4 revenues of $24.7 billion, and non-GAAP EPS of $1.15.

Personally, however, I believe that Tesla’s sales for the December quarter will likely be somewhere around $23 billion (accounting for disappointing Q4 deliveries and lower profit margins due to price cuts). And accordingly, assuming a 10% – 12% net income margin, Tesla’s non-GAAP Q4 profit will likely be in the range of $2.3 and $2.8 billion, or about $0.65 to $0.85 cents per share.

Why I Am Bullish

Will Tesla shares sell-off after Q4 reporting on 25th January? Well, I don’t know. Even though I am clearly negative on the December quarter results, it is hard to tell what negativity is already priced in the stock – being down more than 70% from all-time highs.

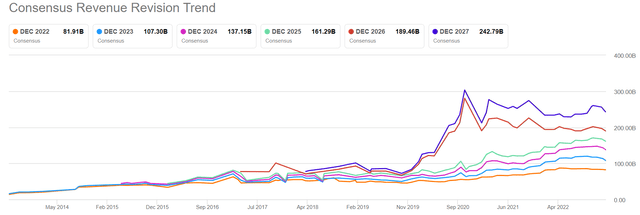

If investors remain bullish on Tesla’s long term potential, like I do, then the Q4 results will likely provide a ‘buy the dip’ opportunity. Notably, analyst consensus expects that Tesla could grow to generate $137 billion of revenues in 2024, and $243 billion of revenues in 2027. In addition, I believe Tesla will confidently claim above-industry margins, given the company’s strong brand and technology exposure.

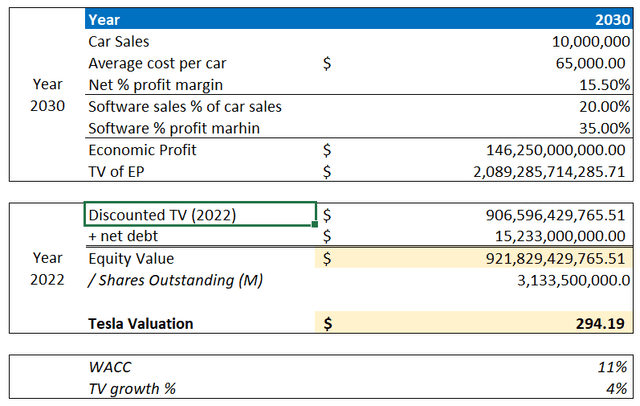

That said, I continue to believe that Tesla will sell about $10 million cars by 2030 and claim a $146.2 billion economic profit based on a 15.5% net-profit margin, as well as various profit-accreditive software sales.

And with a 11% cost of equity, Tesla stock looks more than 100% undervalued. Based on the below variables, I calculate a fair implied price per share for TSLA equal to $294.19.

Author’s Assumptions and Calculations

Conclusion

Tesla is expected to report results for the December quarter 2022 on January 25th. And I argue that investors should expect a disappointment as compared to current analyst estimates, given lower than expected delivery numbers and likely margin compression on discounts. In my opinion, Tesla’s revenue for the December quarter will likely be somewhere around $23 billion, and assuming a 10% – 12% net income margin, Tesla’s non-GAAP Q4 profit will likely be in the range of $2.3 and $2.8 billion, or about $0.65 to $0.85 cents per share.

However, based on long term estimates, I continue to calculate a fair implied price per share for TSLA equal to $294.19. Tesla remains a ‘Buy’.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advise.